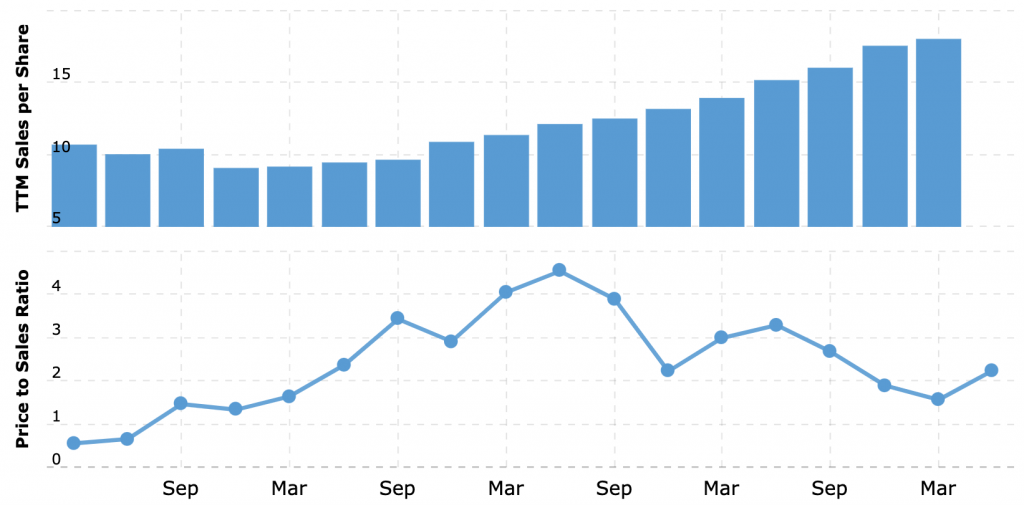

Baozun might be known as “the Shopify of China”, but their stock isn’t priced like it. Shopify’s valuation is 30x higher than Baozun, relative to each of their sales.

Baozun’s growth has slowed due to the United States trade war against China. That, coupled with fraud concerns around Chinese companies, has cut Baozun’s price to sales ratio in half since June 2018.

I believe Baozun’s risks are more than priced in, and I made a big bet on them in May 2020. Premium members who invested at the same time realized a 50% return already, and I believe there’s a lot more upside to come.

What is Baozun?

Before digging in a company’s numbers, I often look at the business itself. I then ask myself, “how much would I be willing to pay for that business?”

Let’s try it on Baozun. If I simply asked you how much you would be willing to pay for the Shopify of China, what would you say?

Well, Shopify has a $100 billion market cap. We can safely assume that China’s GDP & e-commerce adoption will grow faster than the United States, since they have a lot more people. However, we can also assume that Baozun will have more trouble expanding outside of China.

Alright, knowing all of that, do you have a number in mind?

Next question, was that number larger or smaller than $2.3 billion?

Baozun’s market cap as of this writing is $2.3 billion. If that is enough for you to invest in the Shopify of China, feel free to skip the rest of this and call it a day.

Distribution for Foreign Companies Selling In China

For the rest, Baozun manages branded stores and official marketplace on behalf of their partners. They select and purchase goods from these brand partners and and sell the goods directly to consumers.

China is notoriously difficult for foreign companies. Not only are the demographics different, but the government is much more involved with these businesses.

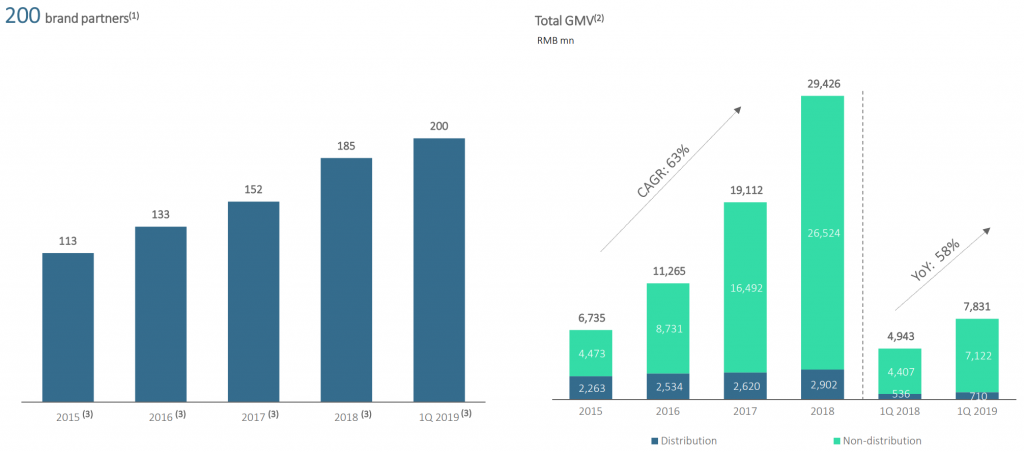

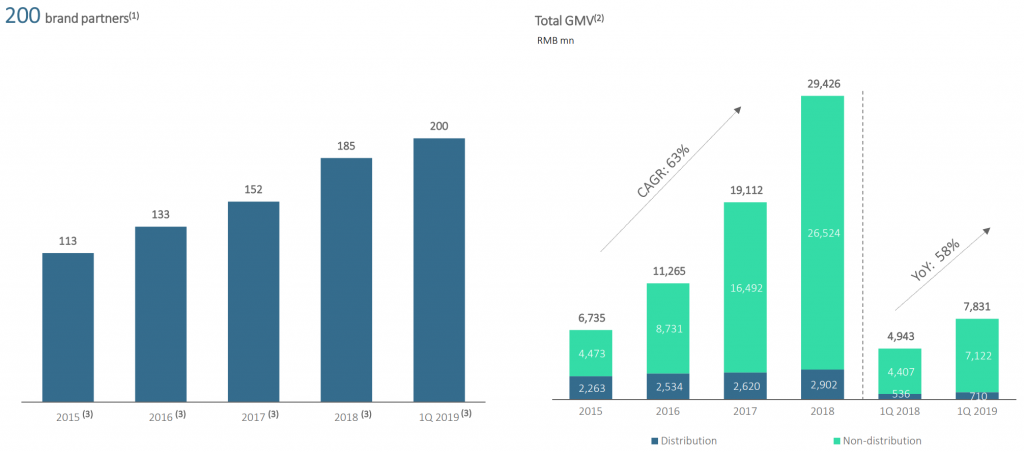

Many foreign companies have decided that it’s easier to have Baozun manage all of the e-commerce for them. Over 200 brands partner with Baozun, such as Nike, Microsoft, and Haagen-Dazs.

Services Provide More Upside

Baozun may have more opportunity than just being the Shopify of China. Not only are they providing end-to-end e-commerce, they are also optimizing and managing existing e-commerce businesses.

Baozun provides one or more of the following services for existing e-commerce businesses:

- IT solutions

- Online store operations

- Digital marketing

- Customer service

Existing e-commerce businesses in China may not need to outsource everything to Baozun, but they likely need to outsource something. Even Alibaba uses Baozun, which makes Baozun well positioned to capture the long tail of Chinese e-commerce companies.

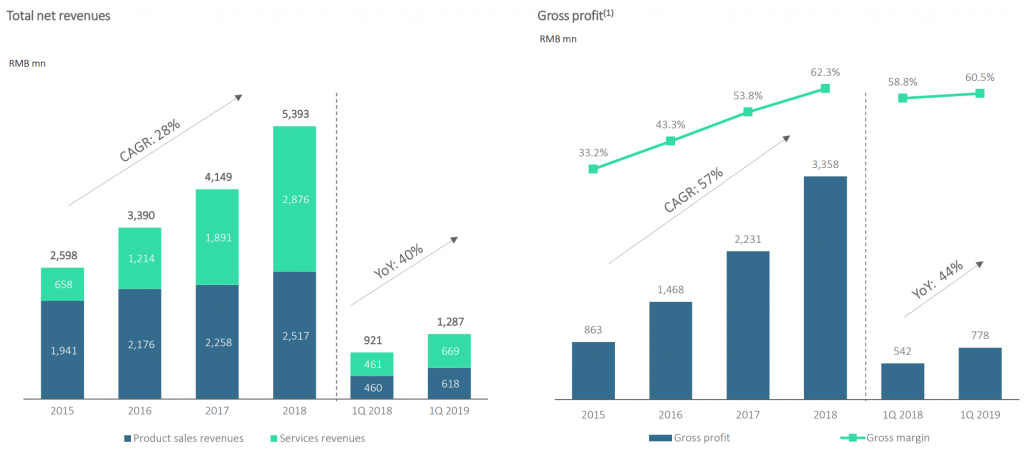

Thanks to their success in services and distrubution, Baozun’s revenue has grown 28% over the last four years in spite of the trade war. On top of that, gross profit has grown 57%.

Gross profit growth is a key metric. This means that Baozun is gaining operating leverage for every incremental customer they are adding. Think of the opposite of WeWork’s business model, and you have something like Baozun.

Chinese E-commerce Is Already Big

I previously wrote about how 550 million Chinese citizens will enter the middle class by 2022, which is 1.7x the entire United States.

Those citizens are already spending money online. Online retail sales grew 27% to $1.9 trillion in 2019. China has 54.7% of global e-commerce sales, while the United States has just 16.6%.

That’s a ton of money, literally trillions of dollars, and Baozun has just scratched the surface. They accounted for $4.2 billion ($29 billion RMB) of gross merchandise volume (GMV) in fiscal year 2018, growing at 63% over the past 4 years.

Baozun made over $1 billion in revenue, which is 60% of Shopify’s trailing 12 month’s revenue. Time will tell if that means Shopify is overvalued or Baozun is undervalued. If you’re curious about my opinion, the answer is yes.

What About Fraud Concerns?

As I wrote before, trust is one of the big reasons why Chinese stocks are so much cheaper than their US counterparts.

Chinese companies are notorious black boxes, how can we sanity check Baozun for fraud?

First of all, they were founded in 2007. They are not a fly by night company such as Luckin Coffee, which was founded in October 2017.

Also, they are audited by Deloitte Touche Tohmatsu LLP, not Ernst & Young. EY audited frauds such as Luckin Coffee, Sino-Forest Corp, and most recently Wirecard. Quick aside, can anybody explain why EY is still in business? Let alone reputable? It only took Arthur Anderson one fraud to get dissolved.

Finally Alibaba owned nearly 24% of Baozun when they IPOd in 2015. Alibaba is 8 years older than Baozun, and is worth over $600 billion. The risk to their reputation for backing a fraud is far greater than their gain from an IPO.

With that being said, Alibaba no longer holds Baozun. I could not find why they sold, only that their 13F no longer shows Baozun as a holding. This could potentially be due to Alibaba becoming a customer, Tmall was integrated into Baozun in 2019.

We can never be 100% sure about fraud with China. The recent Wirecard incident in Germany shows that we can never be 100% about fraud anywhere. We get paid for taking risks, and I believe that a 13 year old company that was backed by Alibaba and not audited by EY is a safe bet.

Baozun’s Uncertainty is Priced In

I previously wrote that whenever we look at valuations, we should be asking “relative to what”?

I prefer gauging the price relative to sales. Why sales? It can’t be manipulated like profits (unless you’re Luckin Coffee). Revenue stays constant regardless of how companies change accounting practices, or how governments change their tax policy.

Let’s see how Baozun’s valuation looks relative to their sales.

Baozun’s price to sales is at the same level as it was in June 2017. Furthermore, their market cap is the same as it was in February 2018. This is despite selling 70% more stuff today.

Why is their relative valuation down? It’s mostly due to factors outside of their control:

- China’s ongoing trade war with the United States

- Investor trust with Chinese companies

While I have no idea how long China’s trade war will last with United States, I do believe these concerns are priced in. Shopify is priced at 61x sales, while Baozun is just above 2x with higher gross margins.

As I wrote about Chinese companies, my north star is whether or not they are executing. Baozun has done exactly that in a challenging macro environment. Premium members have been rewarded with a 50% return after owning Baozun for a month, and I believe there’s a lot more room to run.