Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Bullish equities, long bonds and gold

This equities call was wrong, and the S&P 500 rolled over during the 2nd half of the week, dropping -2.5% overall.

Although I was not exposed to equities, yields kept up their advance, breaching 5% for the first time since 2007. This unfortunately made my bond losses even worse.

S&P 500 Closed Below 200 Day, But Significant Liquidity Coming In

As for the broader market, I wrote last week that I “will quickly reverse my bullish thesis if the S&P 500 does not follow through.” I opened modest long equities once price approached the 200-day moving average (black line), and reversed my thesis by hedging those longs once price closed below on Friday (blue arrow).

Given that closure, I’m neutral equities until price reclaims that 200-day moving average, which ideally happens Monday. I have written extensively about why I’m bullish over the intermittent term, but none of that matters until price reclaims that moving average.

While I am neutral, I don’t think now is the time to turn short or bearish, given how much liquidity is coming back in. Notice how Reserve Balances with the Fed have ticked up meaningfully this week (yellow line), while the S&P 500 (blue line) has fallen off a cliff (blue box).

As you can see on that chart above, higher reserve balances typically power up equities over the short run. This is one of the reasons why I felt comfortable going long equities on Thursday.

Assuming we do see a bounce in equities, the power of that bounce will be critical. The S&P 500 needs a follow-through day, and I don’t plan on getting too bullish until we see it.

Bonds Near 20-Year Lows

If you bought 20+ year treasury bonds 20 years ago, there’s a good chance those bonds would be worth the same price today.

TLT has been cut in half over just a couple of years, as yields breached 5% for the first time since 2007.

And while this has been a devastating drop, even for me who has only held for a couple weeks, this could be an incredible investment opportunity once yields reverse.

And speaking of yields, we still see that momentum (RSI, purple) is not keeping up with yields (top arrow).

Who knows when that reversal happens, I was certainly wrong with my timing, but I still believe bonds will be a compelling opportunity.

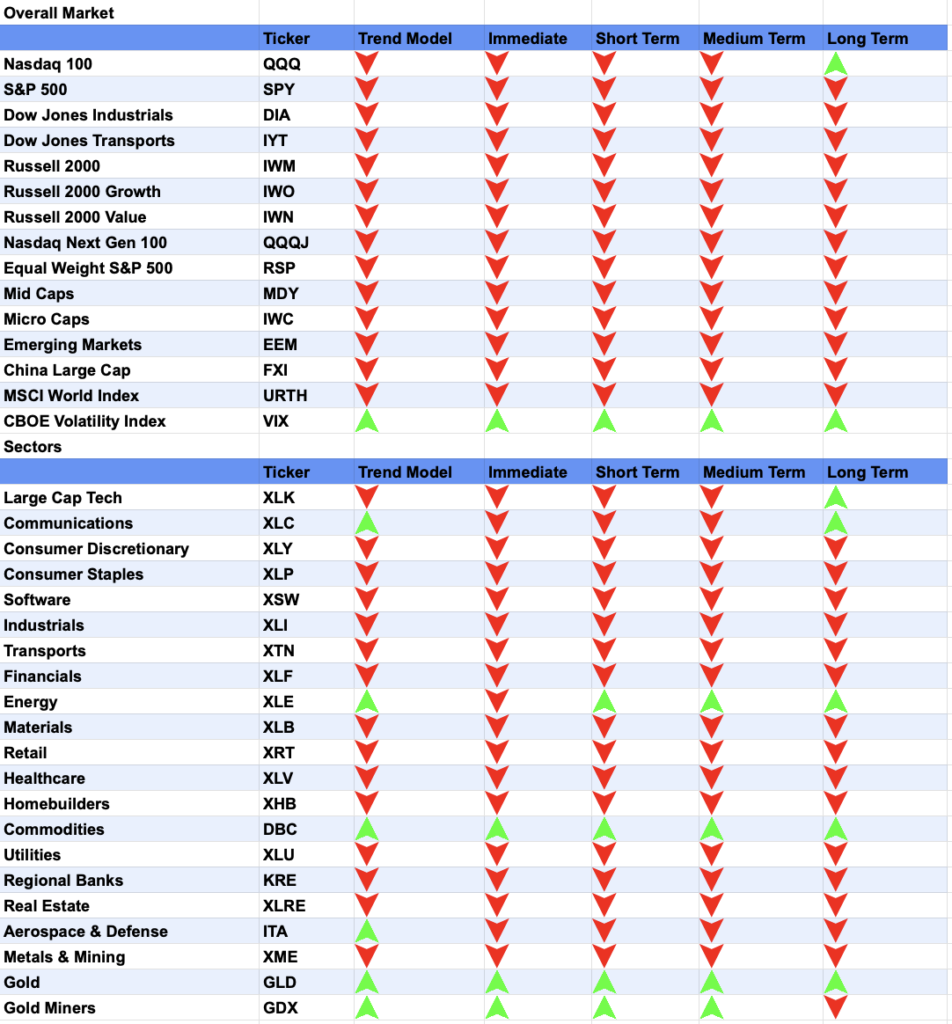

Market Trends – Risk Still Outperforming

Another recurring theme has been riskier themes outperforming risk-off. While the S&P 500’s long term trend turned down, the riskier Nasdaq 100 is still holding strong.

And I know what you’re thinking, that’s because money is rotating into big tech like Microsoft, Google, & Apple.

Fair enough, but if that is true, why is the IPO index also outperforming?

Couple this bullish rotation with the positive seasonality I wrote about last week, and I don’t believe it is time to go short just yet. Let’s see how the S&P 500 does next week.

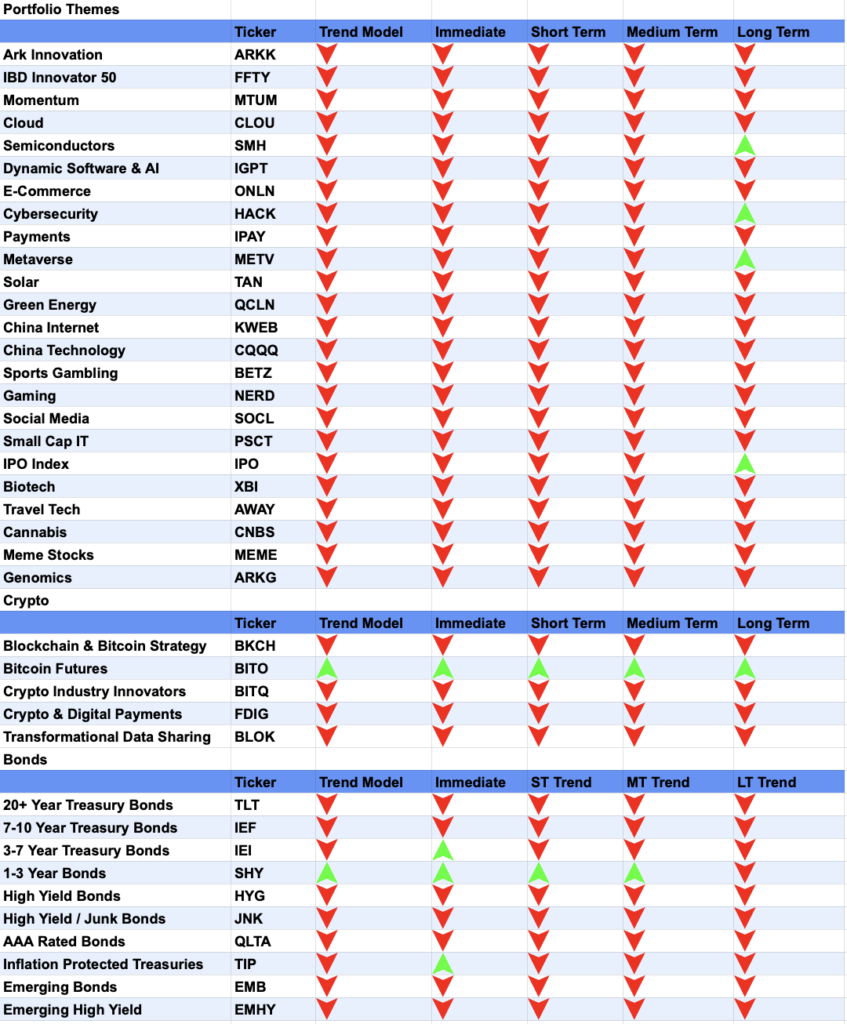

Futures – Long Bonds, Gold, & Equities

Once again, this bonds call has been nothing short of a disaster. The liquidity coming in, coupled with the yield’s ever declining momentum, is why I’m not reversing this position just yet.

The big key is how the S&P 500 responds this week. If we see a powerful reversal in a follow-through day, I’ll likely cover my hedges and add on my long equities position.