Uncertainty is abound due to the coronavirus, leading many investors to sit on the sidelines. Although waiting for the dust to settle helps psychologically, past crises show that you’ll miss the boat if you wait for things to settle down.

Insiders may not know about that, but they’re investing anyways. While the masses are panicking, insiders are buying shares of their companies at unprecedented levels.

That doesn’t mean you should invest in companies just because valuations are low and insiders are buying. Many of these businesses have low margins, little differentiation, and high regulations. If that’s not concerning enough, their debt levels could wipe out your entire investment.

During a crisis, you can invest in sh*tty businesses at an incredibly low price, or incredible businesses at an affordable price. Choose accordingly.

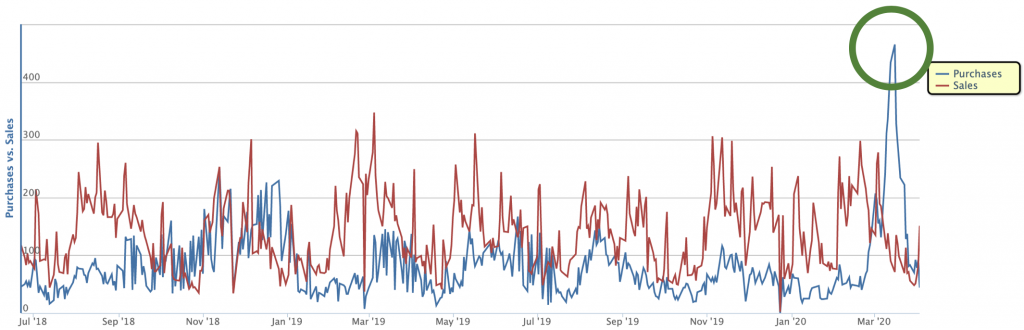

Insider Buying Has Exploded

“Insiders” are the directors, officers, and executives within a company. All of their transactions are publicly reported, allowing us to see how they are personally addressing this crisis.

General purchases and sales aren’t terribly concerning. Executives may be exercising stock options when they buy, and might have bills to pay when they sell.

Huge aberrations, on the other hand, could be a strong signal. When executives bet the ranch on their company, they likely believe that the company’s undervalued.

Don’t treat it as gospel though – Jeff Immelt bought $45 million worth of General Electric stock while he was CEO between 2015 – 2017, with the lowest purchase price at $28 per share.

Today, GE is trading below $7 per share, making Mr. Immelt’s investment worth less than $11 million. This is the equivalent of the Captain of the Titanic buying shares right before his boat hit the iceberg.

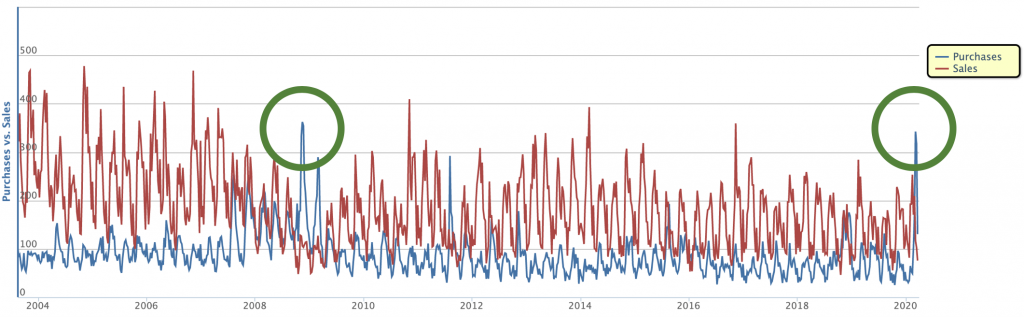

Since some insiders may share the same investment wherewithal as Mr. Immelt, let’s zoom out and see if there’s any wisdom in the crowds.

And compared to the past 18 months, the “crowd” of insiders bought a ton of their employer’s stock.

By “a ton”, I mean “once in a decade”. The last time insiders bought this much was 11 years ago…during the global financial crisis. That was a great time to invest, as the S&P 500 is up nearly 3x since then.

While insiders may not call the bottom, they historically back the truck when they believe prices are low.

Patience is Not Your Friend During a Crisis

Insiders may have been bullish about their companies, but the headlines say otherwise. As of April 9th, nearly 17 million people have filed for unemployment since the coronavirus pandemic.

Understandably, many investors are sitting on the sidelines until this blows over. While patience is your friend when companies are overvalued, it’s your mortal enemy during a crisis.

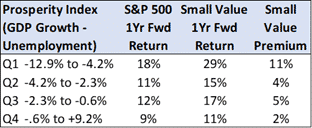

Dan Rasmussen at Verdad Capital recently wrote about the perils of waiting out a crisis:

Correctly predicting negative short-term GDP and employment outcomes and avoiding the market after it had sold off was a horrible investment strategy. We previously wrote about our friend Russell Pennoyer’s idea of a Prosperity Index (GDP growth minus the unemployment rate). We found that the worse the prosperity index was, the better future stock return.

Stock Returns vs. the Prosperity Index by Quartile 1948–2018

In other words, your returns are brightest when economic conditions are the sh*ttiest. Suppose GDP has contracted by 2%, and unemployment is 8%, your Prosperity Index is -2% – 8% = -10%. While headlines would probably say the world is ending, a -10% Prosperity Index historically nets you 18% within a year.

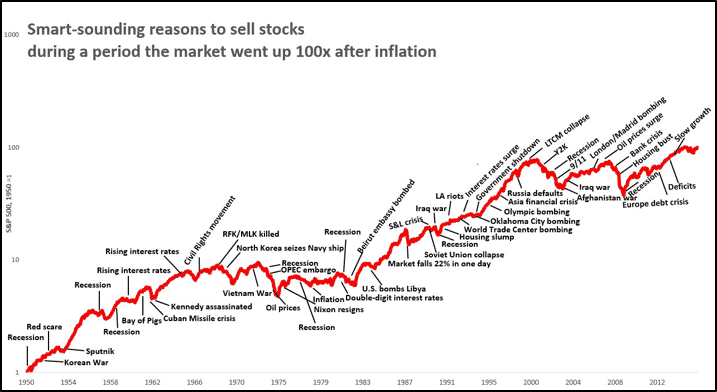

And for those who say that the bad news isn’t over yet, you’re definitely right. In fact, there have been hundreds of legitimate reasons to get out of investing over the past couple of decades. Here’s a chart of the S&P 500 going up 100x after inflation, along with all of the reasons why you should have left the game.

Looking backwards, a few of these concerns were legitimate. But how could you have known beforehand? Who would have known that the market would rally after John F. Kennedy’s assassination, only for valuations to fall after North Korea seized a US Navy Ship?

More importantly, when would you have reentered the market? While the bad news kept coming, valuations keep increasing.

Target Good Businesses, Not the Obvious

Since we don’t know when to invest during a crisis, do we at least know which companies to invest in?

Ideally, you’ll invest in the same companies that you planned on before a crisis. These are great businesses that are probably cheaper than they were before.

“Great businesses” typically are best in class in a growing industry. They also have high gross margins, little to no debt, and recurring revenue.

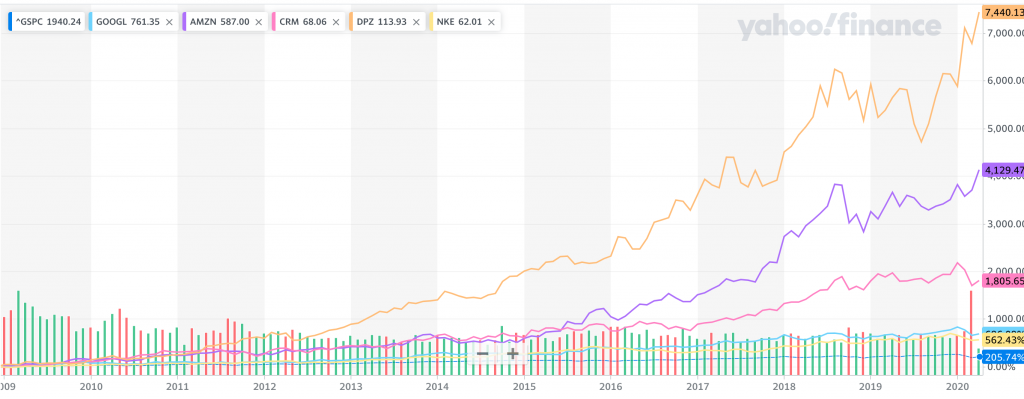

Let’s consider the financial crisis, what were some booming industries and their respective best in class companies?

- Search: Google

- Ecommerce: Amazon

- SaaS: Salesforce

- Delivery: Domino’s

- Athletic Apparel: Nike

How did these best in class companies do after the global financial crisis?

Your worst performer in that basket of stocks would have been Nike, just under Google with 562% returns. If you invested $10k in each of these companies ($50k total), you would have $1.5 million today. Had you invested in the S&P 500, your $50k would be worth $153k today.

Were these companies cherry-picked? I don’t think so, feel free to name a better company in each of these industries back in 2008.

Granted, these industries were cherry-picked. Some better performing industries were intentionally left off, such as smartphones (Apple +1,700%), but other promising industries never realized their 2008 hype, such as 3D printing or solar.

Let’s suppose you replaced the top two performers (Domino’s & Amazon) with companies that went to zero. Your net worth would instead be $343k. Much less than we discussed before, but still 2x the S&P 500.

Companies to Avoid

Which companies should you avoid? Probably the obvious – let’s revisit the 2008 financial crisis.

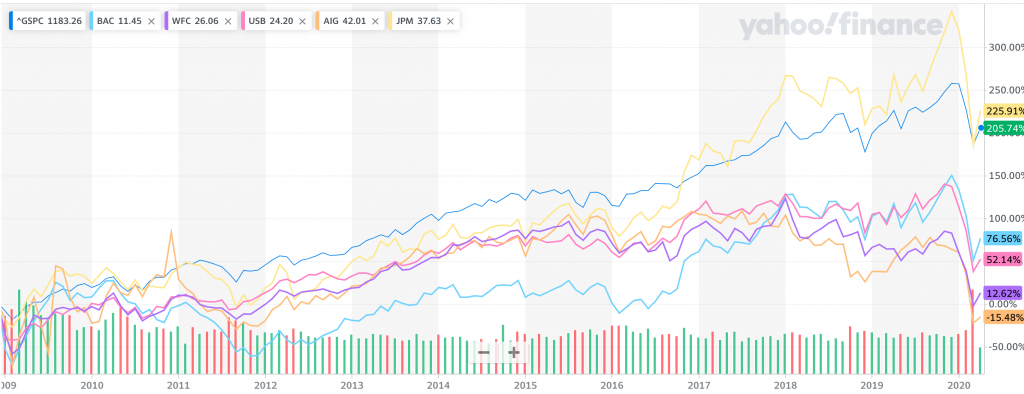

When the economy cratered in 2009, banks got hit the hardest. Imagine you timed the market perfectly, avoiding the crash and buying at the bottom. How would those investments in leading banks performed?

It turns out only one bank beat the S&P 500, and that was JP Morgan. Every other investment would have performed worse than the broader market, and some would have lost you money.

Had you invested $10k in each of these “obvious” companies, your $50k would be worth $85k today. Considering the S&P 500 would have been worth $153k, these banks would not have been the best place to park your money.

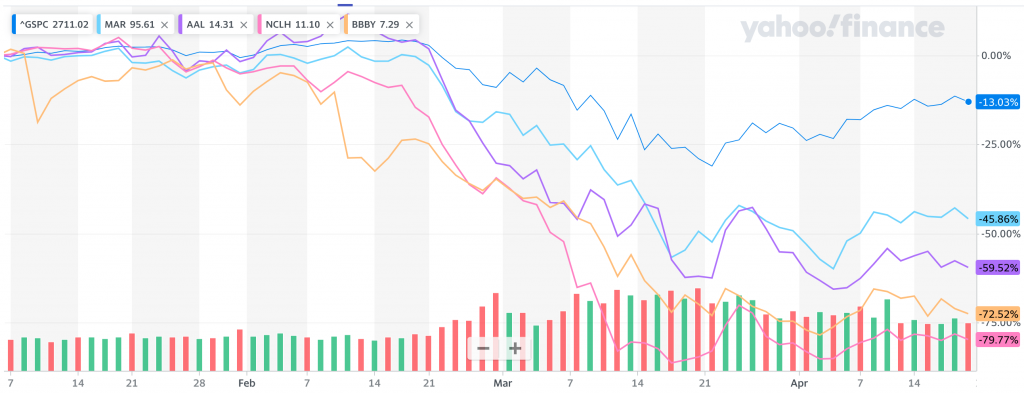

What are the “obvious” investments right now? Cruise operators, airlines, hotels, oil, and retail stores are top of mind. Their valuations have cratered over the past month, similar to bank stocks in the financial crisis.

Before we back the truck into these companies though, let’s ask ourselves again: are these good businesses?

These businesses, in aggregate, have high leverage, low margins, little differentiation, and high regulations. If you were looking for the opposite of good businesses, you found them.

Debt Could Blow Up These Companies

Remember when I said that these businesses are highly levered? That debt could bring your investment down to zero.

Consider their current debt to equity levels:

- Marriott: 16:1

- American Airlines: 4:1

- Norwegian Cruise Lines: 1:1

- Bed Bath & Beyond: 1:1

The best of these companies still have as much debt as their equity value. Meaning, if any of these businesses are tight on cash, they do not have capacity to sell more shares to pay off their debt obligations.

Nobody is traveling or shopping thanks to current events, which means they aren’t making money. Add the fact that they can’t raise more money thanks to their debt levels, and it’s very likely that some will file for Chapter 11.

What if the government bails them out? Well, that hasn’t always worked out for investors. All investors were wiped out when General Motors was bailed out in 2009, and the same could happen to any of these companies.

Many of these “obvious” companies were poor businesses to begin with, and their debt levels could wipe out your entire investment. The risk of losing everything isn’t worth the reward of owning a sh*tty business afterwards.

Investing During the Coronavirus

And that’s the punchline, investment targets shouldn’t change much during a crisis.

Many industries have cratered, such as cruise operators, airlines, hotels, and retail stores. Although they look like great deals compared to a few months ago, there’s no guarantee that they’ll bounce back to their pre-COVID values tomorrow.

Even if they do, remember that your best outcome is being stuck with a bad business. On the other hand, that investment could go to zero if this pandemic lasts too long.

Instead, focus on the companies that were already on your radar. They may have been overvalued before, and your patience may have paid off if the business fundamentals are in tact.

Timing will always be the difficult – no crystal ball tells us where the stock market will go, but there are some ways to tell that valuations are compelling. Premium members can see how I have timed investments so far.

One is massive insider buying. This happens rarely, but when insiders back the truck in their own companies, odds are the price is right.

Whatever you do, don’t wait for the news to turn positive. You were patient when valuations were high specifically so you could be aggressive when valuations are low. Waiting for the dust to settle may help your sanity, but it typically doesn’t help your portfolio.

Embrace the negativity – but before investing in anything, ask yourself the obvious: “is this a good business?”