COVID-19 is accelerating the retail apocalypse – even when stores open back up, people would rather go to the DMV than inside a dressing room.

While the world is changing around them, all retailers can do is sit back and watch their self destruction. Sky-high leverage, coupled with underinvesting in personalized eCommerce, has left them castrated.

Some companies have been investing in this new reality all along, and Stitch Fix is one of them. This retailer has been digging trenches with stylists since 2011, and these stylists are giving consumers a personalized eCommerce experience.

I first invested in them in April 2020, and they are currently one of my ten largest holdings. Premium members have seen these transactions in real time.

Retail is a notoriously difficult business, but winners have rewarded shareholders for that risk. Although they are at the mercy of short term headwinds with the rest of apparel, I believe Stitch Fix will survive and ultimately come out of this crisis stronger.

What is Stitch Fix?

According to their S-1, Stitch Fix is transforming the way people find what they love, one client at a time and one Fix at a time.

I love the vision, but let’s simplify what they do today: Stitch Fix is an eCommerce retailer.

More importantly, they are a personalized eCommerce retailer. Previous successful eCommerce retailers put commoditized products online, and married search algorithms with their lower cost structure to squeeze the margins out of retail incumbents. Think Amazon with books.

Unfortunately, this doesn’t work as well for products that are personalized, such as apparel. Digital music is a good example of this.

There was digital music before Spotify – some of you may remember Napster, Limewire, and Kazaa. Aside from having millions of tracks available, they were free! The only problem? It took an eternity to find tracks, download them, and create playlists. It turns out our time is worth something, and Spotify’s 130 million users agree that it’s worth $10 per month to automate this.

Apparel eCommerce is like Limewire, minus the free part. There’s an overwhelming selection of clothes, shoes, and accessories online, and customers don’t know where to find their style.

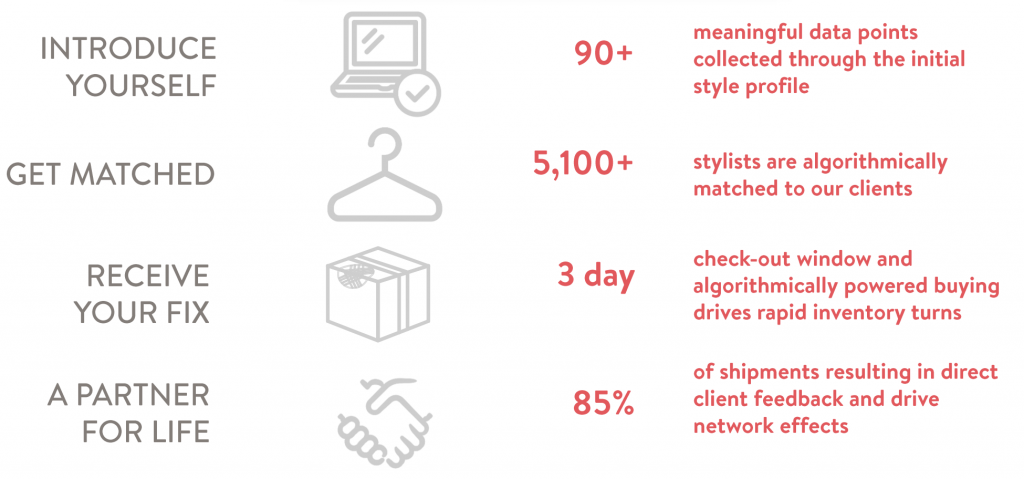

Stitch Fix bridges this gap with over 5,100 stylists. These stylists build personal relationships with their customers, marrying data science with their judgement to ship personalized styles from their broad base of merchandise. Personal touches ranging from styling advice and context help stylists build long-term relationships with their customers.

Who Gets Rich in Retail?

Imagine that you dropped everything you did today for the sole purpose of getting rich. Which industry would you dedicate your life to?

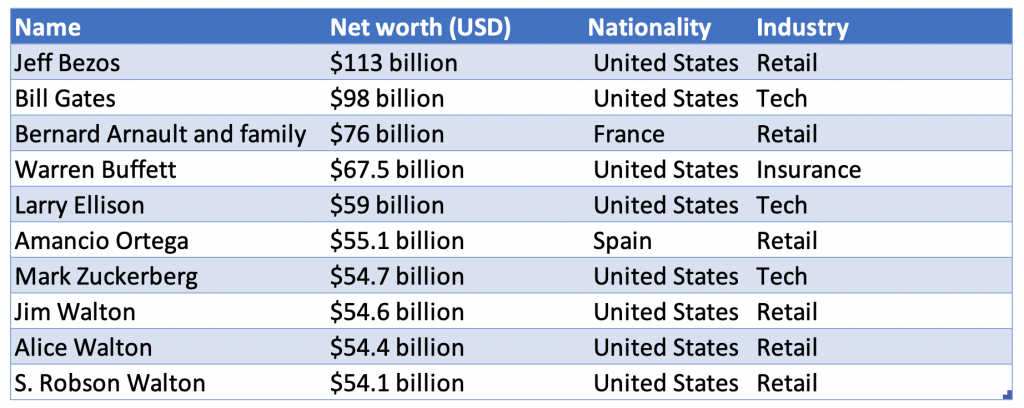

Technology makes sense, we all have heard about the riches from Google, Apple, and Uber. But before you quit your job and leave your family to make the next groundbreaking swiping app, let’s consider who the wealthiest people in the world are:

It turns out that 6 of the 10 wealthiest people in the world came from retail, including the wealthiest person in the world, Jeff Bezos. Granted, AWS is represents half of his net worth, but stripping that out still puts Jeff in the top ten for retail alone.

This makes sense when you think about it – once you build an incredible brand, your customers are locked in. As Scott Galloway explains in The Four:

Buying a diamond necklace out of the back of a truck, even if the stones are real, isn’t as satisfying as the purchase at Tiffany, from a well-dressed sales assistant who presents the necklace under brilliant lights and speaks in hushed tones.

People value a Louis Vuitton bag exponentially higher in a Louis Vuitton store compared to the same bag on the street. People also trust Amazon’s prices more than the rest of the web, which is why 49% of consumers search on Amazon first. Building a new store or a pricing search are easy to copy, but your odds of success are non-existent.

Retailers & Drug Lords

Which is why so many of the wealthiest people in the world are in retail, and it’s exactly why drug lords are so wealthy: it’s a tough business. Did you notice that the founders of Bed Bath & Beyond, Dick’s Sporting Goods, and Macy’s were not on Forbes list of billionaires? Similarly, Bodie never had a shot at cornering Baltimore’s drug market in The Wire.

Anybody can start a retail business, and everybody will come after you if you’re remotely successful. Incumbents will stop at nothing to take you out, and your own employees could leave at any moment to compete with you. Finally, once you’re big enough and think you’re out of the woods, the government will come after you with antitrust complaints. Pretty similar to drug kingpins, right?

But what if you make it? Then you’re on top of the world, and the only thing that can stop you is yourself. Pablo Escobar may still be around if he didn’t order the murder of Colombia’s favorite presidential candidate, and Sears may still be around if they invested in the internet.

Which is the funny thing about retail. Instead of seeing the carcasses of retail stores in front of them, they get in line for the next asteroid so they can join their fellow dinosaurs. Google “retail apocalypse” and you’ll see what I mean.

Thanks to this retail complacency, Stitch Fix has a legitimate chance of winning. If they do, shareholders will be rewarded tremendously. Valued at just under $2 billion, they are decades away from succumbing to their own self destruction.

What if Retail Stores Copy Stitch Fix?

I was worried about bookstores copying Amazon back in 2005. Is it easier to stand up a website, or open 511 retail stores like Borders? The answer seemed obvious back then, and Amazon’s success shows how obviously wrong that assumption was.

But a subscription service should be easier to stand up, right? Well, great brands have already tried. Nordstrom acquired Trunk Club for $350 million in 2014, and wrote down $197 million of it just a couple years later. Fast forward to 2020, and Nordstrom doesn’t even break out Trunk Club’s revenue or subscriptions in their earnings reports.

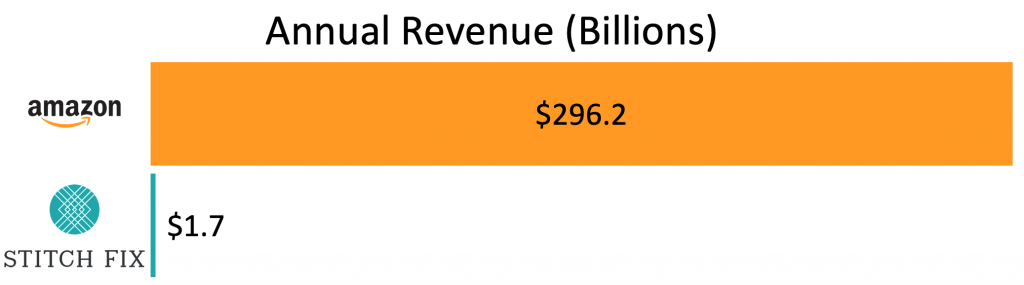

Another existential threat could be Amazon, which announced Prime Wardrobe in 2019. Investors are right to fret if Amazon steps on their turf, but how much will Amazon focus on this space?

With nearly $300 billion in annual revenue, Amazon will increase their revenue by 0.6% if they take all of Stitch Fix’s $1.7 billion in sales. Similar to Microsoft fighting Pluralsight, the juice just isn’t worth the squeeze.

As for other retailers or startups jumping in, Stitch Fix addressed that with their stylists. These stylists increase lock-in thanks to their customer relationships, and it’s a trench that incumbents can’t afford to dig.

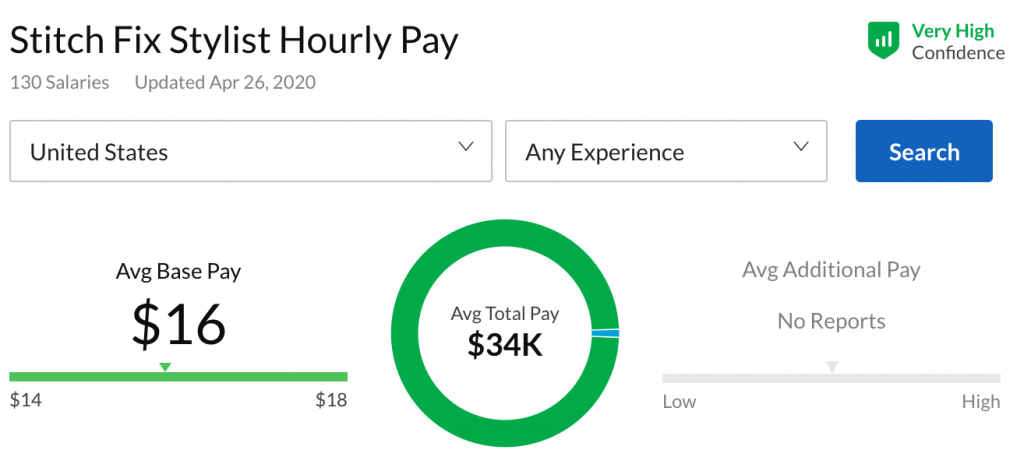

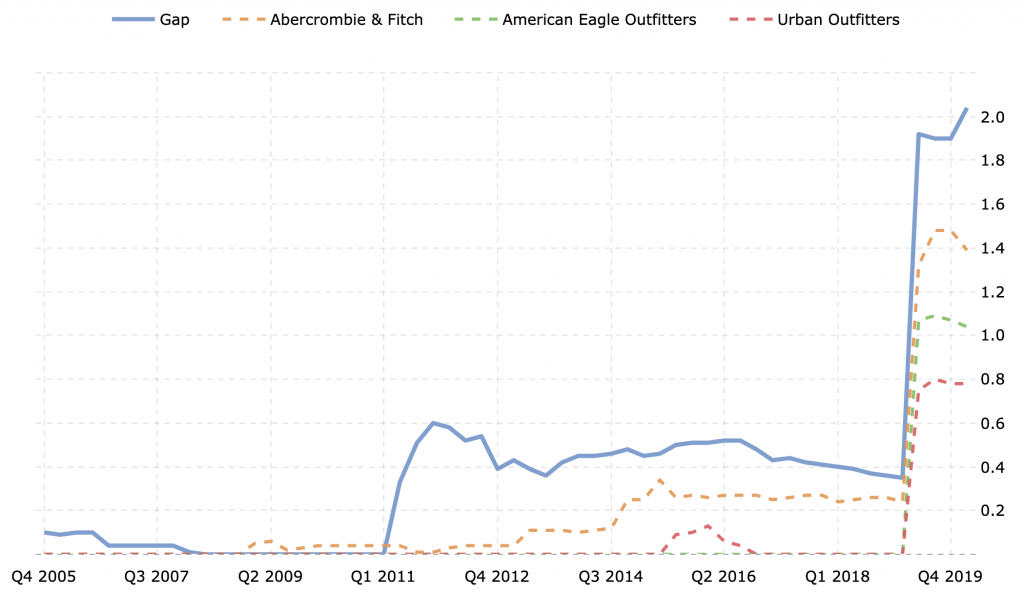

The average Stitch Fix stylist makes $34k per year according to Glassdoor, which means they’re spending $173 million, or 2x Abercrombie & Fitch’s 2019 free cash flow, on their 5,100 stylists every year.

If The Gap wasn’t willing to cut their free cash flow by 30% to compete with Stitch Fix in 2019, how will they find the money when they’re projecting to lose over $1.1 billion in cash in 2020?

Another Asteroid Is Coming

Amazon did not kill book stores, eCommerce killed them. All Borders or Barnes & Noble had to do was invest in larger warehouses and eCommerce, but they couldn’t justify the expense. Somebody was going to take these bookstores down, and Barnes & Noble and Borders refused to do it themselves.

Similarly, Stitch Fix could be the eCommerce asteroid that wipes out fashion retail, and COVID-19 just fastened a hyperdrive on them.

While retailers are sitting on empty real estate with time-consuming eCommerce experiences, Stitch Fix is open for business. Even once stores open up, how many people will go back to retail stores?

Especially for apparel – how many people will want to try on clothes that somebody with COVID-19 may have worn? Even if the dressing rooms and clothes are disinfected, people will think about it psychologically. If a toothbrush was completely disinfected after being dropped in a toilet, and you were given lab results proving this, would you use it again?

You’ll probably buy a new toothbrush. Similarly, I believe people will find a new way to shop as well.

Even if COVID-19 disappeared tomorrow, many may realize that Stitch Fix is a time machine. Instead of spending hours shopping in stores and online, you’ll receive personalized fashion at your door. Feel free to spend that saved time reading my site.

Is Stitch Fix Another Blue Apron?

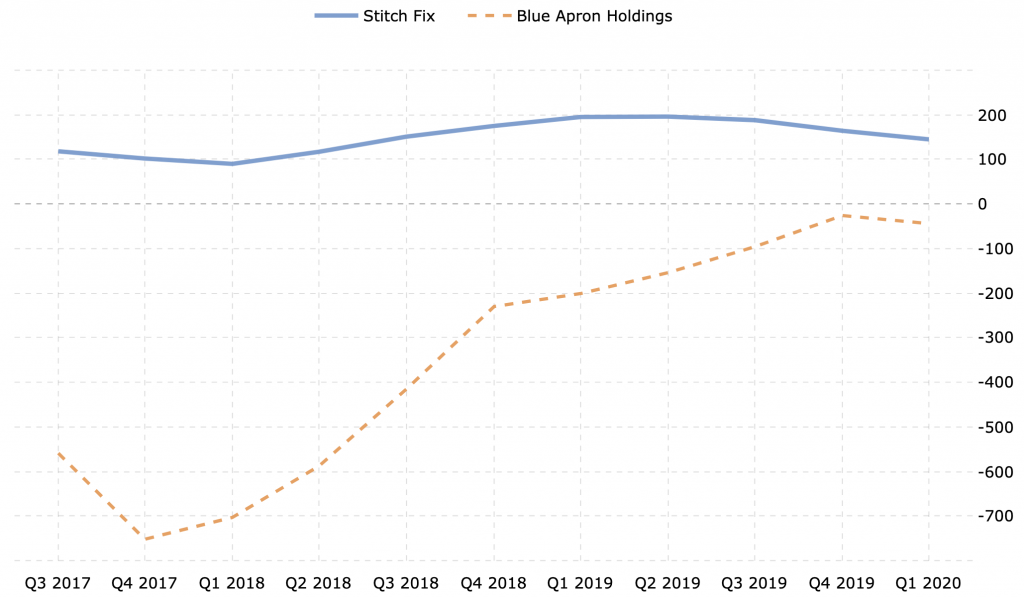

Stitch Fix is disruptive, but so are many other unsuccessful direct to consumer companies. Blue Apron is the poster child – their stock is down 94% from their IPO.

Does Stitch Fix have a similar problem? Here’s quick way to check, when is the last time you heard their ad on a podcast?

I’m convinced that most direct to consumer business models are to funnel shareholder dollars to podcasters. Blue Apron and Casper have executed this business model flawlessly. Unfortunately for shareholders, they would have been better off giving half of that money directly to podcasters instead.

Stitch Fix is not one of those companies – they are not exchanging dollars in marketing for nickels in revenue, and their positive free cash flow reinforces this.

So there you have it, Stitch Fix is not only in a disruptive position, they can also reinvest in their business. Uber has existed for 11 years, and is still not at this point. Uber is also 25x the valuation.

Self Destruction – Humanity & Retail

In spite of climbing to the top of Earth’s food chain, humanity has a remarkable tendency towards self destruction. This trait was perfectly summarized by Abraham Lincoln during the Lyceum address as the civil war started, which also opens Titus Andronicus’ critically acclaimed record, The Monitor.

From whence shall we expect the approach of danger? Shall some transatlantic giant step the earth and crush us at a blow? Never! All the armies of Europe and Asia could not, by force, take a drink from the Ohio River. Or set a track on the Blue Ridge, in the trial of a thousand years

If destruction be our lot, we ourselves must be its author and finisher. As a nation of free men, we will live forever, or die by suicide.

Just as all of the armies could not, by force, take a drink from the Ohio River, Stitch Fix could not have built a viable business if legacy apparel companies invested in stylists first. Instead, these businesses decided to be their own author and finisher, by leveraging up and not investing in eCommerce.

This leverage left them completely exposed for a downturn. COVID-19 is that downturn on steroids – shopping has changed, and none of them can afford to bridge Stitch Fix’s moat.

These retailers could have lived forever by investing in the future, or die by suicide with excessive leverage. They chose suicide, and new empires will arise from their ashes. Retail shareholders are rewarded tremendously when they win, and I believe Stitch Fix will be one of those winners.