Investors worry that the United States will delist Chinese companies, and these valuations are going down accordingly.

This is due to the Senate passing the Holding Foreign Companies Accountable Act. While this bill will protect United States investors and strengthen their market integrity, I don’t expect China will sign off on this without major concessions. These concessions are unlikely with our current administration.

While worries about China pulling their shares are possible, I believe they are exponentially less probable than a more likely retaliation. This retaliation has been consistently used by the Chinese, and is not priced in to their respective companies.

In the meantime, great Chinese companies are priced at a massive discount relative to their United States peers. If these companies keep executing, and China’s GDP keeps growing, investors could realize fantastic returns.

China’s Birth of Capitalism

In 1978, Vice Premier Deng Xiaoping opened China’s borders to foreign direct investment. All of China’s economic success can be traced back to him.

Now, I’m sure many democracies wish that China wasn’t a superpower at this moment. Whether or not these geopolitical disagreements are worth the fact that hundred of millions of people are not living in abject poverty is not going to be argued here.

As capitalists, there is no argument. Having hundreds of millions of people who can work with us, buy our stuff, and build companies that we can invest in is a great thing. And ever since we could invest in China, capitalists have been swimming around the country like sharks smelling blood.

Only problem was, the Chinese were not capitalists in 1978. The Communist Party of China took over the country in 1949, and capitalism was effectively eliminated. Even Deng Xiaoping himself was once purged for being a “capitalist roader”.

Suffice to say, initial investments did not go well for foreign investors. The book Mr. China: A Memoir shares amazing first hand experiences of two capitalists who were the first to invest in China. Their reward: burning through $400 million. The book is worth your time, but probably not worth $400 million.

China’s Economy & Tim Duncan’s Game

The arrogance looks obvious hindsight, but let’s give these capitalists the benefit of the doubt. Imagine, in light of The Last Dance, you want to go back in time and train somebody to be better than Michael Jordan. Who would you pick?

Perhaps Tim Duncan. He earned 5 rings, 2 MVPs, and 3 Finals MVPs without your help. Most importantly, he didn’t pick up a basketball until 9th grade. Imagine if you started training him as a child, what could he have become?

The only problem? Tim Duncan was a swimmer. Swimming was in his family. His mom was a champion swimmer, his sister an olympic level swimmer, and he aspired to swim in the olympics as well.

Then, in 1989, Hurricane Hugo devastated The Virgin Islands. It destroyed the only Olympic -sized swimming pool on the island.

Duncan’s fear of sharks kept him from training in the Atlantic Ocean. He had to find another sport, and his brother-in-law suggested he take up basketball, which happened to be right before 9th grade.

Tim Duncan didn’t train for basketball sooner because he wasn’t ready for basketball. Similarly, Chinese citizens did not respond to capitalism in 1978 because they were not ready for capitalism.

However, 1978 was a long time ago, and things have changed.

The “Sleeping Dragon” Is No Longer Sleeping

“There, is a sleeping giant. Let her sleep. For when she wakes, she will shake the world”.

-Napoleon Bonaparte

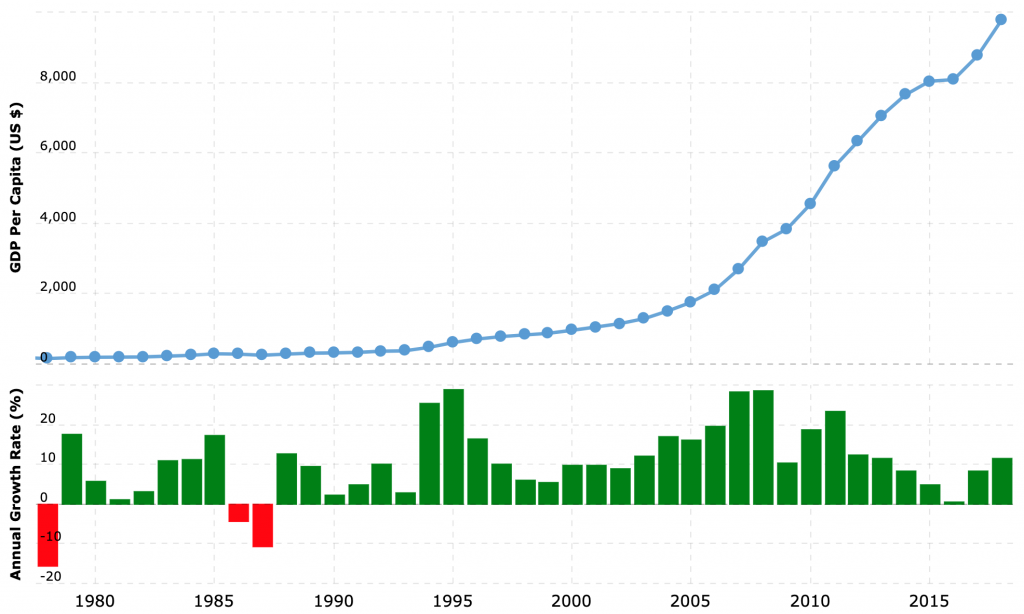

Fast forward forty years, and several generations have seen unprecedented GDP growth. The average Chinese citizen earned just $156 per year when Deng Xiaoping opened the markets. Fast forward to 2020, and GDP is still growing nearly 7% per year. More importantly, the average person now earns over $10k per year.

These generations have seen the benefits of capitalism, which has lit a flame that is missing in Europe and dwindling in the United States: optimism. When a generation sees such meaningful improvements to their livelihoods, they know things will get better in future. This optimism in the future becomes a self-fulfilling prophecy.

Charlie Munger discussed China’s strength at the Daily Journal Corp annual meeting in January 2020.

“the strongest companies in the world are not in America…I think Chinese companies are stronger than ours and are growing faster”

This strength is not slowing down. McKinsey estimates that over 550 million Chinese citizens, or 1.7x the United States total population, will reach the middle class by 2022.

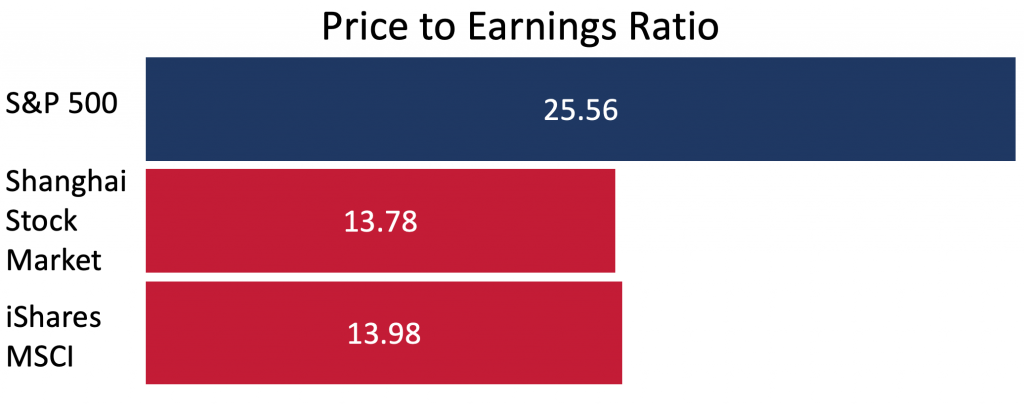

But here’s the odd thing, despite this growth, Chinese companies are cheaper than their United States counterparts.

Even though the Chinese have substantially higher GDP growth they are valued at nearly half of the profits of their peers in the United States.

Generally, faster growing companies are valued higher than their slowing growing peers. What’s different in China?

In one word, trust.

Fraud Has Been China’s Achilles Heal

Chinese citizens have seen the benefits of wealth over the past forty years. Rightfully so, they crave more of it.

This entrepreneurial drive has created incredible companies that are worth hundreds of billions of dollars. Tencent and Alibaba are the front-runners with market caps north of $500 billion. They may seem like flashes in the pan, but both been around for over 20 years.

Unfortunately, some companies want to get rich without putting in the time or the work. It turns out that fraud is a viable shortcut to increase your wealth, and falsifying sales is much easier than actually selling.

The “Luckin Coffee Act”

The Holding Foreign Companies Accountable Act might as well be called the “Luckin Coffee Act”.

The Wall Street Journal wrote about Luckin’s fraud in April:

The Xiamen-based company on Thursday said an internal investigation found that its chief operating officer and several others fabricated transactions amounting to 2.2 billion yuan ($310 million) from the second quarter to the fourth quarter of last year.

The news erased more than $5 billion, or 75%, from the company’s market value on Thursday.

Luckin Coffee was founded in October 2017. Two years later, they IPOd on the Nasdaq with a $5 billion valuation. It turns out, their unprecedented growth was actually fabricated at an unprecedented level.

We shouldn’t be surprised that the United States is responding to such an egregious fraud. Even more concerning is that Ernst & Young audited them. Which is one of the Big Four accounting firms.

Luckin is not the only fraud that came out of China. Short seller Carson Block of Muddy Waters (who also shorted Luckin) has done a remarkable job finding frauds in China. His first short sent the Sino-Forest Corp into bankruptcy. Ernst & Young coincidentally audited that fraud as well.

Since the Big Four cant get their sh*t together, somebody else needs to step in.

What Does The Act Mandate?

At face value, the Holding Foreign Companies Accountable Act sounds perfectly reasonable. It essentially extends the Sarbanes-Oxley Act.

Specifically, the bill will prohibit trading in foreign companies who do not:

- Have their auditors inspected by the Public Company Accounting Oversight Board for 3 straight years.

- Reveal whether they are owned or controlled by a foreign government.

Any foreign companies, including Chinese, who do not check these boxes will be delisted from trading in the United States. This includes over-the-counter exchanges, also known as the “pink sheets” where companies like Tencent trade.

How Will Chinese Companies “Delist”?

Chinese companies listed in the United States have been hit hard since the Senate passed this bill. People are worried that these companies could become the next Luckin Coffee. Once these companies are delisted, they could ultimately become worthless.

However, similar to the Chicago Cubs saying they would have gone to the 2003 World Series if it wasn’t for Steve Bartman, Luckin did not crater because they were delisted.

The Cubs missed the World Series because they played poor baseball – Alex Gonzalez booted a sure double play after the Bartman incident. Similarly, Luckin cratered because half of their revenues were fake.

Chinese Game Theory Is Unlikely

Assuming this bill passes, Chinese companies will have 3 years to get themselves audited. If any Chinese company agrees to these audits, they will be seen as best in class in China. Their valuation multiples will skyrocket closer to their peers in the United States. Better yet, they have three years to prepare for it!

United States companies are not valued higher because they’re growing faster, they’re valued higher because investors trust them. Any Chinese company who earns that trust will be rewarded with higher multiples as well.

As valuable as this is, I don’t see any Chinese companies taking up the offer. Major concessions would be needed to earn the Communist Party of China’s approval, which is unlikely under our current administration. So let’s assume that all of the Chinese companies will be delisted.

China’s Delisting Process – Alibaba’s Playbook

Delisting is not as simple as flipping a switch. These Chinese firms will need to list on another exchange, such as Hong Kong, and buy out the equity from the American exchanges. The shares could be purchased with new shares, as well as straight cash.

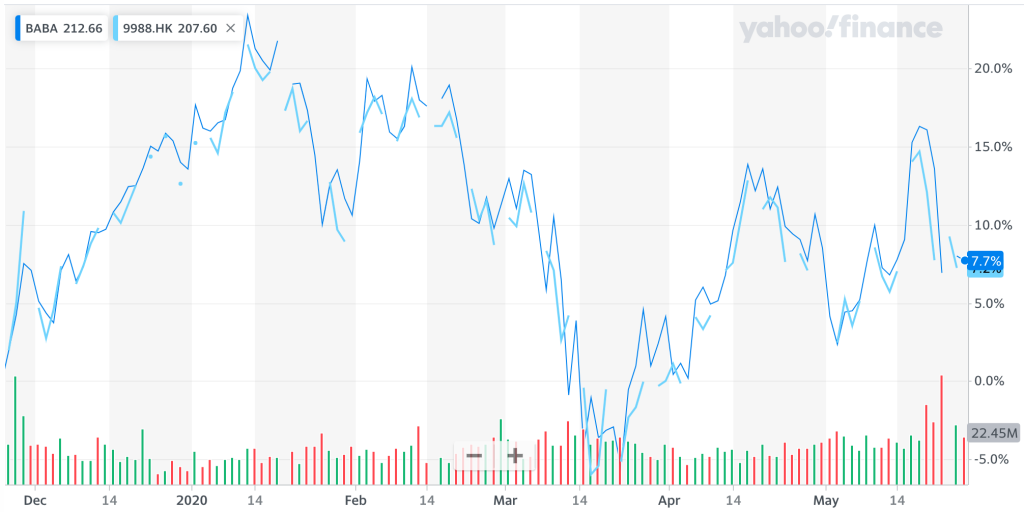

We have already seen this with Alibaba. Alibaba originally IPOd on the NYSE in 2014, and then IPOd in Hong Kong in November 2019.

Below is how the NYSE Alibaba (dark blue) compares to the Hong Kong Alibaba (light blue). As you can see, they’re basically a wash.

Which makes sense when you think about it. A $550 billion company like Alibaba is worth, well, $550 billion. If one of the tickers became 10% cheaper, investors could effectively buy a $550 billion company for $495 billion. Demand would cram in and bid the price back up before that could happen.

Let’s suppose the Holding Foreign Companies Accountable Act passes. Alibaba’s value holds steady at $550 billion over the next 3 years, and they decide that the audits are not worth staying in the New York Stock Exchange. Where do they go from here?

First, Alibaba would allow NYSE shareholders to convert their equity to Hong Kong, which is something they already do today. Then, Alibaba will buy out any NYSE investors who do not want to convert their equity.

Simple enough, Alibaba will sell Hong Kong shares, and use that money to buy the outstanding NYSE shares. I mentioned earlier that a $550 billion company is worth $550 billion, so these shares will be bought at roughly Alibaba’s valuation.

NYSE investors shouldn’t worry about the share price cratering. If the NYSE shares went south, investors would buy these and convert them to Hong Kong shares at a discount! This is exactly why both the NYSE & Hong Kong listings have been so similar since the November 2019 IPO.

Liquidity Does Not Correlate With Valuations

There is another valid concern. The NYSE has over 2k companies listed with an aggregate market cap of $24 trillion. The Hong Kong Stock Exchange, on the other hand, has nearly 1k companies with an aggregate market cap of $1.7 trillion.

If all of these companies moved to a market with 92% less liquidity, how will valuations be effected?

Let’s consider Tencent. Tencent IPOd in Hong Kong in 2004, and began trading over-the-counter in the United States in January 2010.

All of these extra shares brought extra liquidity to the market. How did the Hong Kong listing do over the month?

As you can see, not well. The company’s market cap dropped by 16% from $34 per share on January 3rd to $28 at the end of the month.

Tencent wasn’t the only company who realized this downturn. Tsingtao started training over-the-counter on the same day, and also declined much further than the broader Chinese and US markets.

- Tencent: -16%

- Tsingtao: -15%

- Shanghai Stock Exchange Composite Index: -9%

- S&P 500: -6%

In the short run, this was simply supply and demand. Tencent’s & Tsingtao’s value didn’t meaningfully increase in January 2010, but the supply of shares available to the world increased substantially. Thus, you have more shares available for a company that is worth exactly the same.

IPO Share Supply & Valuation

IPOs show this as well. I previously wrote that IPOs reward the patient, and much of this logic comes from UC Berkeley Professor Panos Patatoukas.

Panos wrote in 2016 that IPOs have low liquidity. This is due to insiders and early investors being subject to a lockup period. Since so few shares are in the market, stock prices drive up due to high investor demand and low supply. Once the lockup period expires, the valuation normalizes. In other words, the price goes down.

We see this with Pinterest, which was worth $11 billion with $25 million in annual revenue when it was privately held in 2015. Only top tier venture capitalists like Andreessen Horowitz could invest in them at the time. With so few investors all competing for quality companies, Pinterest could effectively name their price.

This continued even when they IPOd in April, 2019. Their market cap rose even higher during the lockup, peaking at $19 billion in August 2019. Unfortunately, reality came once their lockup expired in October 2019. The company’s value went down 5% that day, and are now worth roughly $10 billion with $1.2 billion in annual revenue.

Just to hit that point home, Pinterest is worth less today with $1.2 billion in revenue than they were in 2015 with $25 million in revenue.

Liquidity & Publicly Traded Companies

Public companies have shown the same tendency. Zhiwu Chen, Roger Ibbotson and Wendy Hu, Zebra Capital Management, studied the effect of liquidity risk on stock prices:

The liquidity premium holds regardless of market capitalization (size). However, the liquidity effect is the strongest among micro-cap stocks and declines from micro- to small- to mid- to large-cap stocks:

Across the micro-cap quartile, the low-liquidity group earned a geometric average return of 18.2 percent a year in contrast to the high-liquidity group returning 6.2 percent a year.

Across the large-cap quartile, the low- and high-liquidity groups returned 12.5 percent and 9.9 percent respectively, producing a liquidity effect of 2.6 percent.

Thus, if all Chinese firms waved a magic wand and ceased selling shares in the United States, their valuations should not plummet. In fact, the value could increase if they continue executing.

Harvard would not be that prestigious if everyone was accepted. People want what they can’t have, and exclusivity could increase the valuations of China’s most successful companies.

United States Shareholders Should Be Fine

Which gets to the consequences. Assuming this bill passes, how do you think China will retaliate?

Is it possible for Chinese companies to walk away from their United States shares once they are delisted? Essentially, the Chinese say the shares are worthless?

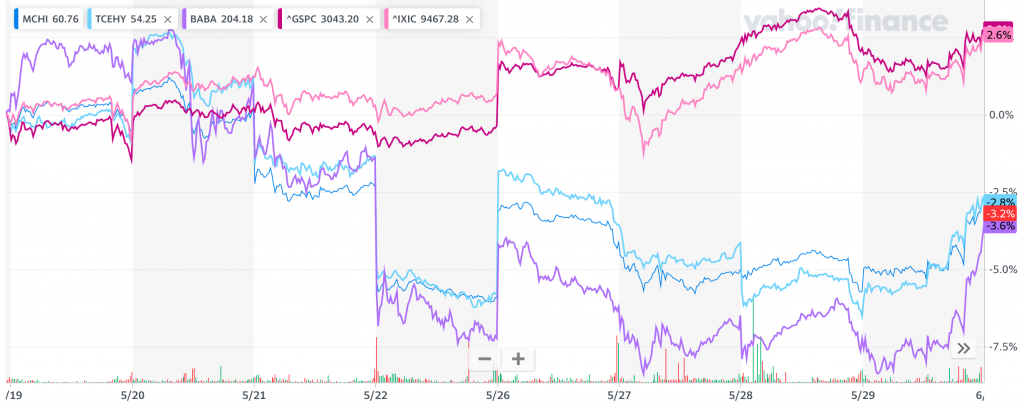

According to valuations, that’s what many investors must be assuming. Since the bill passed on May 20th, 2020, the S&P 500 and Nasdaq are up. During that same time, China’s broader ETF is down, including leading companies like Alibaba and Tencent.

Is it possible that China will pull the ripcord? Yes, but this is also the nuclear option. If Alibaba, Tencent, or any of these other companies dropped a warhead like that, what are the odds that they can ever raise capital again?

Perhaps the readers in London think they are immune to China doing the same. However, if China was willing to do this to the United States just for an audit every 3 years, how do you think they’ll respond to your country offering half of Hong Kong citizens a path to UK citizenship?

In short, every foreign investor will worry that the same thing will happen to them. Additionally, these companies would blow up their American partners who own this equity as well. Google and Walmart own roughly $4 billion of JD.com, the Amazon of China. Consider those and any future partnerships gone if JD burned down that $4 billion.

How Will China Retaliate?

If the nuclear option isn’t reasonable, how else could China retaliate? Simply put, the obvious way.

They’ll go after United States companies doing business in China.

Despite the obvious, investors have been bidding these companies up since the bill passed on May 20th.

Starbucks Growth Depends on China

China represents 10% of Starbucks revenue. They have roughly 4.3k stores, and plan on tripling their revenue by 2022.

Imagine you’re Xi Jinping. If the United States passed this law, would you sit back and let Starbucks keep opening stores and taking market share in your country? Or, would you make their life a little more difficult?

Perhaps Starbucks’ building permits won’t get approved as quickly. Maybe their existing stores will be shut down for breaking “health violations”. Why stop there? Just raid their China headquarters and shut the whole company down!

None of these ideas are new. You can find them all in China’s playbook.

Tesla Could Lose More Than Intellectual Property

Stealing Starbucks IP is not a big deal. Anybody can buy beans from Colombia. Their brand, however, is impossible to copy.

Tesla, on the other hand, has incredible intellectual property. I previously wrote how Tesla has already accused China of stealing their intellectual property. Imagine what more China could do if they felt like it.

Tesla sold roughly 4k cars in China in April 2020, a 10% increase over the previous month. Their stock has tripled while their sales have declined over the past 3 quarters, meaning investors are betting a lot on China’s potential.

With so much riding on China, the Communist Party of China could torpedo Tesla’s stock price with 3 simple steps:

- Step 1: “audit” (steal) Tesla’s automobile technology.

- Step 2: shut down the factory due to failing said “audit”.

- Step 3: ban all Tesla sales in China due to failing the “audit”.

Starbucks and Tesla are just two examples. Rest assured, if this bill passes, any company with exposure in China could be at risk. Remember, Apple’s supply chain is all in with China.

Chinese Delistings – Investors Are Missing The Obvious

China has been growing at a breakneck pace since Deng Xiaoping opened the floodgates in 1978. Over the past several decades, China has built their capitalistic muscle. Thanks to the unprecedented wealth creation, the Chinese have bought in. That optimism is creating a self-fulfilling prophecy of continued growth.

Despite this unprecedented growth, Chinese companies are worth roughly half the profits of their peers in the United States.

Great Chinese companies have been casualties in the China-United States trade war since it started in 2018. While the Holding Foreign Companies Accountable Act is escalating this tension, the bill will protect American investors from frauds like Luckin.

Great Chinese companies would benefit from these audits, but the Communist Party of China would not sign off on it. They would need major concessions from the United States to save face, which is unlikely under our current administration.

Time will tell when this uncertainty gets resolved and prices normalize. Until then, I believe that the value of these great businesses will unlock if they continue executing. These strong businesses, combined with China’s breakneck growth, could lead to fantastic returns.

Scrutinize United States Companies With Chinese Exposure

Instead of worrying about the great Chinese companies, I suggest scrutinizing your United States positions. How large are their China exposures? How much would their revenue decline if China kicked them out of the country?

Or simply Google, “<company name> China growth”:

Aside from scrutinizing my United States positions, I have been buying Chinese companies that I consider great. I’ll write about some of these, and premium members already know about them.

Three years is a long time from whenever this bill passes. A lot could materially change these businesses, which could make them not worth owning. Also, our administration could have a more accommodating point of view then.

If the worst happens, my north star will be whether these businesses are executing. Assuming they are, I will exchange the Chinese delisted shares for their foreign counterparts.

If I’m right about these companies, I hope you can do the same.