Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Leaning bearish equities, still positioned neutral

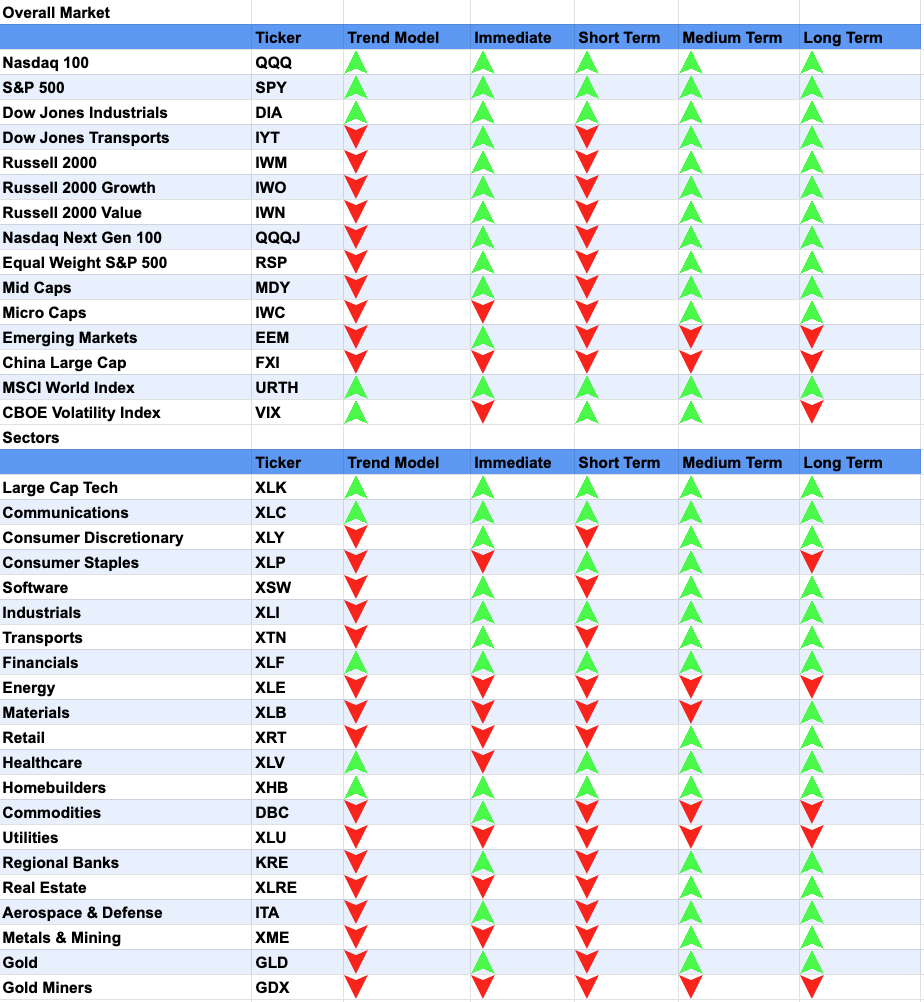

The week finished quite bullish, with the S&P 500 hitting all time highs +1.2%, and the Nasdaq 100 +2.9%. But notice how the number of stocks advancing (blue line) have been declining while the S&P 500 is making new all-time highs.

Healthy stock participation is needed for healthy bull markets, and we’re clearly seeing the opposite here. The same divergence happened at the end of 2022.

And we’re not just seeing this dynamic in stocks advancing, other bullish indicators are hinting at more caution. Dow Transports (blue line), the stuff that moves our economy, are still nowhere near all-time highs compared to Dow Industrials (orange line).

Dow Transports vs Dow Industrials

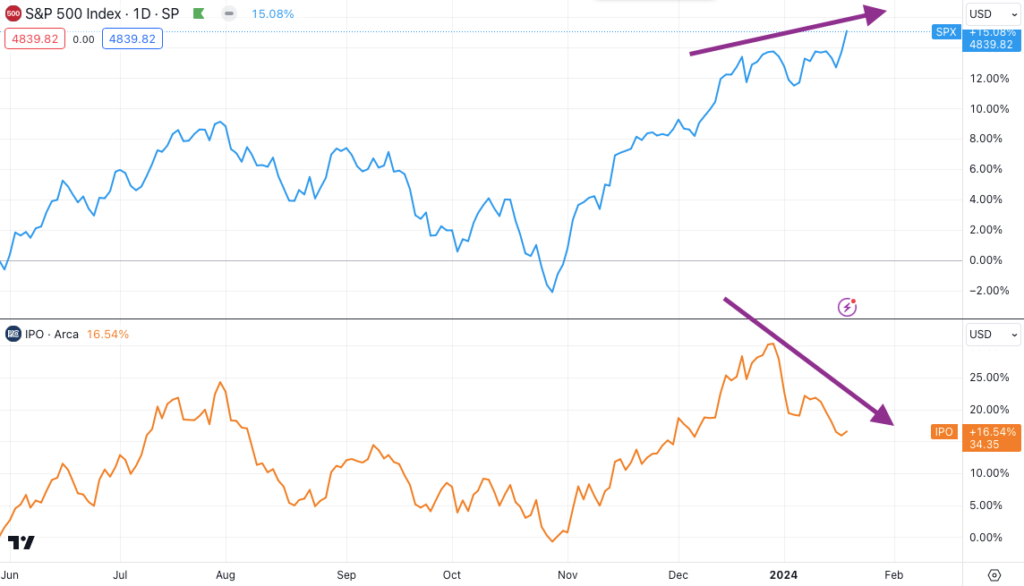

Small cap growth ($IPO, orange line) is also falling quickly behind the S&P 500 (blue line), suggesting that more money is rotating out of risk.

S&P 500 vs IPO Index

Fed Is Talking Down Markets While Data Improves

Fed Board Governor Waller said this week there is “no reason to move as quickly, cut as rapidly as in past”. Two days after that, we saw a huge beat in jobless claims. In other words, nothing that would change Waller’s narrative.

Interestingly, the bond market has been responding. Notice how the 10 year yield (blue, inverted) has been rising since the year started, while equities (orange) have also been rising.

That’s pretty uncommon, as the chart shows. Equities have had an inverse correlation with yields for years. Has the inverse correlation between yields and equities decoupled, or will one of these follow the other?

Given how pessimistic smart money is relative to retail, my bias is that equities will eventually follow yields, although I (thankfully) haven’t positioned myself that way yet.

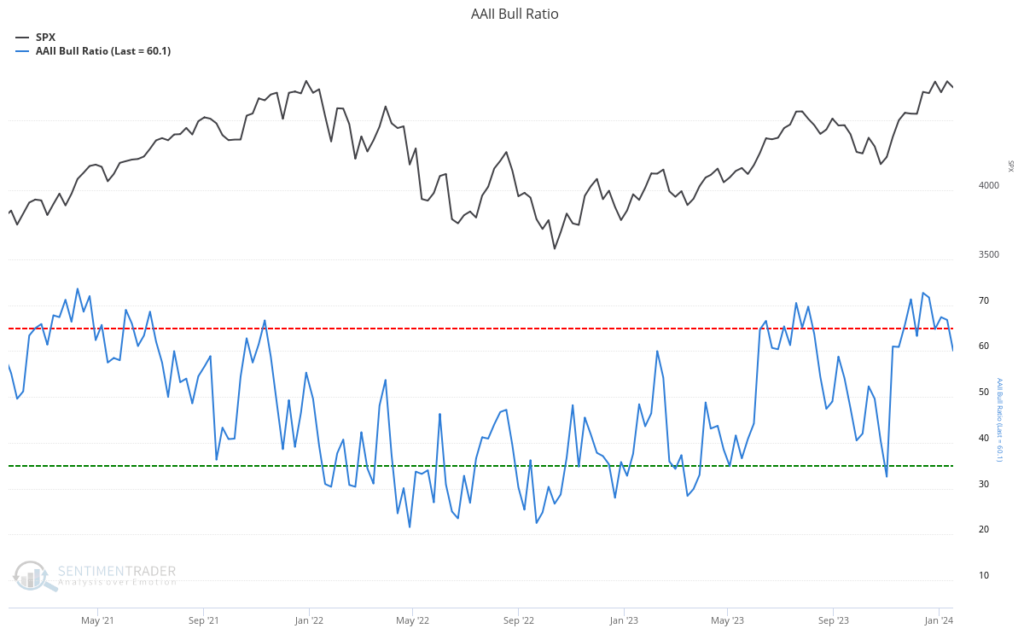

The AAII Bull Ratio looks similar. While the exuberance is gone, we’re still pretty close to that red line, suggesting that investors are still very optimistic.

All of this is why I echo my short term concerns over the past several weeks. While I’m still bullish longer term, it seems like equities are ahead of their skis. The bond market has already responded, let’s see if equities also will.

Market Trends – Bonds Are Turning Down

Speaking of the bond market already responding, longer term bonds like $TLT rolled over this week.

I already showed the inverse correlation between yields and equities, let’s look at the correlation between $TLT (blue line) and the S&P 500 (orange line).

Bonds vs S&P 500

Once again, these two have been correlated for quite some time. Is that correlation decoupled, or will one of these securities follow the other?

Futures – Neutral Equities

I keep writing that I am “waiting for more clarity before going long or short”, and while more risk seems to be growing in the short term, equity prices are still rising.

Hopefully you can appreciate how difficult the timing is for going short. I’ll let you know once I pull the trigger, as well as if the evidence changes and supports going long. Have a great weekend in the meantime.