Happy New Year Everyone,

I hope you had a great week, and wish you the best for 2023. Here’s a quick recap of last week’s plan:

- I was leaning towards more upside in equities this week, and went long bonds expecting rates would fall

Rates have not fallen, but we may have seen the start of a bear market rally towards the end of the week. If that is right, falling rates would help fuel that rally.

Major indexes fell initially, and closed at roughly even for the week. I’m still leaning towards more upside in equities, and plan on going long equities once I believe the coast is clear. This will probably only be held for a few days, as I’m very bearish after the first week of January.

Portfolio & Market Updates

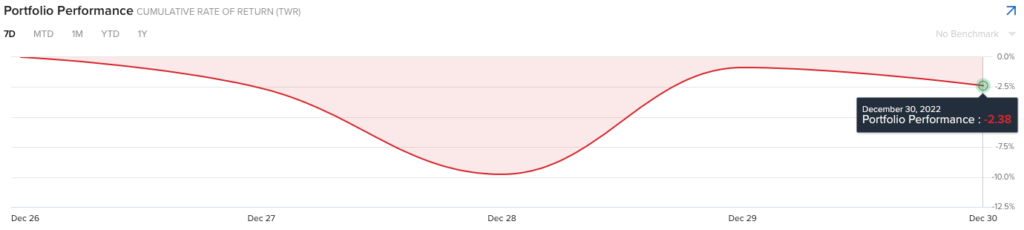

My portfolio was down -2.4% this week, which was thanks to the bond holdings I mentioned.

This underperformed all indexes, which basically closed for a wash.

- S&P 500 (-0.14%)

- Nasdaq 100 (-0.42%)

- Ark (+0.9%)

- Small Cap Growth $IWO (+0.15%)

End of 2022 Returns & Futures Pivot

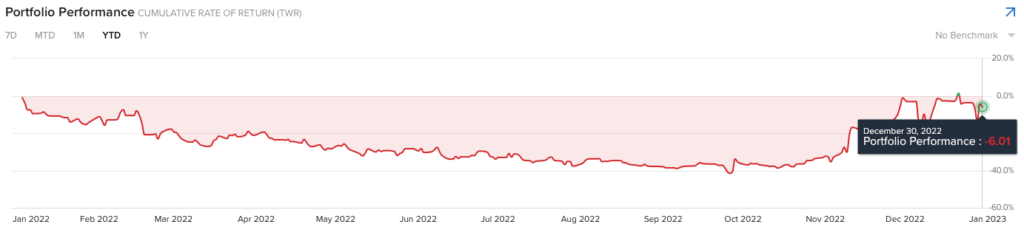

That bond purchase put my year in the red, as I closed out 2022 down 6%. You’ll notice that I was green for YTD returns when that purchase was made on December 20th.

Despite closing in the red, my returns far outperformed any other market index, including bonds. I added some more markets for context.

- S&P 500 (-19.4%)

- Nasdaq 100 (-33%)

- Ark (-67%)

- Small Cap Growth $IWO (-26.8%)

- Small Cap Value $IWN (-16.9%)

- Emerging Markets $EEM (-22.4%)

- 20-Year Bond ETF $TLT (-32.8%)

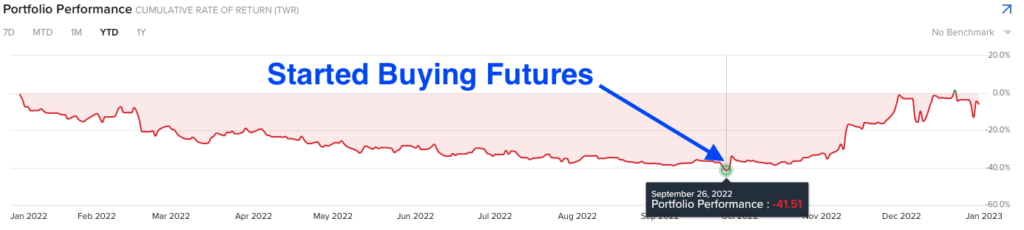

That is a huge turnaround, and is 100% thanks to my futures pivot at the end of September. My first futures purchase was on the blue arrow below.

Before then, I was on pace for a 41.5% loss, despite mostly being in cash through the year. Thus, I earned a 78% return over the past 3 months thanks to my futures pivot.

Futures Pivot & Bear Market Volatility

I explained in this month’s webinar why I’m focusing on futures during this bear market, which was done after 3 months of trial and error.

- No wash sales

- Better tax treatment

- 60% long-term capital gains

- 40% short-term capital gains (income)

- Wider trading hours – most market action happens overnight

Ultimately, those bullets come revolve around how volatile bear markets are. The webinar really spells this out, and the image below shows the gist. Notice how much more the S&P 500 fluctuated (as shown by the lower blue rate of change ROC line) during the COVID crash (between the 2 red lines).

ROC is simply the % change up or down in a given day. Below, you’ll see the same story in our current bear market as well.

This volatility makes timing difficult with ETFs and single stocks due to wash sale rules. I showed where I struggled making money in the December webinar, despite making directionally accurate calls. Futures have resolved this issue for now, albeit from a small sample size.

Trading futures was not the initial intent of this website, nor was it something I ever did before this year. My North Star has always been maximizing my returns, and transparently sharing my actions and overall returns. Hopefully this shift towards futures, and the subsequent returns from that change, show how committed I am to this mission.

Rest assured, I’ll buy individual positions once I believe a new bull market is starting. I just don’t think that time is now. My December webinar shows what I’m waiting for, which are explained in the Resources section. Frankly, I enjoy analyzing companies more than trading futures. The macro environment and idiosyncratic risk made buying individual names too difficult, so I learned new methods to monetize this environment.

Thank you for your patience on this, and please reach out if you have any questions about my strategy in this bear market.

ETFs for Futures: Still a Work in Process

Some have asked whether this futures strategy can be mirrored using ETFs, and I should have enough data by the end of February. There are two big constraints that I’m working through:

- Trading only during regular trading hours, as most market movement happens overnight

- Wash sales, you cannot repurchase a similar security within 30 days (before or after) selling for a loss, otherwise you must delay realizing that loss

Please reach out if you have any questions about wash sales. I’m not licensed in any of this stuff, and can’t give advice, but I have paid accountants and consultants handsomely for absolute clarity, and will happily share what they have taught me.

So far, my bond ETF (mirroring my long futures position in $TN) is down 11%. Please reach out if you would like any updates before February.

Equity/Bond Ratio Priced in Lower Earnings in 2023

I have seen many market calls for 2023, such as this tweet from the Chief Investment Officer at Morgan Stanley.

Remember that people like Wilson are retail facing. I believe most professionals already know that “earnings risks are rising”, because it has already been priced in.

Notice how correlated the equity/bond ratio (blue line) is with earnings (orange line). This ratio even called the abrupt COVID earnings crash, and subsequent snap back.

While retail may be surprised with lower earnings, and market makers could exploit this when retail reacts, I believe most institutional investors are ready for the earnings misses in 2023.

Market Trends – China Still Strong, Biotech Consolidating

China is still looking good, and the long term trend for Dow Industrials is still green. The Dow Industrials turned up on November 7th, and the long term trend is still holding strong.

This is why I’m predominately buying Dow futures $YM when I’m going long equities. I don’t think a market has ever crashed above the 200-day moving average, and the Dow is holding this threshold (which is my proxy for long term trends).

As for China, I’ll keep waiting since I’m so bearish later in January. Any outperformance during a drawdown shows that institutions are picking them as the next winners. If my mind changes about a January drawdown, I’ll let you know.

Similarly, biotech’s long term trend has turned up, but is has really been consolidating since July.

Let’s see how this sector does in any drawdown as well. If they hold strong, we could be looking at the next sector that is breaking out.

Sold: Airbnb (ABNB) | Reduced: Roku (ROKU) & Twilio (TWLO)

These were purely tax moves. My futures pivot made great gains, and these sales eliminated any tax liability.

I’m so disappointed in what happened with these names. When I liquidated my positions in November 2021, I wrote about how “The trend on all of these turned down, and I sold them to prevent further drawdowns.” I did not know how severe that “further drawdown” would be.

Clearly I missed this bear market at the time, and missed how severe this drawdown would be for Roku & Twilio. Both of these names were held because my market trend model turned down on them months earlier, and I would not apply the model retroactively.

Hindsight shows I should have sold these long ago, and Twilio’s earnings shows why these drawdowns are so disappointing.

Notice those green E’s at the bottom of the chart, which are earnings beats. Twilio & Airbnb have consistently beaten their earnings (Roku had one miss in July 2022), yet all names are down gut wrenching levels.

I’m sorry again for how awful these drawdowns have been, and hope you know how committed I am in generating alpha in this bear market. Hopefully you have seen this in my futures pivot over the past 3 months, and I’ll keep optimizing this in 2023. My next step is incorporating ETFs for this futures strategy.

What I’m not doing is picking names that have further risk of falling, and telling you that if you can’t stomach these drawdowns, you’re investing in the wrong companies. Such is the mantra for many Twitter “furus” I see, which feels very disingenuous. Why would anybody recommend a stock that will fall further? Given that returns are so correlated with the macroeconomic environment, why wouldn’t people address that?

Big Gains Could Be In Store Once the Bull Returns

On an optimistic note, I think all of these names will kill it once the market turns bullish again. They are consistently executing despite such horrible drawdowns, and their microtrends keep growing.

- Twilio: Marketing with 1st Party Data

- Roku: Connected TV, Streaming, & Cord Cutting

- Airbnb: Increasing Spend on Experiences

There are more microtrends I’m following, and I can’t wait to buy these names once I believe a new bull market is possible. Roku’s returns after prior drawdowns show why I’m so excited.

Futures: Long Bonds, Aiming for Long Equities Next Week

I didn’t see an entry opportunity for equities, but I believe the 90% upside day on Thursday reinforces that a short term rally is possible.

I must emphasize how short term this is. Any equity longs will likely be held for just a few days, as I’m expecting a very bearish January afterwards. If this plan changes, I’ll let you know.

As for those bonds, my rate thesis has been wrong so far, but the divergence I wrote about last week is getting more pronounced.

Yields advancing while RSI is falling suggests that the 10 year yield is running out of steam. While my timing was clearly off, and this position cost me a positive 2022, I’m not seeing anything from a macro or technical perspective that is proving this thesis wrong yet.

We’ll see what happens in 2023, Happy New Year everyone.