Hey Everyone,

I hope you’re having a great week, let’s get into it.

Stray Observations

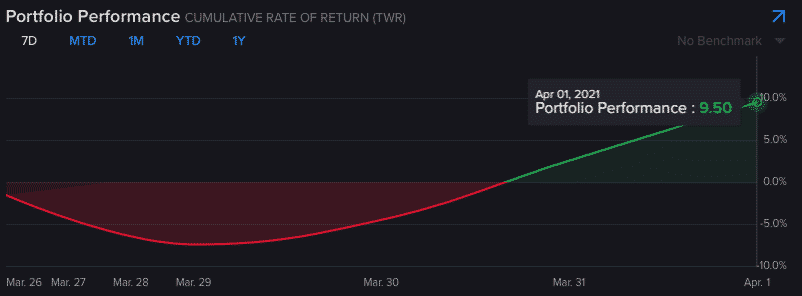

My portfolio closed out above 9.5% this abbreviated week, but I still have a ton of ground to cover. Year to date, I’m down 8.5%, while the Nasdaq is up 3.4% and the S&P 500 is up 7.0%.

Per request in last week’s Clubhouse session, I’ll include my Sharpe Ratios going forward. Investors should strive for a Sharpe Ratio of at least 1x, and you can see that I have underperformed that recently and since inception.

- 30 Days: -4.07 (this is really bad)

- 1-Year: 2.35 (this is really good)

- Since Jan 2018: 0.91 (not good)

This underperformance is a direct result of how much I underestimated this correction. As I have written previously, the big question is if I am right about the market ripping later this year, and whether my positions will be part of that rally. If so, this outperformance will return. Otherwise, as said before, consider this the biggest mistake in my investing career.

Nasdaq 100 Likely Bottomed

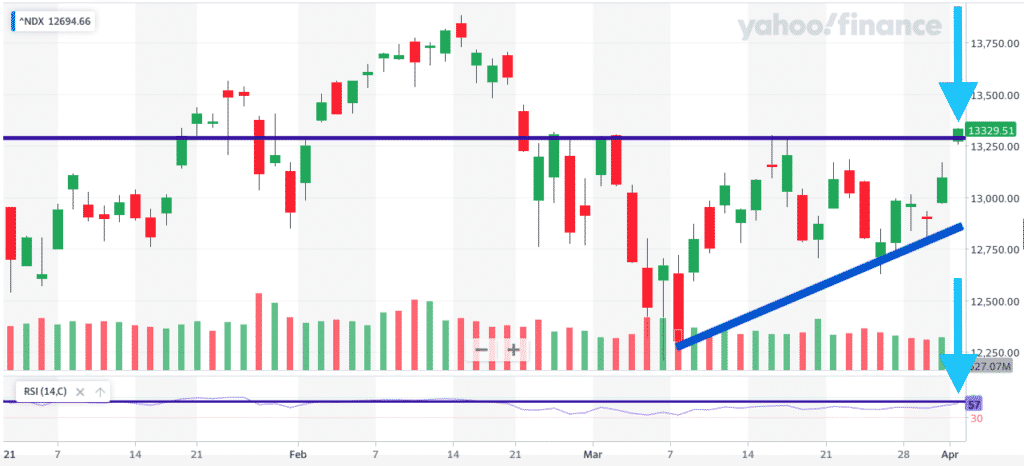

I wrote last week about the Nasdaq 100’s breakout, and said when I would be more comfortable calling the bottom.

Notice how price broke down multiple times at the 13.3k mark in early March – I’ll be more optimistic once the Nasdaq 100 breaches the 13.3k mark with solid volume.

Well, the Nasdaq 100 closed above 13.3k on Thursday, marking a higher high with the highest RSI since before the correction began in mid-February.

Notice how price broke down on the purple line twice in early March. The fact that this broke so conclusively on Thursday was encouraging.

This is not to say that the Nasdaq 100 won’t go below 13.3k ever again, but I am betting with my dollars that March 8th at 12.3k was the bottom of this correction. Let’s see what happens.

Lots of Ground to Cover

If I’m right about the correction being over, the next obvious question is whether or not I’m holding the right positions.

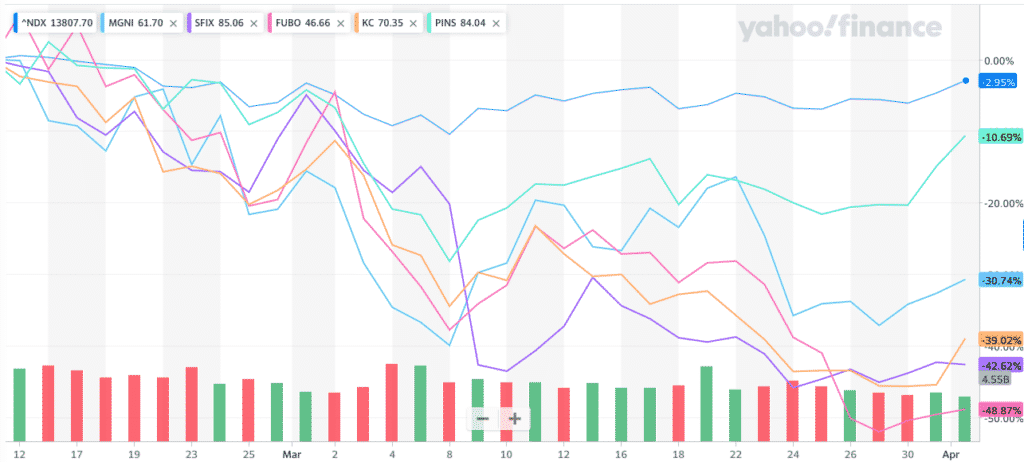

This is more difficult to forecast. Clearly their relative performance since the Nasdaq 100 topped on February 12th has been terrible. In fact, the Nasdaq 100 itself is only down by 3% as of this week.

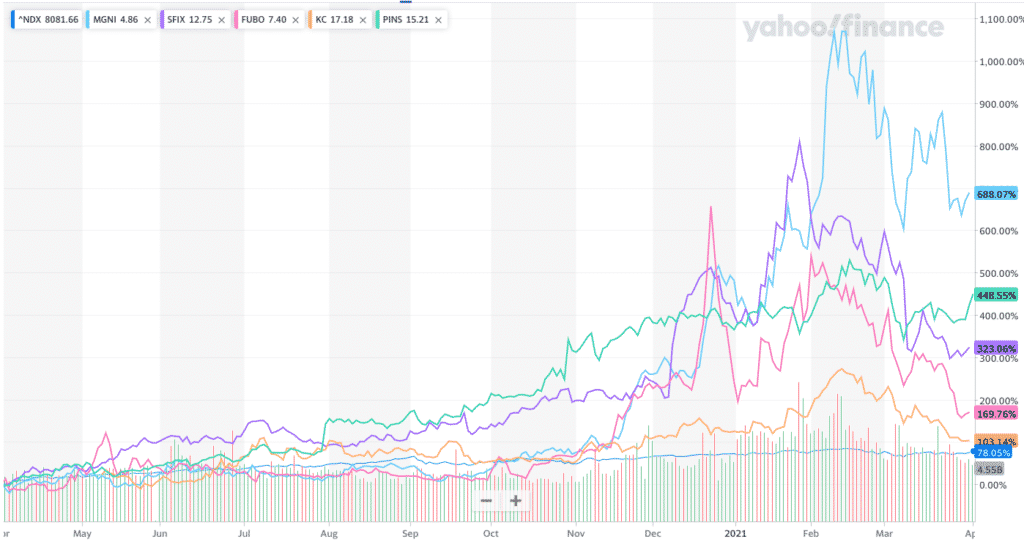

When we zoom out over the past year, however, their outperformance has been unquestionable.

Either we are seeing a fundamental shift away from these market leaders, or these market leaders will resume their outperformance.

I’m clearly betting on the latter. As you can see, this isn’t the first time these positions underperformed over a brief period. Since all of these themes are still in their early innings, I don’t see why this is the end of their road. As discussed with Roku last week, volatility is the cost of doing business.

I’ll change my mind if this underperformance is sustained. For now, I don’t believe this one month sample size is enough to abandon my convictions.

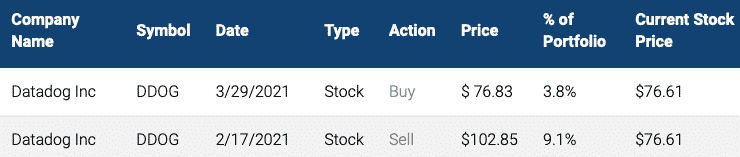

New Position: Datadog (DDOG), 5.7%

I sold out of this position on February 17th because the price broke down from a key level of support. In hindsight, that turned out to be an excellent move.

It seem like $DDOG is close to bottoming. Price hit a lower low, while RSI & MACD are hitting higher lows. This is generally a good sign.

Their most recent earnings were disappointing for analysts, but as I mentioned on the #earnings channel, I had no problem with it.

- Revenue up 56% YoY (~10% beat)

- Operating Margin 10% (consensus was 2.4%)

- Raised Guidance to $825 – $835 million (consensus was $803 million)

- FCF/Op Cash Flow Positive ($16.6 million/$24 million)

- Lowered profit outlook by 1 cent per share below consensus

As I mentioned then: I don’t give a sh*t about net income. Businesses should be measured by their ability to grow operating cash flow and properly invest their free cash flow. This company is increasing their free cash flow and selling more stuff at higher margins, you can’t ask for more than that.

Datadog is an application performance monitoring (APM) provider, and is taking significant share from legacy firms like New Relic.

APM ensures that apps and websites run as expected with optimal speeds, while also assuring backend processes execute as they should.

The legacy vendors in this space are New Relic, AppDynamics (Cisco), and CA Technologies (Broadcom). Another up and comer is Dynatrace $DT, which I previously owned.

$DT is known as the “best”, and $DDOG is known as the “fastest”, as in they iterate their product far faster than competitors. $DDOG is also cheaper and sold in chunks (vs a package like $DT), which is compelling for clients below the enterprise.

As you know, I prefer companies who corner SMB/MM first, and then work their way up to the enterprise. This is why I liquidated my Dynatrace position previously.

New Position: Crowdstrike (CRWD), 4.9%

Endpoint security is frequently the first entry point cyberattackers, and CrowdStrike is leading the charge with their Zero Trust solution.

Cybersecurity is the number 1 priority for CIOs in 2021, well above public cloud, as the high-profile Sunburst hack (SolarWinds) highlighted the need for businesses and government to transform their legacy security architectures.

Our government is catching up to, having increased their CRWD spend by 321% from FY20 to FY19.

Businesses top to bottom are enlisting help from CrowdStrike, from the largest enterprises in the world, to the government, and even the startup I work at. And Crowdstrike’s performance reflects that:

- 77% YoY Rev Growth

- 82% YoY Customer Growth

- 76% Gross Margins (72% in FY19)

After selling software to the C-suite for 10+ years, I can tell you that 9 times out of 10, the C-suite cares about job security. They have a high paying job, and likely don’t own much of the business.

Knowing this, no price is too much for job and career retention. This is likely why Cybersecurity is the number 1 priority for CIOs, and also why CrowdStrike is increasing their gross margins so aggressively – it’s because they can.

One fair question would be, what if another vendor steps in and bundles this product away from CrowdStrike?

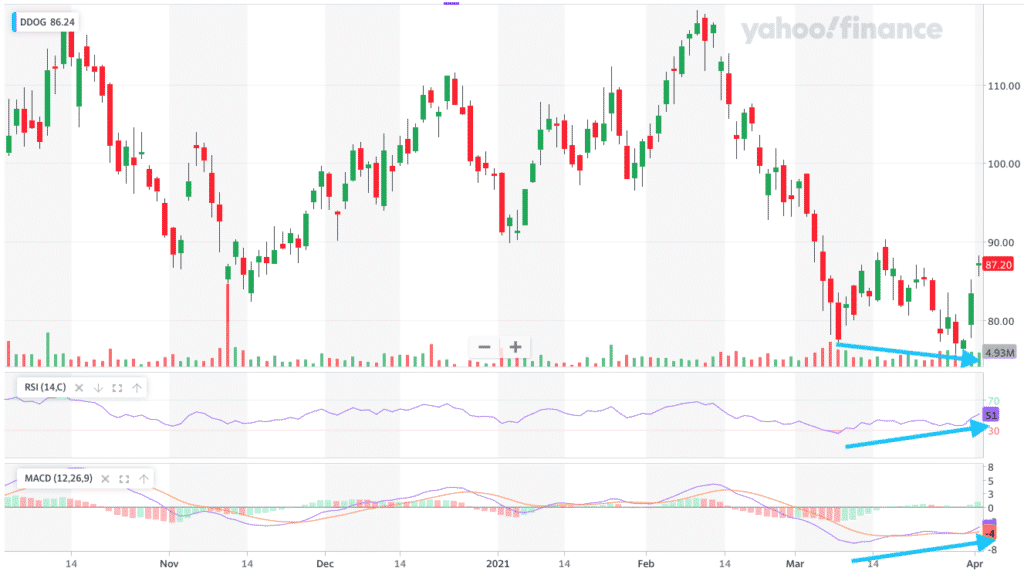

That’s where their network is so powerful. CrowdStrike is no different from Google or Spotify in this regard – each new customer CRWD lands improves their threat detection capabilities, similar to how each new Google search or Spotify listen makes these products a little bit better at finding the right answer or song.

Similar to Google’s search engine or Spotify’s daily mixes, this network will not be possible to replicate, and should give CRWD is sustainable competitive advantage. This screenshot gives you a gist of the network’s benefits.

Thanks to this correction, CRWD is now 27% cheaper than their highs in February at $251 per share with an EV of 30x NTM sales. I consider this price another gift of the correction

New Position: Snowflake (SNOW), 3.7%

SNOW allows compute and storage at scale with any storage provided from any cloud provider. These virtual warehouses can access storage layers independently, which does not compete for compute power. Competitors like Redshift, on the other hand, couple storage with compute.

Ultimately, enterprises are choosing Snowflake because they can load data and run queries with little effort. The alternative is spending a ton of time prepping, balancing, and monitoring traditional data warehouses.

SNOW is killing it, and their performance highlights the value they’re providing.

- 116% Product Revenue Growth YoY

- 168% Net Revenue Retention (this number is bonkers)

- 70% Product Gross Margins (was 63% FY20 & 58% FY19)

Biggest risk is that the cloud titans (AWS or Azure) go up the stack and sell their customers a competitive product. Redshift is an AWS product, for example.

I doubt this move would succeed – aside from Snowflake’s head start and superior product, customers are finding value in being multi-cloud. This gives them negotiating leverage against each cloud vendor.

The other big risk is price. At $60 billion, this is being valued at 102x sales, and ~56x forward sales. That is incredibly high, and this valuation is why I’m not backing the truck on the company.

With that being said, the current price is roughly half of what it was trading for in December.

This is a bet that multi-cloud is still in the early innings, and that the cloud titans will not be able to seize Snowflake’s market share.

New Position: Stitch Fix (SFIX), 3.2%

I reopened my Stitch Fix $SFIX position on Wednesday, March 31st, and increased the position by 40% once I felt the Nasdaq 100 would close over 13.3k. So far, this thing hasn’t filled the gap I was concerned about, which is encouraging.

If you’re curious, this write up from last year explains why I’m so bullish on this company. Since then, SFIX has found a way to increase their subscribers and increase spend per subscriber, all while we have been locked in our homes.

I don’t know about you, but I can’t remember the last time I bought any article of clothing. Somehow Stitch Fix got more customers in this environment, and got them to spend more on something we haven’t needed. Imagine what happens once people start going out again.

As I wrote on March 12th, investors sent the stock down 30% after Stitch Fix lowered revenue guidance by roughly 4%. I believe this is mostly due to Stitch Fix delaying their direct buy rollout, which I am perfectly content with. The last thing we want is for a short term revenue bump that cannibalizes the long term subscription business.

While Stitch Fix figures this out, we have an opportunity to buy a subscription-based eCommerce business for less than 3x sales for $5 billion. While this company will be volatile, I believe the potential reward is well worth the risk.

New Position: Unity (U), 2.7%

I bought this as a short term speculation in November 2020, and sold it for a 40% gain. Today’s prices are 5% cheaper than when I bought back then. Barring any crazy movements in the market, I plan on owning this position long term.

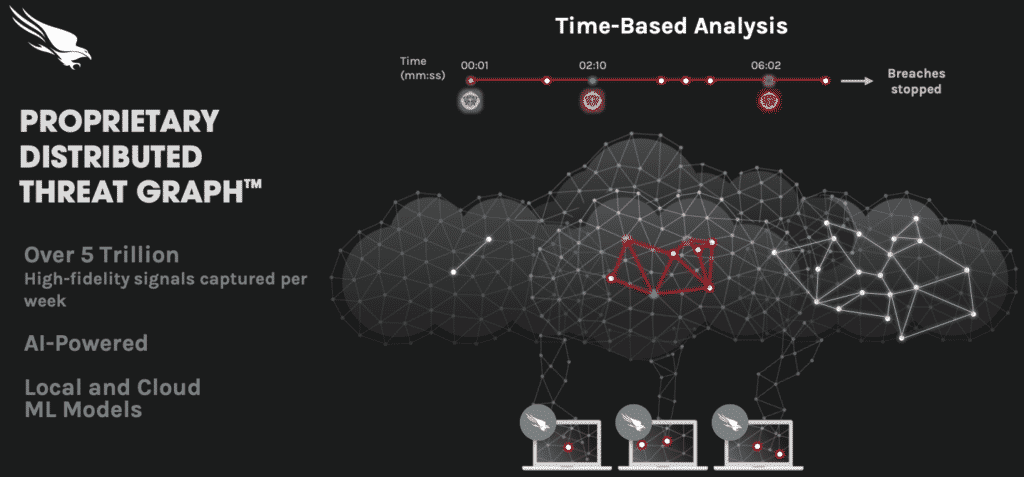

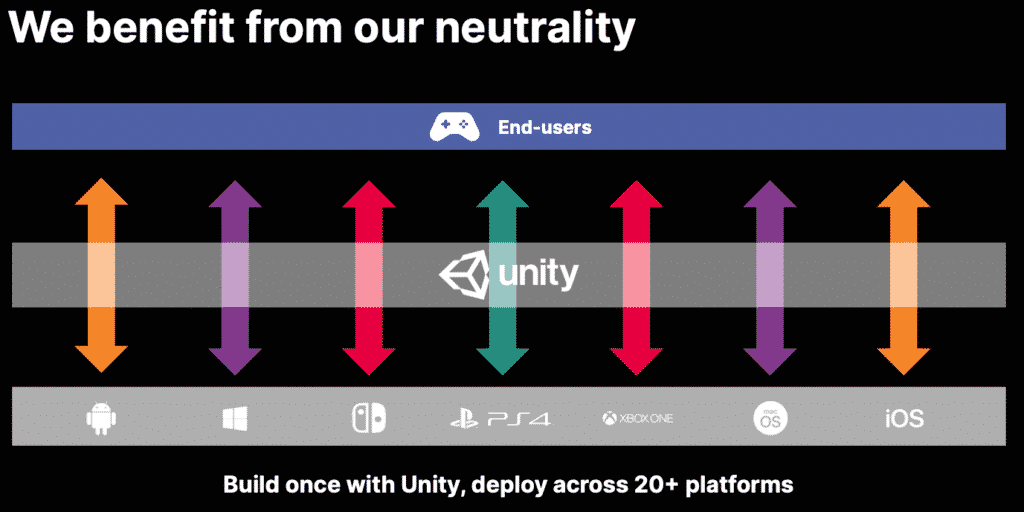

$U operates a platform for creating, running, and monetizing interactive and real time 2D/3D games. Think of them as an AWS for gaming.

Developers can build a game once on Unity, and then deploy it on 20+ different platforms (iOS, Xbox, Playstation, etc). They’re a dominant platform for video games, with only one real competitor in the duopoly (Epic Games Unreal Engine).

Aside from the gaming bet, there’s a broader augmented/virtual reality opportunity that could capture massive gains. In fact, Unity and Autodesk have been partnering on this since 2018.

The companies execution has been nothing but solid:

- 53% Revenue Growth YoY

- 144% Net Expansion Rate

- 2.5 billion MAUs

- 5 billion app downloads/month

By the way, 2.5 billion MAUs is insane. Just to put this number in perspective, here are the MAUs of popular social media platforms:

- Facebook: 2.8 billion

- Snapchat: 347 million

- Pinterest: 459 million

- Twitter: 353 million

Unity almost has as many MAUs as Facebook, and more than 2x the other social media companies combined. Although each company has a different monetization engine, go ahead and multiply any number times 2.5 billion. Trust me, you’ll come up with a very big number for future revenue.

The company’s valuation was my concern when I bought them in November at 43x sales. Thanks to their execution, the company is now valued at 34x sales and 28x forward sales. Still a high price tag, but I doubt I’ll get it much cheaper given their MAU count.

This is a bet that we’re in the early innings of gaming, that $U will find more ways to monetize their MAUs, and that AR/VR will provide tailwinds in the future.