Pluralsight announced a massive billings slowdown in their August 2019 earnings report, and the market cut their stock valuation in half from $4.7 billion to $2.2 billion.

With the best in class product and growing wallet spend, I believe Pluralsight will regain their momentum once they hire and train more salespeople. While there’s no telling when they will turn around, I believe they are trading at a reasonable price due to this uncertainty, and have increased my position since their valuation fell.

What is Pluralsight?

Pluralsight is a leading provider of technology skill development solutions. Their cloud-based learning platform provides a broad range of tools: skill assessments, a curated library of courses, learning paths, and business analytics. Their courses include software development, IT ops, data science, and cyber security.

In addition to their course library, Pluralsight measures user skills with Pluralsight Iris. Iris can measure skills in under 20 minutes, and then report any “skills gap” that users and enterprises have. With this information, companies can make smarter investments to fill those gaps through training and hiring.

The tailwinds behind technology skills platforms like Pluralsight are more like jet streams. The US Department of Labor states that software engineers must redevelop their skills every 12-18 months. Furthermore, there are over 102 million technical employees worldwide, according to the Evans Data Corporation. That’s a lot of people who need continuous training.

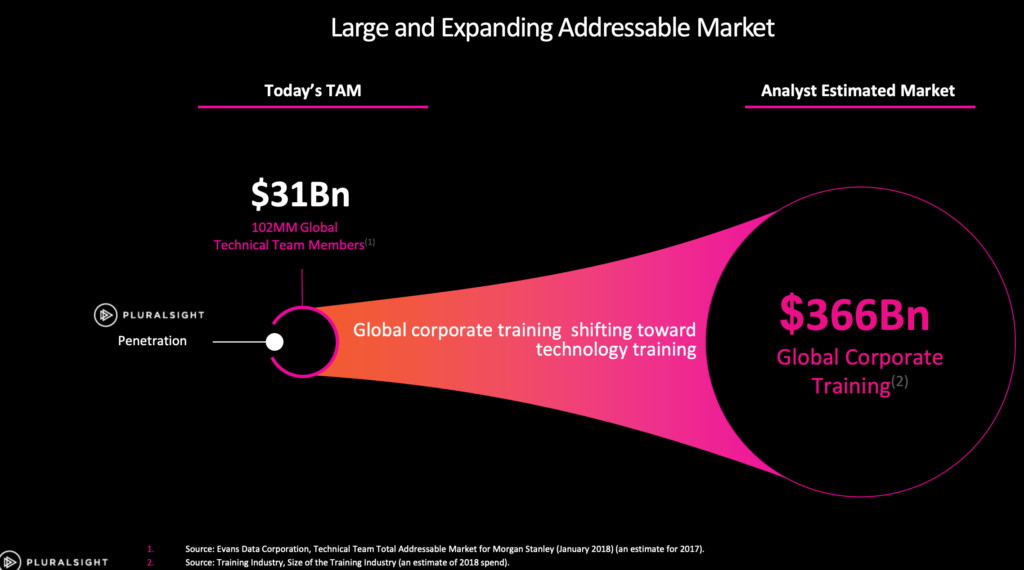

Pluralsight’s Addressable Market

With over 102 million technical workers who could use their software, Pluralsight states that their current total addressable market is $31 billion. They likely calculated this by multiplying the worldwide number of technical team members by the annual cost of their “Personal” license (102 million x $299 = $31 billion).

$31 billion is a big number, and it’s only a fraction of the worldwide budget for global corporate training. Enterprises spent $366 billion in global corporate training in 2018, and Pluralsight’s focus is only 8% of that budget.

A $31 billion TAM could be optimistic, but seeing that Pluralsight’s current revenue is $274 million, does it really matter? Even if the actual TAM is a third of that amount, suppose $10 billion, Pluralsight has less than 3% share, meaning there’s still a ton of growth ahead.

Also, Pluralsight’s market opportunity will grow so long as there are more technical jobs in the future. As more companies move into the digital age, the number of technology-related jobs will grow with them. This puts technology skills platforms like Pluralsight in a great position to capture a greater share of the $366 billion global corporate training budget.

How Has Pluralsight Executed?

Tailwinds can help a business, but only if that business executes. Aside from their recent misstep, Pluralsight has executed incredibly well over the past 3 years.

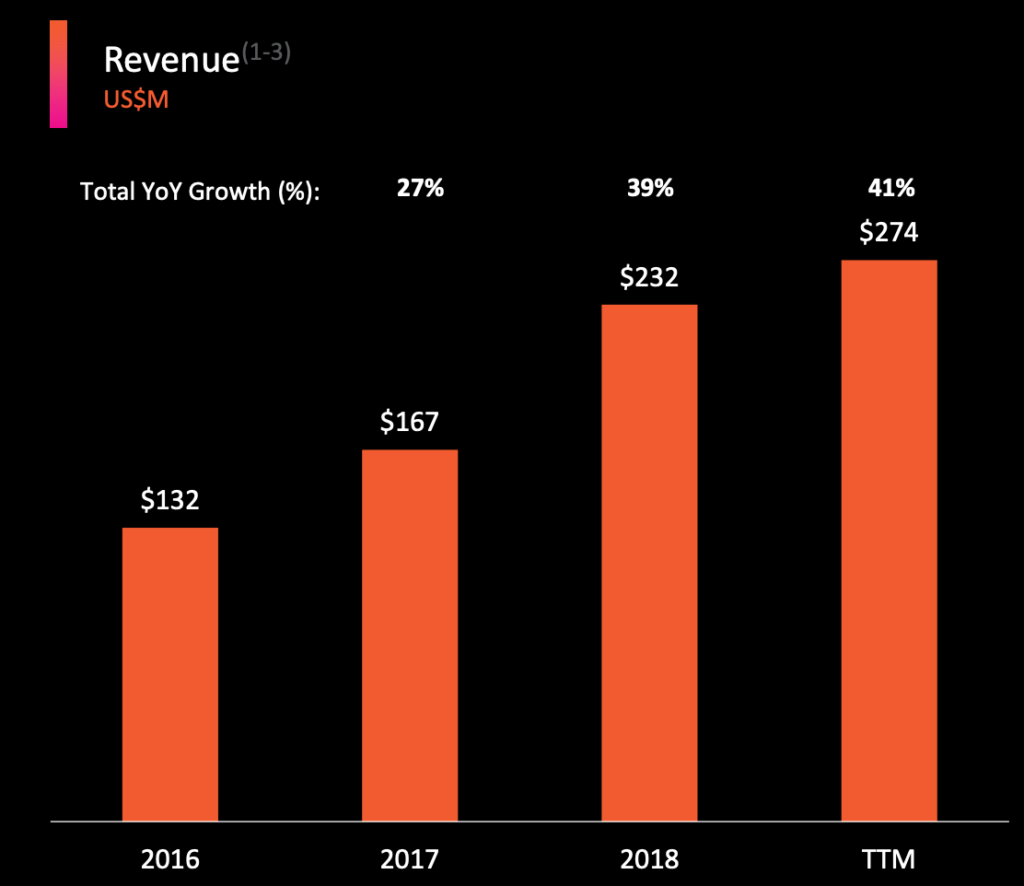

Revenue is Growing 27% – 41% Per Year

Pluralsight’s revenue growth is increasing every year, which means that they are not only riding the tailwinds discussed, they are seizing most of those gains from their competitors.

Typically, revenue growth subsides as businesses grow, but that hasn’t been the case with Pluralsight. Their revenue growth has increased every year since 2016.

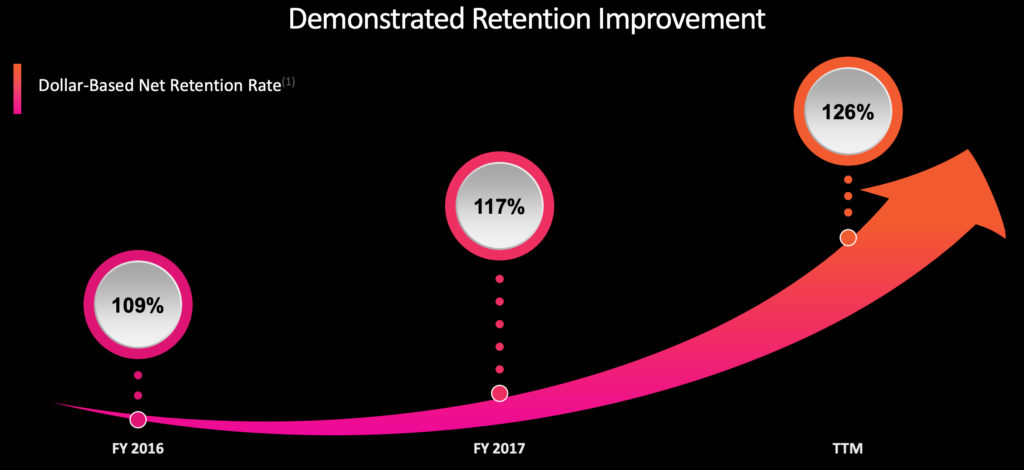

Net Retention Rates are Growing Every Year

Net retention rates gauge how much companies renew services from their vendors, thus being one of the best litmus tests for whether customers find value in a product. If a customer spends $1 million on Pluralsight in 2017, and renews for the same $1 million in 2018, that client has a 100% net retention rate.

Pluralsight has a 126% net retention rate, meaning that their clients are spending 26% more than they spent the year before. More importantly, their net retention rate has consistently increased every year.

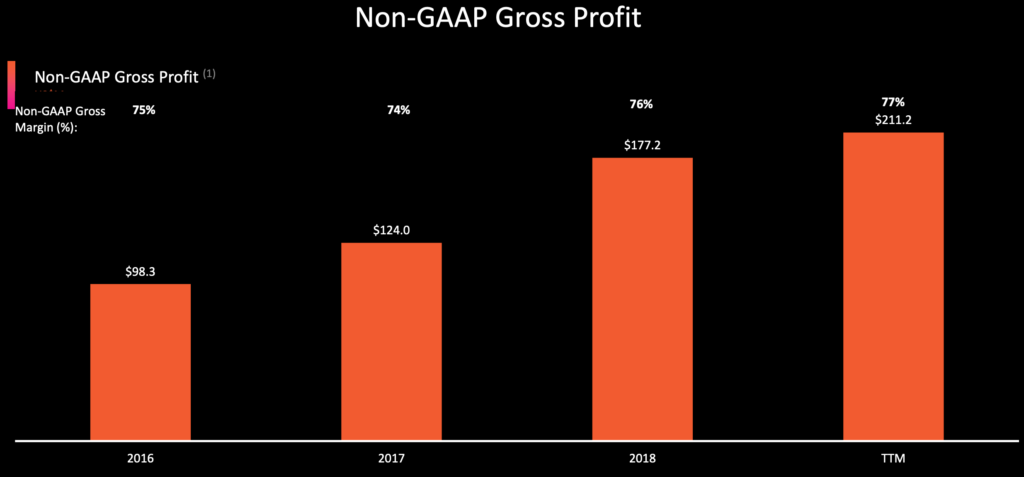

Net Margins Are Expanding

Since all of the costs to develop software are made up front, the marginal cost for selling it is effectively zero. Because you can sell more software for effectively nothing, companies can easily get addicted to selling at lower prices for the sake of hitting short term revenue targets.

Pluralsight is not compromising their gross margins for the sake of growth. In fact, their margins are expanding from 75% in 2016 to 77% today, all while their revenues have grown over 2x.

Margin expansion coupled with rapid revenue growth shows that Pluralsight has pricing power. Customers are willing to pay for Pluralsight despite higher prices, emphasizing the quality their product has relative to their competitors.

Why Pluralsight Declined

Despite their rapid revenue growth and margin expansion, Pluralsight’s valuation was cut in half from $4.7 billion to $2.2 billion after their August 2019 earnings report. Their billings, or net new deals signed, was $80.6 million, which was far below the $89.1 million that analysts were expecting.

$9 million seems like a minor miss, until you consider how massive their deceleration was. Their billings growth deteriorated from 48% in Q1 2019 to 27% in Q2 2019.

Billings are a crucial yardstick for software as a service companies because they reflect future growth. Every dollar of billings will create a dollar of revenue once the services are delivered.

Suppose Pluralsight signs a 1 year, $1 million deal at the end of December 2019, with the software turning on January 1, 2020. That deal will reflect $1 million in billings and $0 in revenue for 2019. By end of December 2020, Pluralsight will recognize $1 million of revenue from that deal.

Therefore, billings are the crystal ball for revenue growth. Although Pluralsight reported solid revenue growth, their crystal ball shows that revenue will slow down, which is likely why investors sold off the stock.

How Pluralsight Addressed the Decline

Pluralsight’s CEO Aaron Skonnard opened the Q2 2019 earnings call with their billings decline:

While we generated strong revenue and EPS in Q2, we experienced sales execution challenges, which impacted our billings. I’d like to share what we learned and what we’re doing to strengthen and improve execution moving forward. We hired over 100 new sales reps in the last 12 months, which may seem like a lot, but that was not enough capacity in the system to sustain our high-growth expectations as we entered the year.

According to Skonnard, their billings miss was due to not hiring salespeople quickly enough. Enterprise software is scalable, but selling it is not. Companies need more people to sell more software to more companies. These salespeople need to be trained once they’re found, which can take over a year for complex products.

Pluralsight has 250 quota-bearing reps right now, and they’re targeting 330 by the end of 2019. This is 10% higher than their original target of 300 reps, which reflects the opportunity Skonnard sees.

Not surprisingly, Skonnard also announced that their Chief Revenue Officer since 2016, Joe DiBartolomeo, will be stepping down. This move makes sense aside – DiBartolomeo’s experience was with managing sales teams at mature companies like Oracle, Qlik, and Dun & Bradstreet. He does not have experience building out a cloud sales team.

DiBartolomeo was replaced by Ross Meyercord, who has been an EVP of Sales at Salesforce for 2 years and CIO for 5 years before that.

Pluralsight’s Sales Narrative Makes Sense

Having sold software myself, I believe Skonnard’s narrative. It is incredibly difficult to hire salespeople who can close seven figure deals. Even worse is that the precious few who are capable of doing it are unlikely to leave their current company. Sales executives know who their best people are, and give those strong sellers lucrative accounts and equity to stay with the company.

Think of it this way – if you’re a killer salesperson making over $300k per year, would you walk away from that for an uncertain paycheck at an unproven company?

Herein also lies the problem. Adding stellar salespeople to grow revenue is as obvious as signing Kevin Durant to win more games in the NBA. Unfortunately, there are only so many people like Kevin Durant. Why should they join yourr team?

It could take a lot longer to hire good salespeople, which means Pluralsight’s story could get worse before it gets better.

Where Pluralsight Goes From Here

Ultimately, the question is whether this billings miss was truly due to not having enough salespeople with enough training.

If this is true, this miss will be a blip on the radar, and Pluralsight will bounce back once they build out and train their sales team. If not, Pluralsight has a big problem.

I personally believe this is a blip, and have been investing since their decline. Pluralsight has the top ranked product, their deal size is expanding, and traffic is holding steady.

Unfortunately, I also don’t know how long this blip will last.

Pluralsight Is Ranked #1 in Technology Skills Platforms

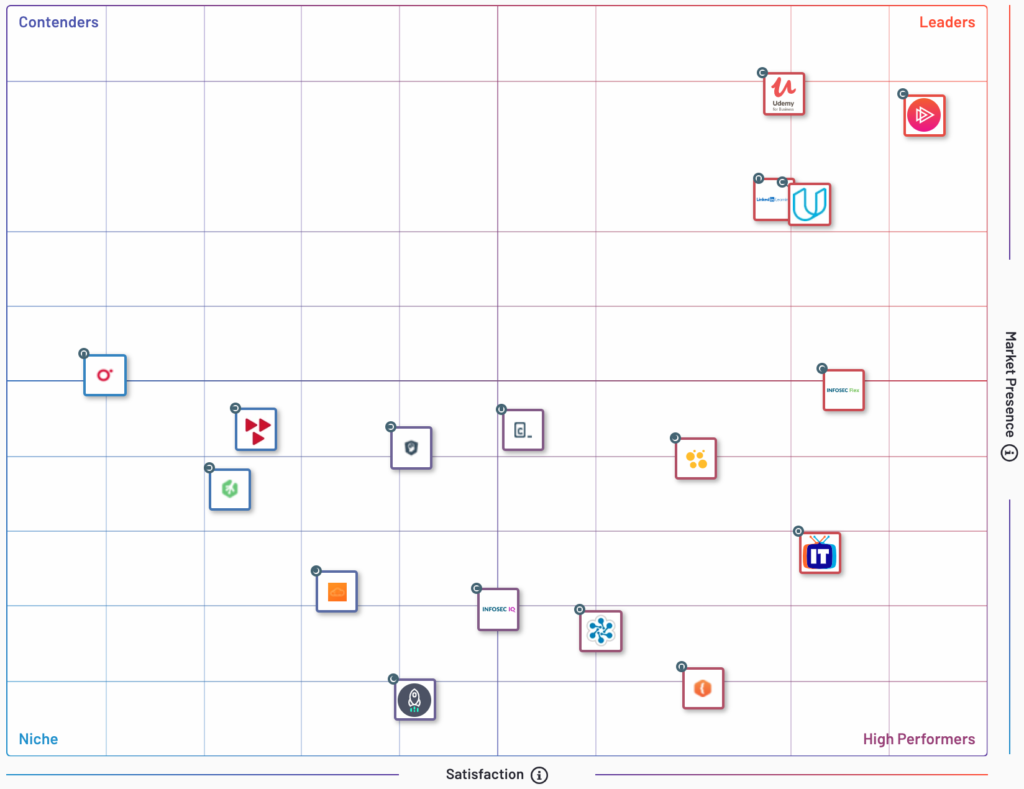

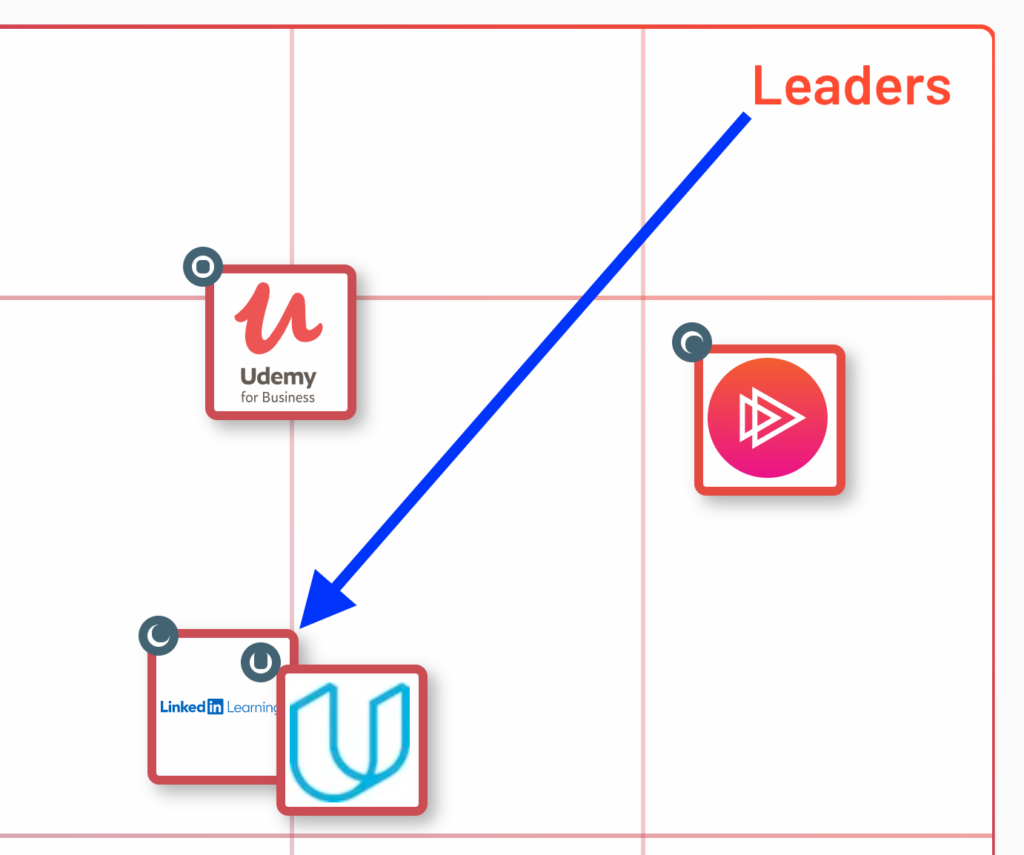

G2 aggregates nearly 1 million user reviews to determine market leaders for platforms. According to the G2 Grid, Pluralsight is the top ranked Skills Development Software available.

Wait a minute, what’s that other logo in the Leader quadrant?

LinkedIn, owned by Microsoft? What if Microsoft goes all in against Pluralsight?

Competitive Pressure from Microsoft is Unlikely

Satya Nadella never brought up LinkedIn Learning when Microsoft acquired LinkedIn. According to his memo, he primarily bought the company for their network of 433 million professionals, which strengthens their competitive positions with Office 365 and their CRM/ERP product Dynamics. This makes sense considering that Office & Dynamics each make the company billions of dollars per year.

Learning is consistently mentioned last whenever Microsoft discusses LinkedIn during their earnings announcements. Here is the one time LinkedIn Learning was mentioned during their annual report in July 2019.

Now to LinkedIn. People are an organization’s most valuable asset. Our strong Talent portfolio from Talent Solutions and Talent Insights, to employee engagement with Glint, to LinkedIn Learning enables every organization to attract, retain and develop the best talent in an increasingly competitive jobs market.

LinkedIn Learning may not be front of mind today, but what would happen if Microsoft changes their tune and goes all in? When it comes to behemoths like Microsoft, I prefer asking what would happen once they took over that target company’s revenue.

Pluralsight’s annual revenue is $274 million, which is 0.22% of Microsoft’s $125 billion in revenue. If Microsoft focuses all of their time and resources on wiping out Pluralsight, they’ll increase their revenue by 0.22%. Is that the best use of Microsoft’s time and resources?

Pluralsight’s Big Deals Keep Growing

Adding customers is only important if they’re spending money, and Pluralsight’s customers continue opening their purse strings. Consider the growth in annual wallet spend from their earnings report:

- $100k – 343 customers, up 62% YoY

- $500k – 61 customers, up 103% YoY

- $1 million – 21 customers, up 91% YoY

Customers are finding value and are thus spending more money over time. In fact, Pluralsight’s top 25 customers are spending 22x their initial purchase.

Network Effects Could Strengthen Their Flywheel

Scarcity drives demand for certain products, ranging from luxury goods to Michelin starred restaurants. There is an inverse correlation between the number of tables at a Three Star Michelin restaurant and the desire for people to eat there. Unfortunately, scarcity is exactly what prevents these products from scaling.

Other products are the exact opposite, their value increases as more people use it. Consider a few examples:

- Google’s search algorithms improve as more people use it

- Spotify’s music curation improves as more people listen to more music

- Salesforce is the de facto CRM because most sales executives and salespeople use it

Pluralsight fits in this bucket as well. As more enterprises sign with Pluralsight, and more users grow accustomed to it, they could become the Kleenex of skills training platforms. As more enterprises and users rely on Pluralsight’s credentials and certifications, the switching costs for abandoning them grow as well.

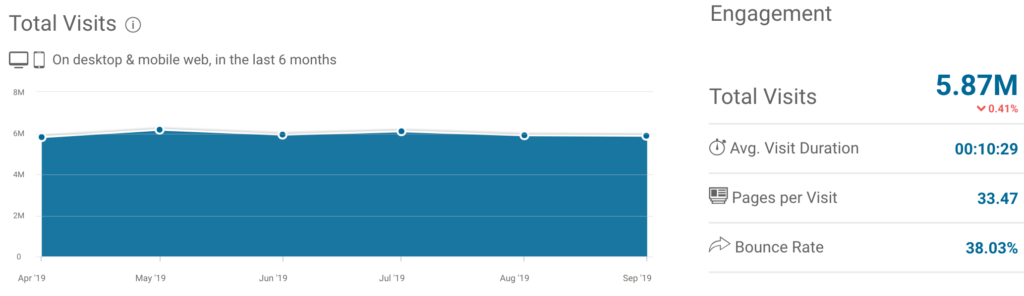

Web Traffic is Holding Steady

This headline is good news and bad news. Although their traffic is not going down, is that a good sign for a company who’s expected to grow at least 30% every year? Shouldn’t more users be signing in and using their software?

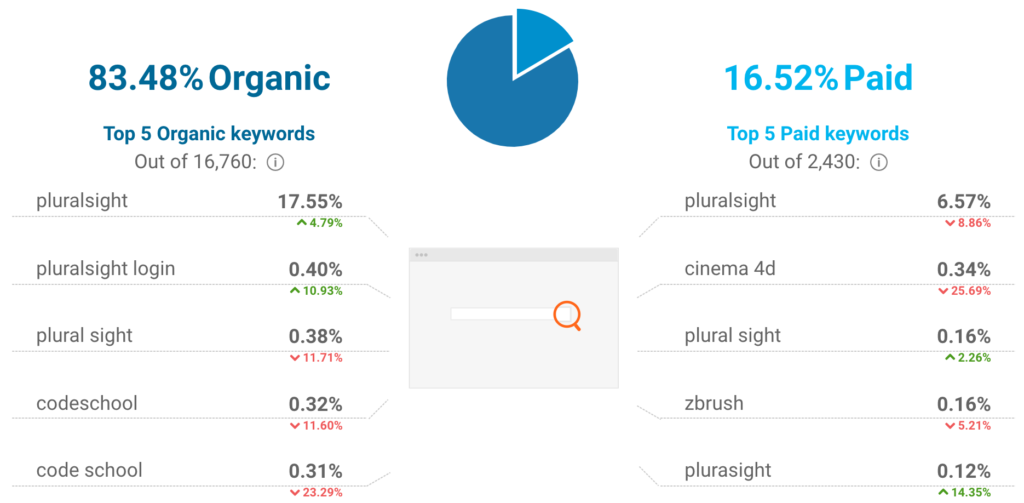

With that being said, only a fraction of Pluralsight’s traffic is paid for. 83% of search traffic is organic, and nearly all of their paid traffic comes from people who search for versions of “Pluralsight”.

While it’s bad news that Pluralsight’s traffic is not growing, it’s also good news that they aren’t acquiring traffic through Google AdWords. This screenshot shows that they aren’t blowing the doors off their advertising budget to acquire new users.

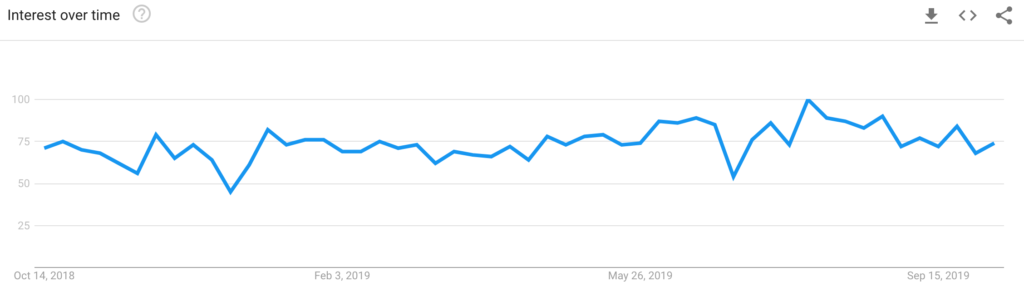

People Are Actively Searching for Pluralsight

Direct searches for Pluralsight have trended up over the past 12 months, albeit at a nominal rate. This is encouraging, because it means that prospects continue to actively search for Pluralsight when they consider technology skills platforms.

Pluralsight Stock – The Bottom Line

Pluralsight had been on my radar since May 2018. They have a best in class product, a monstrous addressable market, and their customers keep spending more money.

With that said, it’s always important to invest at the right price. I started investing in them when their price to sales ratio traded below 10x in December 2018, and have been adding to that position since their Q2 2019 earnings report. Premium members have seen these transactions in real time.

Although the price is attractive to me now, it’s entirely plausible that they will take longer hiring and training sales people, which could lead to more disappointment from Wall Street.

Finally, their sales narrative may not be the problem. If the billings decrease is due to Pluralsight’s product no longer being best class, or because their addressable market is shrinking, then there’s no stopping how far this company will crater.

Investing in companies that have fallen out of favor is not for the faint of heart, but finding companies that Wall Street misunderstands is also how you realize massive returns.

Pluralsight’s lower valuation should lead to larger returns once their momentum returns, as well as cushion the blow if their slowdown is permanent.