Hey everyone,

I hope you had a great week, let’s get into it.

Portfolio & Market Updates

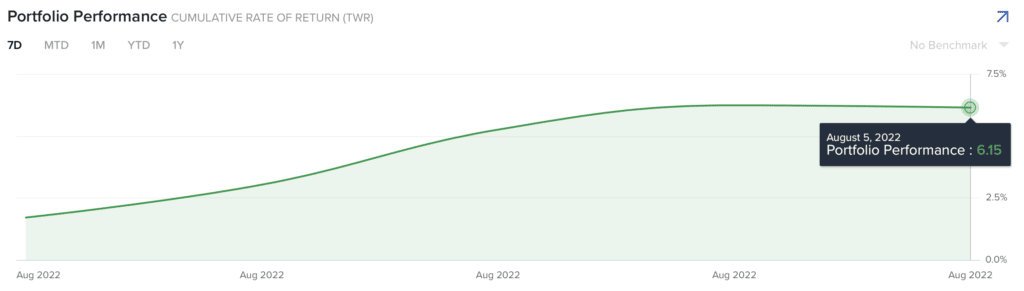

My portfolio rose +6.2% this week, which was well above the S&P 500 (+0.4%), and Nasdaq 100 (+2.0%), but well below Ark (+11%), while small cap growth $IWO was up (+3.0%).

Seeing that 49% of my portfolio is still in cash, the week could have been worse. This week’s outperformance was mostly due to last week’s underperformance, Roku.

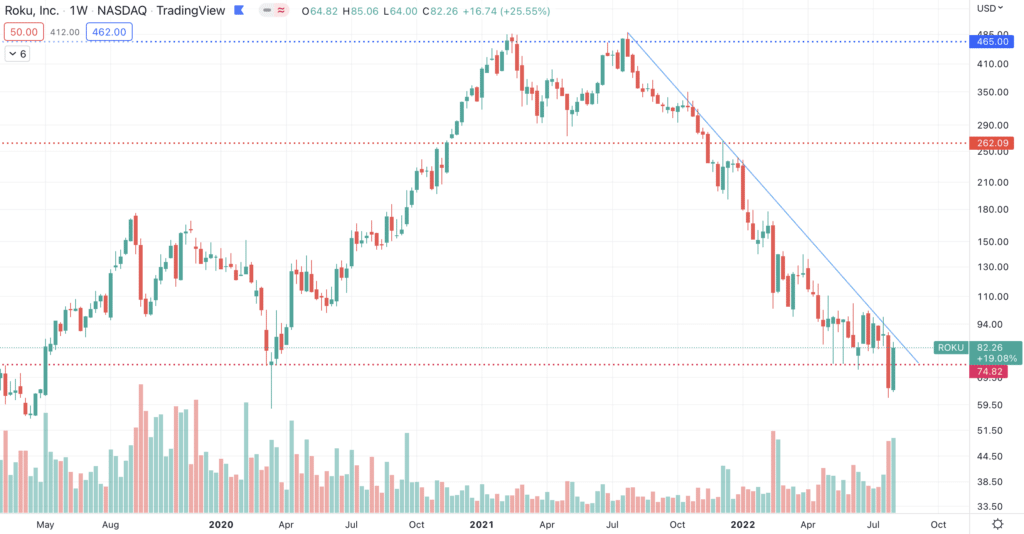

After falling 26% last week, Roku rose 25% this week. I wrote about why I liked Roku fundamentally, and the weekly chart shows that some institutional investors agreed.

Notice how this week’s accumulation volume was higher than last week’s distribution volume.

New positions have helped as well, namely Roblox (+20%), Gitlab (+12%), & Grab (+17%). These new names have helped absorb underperformers such as Twilio. Twilio fell 13.5% on Friday thanks to earnings, yet you see my portfolio closed the day roughly even.

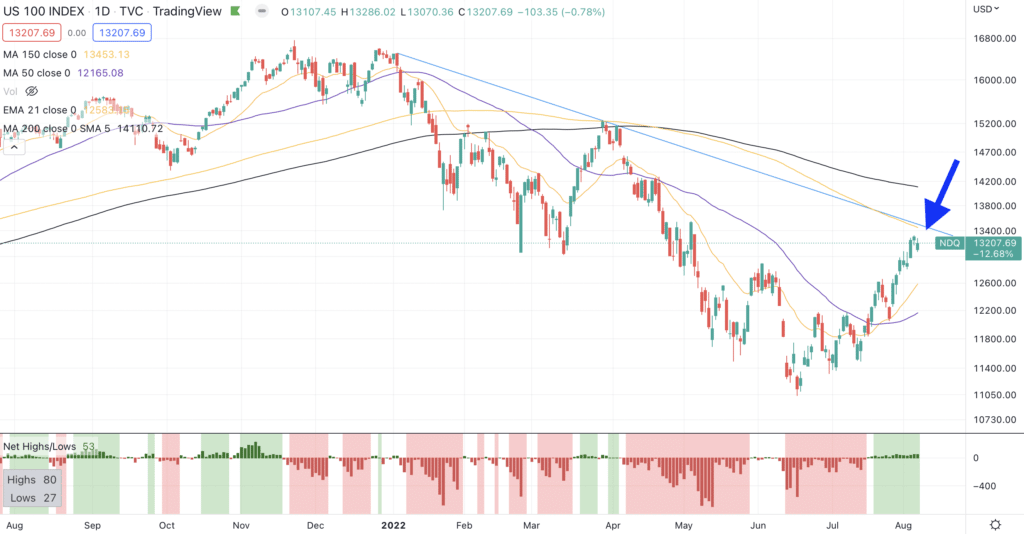

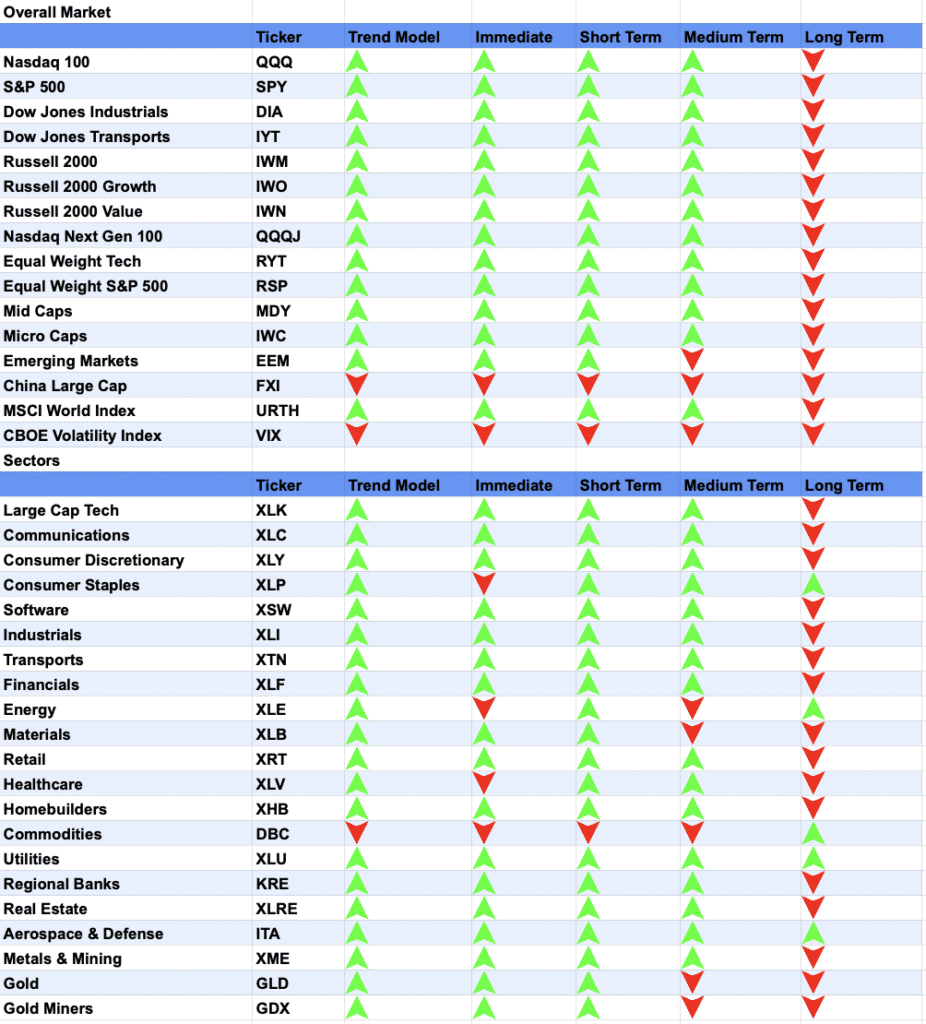

I wrote last week that the general market was approaching a logical level for correcting, as shown by the S&P 500. Fast forward this week, and it appears that tech is approaching a clear level as well, as shown by the Nasdaq 100.

Notice how the Nasdaq 100 couldn’t breach this trend back in March, and sold off hard after failing. That could happen again, and I believe the Nasdaq will telegraph this by showing more net lows than net highs. As you can see, this worked out very well in April.

I’m staying cautious in the meantime, as I wrote about my concerns last week:

- Retail optimism returning (SentimenTrader echoed the concern this week)

- Seasonality (August & September are the worst months)

- The 200-day moving average being a lid

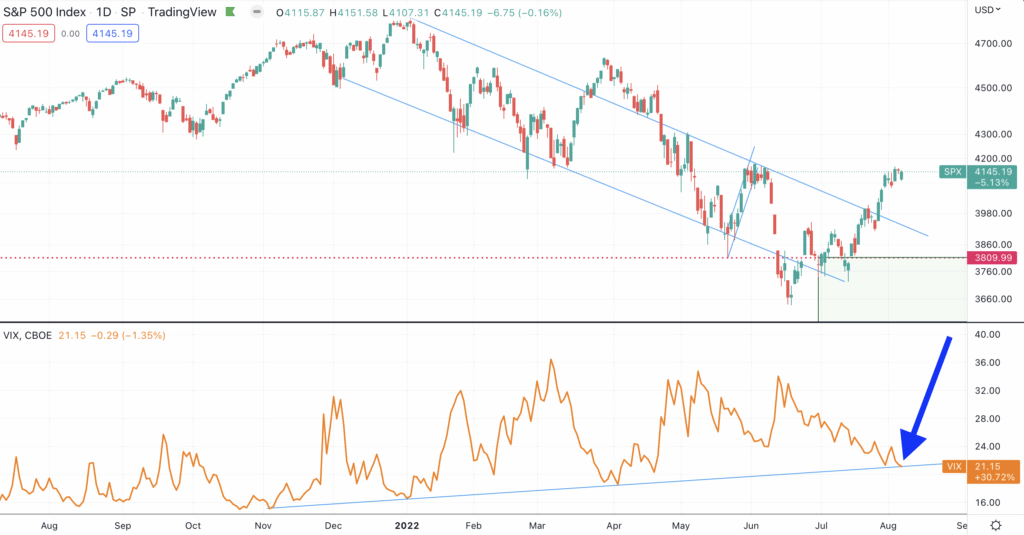

We can add another concern now: the VIX is at the bottom of their trend since this bear market started.

As you can see, the S&P 500 hasn’t reacted well any other time the VIX bounced off this trend.

If the market does react negatively, I will likely reduce exposure, and could short weaker companies. Prior drawdowns have been fast, and I would rather secure any gains and wait for the coast to clear. With that being said, I also don’t plan on selling anything that is still trending up.

Earning Beats This Quarter, Rest of Year in Question

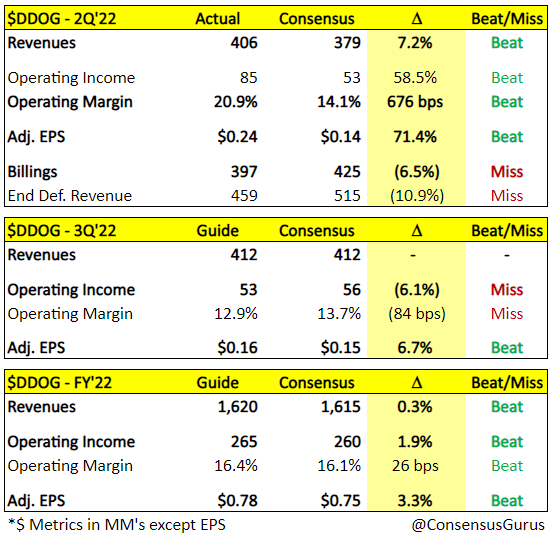

One of the reasons why the S&P 500 is up 14% from June lows is that earnings has been far better than many feared. We saw this across the board with semiconductors (AMD & Lam Research), travel (Airbnb & Booking), credit cards (PayPal & Square), and cloud (Datadog & Confluent).

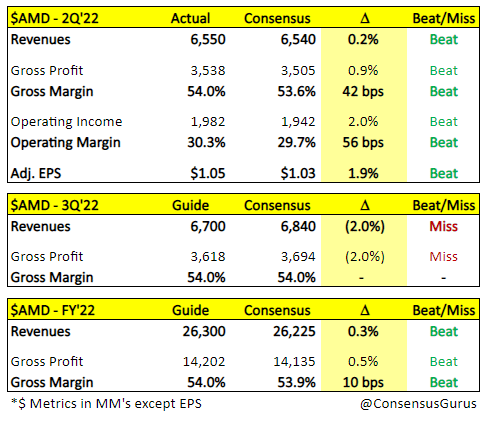

The real question is how they’ll do the rest of the year. Many gave muted Q3 guidance, and plan on making up for those misses later in the year. AMD is a great example, as shown by Consensus Gurus.

Notice how AMD is taking a hit in Q3, and is making up for that with elevated guidance later this year. Datadog looks fairly similar.

Only time will tell what happens later this year, and I believe the market will be a leading indicator. If I see companies start breaking down, I’ll likely get more defensive.

More Acquisitions Lifting Valuation Floors

Aside from positive earnings this week, there were two acquisitions which likely helped the tech space.

- Ping Identity +67% after announcement

- iRobot +20% after announcement

Ping Identity especially shows how depressed software valuations are. The fact that this was a leverage buyout from Thoma Bravo is even more encouraging, as it shows the debt market can support such large premiums on software.

It’s difficult knowing what will happen in the short run, but these acquisitions are showing how undervalued technology is.

Market Trends

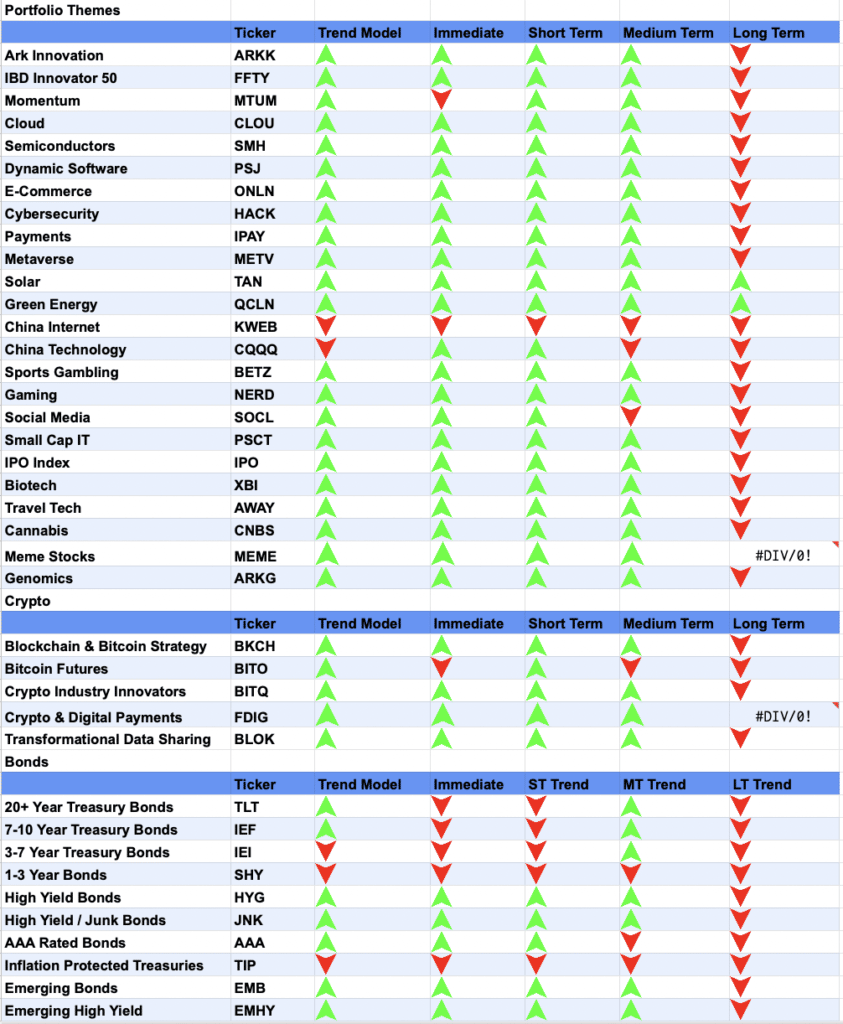

As for market trends, it’s more of the same as last week. The long term trend is still down in the general market and portfolio themes, with solar being the exception.

The real question will be who holds up the strongest if there is a pullback. Solar has been strong, and I believe travel tech will do well, as I opened positions in Grab & Airbnb.

Those themes with the most relative strength will likely be the next set of leaders in any bull run.

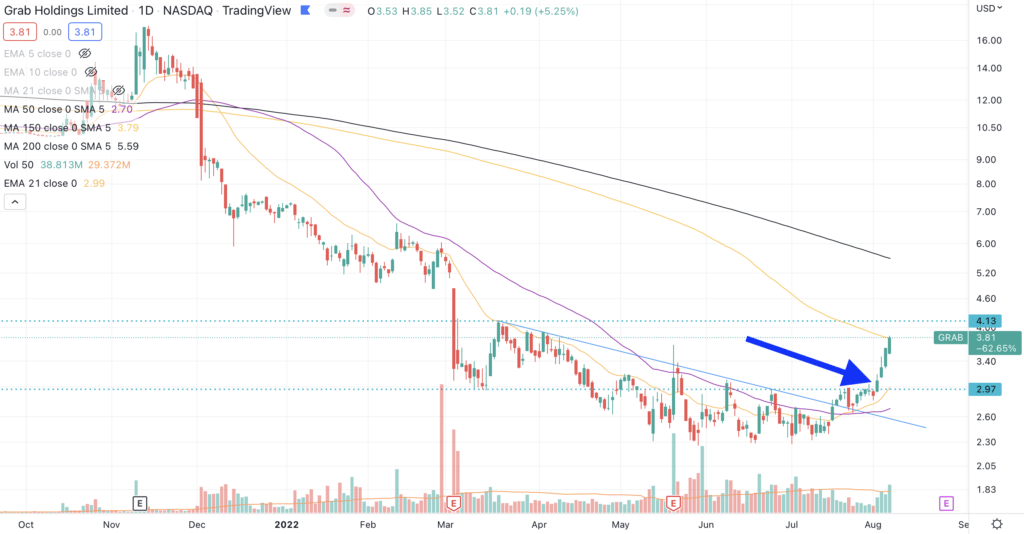

New Position: Grab Holdings (GRAB), 5.8%

The Uber, PayPal, & DoorDash of Singapore, Grab is down 78% from their November 2021 highs.

Price had been consolidating below the $3 level since June, and I opened a position once price broke above.

I doubled this position later in the week when a compelling entry point arose, and Grab ultimately closed the week 2 pennies above the 150-day moving average (yellow line) on Friday. Many investors use the 150-day moving average as the long term trend.

This position is up so quickly (18% in aggregate) that there isn’t a logical stop level. I’ll keep an eye on any potential pullbacks, and will decide based on the price action if I’ll reduce or add exposure. Longer term, I believe this company has a lot of potential.

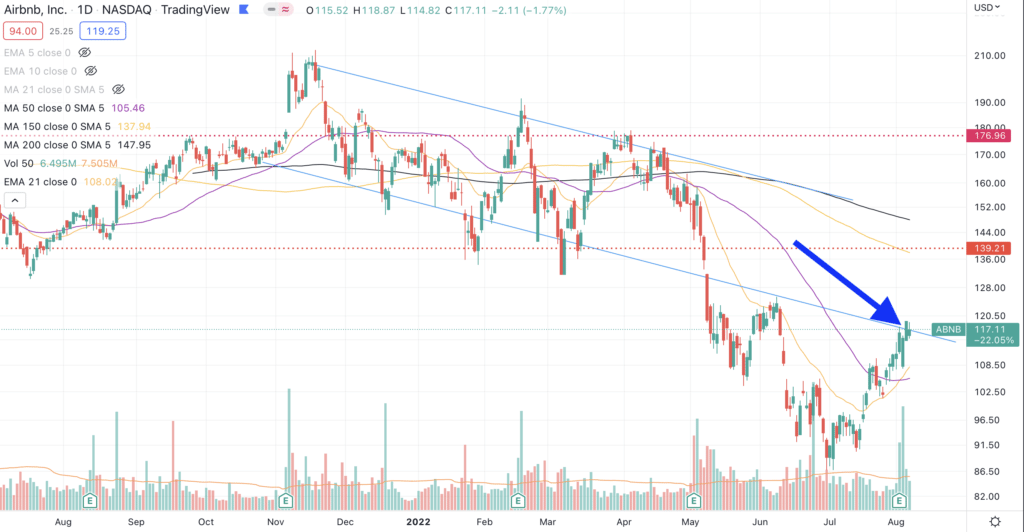

New Position: Airbnb (ABNB), 3.4%

Airbnb announced a great beat and raise this week, then fell 8% after hours. I wrote on Slack that this drop didn’t make sense, and opened a position with them the following day.

Price is selling off at the same downtrend line as when they sold off in June (blue arrow). If ABNB can’t break through again, I’ll likely set a stop at the 21-day EMA (orange line).

Add: Gitlab (GTLB), +50%

Gitlab finally broke above the $60 level (blue line), which had been resistance previously. I added to this position on Tuesday (blue arrow), and price is now resting below a newly formed 200-day moving average (black line).

Given how price broke down the last time Gitlab closed below $60 in March and April, I will likely sell this position out if it breaks back down.

We are seeing more follow through in breakouts including Gitlab, which is encouraging, but the longer term trends are still down. I’ll keep adding exposure as I find opportunities, and will stay cautious given the concerns I wrote about last week.