TSLA vs TSLAQ keeps intensifying, with each side passionately betting against the other. For polarizing companies like Tesla, sometimes it’s better to sit back and watch as an investor.

What are the biggest rivalries in the world? Ohio State vs Michigan? Lakers vs Celtics? Israel vs Palestine?

How about TSLA vs TSLAQ? These groups go together like nuclear power and Chernobyl. And just like Chernobyl, investors on teams TSLA & TSLAQ are actively ignoring warning signals that could trigger a nuclear meltdown in each of their portfolios.

For the silent majority who does not spend all day obsessing over Tesla on Twitter, this rivalry is between the bulls of Tesla (TSLA) vs the bears of Tesla (TSLAQ). The “Q” at the end is added to stock tickers once they file for bankruptcy, feel free to connect the dots on what the bears are insinuating.

The greatest war on Twitter is happening right before our eyes between TSLA & TSLAQ. Here are some recent $TSLAQ posts on Twitter:

Tesla is up 3x over the past 6 months, and team TSLA is dancing on the figurative graves of the short sellers. Before we feel too bad for TSLAQ, we can safely assume that they were dancing on TSLA’s graves when the stock was cut in half last year.

Each side is getting more polarized towards their beliefs. Team TSLA believes that Tesla could monopolize the electric vehicle market, whereas team TSLAQ believes that Tesla could run out of money any second.

Let’s analyze each side’s case.

The Case for TSLA

Team TSLA has several legitimate points backing their claim. Not only is Tesla capitalizing on the paradigm shift of electric vehicles, they also have higher margins thanks to building fantastic cars that sell themselves.

Tesla Could Be the Apple of cars

Apple didn’t get where they are by simply making a great phone – they hopped on the smartphone wave, which turned out to be a tsunami. That tsunami obliterated all of the incumbents who swam against it.

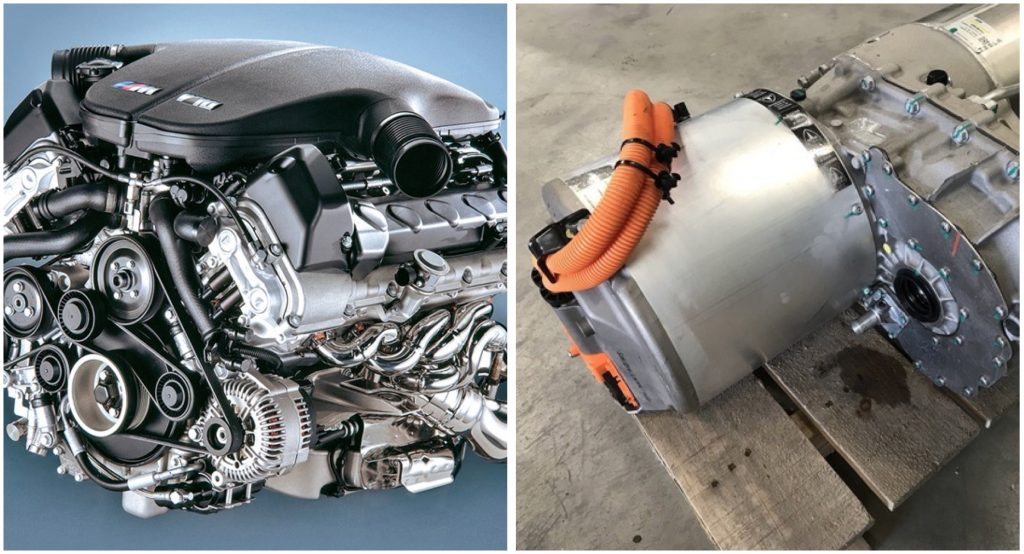

Similarly, auto manufacturers face a paradigm shift from internal combustion engines (ICE) to electric engines.

How? Electric vehicles change the auto manufacturing game. The engine is the most complex and important part of an ICE car, yet one of the simplest parts of an electric vehicle.

A recurring nightmare is for my ICE car to break down on the freeway. After opening the hood, I stare hopelessly inside while Googling what to do. While I’m Googling under the hood, my wife realizes that any shred of masculinity I had was a mirage.

I’m intimidated by ICE engines because they’re incredibly complicated. They have thousands of moving parts connected by belts and gears, which need to stay cooled and oiled, and god knows which liquid is which. You feel like a genius when you notice the blue fluid is low, only to realize that it’s for cleaning the windshield.

Electric engines, on the other hand, are incredibly simple. They’re smaller, lighter, and involve only a handful of moving parts.

Legacy ICE manufacturers have teams of engineers who focus solely on combustion engines, and they wield a ton of power thanks to the engine’s complexity. With the new paradigm of electric engines sending them straight to the basement of the corporate value chain, how many of these engineers will go down gracefully for the greater good of the company?

Navigating these internal politics will not be easy for combustion manufacturers, just ask Nokia how well they transitioned to smartphones.

Tesla’s Product & Vertical Integration Yields Higher Margins

When is the last time you saw a Tesla commercial? Think about the holidays, how many advertisements did you see of people surprising their spouses with a Tesla that had a huge red bow on it?

That’s the punchline, Tesla doesn’t even have a marketing budget. They have never advertised on television, which gives them a huge competitive advantage. Unlike every other automaker who is dumping billions in advertising, Tesla lets their cars speak for themselves.

Same goes to vertical integration. Tesla famously does not have car dealerships, because they don’t need people to sell their cars. Traditional automotive companies are stuck with dealers, and that liability will compound as Tesla scales. While other companies are transforming from ICE to electric, Tesla can keep cranking out cars at a lower cost structure.

China Expansion Creates Substantial Growth

Earlier in January 2020, Tesla delivered the first China-made Model 3 to employees in the country.

China has seduced many North American companies. With over a billion people, China has the fastest growing middle class in the world. Companies from Starbucks, Apple, and Kentucky Fried Chicken have entered that market hoping for immense riches.

Unfortunately, China doesn’t give access to their market for free. Here’s what a Beijing policy maker told the Wall Street Journal when asked about DuPont’s allegations that their Chinese partner stole DuPont’s technology:

“China’s offer to the world has been straightforward, foreign companies are allowed to access China’s markets but they would need to contribute something in return: their technology.”

That is indeed straightforward. Now that Tesla has access to China’s market, could their technology be stolen?

China makes it easy to steal electric vehicle technology, they mandate audits of all of foreign vehicles before they can start mass production. This “audit” gives China time to steal technology, so is it a stretch that China might?

In fact, Tesla has already accused a Chinese competitor of doing exactly that.

In all fairness, China has spent over a decade copying the iPhone, and still hasn’t figured it out. Even if they did replicate a Tesla, Tesla’s brand will likely be more prestigious than any Chinese competitor.

But that’s assuming China plays fair after stealing their technology, and I don’t see enough incentives for China to protect Tesla.

The Case for TSLAQ

TSLAQ has legitimate reasons to worry about Tesla’s future as well. The company can’t make money, misses targets, and is threatened by legitimate entrants.

Tesla Doesn’t Make Money

Tesla, like Apple, makes an incredible product. However, the comparison between Tesla and Apple stops at product quality. The true testament to your product’s success is whether the product can generate free cash flow.

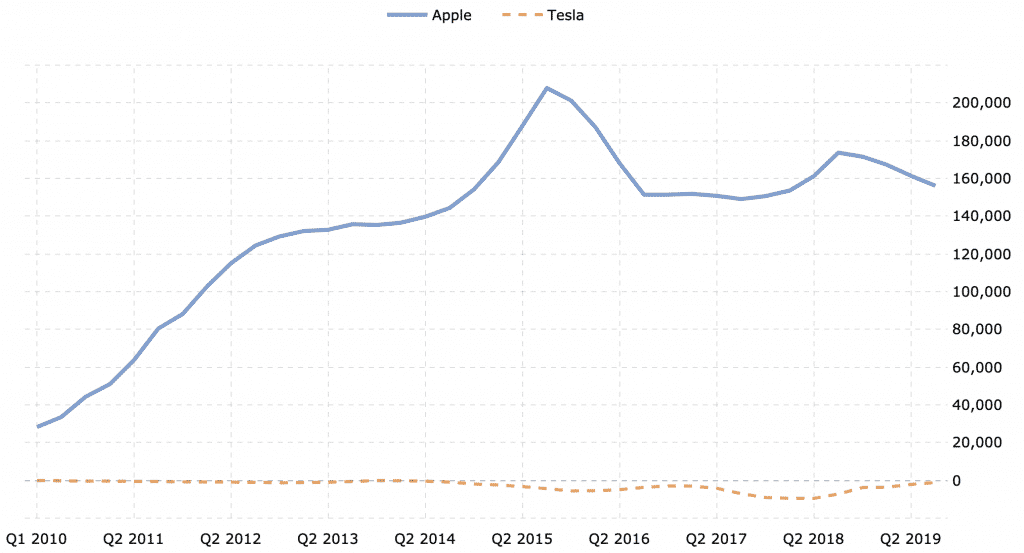

Let’s see how those companies have done over the past 10 years:

Tesla has only two years of free cash flow during their entire existence. Apple, on the other hand, has been cash flow positive well before the iPhone. That cash flow exploded once the iPhone released, and they have printed money ever since then.

Bulls will argue that cash will come as they sell more cars. As of February 2020, however, the company has not consistently generated free cash flow.

Tesla Consistently Misses Their Targets

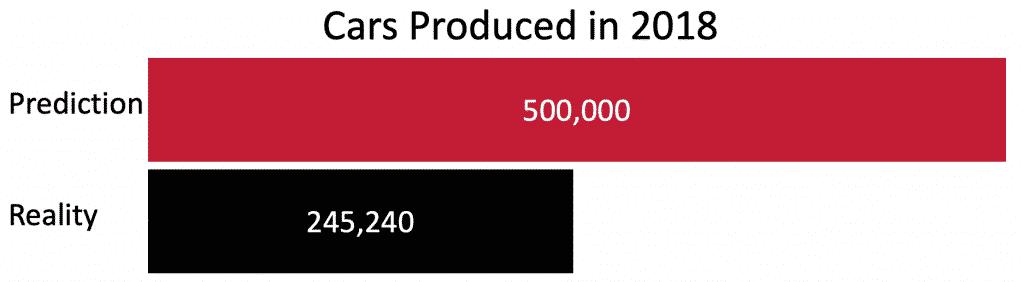

Tesla’s targets are the corporate equivalent of New Year’s Resolutions. Just like us, they see an infinitely better version of themselves in the future. And just like us, once the end of the year comes, they find themselves more overweight, less active, and drinking more alcohol than the year before.

If that last sentence hit too close to home, I have some good news for you. Whatever your resolutions have been, odds are that you accomplished them far better than Tesla has.

Consider Tesla’s 2018 production goal of 500,000 cars, they did not even get halfway to that number. In fact, their 2020 goal is to produce 500,000 cars as well. Even $130 billion companies can fail their New Year’s Resolutions.

In all fairness, Tesla is setting audacious goals. Remember when Elon Musk announced that they will have a million robotaxis by 2020? That was incredibly audacious, and since there isn’t a single robotaxi released as of February 2020, this looks like a miss as well. However, if anybody wants to bet on the over, please email me directly.

Just like our New Year’s Resolutions, we could go on and on about their misses as well. They were two years late with the launch of the Model X, and still haven’t completed their goal of conducting a hands-free trip across the US. Musk claimed that would happen by late 2017.

Elon Musk has incredible vision, which explains why Tesla’s cars are so much nicer than the competition. However, each miss brings more doubt towards whether Tesla can execute their audacious goals.

More Competitors Are Entering the Market

Tesla has enjoyed an effective monopoly on luxury electric vehicles. Most electric vehicles have been the Palm Pilot to Tesla’s iPhone. Buying a non-Tesla electric vehicle meant you cared about the environment, and also assured that you were going home alone that evening.

Starting in 2020, Tesla will have serious competition with good looking electric vehicles from luxury brands.

The most formidable is Porsche. Porsche’s Taycan is a direct competitor to Tesla’s Model S, and won the bronze medal for Luxury Hybrid & Electric Cars at US News (behind Tesla’s Model S & Model 3, respectfully).

Porsche released the Taycan in January 2020 in Europe, and will start selling in the United States this spring. Even though the car isn’t out yet, the nearly 100 year-old luxury brand is already capturing share. Porsche’s CEO recently told Bloomberg that half of all Taycan buyers are new to the Porsche brand.

They aren’t just selling to loyal Porsche customers, they’re selling to people who wanted a luxury electric vehicle, and chose Porsche over competitors such as Tesla.

Porsche is not the only brand coming after Tesla. Both Jaguar & Audi released electric SUVs that are ranked #1 & #2 Luxury Electric SUV according to US News. Tesla’s Model X was ranked behind them at third.

Tesla’s Executives Are a Revolving Door

Over the past two years, Tesla has turned over more of their executives than the Cleveland Browns coaching staff. Twenty-four executives (VP and above) have left over the past two years, and twelve left last year:

- January 2019 — Todd Maron, general counsel

- February 2019 — Cindy Nicola, vice president of global recruiting: LinkedIn profile does not list next position

- February 2019 — Dane Butswinkas, general counsel

- March 2019 — Deepak Ahuja, CFO

- June 2019 — Felicia Mayo, vice president of human resources and head of diversity

- June 2019 — Peter Hochholdinger, vice president of production

- June 2019 — Steve MacManus, vice president of interior & exterior engineering

- July 2019 — Jan Oehmicke, vice president of Tesla Europe

- July 2019 — JB Straubel, chief technology officer

- August 2019 — Stuart Bowers, vice president of engineering

- September 2019 — Sanjay Shah, senior vice president of energy operations

- December 2019 – Jonathan Chang, general counsel

Elon Musk is by no doubts a remarkable leader, but building incredible companies is a team sport. You need a fantastic team in addition to that remarkable leader. Apple would not have been had Wozniak not joined Steve Jobs, and they could not have scaled their iPhone production without Tim Cook.

Similarly, Tesla needs to keep their star players if they want to dominate the automotive industry.

Is TSLA or TSLAQ Right?

With the facts laid out, what’s the verdict?

Premium members can track which side I’m on in real time. For all other readers, I believe that both groups are wrong.

Why? Because each side is facing ironclad counterpoints that could wipe out their thesis. Even worse, each group is ignoring legitimate threats from the other side!

Your money is finite. You only have so much to invest, why invest or short a company that has so much risk on either side of your bet?

Imagine playing Russian Roulette, and you get to choose how many bullets to put in your revolver. Assuming no difference in odds or payout, how many bullets would you put in the gun?

Ideally zero, and hopefully not a full chamber. The more bullets you put in, the more likely your corpse gets carried away from the game.

This is why both sides are wrong. Tesla’s revolver is fully loaded against both Tesla bulls and bears. All it takes is for one bullet to be in the chamber, and TSLA or TSLAQ turns into a carcass that’s bleeding out on the table.

Several companies have incredible growth potential, and arguably have more growth potential than Tesla. Even better, they have far fewer bullets in the chamber. Why not invest in them instead?

Same goes for the shorts. Betting against the electric vehicle paradigm is like swimming against a tsunami. There’s a remote chance that you’ll make it to the other side, but your odds of survival are exponentially higher if you avoid the tsunami and wait for another wave.

Tesla’s Stock Price vs Execution

“What about the stock price?” asked the Tesla bulls. The company is up over 3x from their floor in a matter of months, hasn’t team TSLA already won?

Tesla’s stock price certainly reflects that.

Unfortunately for the bulls, higher stock prices alone simply reflect higher expectations that a company will execute. There’s no guarantee that they will until the games are played.

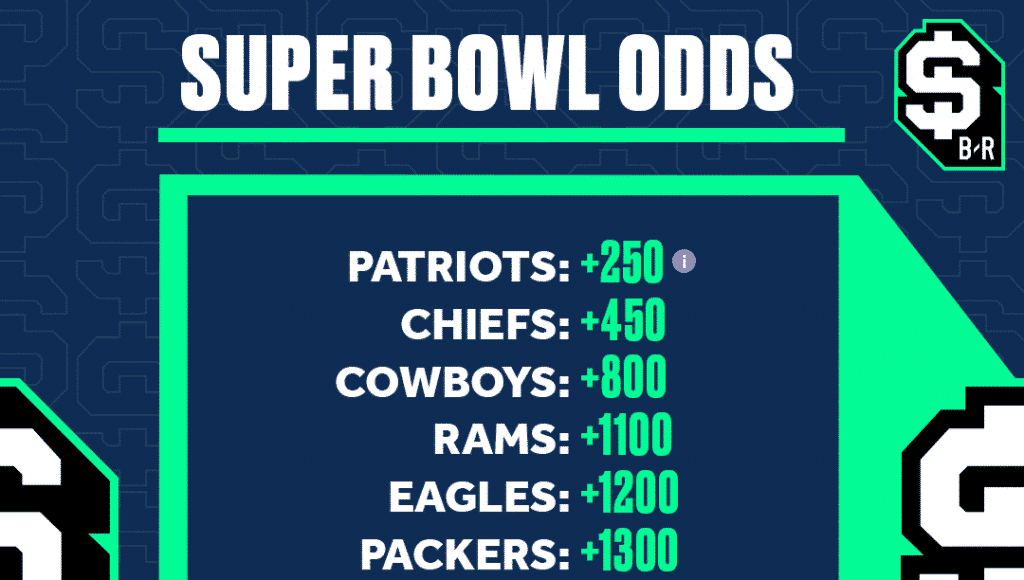

Similarly, the New England Patriots did not win the Super Bowl simply because they had the best odds when the 2019 season started. How many of their fans are celebrating their high expectations after losing to the Tennessee Titans in the first round of the playoffs?

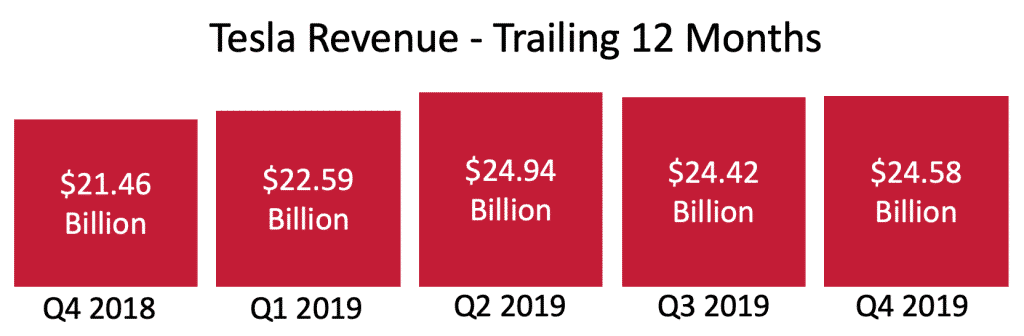

Tesla bulls would have a better case if sales increased during the same time the stock skyrocketed. Instead, their trailing twelve months revenue has actually declined since Q2 2019. In fact, their revenue hasn’t meaningfully increased since Q4 2018.

If their revenue is stagnant, what else is causing Tesla’s parabolic increase? From their Q4 2019 update.

We expect positive quarterly free cash flow going forward, with possible temporary exceptions, particularly around the launch and ramp of new products. We continue to believe our business has grown to the point of being self-funding.

Tesla had another big update – positive free cash flow going forward! This means they can self-fund their growth from now on, and won’t need to tap the equity and debt markets.

But did you catch the line immediately after? They mention “temporary exceptions” of not being cash flow positive. How fragile are these future cash flows?

Tesla’s Cash Flow Durability

Consider how Tesla became cash flow positive, from their Q4 2019 update (highlights are from me):

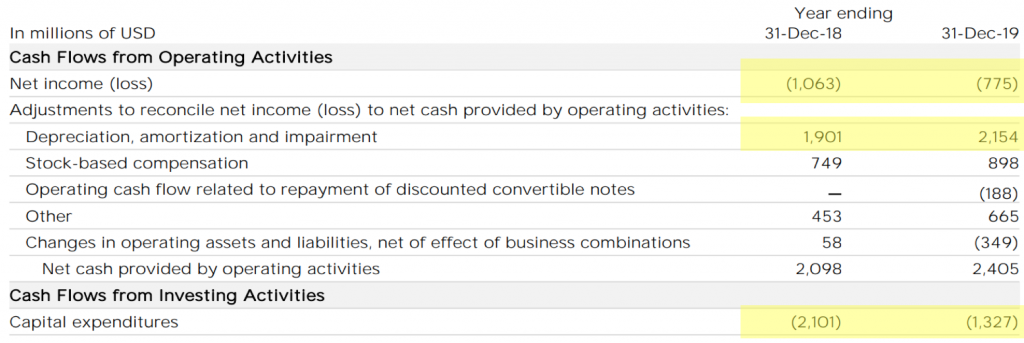

The highlighted sections tell the story. Let’s start with the good news: Tesla’s 2019 net loss was roughly 30% less than their 2018 net loss.

The bad news? Their depreciation increased 13% from 2018 to 2019, while their capital expenditures were cut by 37%. In aggregate, Tesla is only reinvesting $1.3 billion of the $2.2 billion that has been depreciated from the company. This makes sense if they are scaling back and cutting volume, but doesn’t Tesla plan to grow?

What’s wrong with that? Imagine you’re an Uber driver, and realized how to quickly increase profits: never service the car! No oil changes, no new tires, no brake pads. All of that is eating up your profits, just fill the gas tank.

Now imagine you’re a passenger, how safe would you feel riding in that car after 200,000 miles? Would you hop in, or pay Uber’s $5 cancellation fee?

Replace that car with a series of factories that are responsible for producing 500,000 cars per year, how would you feel owning a company who isn’t reinvesting in said factories?

Reinvestment is Critical to Growth

That exaggeration is the point. One blip in capital expenditures won’t sink a company, just like how delaying your oil change by a few thousand miles won’t blow up your car.

However, investors should worry about any asset-heavy company who permanently cuts back reinvestment in their business, while also forecasting massive growth. Time will tell whether those cuts are consistent – if it is, investors should be worried.

Which goes back to durability. How likely can Tesla maintain positive cash flows if they’re generating net losses? Eventually, they will need to invest in their factories, and at this moment, doing so will shut off the cash flow valve that took years to open.

Simply put, not much at the business has meaningfully changed. Sales have declined over the past two quarters, and their free cash flow would evaporate if they reinvested in their factories.

Tesla bulls can claim victory once the company executes, all they can claim in the meantime are higher expectations.

TSLA & TSLAQ: Put The Gun Down

Tesla is an incredibly polarizing company, and the rivalry between TSLA & TSLAQ is getting more intense in 2020.

TSLA claimed victory with the company tripling in value over the past 8 months, and they aren’t slowing down. With Tesla light years ahead of their competitors in the electric vehicle shift, bulls expect that the company will keep climbing in value. Cathie Wood at Ark Invest recently wrote that Tesla’s 2024 price target is $7,000 per share. That’s a 9x increase from where they are today, making Tesla a $1.2 trillion company

However, the red flags from Tesla bears are still out there. The company has not consistently made money (only forecasts that they will), their executives are leaving in droves, legitimate entrants are coming, and they are still missing targets.

Your money is finite, and Tesla’s chamber is fully loaded to take out the bulls and bears. Instead of taking a side, put the Tesla gun down, and find companies with fewer bullets in the chamber.

The band Rush said it best, “If you choose not to decide, you still have made a choice.” Instead of taking sides between TSLA & TSLAQ, you can be patient and “choose free will”.