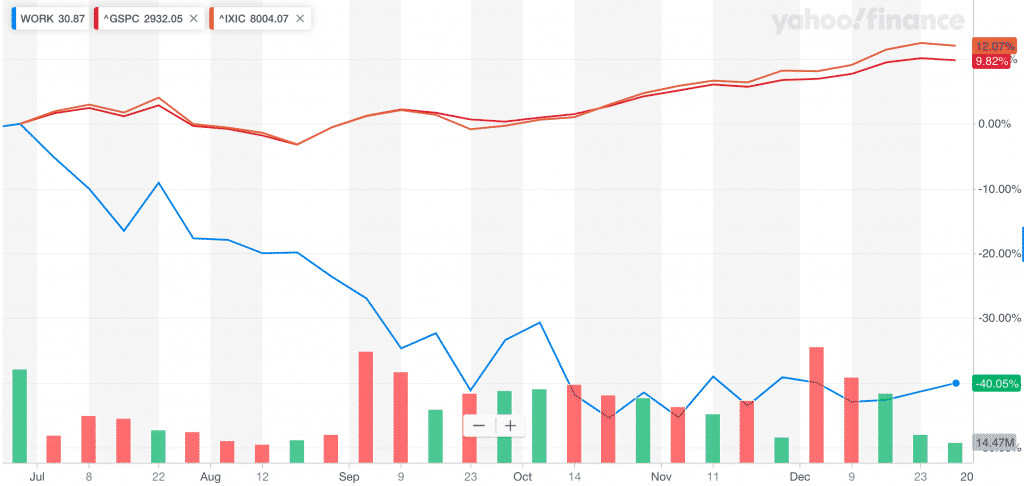

In August 2019, I wrote about Slack’s direct listing and the virtues of patience for IPO investing. How would you have done if you took my advice and avoided this company?

Quite well, it turns out. Over that time, Slack is down over 40%, while the S&P 500 is up nearly 10%, and the Nasdaq is up over 12%.

Why is Slack down so much relative to the market? Simple, they were overvalued with a sky-high 39x multiple of sales.

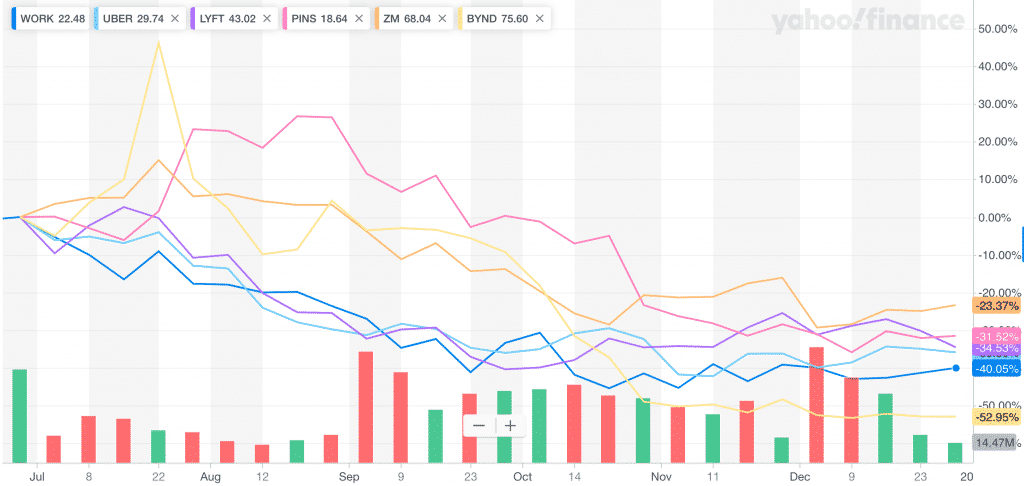

In fact, just about every IPO is down substantially over the same time. If you invested in these transformational technologies that IPO’d in 2019, you would be down between 23% – 53%.

- B2B Communications: Slack & Zoom Video

- Transportation: Uber & Lyft

- Social Media that isn’t toxic: Pinterest

- Meat Substitute: BeyondMeat

How could all of these transformational businesses be down? As I mentioned previously, all of their optimism was already priced in, which made them drastically over valued.

FOMO Will Bankrupt You

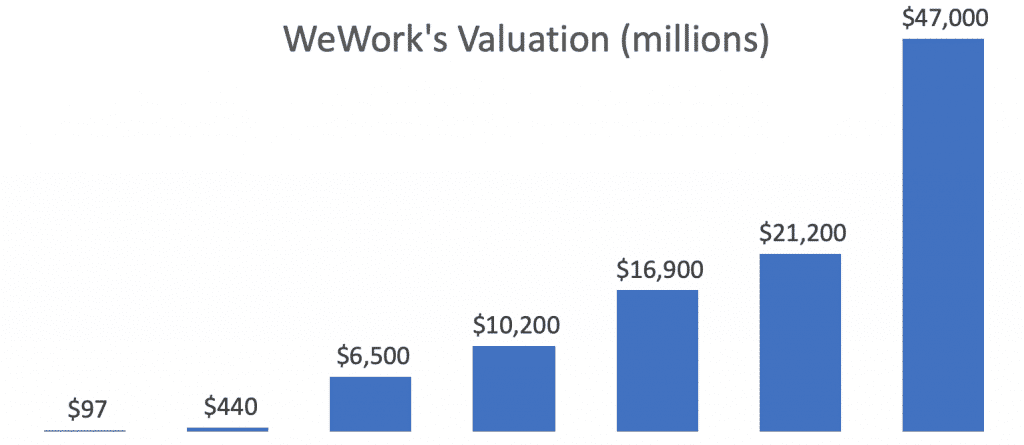

Initial public offerings are difficult to avoid. The company wouldn’t be in this position had their value not grown exponentially. Now we, the retail investors, finally get to share in those riches. Consider WeWork’s meteoric rise.

Before we get too excited, why are these venture capitalists and employees selling a stake in their company if they know the value will skyrocket? Put another way, if a crystal ball told you that your investment would double over the next 6 months, would you sell that position today, or 6 months later?

That’s the problem with IPO investing. Investment bankers have been hired to raise as much cash for the company at the highest valuation possible.

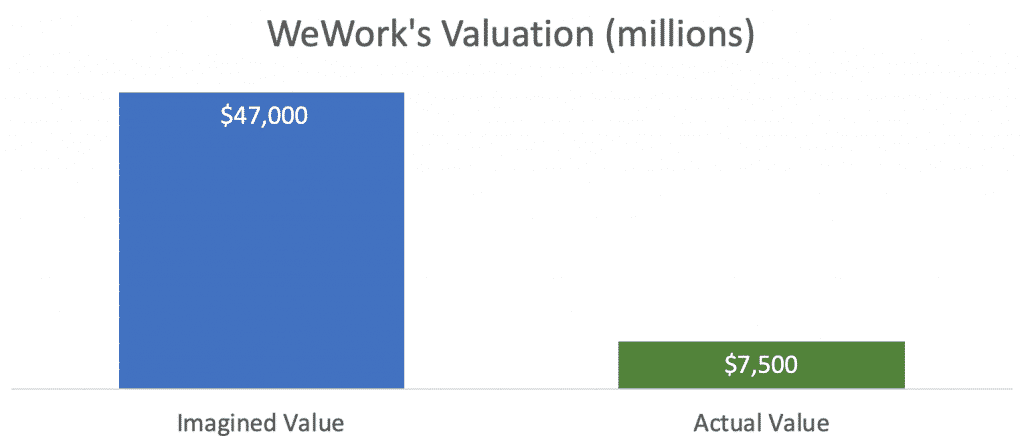

WeWork is an incredible example, which I wrote about once their S1 was released. This company tried to sell equity at a $47 billion valuation – after there were no takers, the valuation plunged to $7.5 billion. Imagine how much money retail investors would have lost if WeWork pushed this through.

Valuations Take Time To Correct

Just because a company is valued high initially, doesn’t mean that the value will plummet tomorrow. In fact, some of these companies could skyrocket, at least at first.

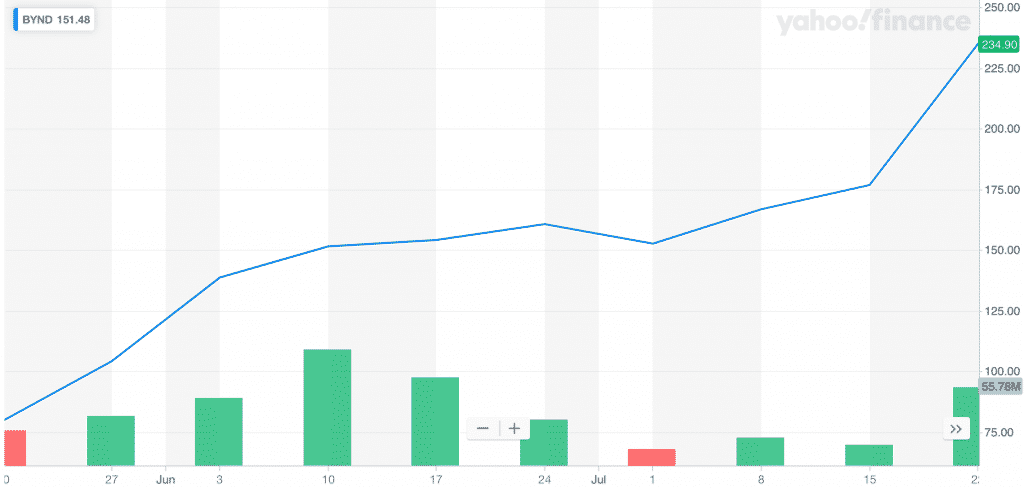

Consider how BeyondMeat’s valuation ballooned nearly 3x after their IPO.

At its peak, BeyondMeat’s valuation was over 70x their revenue. That is 9x the valuation of reasonably priced software companies such as Pluralsight while missing the three crucial ingredients that justify software’s high price to sales premiums: instant scalability, sky-high gross margins, and recurring revenue.

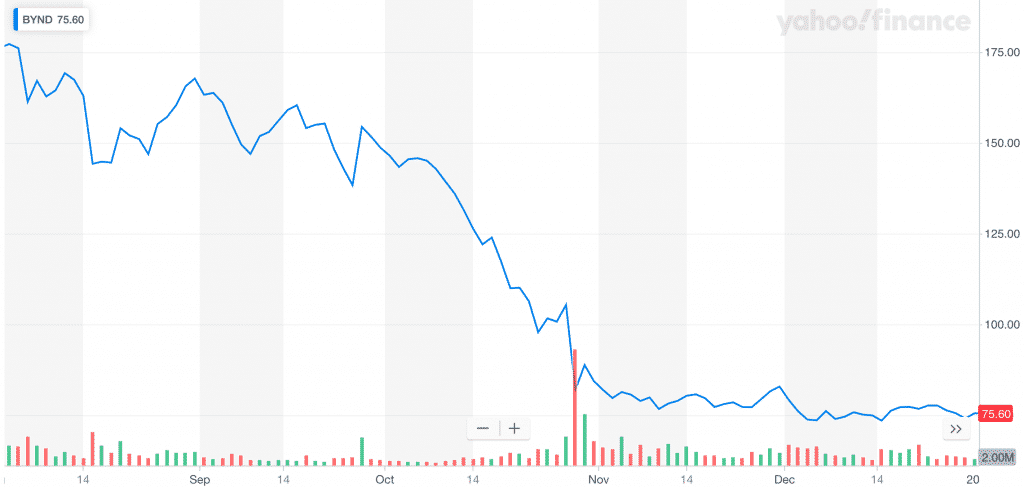

Of course, the invisible hand of the market (also known as “rationality”) finally came to play, and wiped out 60% of BeyondMeat’s valuation.

This isn’t to pick on BeyondMeat. In fact, quite the opposite. They raised an immense amount of capital at sky-high valuations, which prevented the existing investors and employees from diluting their equity. But who was that at the expense of?

You, the retail investor. Especially those of you who invested in their secondary offering at $160 per share. But if we’ve seen this movie before, why does it keep happening?

In a word, FOMO (fear of missing out), which Warren Buffett perfectly articulated in September 2018:

People start being interested in something because it’s going up, not because they understand it or anything else. But the guy next door, who they know is dumber than they are, is getting rich and they aren’t. And their spouse is saying can’t you figure it out, too? It is so contagious. So that’s a permanent part of the system.

Is that guy next door dumber than you? Odds are you think so. If 93% of Americans claim to be in the top 50% of driving skills, what percent of people believe they are in the top 50% of investing?

Our society stands on the shoulders of giants, while successful investors lounge on the carcasses of investors who bought at the top because they were afraid of missing out (hello Bitcoin at $20k), and sold at the bottom in a panic.

Now What?

Hopefully you avoided all of these companies during their IPO hype. Now that they’re cheaper, what should you do? Most of these businesses have not changed, but the narrative and valuation has. There is no silver bullet to analyzing these companies, but these questions should be answered before investing in them.

Why Is The Value Declining?

Before pulling the trigger on any of these companies, read about why their valuations have gone down.

Once you know all of the reasons, sanity check each and verify whether the problems are legitimate.

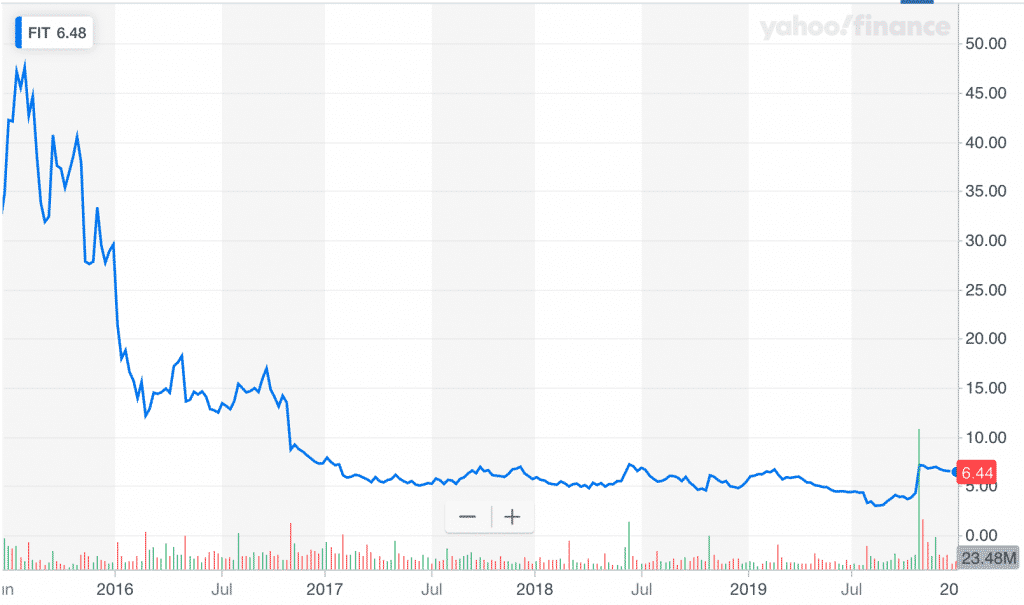

For example, FitBit plunged because they were losing share to Apple. Apple has a massive ecosystem, along with a luxury brand that siphons out the majority of hardware profit. This is an existential threat, and investors were all but guaranteed to lose money regardless of when they invested.

However, the issues leading to the drawdown could be overblown. I wrote about how Twilio’s decline was overblown in my original Virtues of Patience post:

-Twilio’s early investors and insiders liquidated 8% of the company’s valuation

-Competitors like Vonage were entering the space

-Customers like Uber built their own communications platform

It turns out only one venture capitalist sold the company, Vonage was not a credible threat, and building a communications platform is more difficult than Uber thought.

How Good is the Business?

Even if crystal meth was free, I still wouldn’t touch it. The psychosis, severe tooth decay, and convulsions are simply not worth the false sense of well being and energy that comes in the short term.

Similarly, sh*tty businesses should have as much space in your portfolio as crystal meth should have in your bloodstream. Sears looked like a great deal until it went to zero. People similarly invested in MoviePass because each share was just $1.

Unfortunately, evaluating businesses take a lot of work. Here are some questions that can help identify whether or not a business is “good”:

- How high are margins?

- Is revenue expanding or declining?

- Are margins expanding (which shows pricing power)?

- What would happen if the business disappeared tomorrow?

- Who are their competitors?

- How hard is it to switch to a competitor?

Sears, for example, had: declining revenue, and low margins that kept shrinking. Furthermore, life is going on just fine without them.

Conversely, how could I get my Star Wars Baby Yoda Plush Toy delivered in two hours without Amazon Prime?

It turns out that any number of shares multiplied by $0 comes out to…$0. Avoid arithmetic at your own peril.

How Cheap Are They Relative to Peers?

Slack is down roughly 40% from their direct listing, but their price to sales is still 22x. How cheap is that compared to other fast growing software companies who have high margins?

- Twilio: 14x

- Pluralsight: 8x

- PagerDuty: 12x

- Zoom Video: 35x

Clearly it’s not cheap, and you can find other companies who are more expensive. If the valuation is still higher than peers, there may be better companies to invest in.

What Could Take The Company Down?

Are there existential threats to any of these businesses? For all of them, the answer is yes:

- Slack: Bundling from Microsoft Teams

- Pinterest: Being copied by Facebook, similar to Snapchat

- Zoom: Bundling from Cisco or Microsoft

- Uber & Lyft: Constant price wars for drivers and passengers

- BeyondMeat: Competition from Impossible and established meat companies

Finding threats is the easy part – the difficult part is deciding whether the likelihood is low relative to the valuation. I.e. is the risk worth the reward?

The lower the company’s valuation, relative to the likelihood that these threats come to pass, the higher of a return you’ll realize.

How Much Have Insiders Bought & Sold?

When executives sell some of their equity, don’t dump your investment just yet. The C-Suite has bills to pay just like you and me.

On the other hand, take a long look at companies when their executives make a big bet. They know the company better than anybody, so they might be doubling down for a reason.

As for Slack, CEO Stewart Butterfield has sold roughly 5% of his equity since their direct listing. More importantly, no executive or director at Slack has invested in the company as of the end of 2019.

If no insider believes Slack is a deal despite being down 40%, maybe they believe the price is still too high.

IPO Investing Rewards the Patient

Anybody who says that they wish they would have invested in Amazon at any price is either: a liar, or does not understand numbers.

If you invested $10k in Amazon at the height of the dot com bubble in 1999 at $116 per share, you would have roughly $164k today.

16x returns are not bad, but do you know what’s better? A 318x return. Had you patiently waited a few years and invested when the company was under $6 per share, you would have over $3 million today.

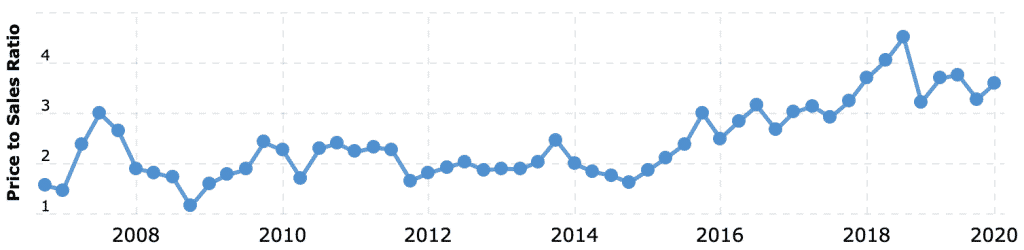

Since we don’t have crystal balls, there was no way to know that $116 was the top, or that $6 was the floor. However, we do know that Amazon’s price to sales multiple is generally between 1.5x – 4x.

In 1999, Amazon’s price to sales multiple was over 35x on 19% gross margins (their margins are 2x higher today thanks to AWS). A couple years later, that multiple cratered to 0.9x at the trough of their valuation.

Odds are that we’ll miss the exact bottom for these companies, just as we missed with Amazon. As long as we’re investing at a reasonable price relative to their historical valuation and peers, we’ll realize a substantially higher return on our investment.

I didn’t believe Slack’s price, along with any of the other recent IPO companies, were reasonable in my original post. Similar to then, I’ll patiently wait on these companies, and Premium members will see when I invest.

For everyone else, I’ll continue publishing my recent investments.