I believe the stock market is getting overvalued. While I generally oppose pessimism, there are too many red flags given where we are politically and economically.

Premium members have watched me shed 30% of my portfolio over the past week, while also building short and put positions.

Several indicators show that the market may be overheating. I do not have a crystal ball, and have no idea when the market could correct. I’m still net long, but will increase my short positions if the market keeps going up.

Pessimists Are Sometimes Right, But Never Rich

“For reasons I have never understood, people like to hear that the world is going to hell.”

-Deirdre N. McCloskey

Our society is transfixed on negativity. Positive news rarely makes the headlines. Movies showing our dystopian future have grossed billions in the box office. Despite the world improving in almost every conceivable measure throughout history, we are bombarded by how the world is getting worse.

If I could describe all of these pessimists with one word, it would probably be: “geniuses”. Seriously, they make incredible points about our impending doom, drawing on research and statistics that most of us never knew existed.

The same goes for investing. I previously wrote about all of the legitimate reasons we have been told to get out of stocks. These harbingers do their homework, generally far more than we do on the topic.

Which is why we should never argue with them. They did more research, and will railroad us in a debate. However, our optimistic actions will generally speak louder than their words.

Why? Because pessimists, generally, are not rich. Only an optimist will hold on to all of their shares when they know their company is insanely overvalued. Jeff Bezos did exactly that with Amazon during the dot com bubble. It also takes an optimist to know that things will generally get better. Not only for their company, but for society as a whole.

As much as you can tell about my disdain towards pessimism, I will say, they are sometimes right. Michael Burry nailed it with the housing crisis, netting 489% in the ashes of the Global Financial Crisis. I may not be Michael Burry, but I am getting pessimistic towards some valuations relative to where we are economically.

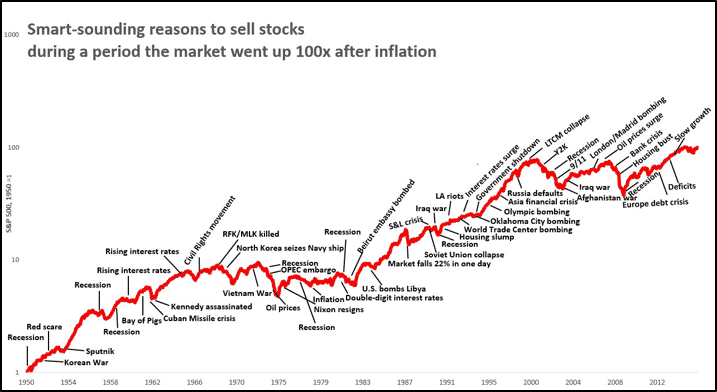

S&P 500 Price to Sales is at a Record High

First of all, we should never be looking at relative prices, ever, when deciding whether or not a company is overvalued.

If somebody is selling a safe full of cash for $10 million, how do you know whether that price is too high or too low?

Easy, it depends on how much cash is in the safe!

Similarly, valuations should depend on how much cash businesses can generate in the future. This gets more difficult for early stage companies, since they are reliant on their terminal value. For a variety of reasons, the business may never meet their destiny. To hedge this uncertainty, I advocate for patience and buying at a low price.

Thus, saying that the market is overvalued because the S&P 500 is over 3,000 is as ridiculous as saying that Amazon was overvalued when they were $500 per share in 2015. For each of these claims, we should be asking, “relative to what?”.

For the S&P 500, I prefer gauging the price relative to sales. Why sales? It can’t be manipulated like profits (unless you’re Luckin Coffee). Revenue stays constant regardless of how companies change accounting practices, or how governments change their tax policy.

Right now, the market’s price to sales ratio is 2.27x. This is 53% higher than the median price to sales of 1.48x.

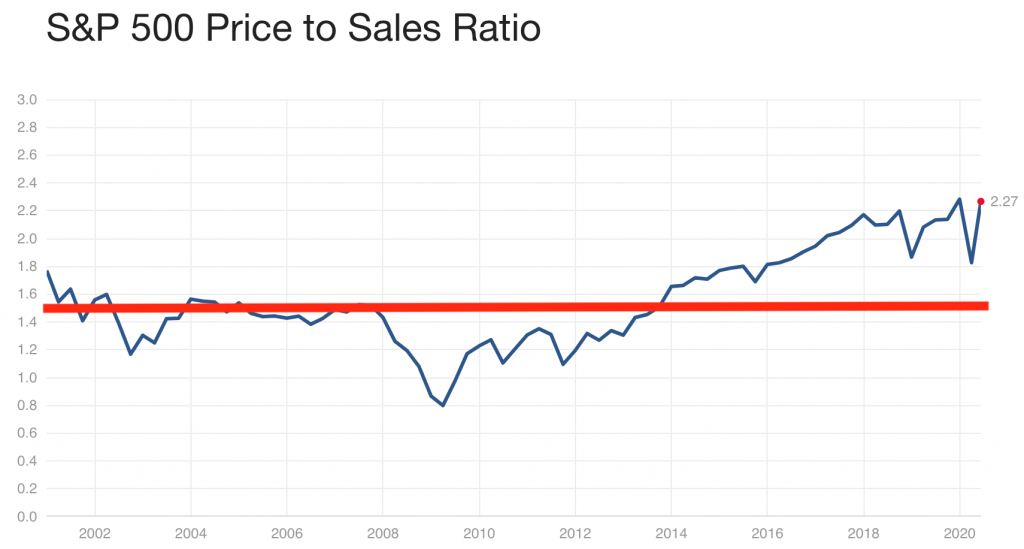

Put-Call Ratio is at Historic Lows

This measures the proportion of put options purchased relative to call options in a day. Generally, more call options reflect positivity, while more put options reflect the opposite.

The put-call ratio is kind of like red wine. A glass or two isn’t bad for you, but several bottles will cause a crushing hangover.

As you can see in the chart, the put-call ratio is lower than it has been over the past 4 years. Investors are binge drinking on call options, and only time will tell whether the hangover comes.

Fear & Greed Index

“The time to buy is when there’s blood in the streets.”

-Baron Rothschild

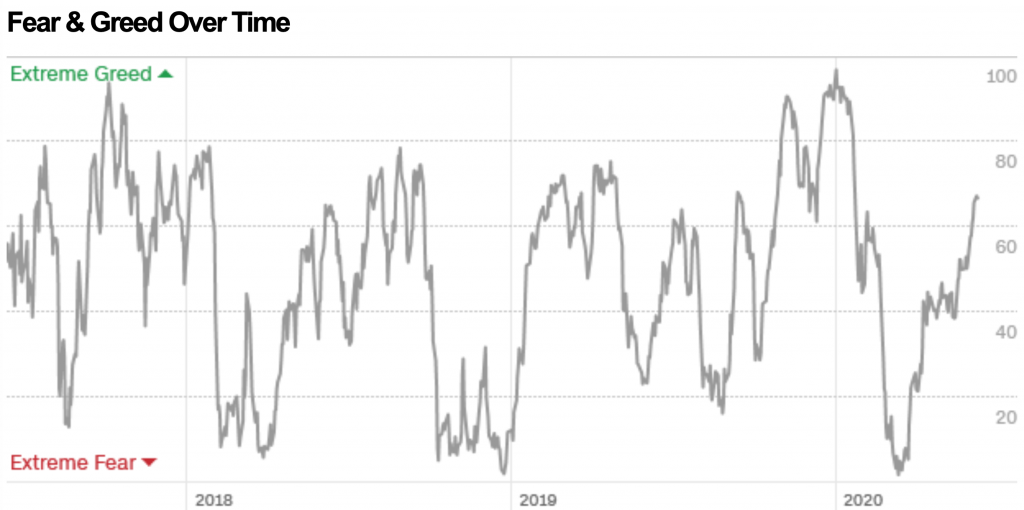

Another market favorite is CNNMoney’s Fear & Greed Index. This aggregates several data points, including the put-call ratio, and shares an aggregate score.

Simply put, “Fear” generally means the market is oversold, and “Greed” generally means the market is overbought.

As you can see, the market is squarely in “Greed” today. Could it get more extreme? Of course, but isn’t any type of “Greed” excessive during a pandemic and record unemployment?

Once again, time will tell whether the market goes up from here. As the Fear & Greed Index inches towards the “Greed” extremes shown below, my concerns, and short positions, will rise with it.

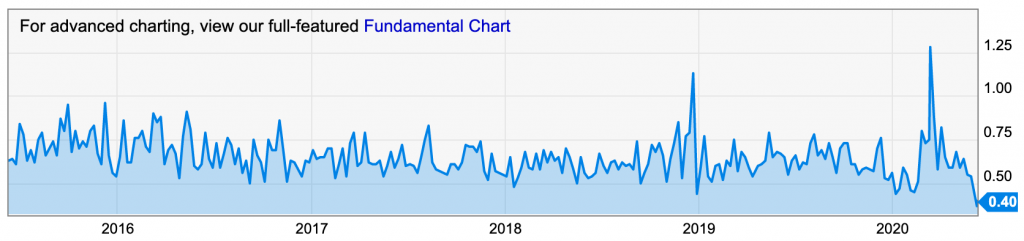

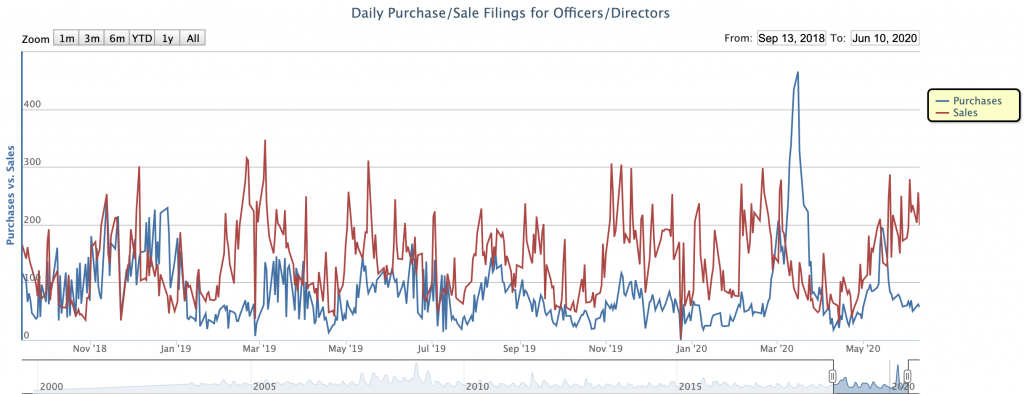

Insider Buying Is Down, While Selling Is Up

In April 2020, I wrote about how insider buying exploded.

General purchases and sales aren’t terribly concerning. Executives may be exercising stock options when they buy, and might have bills to pay when they sell.

Huge aberrations, on the other hand, could be a strong signal. When executives bet the ranch on their company, they likely believe that the company’s undervalued.

As you can see, insider buying has trended down since then, while insider selling has gone up. While these moves are not “huge aberrations”, insiders certainly do not believe their companies are as appealing as they were in March.

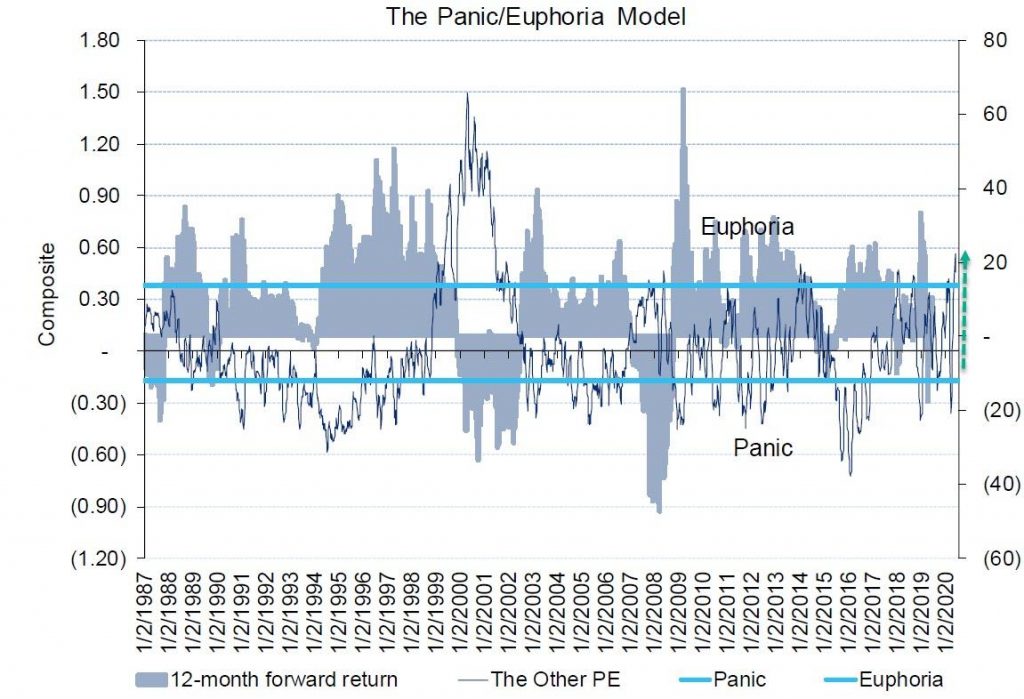

Citi Panic/Euphoria Model

Citi’s Panic/Euphoria Model is, on the other hand, extreme. The euphoria sentiment is at the highest point since the dot com bubble in 2002.

I don’t believe another dot com bust is on the horizon. These businesses, while possibly overvalued, are legitimate. With that being said, it’s yet another data point that the we might be ahead of our skis.

General Temperature Checks

Aside from these official numbers, it never hurts to run some sanity checks. What is the everyday person doing? What are they saying?

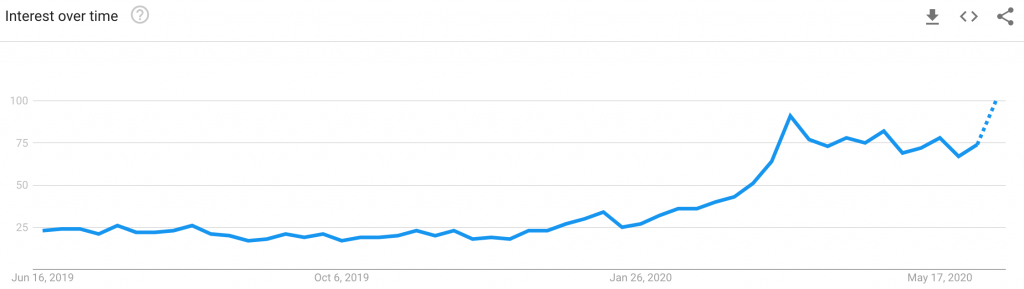

Google is a great place to check, and I may have found the most entertaining market indicator in finance.

Google Searches

The beauty of Google is that if we search for anything long enough, we can prove any point that we want.

I did my best to not fall in to this trap. When searching for trends, I sanity checked them with countering searches to validate whether trends were heading in the same direction.

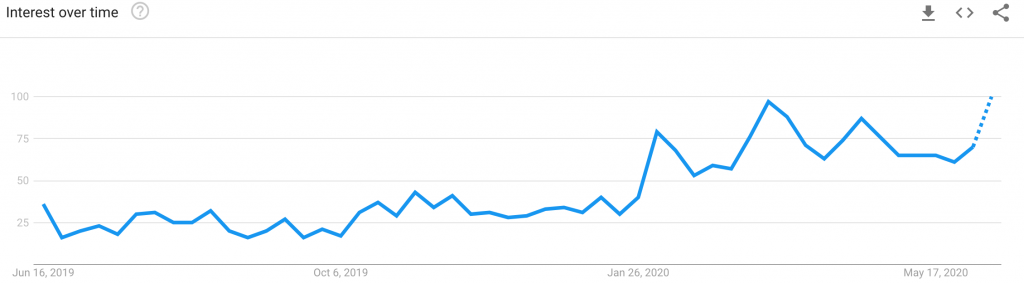

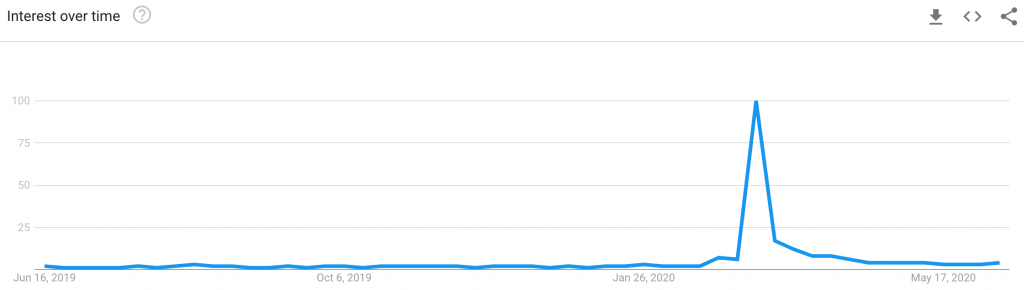

As you can see below, Google’s search trends for “Day Trading” and “Call Options” have gone up. On the other hand, “Bear Market” had a quick spike (you can guess when) and quickly retreated to nothing.

“Day Trading”

“Call Options”

“Bear Market”

The Dave Portnoy Indicator?

Alright, I have to get this off my chest. I wrote this article so I can finally talk about Dave Portnoy.

Dave Portnoy is, without a doubt, the single greatest addition to the FinTwit universe. Airlines stocks are a great example why. Instead of boring us by projecting future cash flows against their debt obligations, Dave calls out the obvious, “people will fly…we’re not getting rid of flying”.

The other joy has been riding along Dave’s day trading roller coaster. In less than one month, Dave’s mood changed from being ready to kill someone to being smarter than Warren Buffett. If you can’t find a new show to watch and need entertainment, go to Dave’s Twitter and watch the videos. You’re welcome.

Back to the point, could Dave be a leading market indicator of where the market is? The S&P 500 is up 20% from when Dave was ready to kill someone, and up 12% from his Warren Buffett comment. Where will the market go next?

Here’s what he recently said. This could be the top. If not, I can’t wait to hear what he says next.

Overvalued Stock Markets – I Don’t Have a Crystal Ball

Many hedge funds have already came out with their tail between their legs for being wrong about their market pessimism.

“I’ve been humbled many times in my career, and I’m sure I’ll be many times in the future, and the last three weeks certainly fits that category.”

Stan Drunkenmiller

While my timing could also be wrong, my sentiment towards the market’s valuations is still pessimistic. Premium subscribers have seen the positions I sold, companies I shorted, and puts that I bought. Assuming there is no cure to COVID, my shorts will get more aggressive as the market trends up.

Expect writings on some of these shorts if the valuations get too extreme. In the meantime, enjoy the next video from Dave Portnoy. He’s entertaining no matter which way the market goes.