There’s a ton of hype around the Slack direct listing. Unfortunately, everybody else knows about this, and the positivity is priced in.

What is Slack?

Slack is the premier software for communicating and collaborating. The tool benefits every line of business: accountants, customer support reps, engineers, executives, salespeople, and many others.

Their users collectively spend more than 50 million hours in active use of Slack in a typical week, on either a free or paid subscription plan.

If you have never used Slack, you’re probably asking how chat software could become so valuable. Simply put, you have to try Slack to understand it. This reminds me of when I had to explain Uber to my friends and family in rural Wisconsin back in 2013.

Sure, you could always call a taxi. But how reliable were they? How pleasant was the experience? What happened when you tried to pay with a credit card? These pains and more were why Uber rose to prominence, and it’s exactly why Slack has blown Google’s Hangouts and Microsoft’s Skype out of the water.

What’s So Great About Slack?

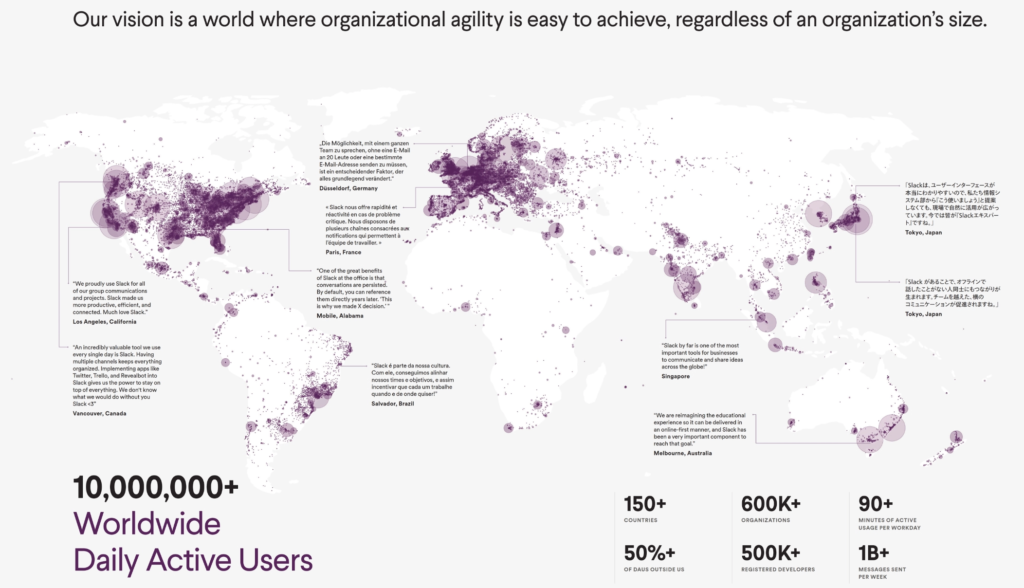

Slack’s meteoric rise can be seen by the incredible numbers shown in their S1.

- Over 10 million daily active users

- 90+ minutes of active usage per workday

- 600k+ organizations

- 150+ countries

- 87% gross margins

- 4x revenue growth in 3 years

With their explosive growth, worldwide adoption, and sky-high margins, how can’t the Slack direct listing be a no-brainer?

Unfortunately, everybody else knows this stuff.Thanks to Slack’s success, they are trading at an incredibly high valuation of 39x revenue.

The Problems With Excitement – Twilio’s IPO

We don’t have a crystal ball to show where Slack’s valuation will be in the future, but we can look at what has happened to other transformational companies.

Twilio’s IPO

Twilio’s IPO was in June 2016, and their market cap is around $16 billion. According to their S1 – Twilio’s mission is to “fuel the future of communications”. Sound familiar?

That’s a pretty transformational goal, and Twilio’s stock price doubled from their $30 June opening day price to $64 in September. Even if you invested at the top of their hype, you would have doubled your investment if you held on.

But what happened after the hype? First, Twilio announced a secondary offering of $400 million, which was around 8% of their market cap.

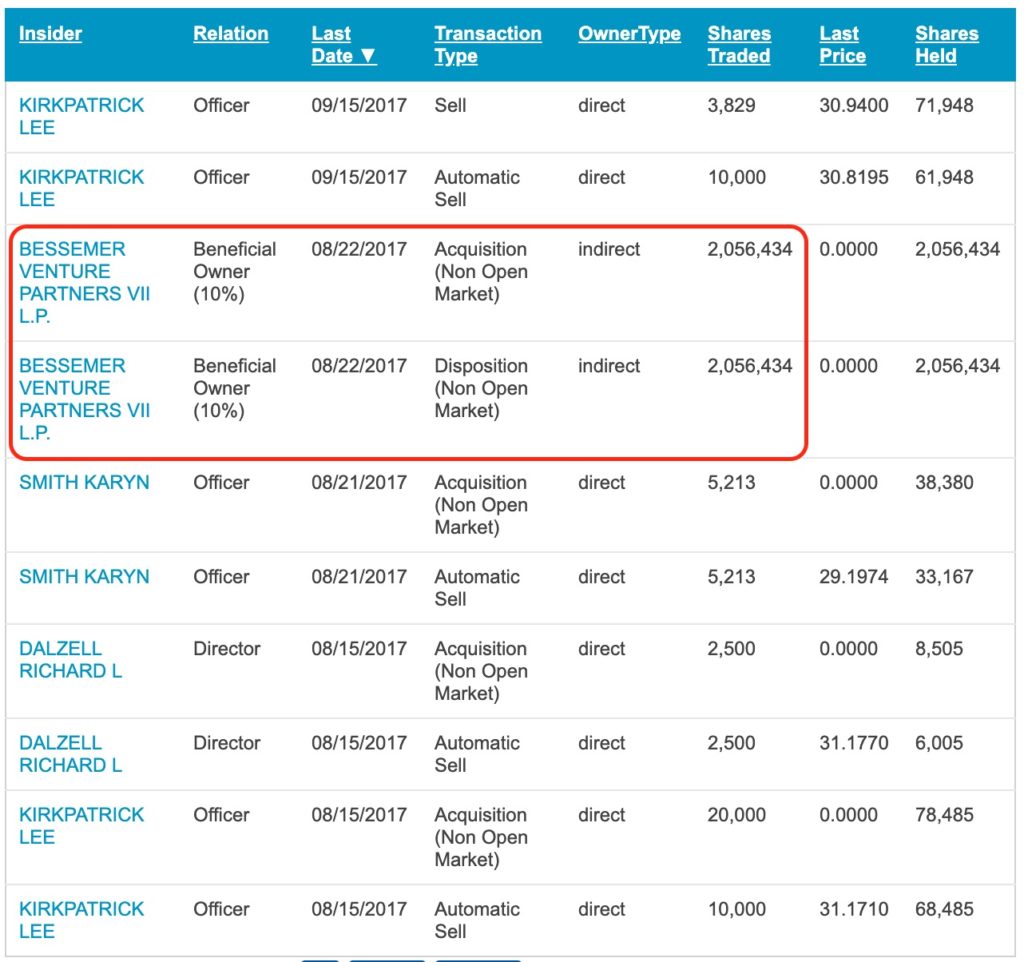

Secondary offerings are a great capital allocation move when your company is overvalued, but in this instance, only $50 million of that offering went to the company. The other $350 million went to early investors and employees at the company (known as insiders).

Aside from insiders and investors selling such a large percentage of the company, doubt started creeping in. Vonage got in the game by acquiring Nexmo for $230 million. More competitors could prevent Twilio from dominating this market.

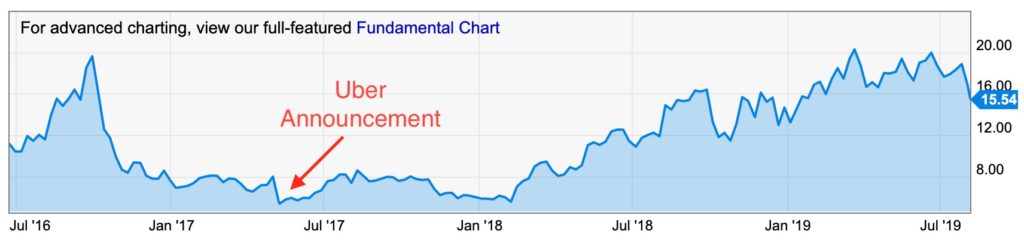

In May 2017, Twilio announced that one of their largest customers, Uber, was building their own communication tools. Twilio cratered to $23 per share after the announcement, and they hovered around that price until February 2018.

Revisiting Twilio’s Negativity

From May 2017 to February 2018, Twilio was in a cloud of negativity, which was exemplified by their price to sales ratio.

Twilio’s price to sales ratio cratered to 5x after the Uber announcement. Let’s recap how Twilio got to this point:

- Twilio’s early investors and insiders liquidated 8% of the company’s valuation

- Competitors like Vonage were entering the space

- Customers like Uber built their own communications platform

With Twilio priced so low, this is exactly where investors can make money. Let’s pragmatically walk through each of those bullet points.

Twilio’s early investors liquidated 8% of the company

Just about all of those shares were from one investor, Bessemer Venture Partners. Many venture capitalists have mandates on when to redeem shares for their investors, and it’s impossible to say why Bessemer decided to sell.

What’s important is that CEO Jeff Lawson did not sell any of his ownership, and all insider sales were negligible. If Jeff or any of his employees were worried about Twilio’s future, then would have been a perfect time to cash out. In fact, Jeff did not sell any shares until September 2018.

If insiders aren’t dumping shares, and all of the liquidation was from one venture capitalist, this secondary offering may not have been a big deal.

Competitors like Vonage are entering the space

Seriously? Do you really think they have the engineering horsepower to take down the ex-Amazon executives at Twilio? What has Vonage ever succeeded in?

Why are we wasting our time talking about them? Let’s move on.

Customers are building their own communications platform

Speaking of engineering horsepower, how many companies have the technical wherewithal and resources to build Twilio?

Uber’s valuation was around $70 billion at the time, how many $70 billion companies are out there? What will all the other companies use for communication?

Even if the mega-tech firms build their own communications platform, that still leaves over 99.9% of the rest of the world for Twilio to sell to. Something tells me they’ll be alright.

Capitalizing on Negativity

It turns out that Twilio may not be in bad shape. All of this negativity surrounding them sounds exaggerated, so let’s invest in them and get paid.

What if you invested before the bottom? Bad news, you probably will. I had no idea that Uber was the bottom, and had personally invested before the announcement. When more news comes, read through it, and ask if this changes your investing thesis.

It turns out that if you were right, any further bad news won’t be a big deal several years from then.

If you invested in Twilio at $20 – $30 per share and held, your return would have been 5x-6x. Not a bad return for a year and a half, and much better than the 2x if you invested at the top of their hype! Those 20% fluctuations may have been tough to digest during their cloud negativity, but who cares now that you have a multi-bagger?

Back to the Slack Direct Listing

Slack’s 39x price to sales ratio is absurdly high, so we already know the positivity is priced in. So what should we do about the Slack direct listing?

We wait.

It is absolutely possible for Slack to execute perfectly, not face any competition, and continue growing at a rapid clip. If they do, the stock could go up from here, but not at a crazy pace. The growth is already priced in.

The narrative with these companies almost always changes. It certainly did with Twilio, even with Facebook back in 2012. Remember that?

What Could Change The Slack Direct Listing Narrative?

We don’t have a crystal ball telling us when, or if, Slack’s narrative will change. With that said, there are some obvious companies who have already copied Slack and are bundling it for free.

Microsoft Teams

Microsoft has already ripped off Slack with Teams, and announced that Teams has over 13 million daily active users in July 2019.

Remember Slack’s S1? They only had 10 million daily active users. Microsoft has already blown by them, and the product is only two years old!

Google Hangouts

Remember Google Hangouts? They replicated Slack’s user interface in February 2018.

Google doesn’t disclose how many people use Hangouts, but we do know that Google Cloud makes roughly $8 billion in revenue. It’s safe to say that over 90% of this money is coming from G-Suite, which bundles Hangouts for free.

Will Microsoft or Google Take Down Slack?

I’ll go on the record and say that I’m not worried about Microsoft or Google taking down Slack.

With Microsoft, we have seen this movie before. Microsoft has been at war against Salesforce for the past several years, and still has no meaningful CRM market share. Frankly, it hasn’t been worth Microsoft’s time.

Microsoft makes $125 billion per year, while Salesforce makes $13 billion in revenue per year, and Slack makes roughly $450 million. If Microsoft reached in and took all of Slack’s revenue, their revenue would increase by 0.36%. There’s no way they’ll focus on this product for long. They need to worry about AWS.

As for Google, they had their shot with Hangouts. Who uses that product anymore? I had it at Salesforce, and didn’t realize they had a Slack user interface for 6 months. Once I tried it, I switched back to regular Hangouts. The product wasn’t that good.

Google is a fantastic advertising company, but communications has not been their focus, and I don’t believe that will change.

When Will I Invest?

Premium members know when I invest in real time. Generally, my magic number for software is under 10x sales. When a high growth company with 50%+ gross margins is trading below that threshold, you’re getting a good deal.

Slack’s current revenue is $450 million, and their forecasted revenue is between $725 – $745 million. Therefore, anything between $4.5 – $7.5 billion for the company is a solid price.

Since their valuation is $16 billion and trading for $31 per share, I’m waiting for it to cut in half to $15 before touching the company. That’s a tall order, but we have seen this movie with several tech darlings before.

If Slack’s narrative changes, and the value nosedives, dig into the reasons why. The narrative could easily be overblown, and you could have an incredible investing opportunity in front of you.

Rest assured that I’ll release an update if this happens, and will explain whether I invested. Until then, park your money in good companies that are already in that cloud of negativity. I’ll write about some of them in the future.