Hey Everyone,

I hope you had a great week, let’s get into it.

Portfolio & Market Updates

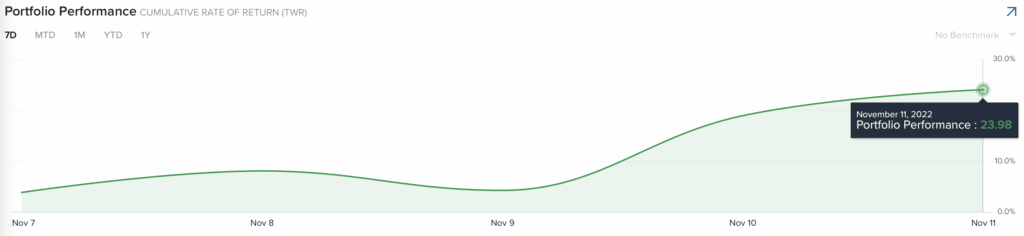

My portfolio was up 24% this week, blowing past the S&P 500 (+5.9%), and Nasdaq 100 (+8.8%). Ark finished up (+14.7%) and small cap growth $IWO was up (+4.8%).

We can thank this outperformance to holding my positions before CPI, where I was relatively long futures before the numbers were released. On top of that, both Roku (+24%) & Twilio (+29%) had monster weeks.

But I was not long equities, bonds, and gold because of a CPI guess. There were 3 reasons why, which I outlined last week:

- The 10 year yield would collapse

- The dollar would keep falling

- The government would influence midterms by adding liquidity

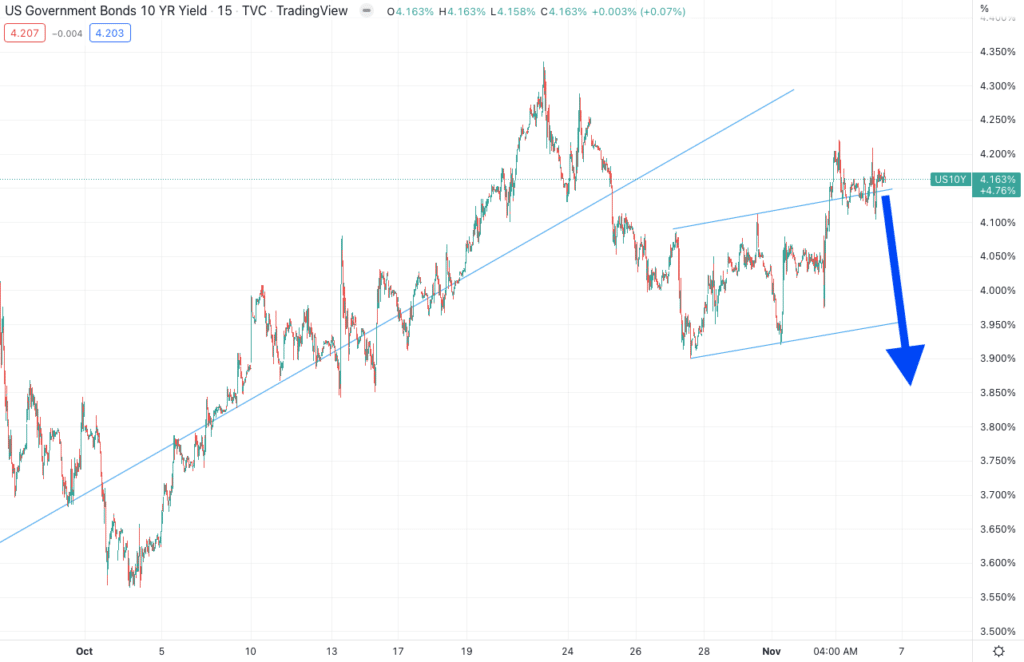

The 10 year yield would collapse

Here is the image I drew in last week’s summary, twice, which I wrote.

As for now, isn’t it interesting that the 10 year yield is meaningfully lower than their October 20th highs despite such tough talk from Powell? It doesn’t seem like the bond market is buying what Powell is selling.

Here’s the 10-year yield one week later.

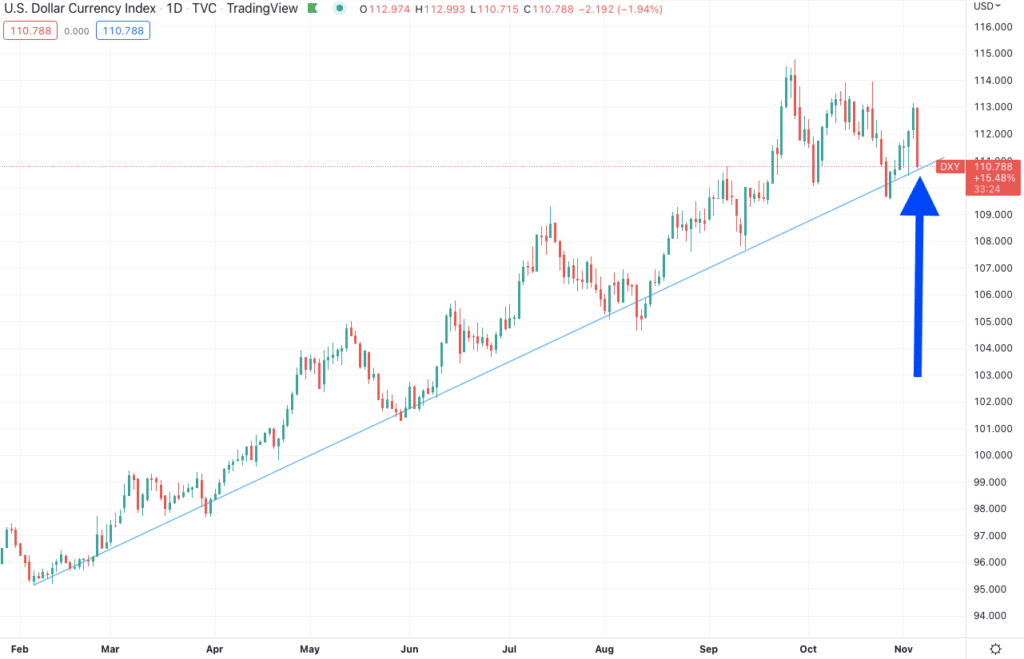

The dollar would keep falling

As for the dollar DXY from last week, I wrote:

a falling dollar will lift equities and commodities, and that could happen early next week. As much as I dislike holding futures over the weekend, these are well in the money, and it seems like both the dollar and yield are on the cusp of rolling over.

Here’s the dollar chart this week, where it completely rolled over.

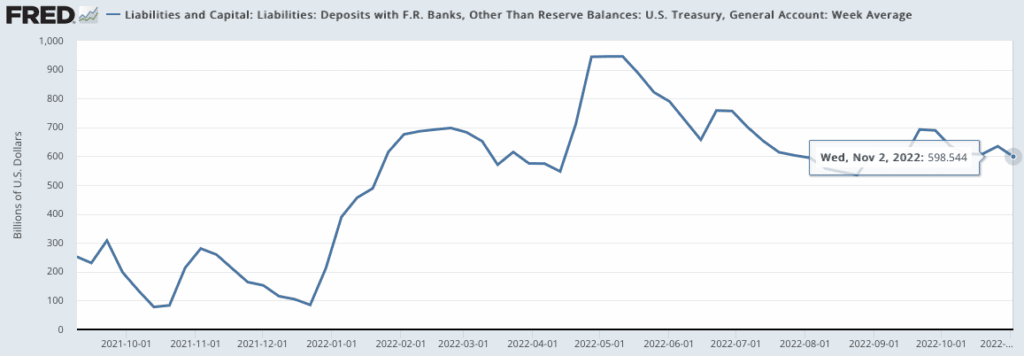

The government would influence midterms by adding liquidity

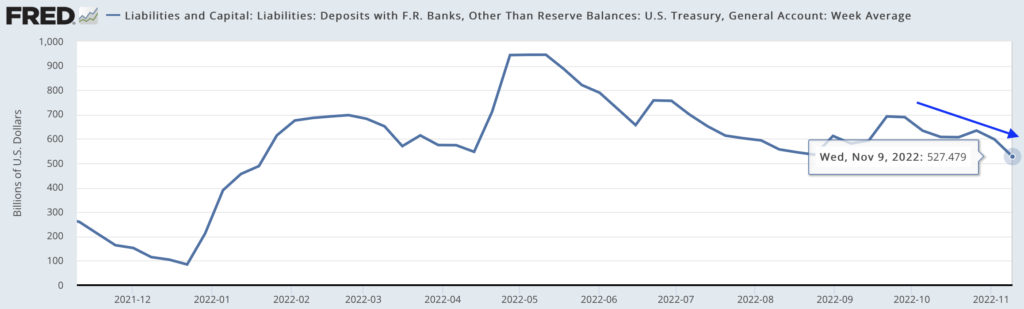

Here was the treasury’s balance sheet last week, where I wrote:

Now, the US Treasury General Account has given out a healthy amount of liquidity since they had over $900 billion the bank in May. As of November 2nd, they had less than $600 billion. My bet is that we’ll see even more money given out next week, which means more liquidity in the market.

Sure enough, roughly $71 billion worth of liquidity was injected into our economy this week.

Now the midterms are clearly over, and we’re seeing positive momentum afterwards, which I have happily cashed in on. I still believe this is a bear market rally, and am leaning to the market rolling over, perhaps as soon as next week.

Concerns After the Midterms

This was a headline last week as well, and I believe it even more firmly now. Notice that despite the market ripping post CPI, we have not seen a >90% upside day since October 4th.

Simply put, institutional investors are not buying stocks hand over fist, which tells me this is run up is likely thanks to short covering and retail exuberance.

I’ll happily take these gains, but plan on shorting this market once the red flags start piling up.

Now look at Ark, which was up 14.7% this week. Despite an incredible run up (notice how it hit COVID crash lows this week), the volume isn’t that remarkable.

Not only have other weeks shown more volume, but there have been 3 weeks of heavier selling. Once again, I just don’t see the demand.

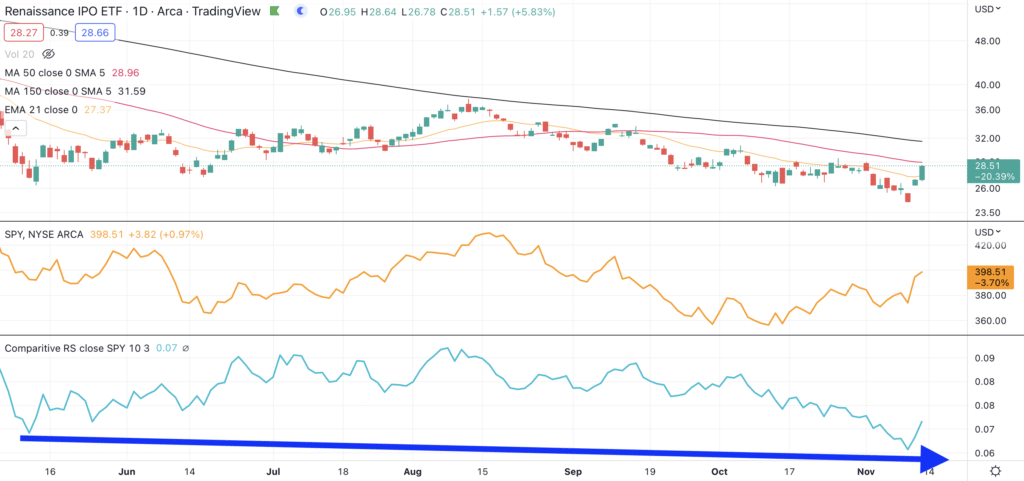

Growth Underperforming Value

Finally, growth officially started underperforming value over the intermediate term. Here is $IPO relative to the S&P 500.

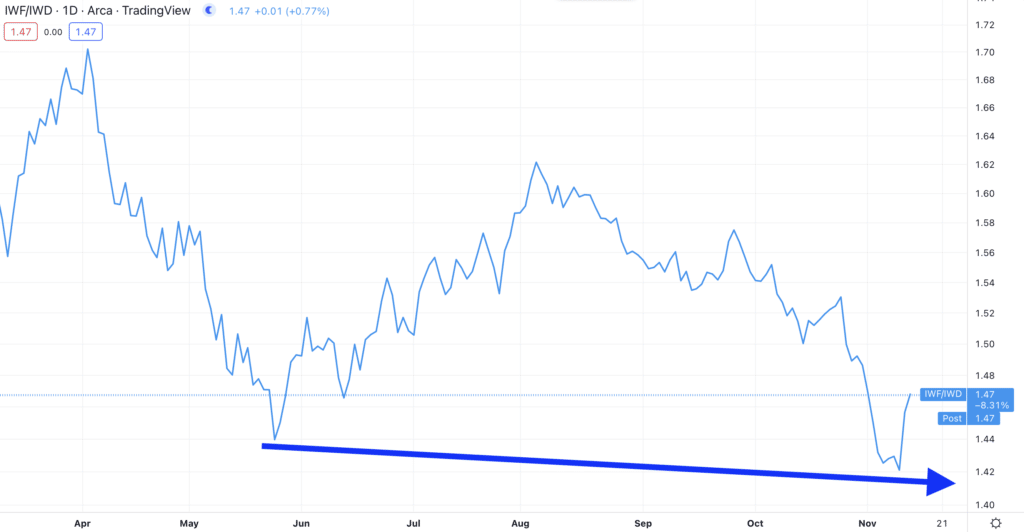

This is not acute for $IPO, here is the Russell 1k growth $IWF vs value $IWD ETFs.

Growth generally leads value out of bull markets, and while I wrote how value was outperforming over the short run, the intermediate trend was still up. That is no longer the case, which is why I’m even more skeptical of this rally.

Despite this skepticism, I have not been sitting on the sidelines. That will likely change later this month, perhaps as soon as next week.

Magnite’s Massive Earnings

Once I see evidence of a new bull market, Magnite is on the top of the list. They blew the doors off earnings this week.

- +11% Revenue YoY (2.7% Beat)

- $0.18 EPS (24% Beat)

- 19% Operating Cash Flow Margins

This stock doubled as a result of that beat, knifing through the 200-day moving average (black line).

This is massive accumulation, and the outperformance clearly speaks to my original thesis with this company. Specifically, they should benefit from CTV growth and Apple’s ATT change (they own first party data unlike Facebook).

Once I believe a new bull is coming, this will once again be one of my largest positions again.

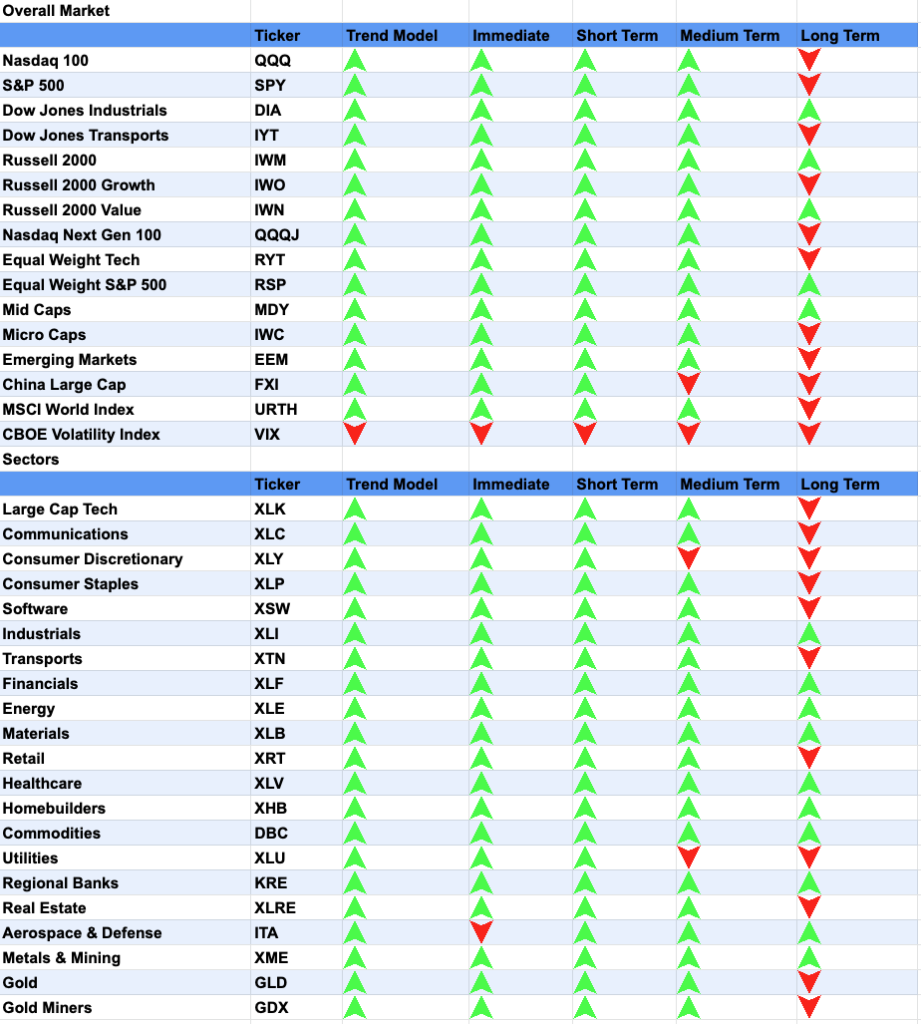

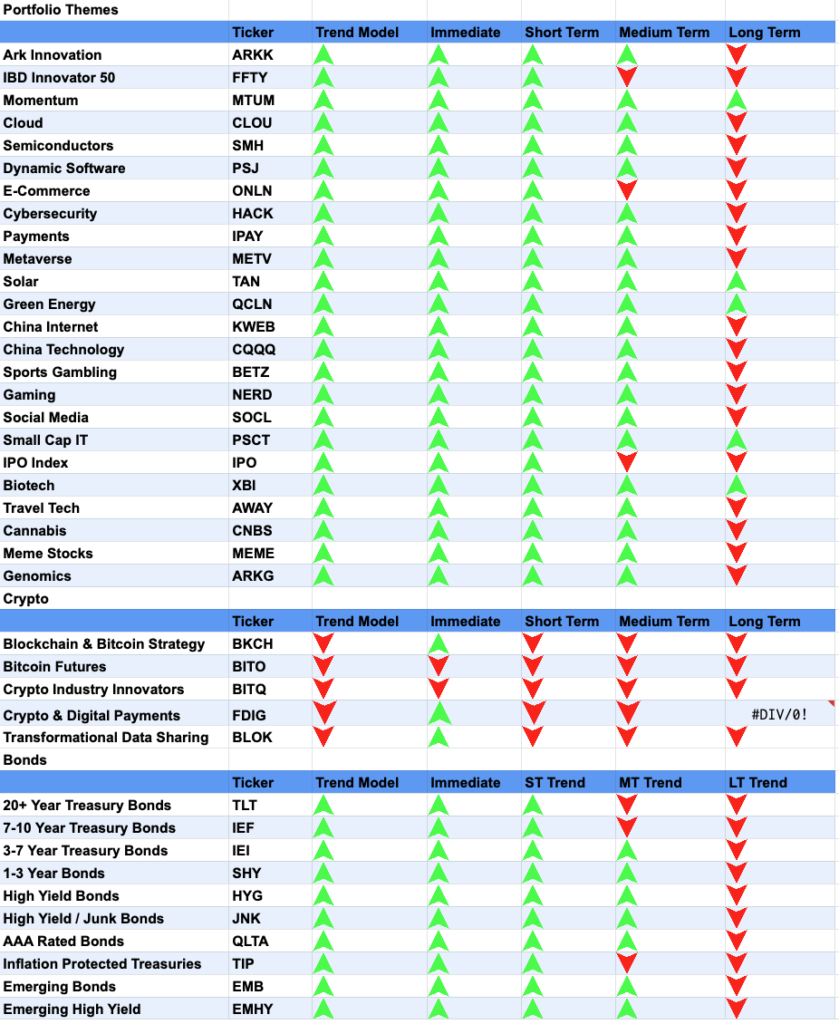

Market Trends

As for market trends, everything looks a lot better. Several sectors have turned up their long term trends, specifically the Dow Industrials and Russell 2k.

Solar & Biotech also have turned up. As of now, my thesis is that this rally will not hold, despite what my trend model is saying. If the facts change, I will change my mind, and will let you know.

Long Futures: Equities (YN & ES), Bonds (TN), Gold (GC)

Generally Friday rallies carry into Monday, so I’m holding these positions into the weekend.

I plan on shorting this market later in the month, and will let you know once I change my tune. Have a great weekend.