iRobot stock is down over 66% since April 2019, primarily due to higher China tariffs and more copycats entering the robotic vacuum market.

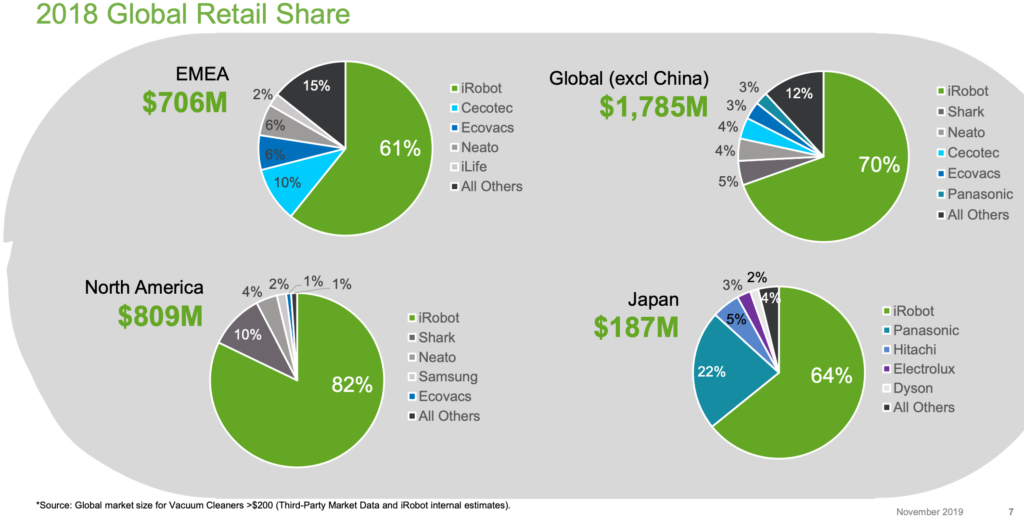

They’re managing these problems by diversifying their supply chain and litigating their patent disputes against copycats. In the meantime, iRobot has over 70% global market share in robotic vacuums, a solid product pipeline, and over 1,400 patents that could put them in the poll position for consumer robotics.

While iRobot manages these issues, you can invest in this consumer robotics leader for only $1.2 billion. I originally invested in them in September 2017, and have tripled that stake in December 2019. Premium members will see any other transactions I make in real time.

What is iRobot?

iRobot is one of the leading consumer robotic companies in the world, and the market leader for Robotic Vacuum Cleaners (RVCs).

They were founded in 1992 by MIT roboticists, including the company’s Chairman & CEO Colin Angle. 90% of their revenue is from the Roomba vacuum, and they’ve amassed over 1,400 consumer robotics patents over these three decades.

Consumer Robotics Are Time Machines

Time is our scarcest resource, and it’s one of the few things that you can’t have regardless of how wealthy you are.

Consider Warren Buffett. At 89 years old and an $88 billion net worth, how much would he be willing to pay to get 60 years of his life back?

This is why time machines have been such a popular writing topic since H. G. Wells wrote The Time Machine in 1895. Until we are blessed with a literal time machine, humans must make due with metaphorical time machines that extend or enhance the time we have.

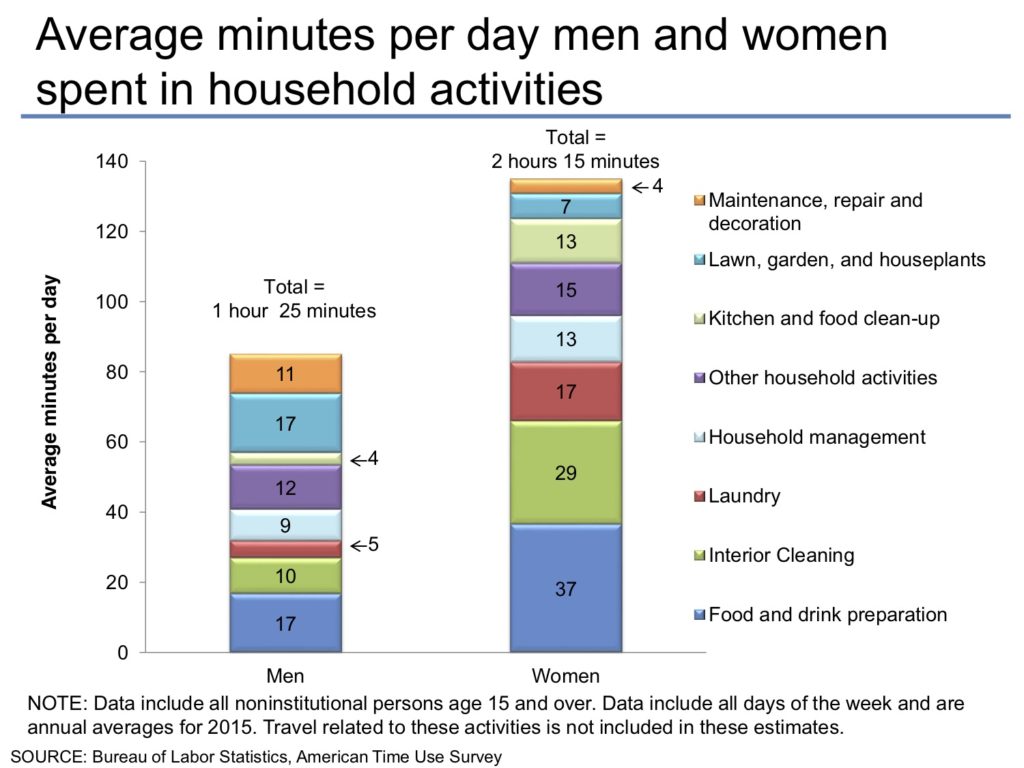

Consumer robotics extend your time by freeing up the manual work you do every day. According to the US Department of Labor, the average American spends nearly one month per year on household chores alone.

Scott Galloway recently wrote that any company who creates over $10 billion in shareholder value must either extend or enhance time. What would you do if you were given an extra month every year? Imagine how much more time you could spend with your friends and family, or how many more books you would read. Who knows, you might even spend more time on this website!

Household chores is just one monotonous task where we lose time, imagine everything else that consumes your time every day. This explains why worldwide robotic spending will increase from $116 billion in 2019 to over $210 billion in by 2022.

While the consumer robotics vision is compelling, iRobot is a robotic vacuum company today. So let’s dive in to that business.

iRobot the Vacuum Company

iRobot has dominant market share in each of the RVC markets, and will make over $1.1 billion from RVCs this year. They have 70% share globally (excluding China) and 82% share in North America. There isn’t a single region where iRobot has less than 61% share.

Can you think of a consumer device company that has such incredible market share? Even Apple’s iPhone only has 42% market share in the United States, and 13% share worldwide.

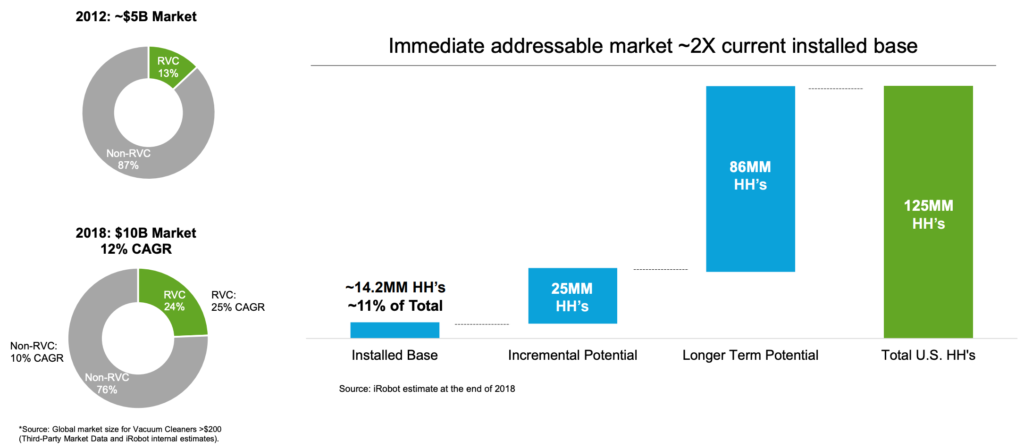

With that being said, iRobot only has 10% of the overall vacuum market, which means that most people are still buying regular vacuums. Similar to how most people bought flip phones when the iPhone came out, it will take several years before RVCs overtake regular vacuums.

Why iRobot Stock Has Plummeted

iRobot has dominant market share, higher margins than Apple, and is poised to ride the consumer robotics wave. They must be killing it, right?

Well, not really.

iRobot’s value has declined by 66% since April 2019, from $3.8 billion to $1.3 billion today.

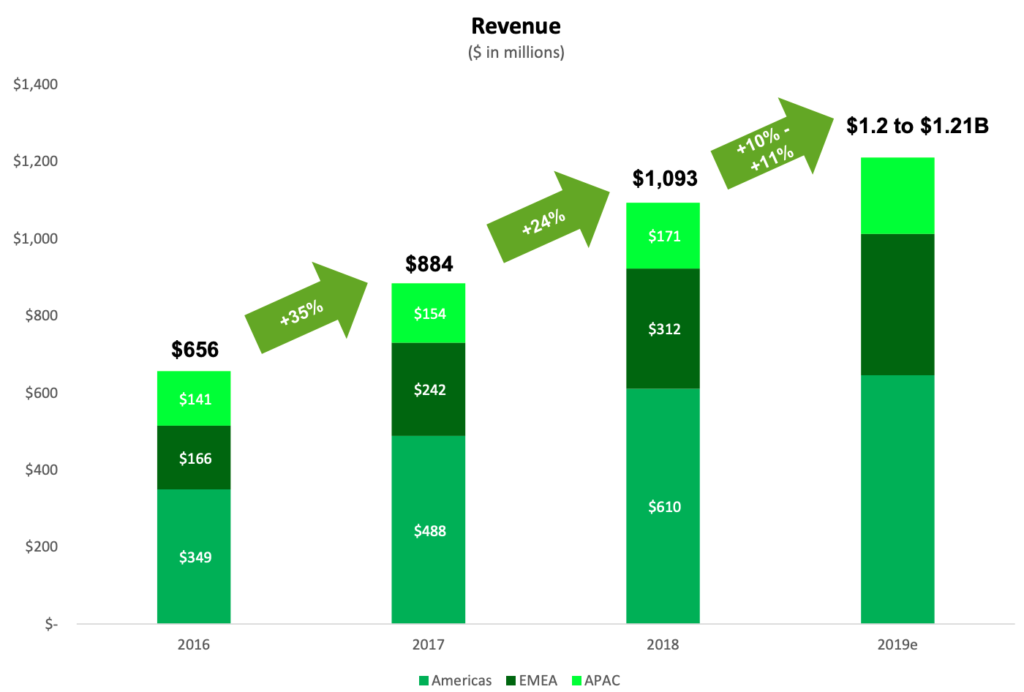

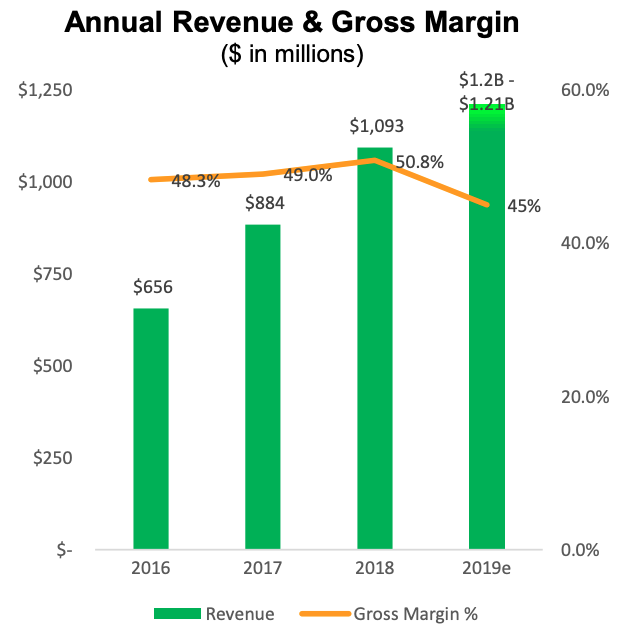

This decline is due to slowing revenue growth and declining margins. Revenue growth has decelerated from 24% last year to 10% in 2019. This is predominantly due to tariffs and the emergence of copycat RVCs.

Tariffs Are Crunching Margins

In May 2019, RVC tariffs increased from 10% (which was enacted by Trump in September 2018) to a crushing 25%. Thanks to this, gross margins have declined from 51% in 2018 to 45% in 2019.

Suppose your income taxes increased by 25% overnight, what would you do?

You would probably try to make more money first, and iRobot did exactly that by raising their prices. Unfortunately, their price elasticity was higher than they hoped. Since customers weren’t willing to pay more, iRobot lowered prices back to their original levels.

iRobot isn’t the first hardware company to find their pricing limits. In fact, Apple cut iPhone prices in their September 2019 rollout as well.

Since you can’t make more money, perhaps you could move to another country without those taxes?

Enter Malaysia. iRobot established manufacturing in Malaysia in 2019, and will ramp up volume in 2020. Assuming the United States and China never settle their trade war, Malaysia will reduce iRobot’s tariff burden as more products are manufactured there.

In the meantime, they still have incredible margins in spite of these tariffs. iRobot’s gross margins are 48%, while Apple, the gold standard of hardware gross margins, are only 38%.

Fighting Copycats Through Patent Litigation

Imitation might be the sincerest form of flattery, but iRobot would happily trade that flattery for less competition. As the RVC market picks up steam, more copycats are emerging.

SharkNinja is one of the most flagrant – they released the Shark IQ Robot more than one year after the Roomba i7+, at half the price. iRobot sued SharkNinja one month after the release for infringing on 6 of their patents.

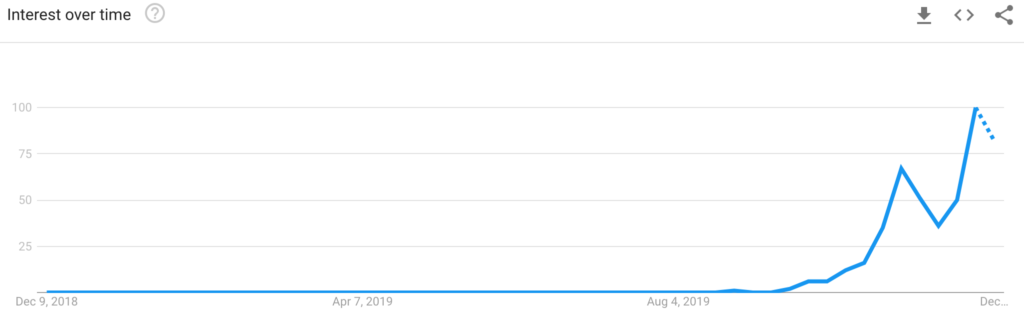

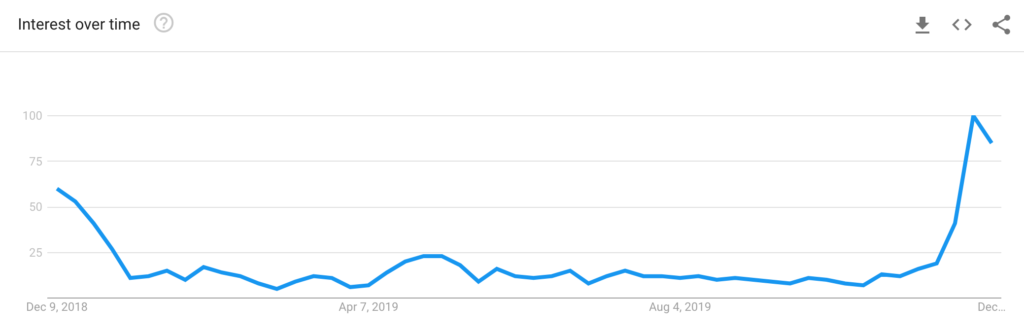

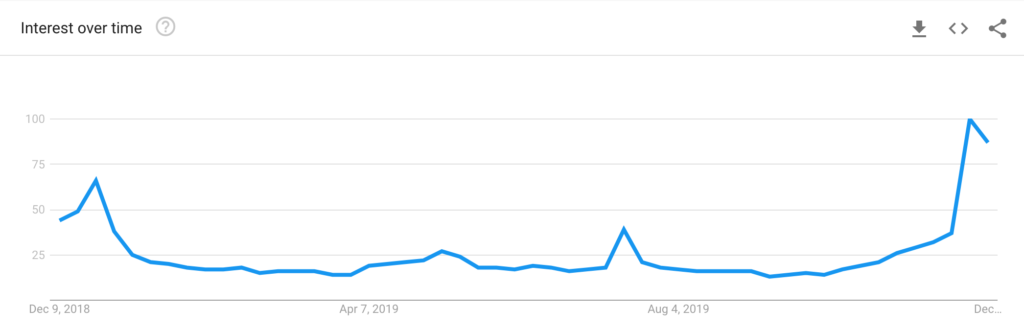

Time will tell whether SharkNinja indeed infringed on iRobot’s patents. While that legal fight happens, consumer interest in SharkNinja’s IQ Robot has surged.

How Can iRobot Turn Around?

iRobot’s decline is based on a change in narrative, not results. They have dominant market share, their revenue is increasing despite crushing tariffs, and they are innovating with new products.

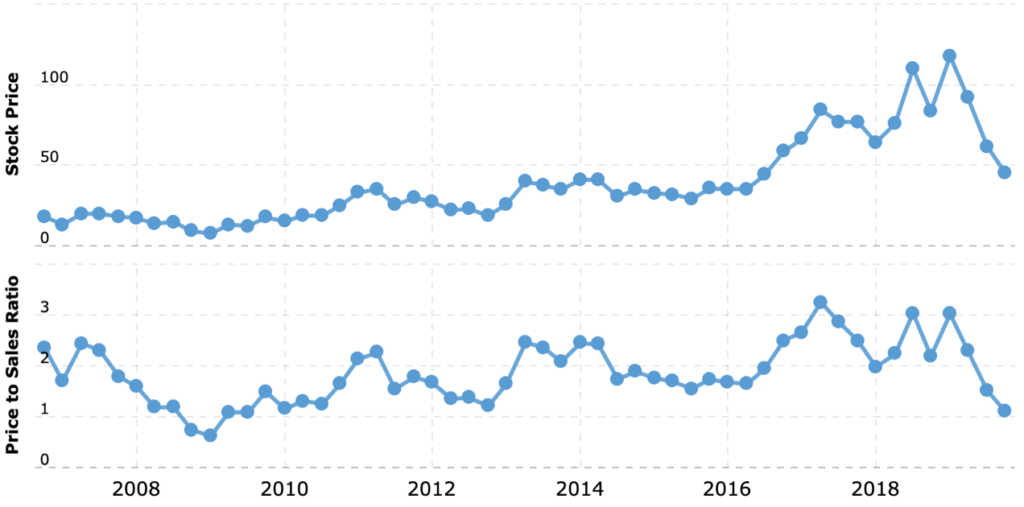

As you can see, iRobot’s valuation is almost perfectly correlated with their price to sales ratio. This is the amount investors are willing to pay for $1 of revenue.

Investors were willing to pay 3x revenue before the 25% tariffs were announced in May 2019. Now, investors are only willing to pay 1x iRobot’s revenue.

This isn’t the only consumer device company who’s narrative has drastically altered the stock price. Look at how correlated Apple’s valuation is to their price to sales as well.

Apple’s price to sales ratio expanded from under 3x in January 2019 to nearly 5x in November 2019 thanks to their services narrative. Likewise, Apple’s valuation increased by 72% over that time as well.

Since the revenue and performance is still there, let’s see what could change the narrative back in iRobot’s favor.

RVCs Still Have $8 Billion in Opportunity

The global vacuum market is worth over $10 billion per year, and iRobot has captured over 10% of that market so far.

While iRobot already makes over $1 billion from vacuums today, 76% of households still don’t have a robotic vacuum. Therefore, nearly $8 billion is up for grabs in the RVC market, and that market is growing 25% every year.

Even if iRobot can’t jump from vacuums to consumer robotics, they still have a lot of opportunity in the market they’re dominating.

Search Interest is Exploding For Their Products

While iRobot defends their patents in court, searches for iRobot’s products are surging. Both Roomba & Braava searches are up significantly compared to the past holiday season, showing that customers are still willing to pay a premium for iRobot despite the new entrants.

This makes sense intuitively. If the whole point of consumer robotics is to save time, does it make sense to buy an inferior product where you’ll later spend time dealing with repairs, cleaning up areas the robot missed, or getting the robot unstuck?

Geographic & Supply Chain Diversification Will Raise Margins

iRobot’s manufacturing plant in Malaysia went live in November 2019. They’re producing Roomba’s low-end 600 series, and may add more product lines in 2021.

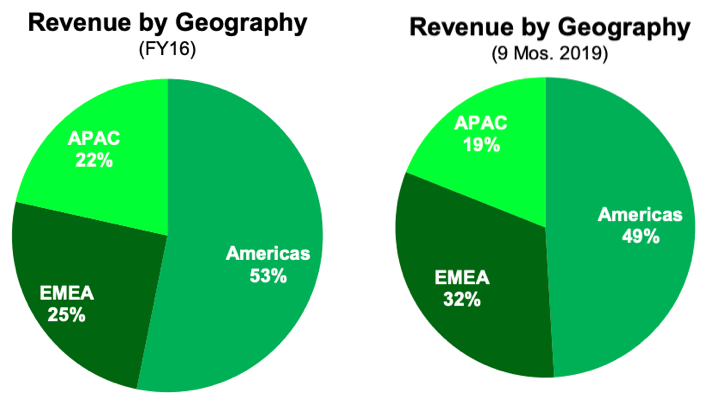

While the Malaysia plant ramps up volume, iRobot is also accelerating growth outside the United States.

iRobot’s international revenue grew by 25% year over year during Q3 2019, and has expanded from 47% of total revenue in 2016 to 51% in 2019. Since the China tariffs only apply to products sold within the United States, this international growth will improve iRobot’s margins.

iRobot is Expanding to New Product Categories

While 76% of the vacuum market is still up for grabs, iRobot isn’t satisfied with just conquering that market.

Their north star is to corner the entire consumer robotics market. Remember, the average person spends one month of their life every year on household chores, which means there is more to automate than just vacuuming.

Fortunately, the new Braava mop and Terra lawnmower gets iRobot closer to that goal.

Braava Robotic Mop

iRobot’s newest Braava mop was released in May 2019, and their revenue will exceed $100 million in revenue for 2019. Braava is growing annually at 47% over the past three years.

Braava’s rapid growth is largely thanks to targeting their existing Roomba customers. Since the Roomba has already mapped their customer’s homes, the Braava can quickly compliment the Roomba for mopping.

iRobot will release more robotic compliments over time, and the company’s success hinges on how quickly each new product grows relative to their predecessors.

Terra Robotic Lawnmower

iRobot piloted the Terra lawnmower in the United States & Germany throughout 2019, and will start selling the product in 2020.

The global robotic lawnmower market will be $3 billion by 2023, and the entire lawnmower market was $26 billion in 2017.

Americans spend an average of 73 hours per year on lawn care, according to the US Department of Labor. What would you pay to get 3 days of your life back every year?

There are several competitors in the robotic lawnmower space already. Including well established players such as Deere, Honda, and MTD Products (backed by Black & Decker). Although many companies have a head start, none of them have made much headway.

Why not? Their products are too difficult to use. Users need to bury boundary wires throughout their yard, and then replace them if any changes are made to that yard. Imagine digging up your backyard just to plant some flowers.

With the Terra, users simply place wireless beacons around their yard and take the robot for a spin. Lawn alterations are as simple as moving a beacon.

Terra’s simple installation and lack of competitive headway give iRobot a great chance to crack this market.

Each New Product Makes the Flywheel Stronger

Consumer robotics are not just the way iRobot becomes a multibagger, they’re also a strategic imperative to prevent the Roomba from being commoditized.

How? Imagine you have several robots handling different tasks, one is vacuuming, one is mopping, and another is washing windows.

If each of these robots are from different manufacturers, how would they communicate with one another? Also, how many software interfaces will you be managing? If the vacuum collides with the mop, which robot vendor is liable?

This is exactly how Apple gets away with charging big premiums for their products. They have a monopoly on their operating system, and integrating each of their complimentary products are a breeze.

iRobot is employing the same strategy. They have a monopoly on their Imprint Smart Map, which gives robots the ability to learn, map and adapt to your home. The robot learns your floorplan as it cleans and remembers this map for future cleaning jobs. This enables iRobot to determine the best way to clean based on the orientation of each room.

This is why the Braava has grown so much faster than the Roomba, and why each subsequent new product should grow faster than their predecessor.

While the Braava has quickly grown, we still have a sample size of one for now. This is a vision, and the Terra’s 2020 release will be a great test of how strong this flywheel is.

iRobot – The Bottom Line

iRobot has had a rough year, dropping 66% over the last 7 months. This has mostly been due to issues outside of their control. Tariffs are taking a huge chunk out of their margins, and their patent lawsuits are still being litigated.

While iRobot manages these problems, you can invest in a leading consumer robotics company for only $1.2 billion.

iRobot has dominated each of the product categories they entered, and has over 1,400 patents to help them release new product lines. Their new mop and lawnmower highlight just how valuable those patents are.

Any company who captures the consumer robotics space will be worth an incredible amount of money. iRobot has a lot of work to do, but they have a great chance of being that company.

If they don’t, you’re still getting the world’s best robotic vacuum and mop company at an incredible price.