The WeWork IPO is rampant with red flags – their CEO is cashing out equity before the IPO, and treating the company like his personal piggybank. These issues need to be resolved before investing in the company.

Far less egregious examples of this have occurred with previous IPOs, and history shows that retail investors bear the cost after the IPO.

What Are The Goals of an IPO?

Before explaining WeWork and the red flags, let’s quickly discuss the goals of an IPO.

Most assume that a successful IPO happens if it”pops” an absurd amount the first day. When Beyond Meat popped 163% their first trading day, the press congratulated the company for tripling their value.

Here’s a quick thought experiment – if you’re raising $1 million for your business, which terms would you prefer?

- $1 million for 30% of the company, valuing your business at $3 million

- $1 million for 10% of the company, valuing your business at $10 million

The second option is a no brainer – you get the same amount of money while only losing one-third of the ownership.

Therefore, Beyond Meat’s IPO was a colossal failure. They sold 9.5 million shares at $25 to raise $240 million, and those shares were actually worth over $75. This mispricing significantly diluted existing shareholders.

Thus, a company’s goal in not to have an IPO “pop”. In fact, their goal is to prevent this by raising as much money at as high of a valuation as possible. The more cash they raise now, the more they can invest for future growth. The higher the valuation, the less existing equity holders will be diluted.

Now that we understand WeWork’s goal in their IPO, let’s dive into their business and red flags.

What is WeWork?

According to their S-1, WeWork is a “community company committed to maximum global impact”, and their mission “is to elevate the world’s consciousness”.

Let’s simplify that – WeWork is a real estate company. They sign long-term leases, rent them out for more money, and hope to cross-sell those members in the future. WeWork has three revenue segments: membership fees, additional products & services, and other We Company Offerings.

Membership Fees – 83% of Revenue

WeWork’s bread and butter, they sign long term leases, fix up the properties, and rent them out for more money on short term contracts.

In 2018, WeWork paid $1.5 billion for operating leases, and made $1.8 billion renting them out, which is a spread of roughly 20%.

Additional Products & Services – 5% of Revenue

WeWork sells their members add-on services such as: conference rooms, printing credits, phone services, IT services, and parking fees.

Other We Company Offerings – 12% of Revenue

The final 12% of WeWork’s revenue comes from companies they have acquired, two examples of these are Flatiron School & Meetup.

Flatiron School is a coding education platform offering both online and offline classes for people who want a career in tech. WeWork acquired Flatiron School in October 2017, terms of the deal were not disclosed.

Meetup makes it easy for people to start meetings in real life. They run a website allowing people to create, organize, and join groups around specific interests, kind of like Eventbrite. WeWork acquired Meetup for $200 million in November 2017.

Now that we know WeWork’s business, let’s get into the red flags.

Red Flags with CEO Adam Neumann

We’re not here to discuss whether or not the WeWork IPO is reasonably priced, because we don’t know what WeWork’s valuation will be.

While we wait for that valuation, lets consider all the red flags around Adam Neumann and decide if the WeWork IPO is even worth considering:

- Adam Neumann has cashed out over $700 million of his equity before the WeWork IPO

- WeWork has given hundreds of millions of dollars in loans directly to Adam Neumann

- $362 million at an interest rate of just 2.89% in 2019

- $7 million at an interest rate of 0.64% in 2016

- Neumann owns four buildings that are leased to WeWork

- 3 of these leases were signed the same day that Neumann obtained stakes in the buildings

- WeWork paid Neumann’s landlord entities $4.2 million the first half of this year

- There’s another $237 million in future commitments

- WeWork paid Adam Neumann’s We Holdings LLC $5.9 million for the “we” trademark

- This would be like “The Facebook” paying Mark Zuckerberg for the trademark of “Facebook”

- 3 underwriters in WeWork’s IPO are giving Neumann a $500 million line of credit

- WeWork is paying Neumann’s family members generous salaries

- $200k salary for Neumann’s brother-in-law Avi Yehiel as WeWork’s Head of Wellness

- $200k for one of Neumann’s immediate family members to host 8 events in 2018

Now imagine that you own WeWork, how would you feel about Adam Neumann’s actions? Cashing out equity, treating the company like a piggybank, and paying yourself and family members does not look good at face value.

But if the CEO will give you an incredible return on your investment, why not allow it?

What Happens When CEOs Cash Out?

The short answer is that common sense prevails. If CEOs are selling out meaningful ownership stakes before an IPO, you’ll be in rough shape as an investor.

Thankfully, this does not happen often. When it does, you should definitely steer clear.

Below are three examples of CEOs cashing out before an IPO, as well as the relative return of the company post-IPO.

Groupon’s Founders Sell $870 Million Before IPO

Groupon was a fantastically hyped company back during their 2011 IPO, and the stock soared 31% above their offering price on opening day.

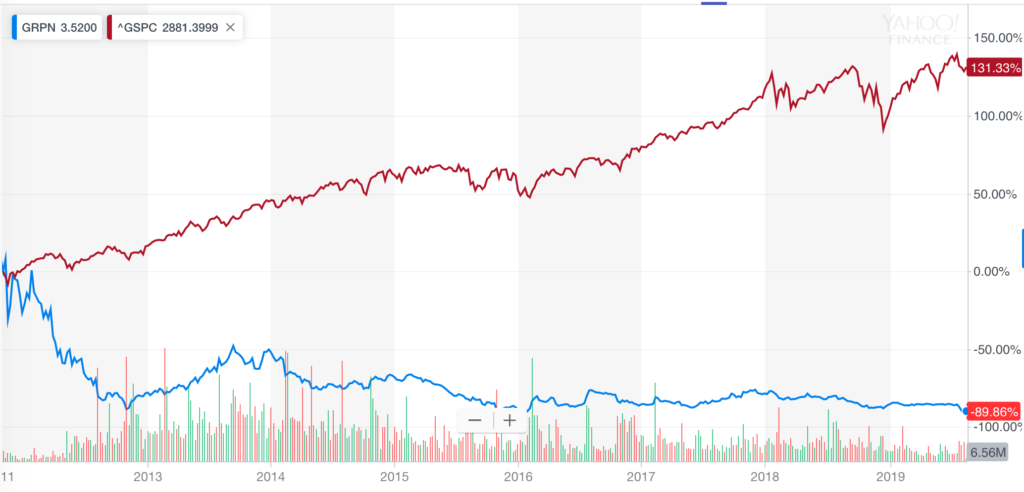

However, there was one massive red flag. Cofounders Andrew Mason, Eric Lefkofsky and Brad Keywell sold $870 million in stock before their IPO. It was an incredible move – the stock has cratered 90% since their 2011 IPO, while the S&P 500 has appreciated over 130%.

Had the founders not sold before the IPO, that $870 million would be worth $88 million today.

Zynga’s CEO Sells $109 Million Before IPO

Zynga had the perfect narrative during their IPO. They built a freemium online gaming company focused on mobile and social, which would disrupt the trillion dollar worldwide entertainment market.

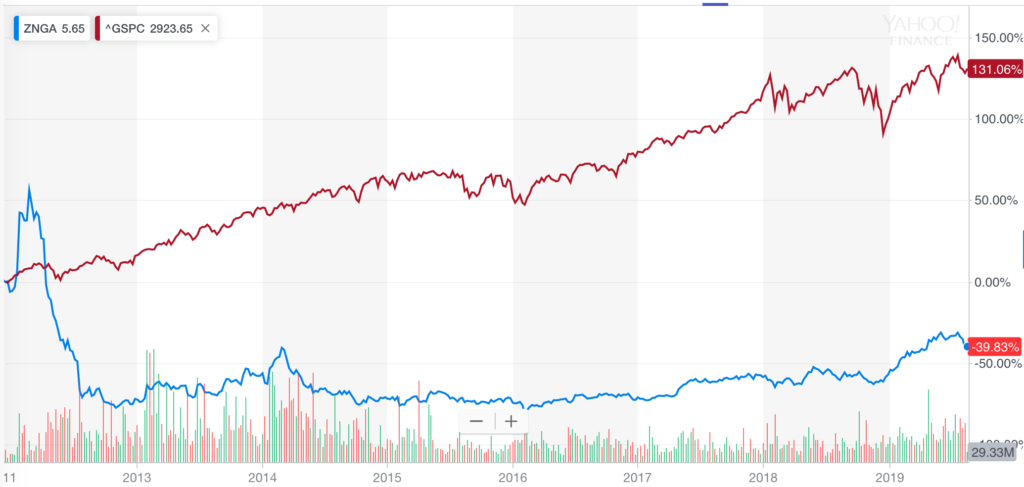

Despite the story, CEO Mark Pincus sold $109 million of stock before the IPO. Afterwards, he sold another $220 million during their secondary offering in March 2012.

Mark also made the right call. His $109 million before the IPO would be down nearly 40% today, and the $220 million during the secondary offering would be down over 60%. During the same time, the overall market was up over 130%

Snap’s CEO Sells $272 million at IPO

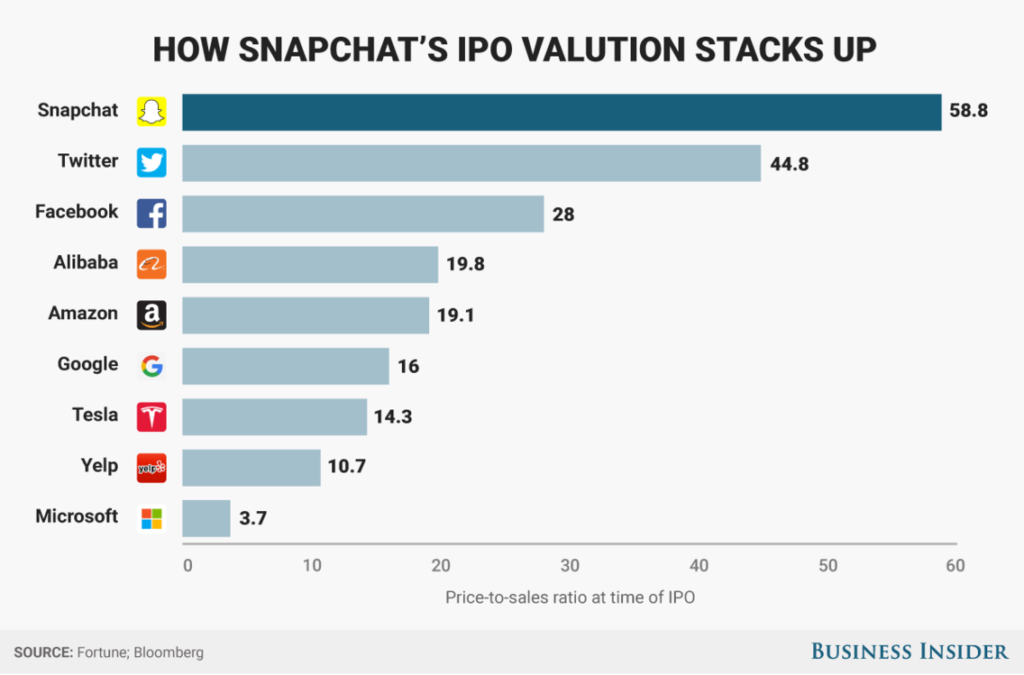

Snap marketed itself as a camera company when they IPO’d in March 2017, and traded at an absurdly high valuation. Their price to sales valuation was the highest ever at IPO.

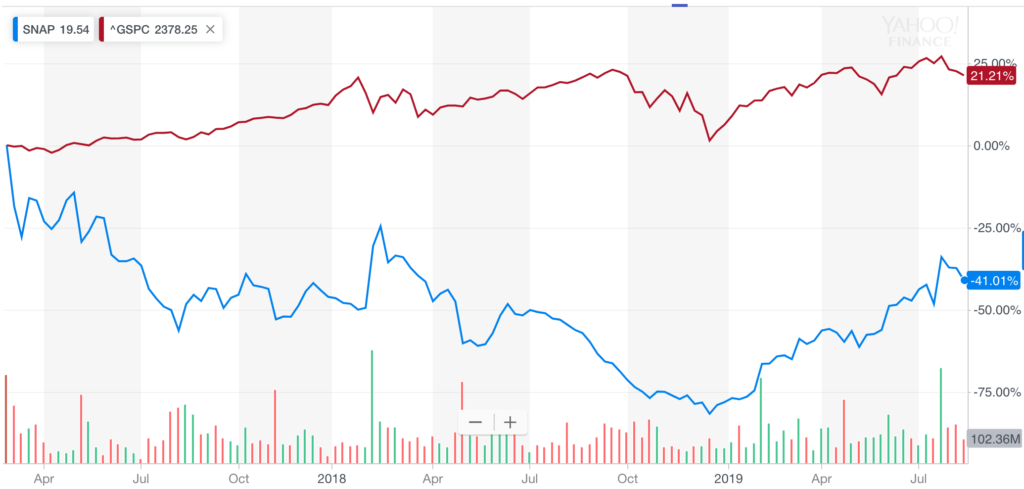

CEO Evan Spiegel might have been worried about Snap’s valuation, and sold $272 million worth of stock during the IPO.

He also received an $800 million bonus for taking the company public, which makes absolutely no sense. Why should you reward the CEO for needing more capital to keep the company running?

Would you give your employee a huge raise for going light years over budget on a project, especially if going over budget lowered your ownership in the company? You probably shouldn’t fire them, but incentivizing that activity is perverse.

Retail investors didn’t mind, at first. The stock popped 41% as soon as the shares were available.

However, investors probably cared after that first day. The stock has trended down since then, and is down over 41% compared to the overall market being up over 21%.

Granted, Snap is up 3x since their December 2018 low. Patience is a virtue, investors will reap major rewards when they wait and buy at the right price. Thanks to hindsight, we know for a fact that the IPO was not the right price. With that being said, we could have made an educated guess by looking at the CEO’s activity, as well as their relative valuation.

Zero Red Flags are Like Height in Basketball

Although incidents like this don’t happen often, I always steer clear when an IPO like WeWork comes along.

Conversely, investments are also not a no-brainer just because the CEO is not liquidating their holdings or treating the company like a piggybank. Just like height in basketball, you’re not an NBA MVP simply because you’re tall enough to play the game.

When the company passes this bar, that’s when the real work of valuing the company and deciding when to invest begins. Premium members will see when I make these investments in real time.

All of the red flags in WeWork’s IPO show that now is not the time to invest. However, if Adam removes his conflicts of interest and shows his commitment to the business, then WeWork could be a compelling investment at the right price.