Hey Everyone,

I hope you’re having a great week, let’s get into it.

Portfolio & Market Updates

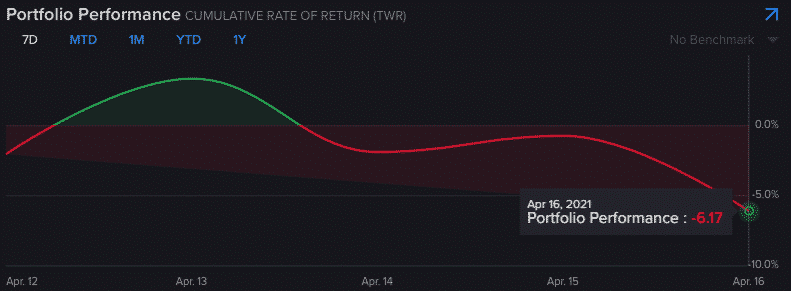

My portfolio was down 6.2% this week, which was well behind the S&P 500 (+1.4%) & Nasdaq (+1.1%). Year to date, I’m down over 10.5%. No matter how you slice it, I have underperformed in 2021.

While I have so far been correct about the Nasdaq 100 bottoming, my positions have mostly not recovered.

As I responded on Slack regarding my largest position, Magnite, it’s easy overthinking your positions in these moments.

Ultimately, I still believe we are in a bull market, and prices are confirming that. Similar to last week, the S&P 500 and Nasdaq are hitting all time highs. That generally does not signal a bear market on the horizon.

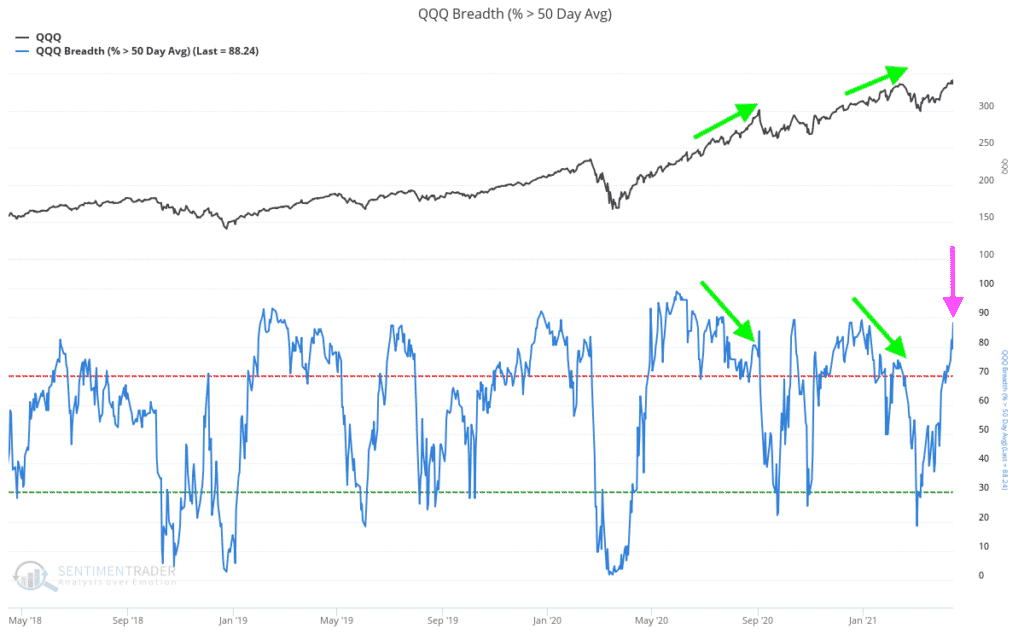

Also, notice how breadth is returning in the Nasdaq 100 ETF QQQ. The top line represents QQQ price, and the bottom line represents % of companies above the 50 day moving average. Essentially, this chart shows whether more stocks are trending up or down.

Notice the green arrows. The prior two occasions where breadth deteriorated while price improved ultimately led to corrections. This is one reason why I shared correction concerns earlier this year and opened hedges before the market tanked.

Now notice the pink arrow. Breadth has improved with price, and that health is why I believe the Nasdaq correction likely bottomed.

But what about my positions? While my recent purchases have mostly done alright (CrowdStrike, Datadog & Roku are up 10% – 17%), you can’t ignore my massive losses in Fubo & XPeng.

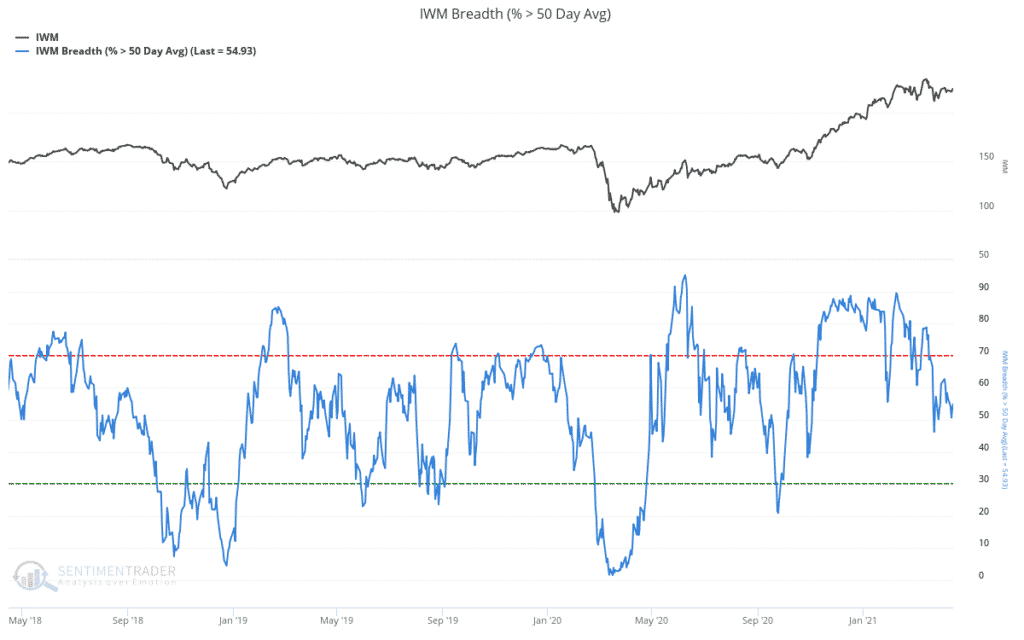

Since I own mostly small businesses, let’s shift from the Nasdaq 100 to the Russell 2000, under the ETF IWM.

There we have it, neither price nor breadth have improved at the same levels as the Nasdaq 100. While QQQ is hitting all-time highs, the small caps are still stalling out.

I mentioned that this was likely in my March 26th summary.

Seeing that big tech led us out of the COVID crash, and has done nothing over the past ~6 months, it would make sense for them to pick up the pace out of this correction.

Why haven’t I cashed in on this, as I suggested I might? Because I believe that the smaller companies I have invested in are at incredible prices. As I mentioned earlier, most of those new positions have done quite well.

Ultimately, I don’t see how this bull market is sustainable if smaller companies don’t participate. If only the largest tech companies are hitting all time highs, we may have a larger problem on the horizon.

NovoCure’s Rally & Patience During This Correction

NovoCure $NVCR, which I bought in July 2020, shot up 50% on Tuesday after they provided a favorable update on their phase 3 trials for lung cancer.

While my position stopped out in September because I was worried about a correction, I heard that at least one of you held on. Which is terrific, as that position is up nearly 4x since my original purchase.

Hopefully this scenario reiterates that I may walk away from great companies early due to how aggressive I am with my holdings. I will tell you when I believe the fundamentals change (I lost my conviction) vs managing exposure against a correction. While I correctly sold some positions and hedged my portfolio anticipating this correction, I was clearly wrong about how severe the correction would be.

Even though I was wrong about the severity, I still believe we are still generally in a bull market, and don’t want to miss on the gains that I lost from selling positions like NovoCure (and Roku) too early. While I’m clearly paying that price with $FUBO & $XPEV right now, I believe their upside potential far exceeds their downside risk.

As I said in the last section and repeatedly during this correction, time will tell if this was the right call, or the greatest mistake in my investing career.

Stitch Fix Founder & CEO Stepped Down

Stitch Fix $SFIX fell ~5% after announcing that CEO/Founder Katrina Lake is stepping down. She’ll be replaced by President Elizabeth Spaulding.

I never like Founder/CEOs stepping down, as my bias always leans toward founder-led companies who have a ton of skin in the game.

This does seem planned, however. Spaulding was brought in to Stitch Fix as a President, and spent much of her tenure hiring key executives and leading Stitch Fix’s growth initiatives. Check out previous earnings transcripts, and you’ll see Spaulding’s speaking role increased each time.

Also, I found tweets from former employees who speak highly of Spaulding. This tweet from Lead Engineer Kelsey Pedersen said it best, she had been with the company for 4 years.

As a former employee, I think Elizabeth is the one who will turn SFIX into a powerhouse. I’m sure she was hired a year ago with the sole purpose of taking over CEO. She’s insanely experienced + smart. I was always super impressed by her in all-hands, strategy meetings, etc.

As someone who has been in this scene for a while, takes like this are not common. Generally, Founder/CEOs are admired at a cult-like level. When they step aside, employees are generally not happy.

While I’m in a better place with Spaulding as a leader, I’m still worried about price covering the gap I have referenced before (light blue line). Investor sentiment could send this down in the near term, and I’ll likely sell if price makes a lower low. Let’s see what happens.

New Position: Stem, Inc (STPK), 2.8%

Stem is being SPAC’d by Star Peak Energy Transition, hence the ticker $STPK and the Star Peak name if you look up the ticker. The new ticker will be $STEM once the SPAC is complete on April 27th.

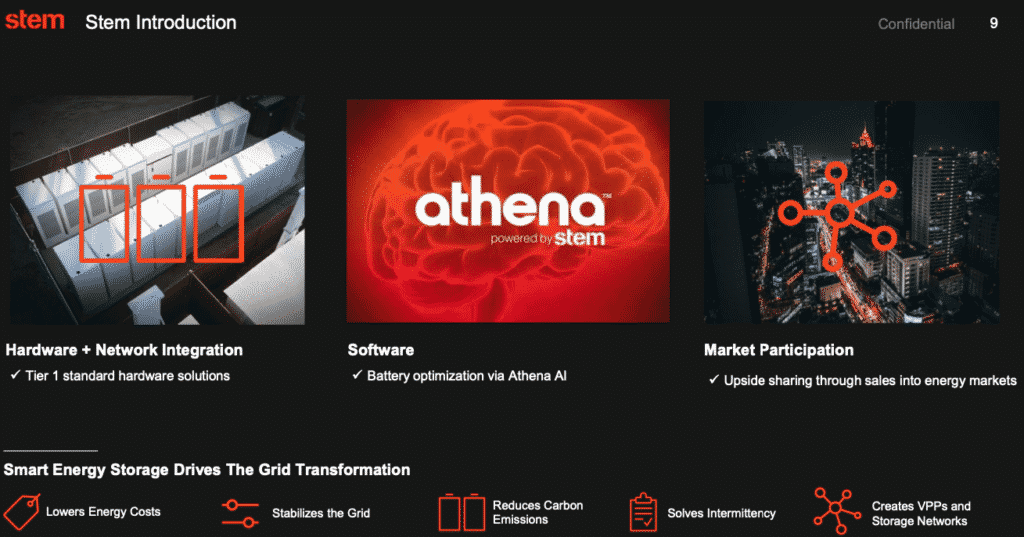

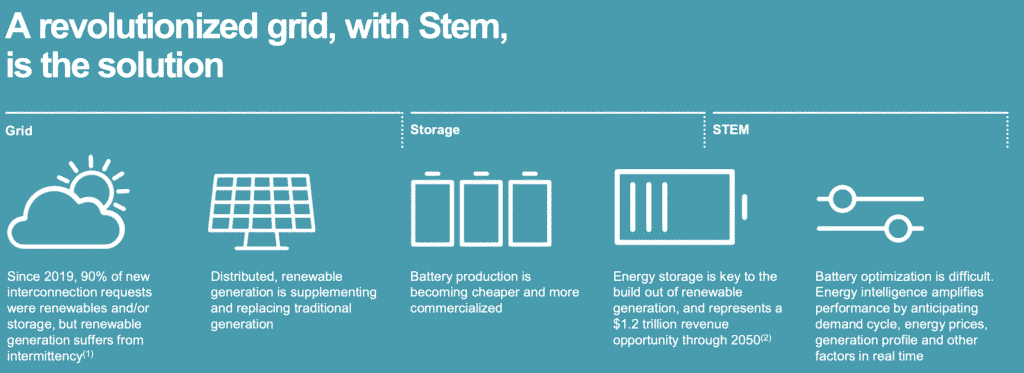

Stem is an AI-driven energy storage business, focusing on battery optimization and energy storage.

While this is a competitive market, Stem has differentiated themselves with their AI named Athena. Athena optimizes time-of-use and demand charges, which helps their commercial customers drop their power bills by 10% – 30%.

Athena also helps utilities, which is the big opportunity. Athena enables solar generation time-shifting and participation in ancillary revenue streams, increasing IRRs by 10% – 30%.

Why is this opportunity so big? Power grids aren’t ready for solar generation, which is a problem that California has already realized. Athena can reduce the volatility from solar, while supporting local grid capacity needs.

Athena is similar to my bullish bet on CrowdStrike – each incremental customer makes Athena smarter, which will make them even more differentiated in the future.

We’re seeing this in their performance, as Stem already has 75% share of California’s behind of the meter (BTM) storage market. California is not only the largest BTM storage market in the US, they are also a leading indicator for the rest of the states.

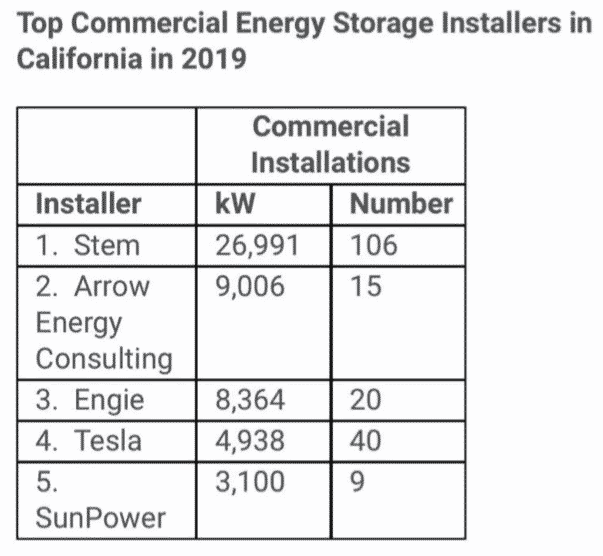

They’re also killing it on the commercial side, as Stem was the leading commercial energy storage installer in California with 3x the kW installed as the next competitor in 2019.

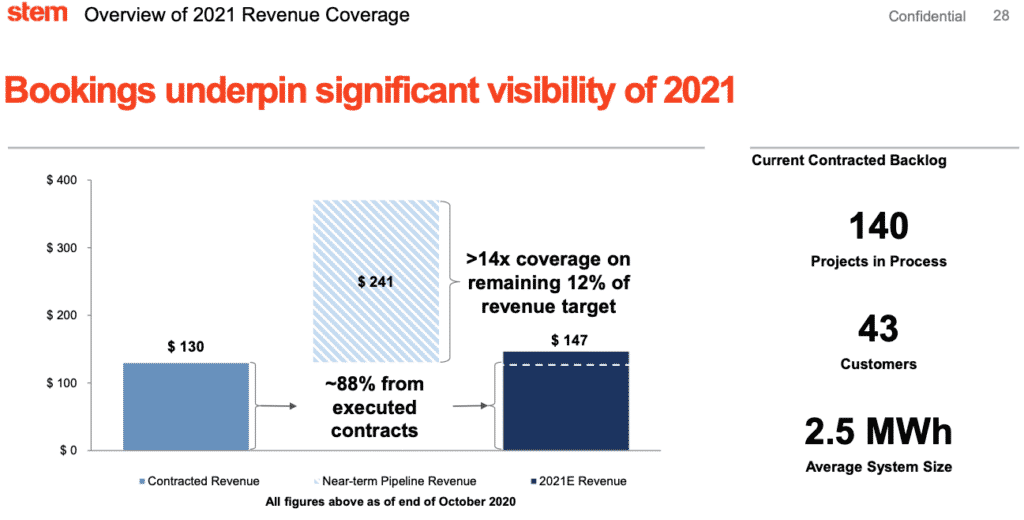

Stem, along with most SPACs, have been hit hard during this correction. While many SPACs are speculative, I believe Stem is less risky, because their forecasted revenue has something that most are missing: a killer backlog.

While Stem’s 2019 revenue was only $17 million, their backlog is over $200 million. In fact, over 100% of their projected 2021 revenue of $147 million is already locked in (this slide is a little old, from December 2020). While many SPACs will likely miss their estimates, Stem seems like a reasonable bet for exceeding their $147 million estimate.

In terms of valuation, $STPK has a market cap of ~$1.2 billion. Considering STPK will own 48% of Stem once the SPAC is complete, the company currently has a market cap of ~$2.5 billion.

Market cap could be misleading on this, as Stem will also have $525 million in cash with zero debt. This makes their Enterprise Value closer to ~$2 billion at the moment, and I believe they will be worth exponentially more if they seize more share.

Assuming more states follow California’s lead and shift to green energy, Stem will have a head start in an incredible addressable market. Considering Biden’s push for green energy and a $2 trillion infrastructure bill being discussed, I believe this is a reasonable bet.

Main risk is that this market is incredibly competitive, as there are many established players already in the space. Also, word is that Stem has so much share in California because they were one of two companies who won a Southern California Edison incentive program that paid for most of the battery project costs between 2015-2018. Without that incentive, the project would not have made financial sense, and competitors did not have access to that incentive.

While those concerns make sense, the market share and backlog is in place, and all of that activity will make Athena smarter and more differentiated as more states shift towards green energy. These states will have similar grid issues, and I believe Stem is in a great position to seize more share.

New Position: Futu Holdings (FUTU), 0.1%

This is a short term speculation. Known as the “Robinhood of China”, $FUTU doesn’t really have any notable differentiators, but they appear to be riding the wave of Chinese citizens entering the stock market.

I have had my eye on them waiting for a breakout, and it looks like that breakout is close to happening. This is a pitifully small position right now, and want it on your radar as I decide how to get more money in this holding.