COVID-19 is devastating the global economy, and biotech firms are investing at a furious pace to treat the disease.

When you peel back the onion, however, they might not be investing as much as you think. Several companies are making splashy announcements about COVID, which is subsequently driving up their share price.

Before you invest in these companies, remember, actions always speak louder than words. Instead of listening to what companies are saying about their COVID progress, look at what they are doing.

Moderna’s Vaccine & Powerball

Moderna jumped on the COVID bandwagon early, shipping their first vaccine batch for Phase 1 trials on February 24th, 2020. Since then, their market cap has risen 3x to $23 billion.

They have shown progress by announcing a successful Phase 1 trial on May 18th, 2020. Here’s what Moderna’s Chief Medical Officer Tal Zaks had to say about the trial (bold emphasized by me).

“These interim Phase 1 data, while early, demonstrate that vaccination with mRNA-1273 elicits an immune response of the magnitude caused by natural infection starting with a dose as low as 25 µg,”

“When combined with the success in preventing viral replication in the lungs of a pre-clinical challenge model at a dose that elicited similar levels of neutralizing antibodies, these data substantiate our belief that mRNA-1273 has the potential to prevent COVID-19 disease and advance our ability to select a dose for pivotal trials.”

The Congressional Budget Office projects that COVID-19 will contract United States GDP by $7.9 trillion over the next 10 years. With such a massive impact, you can imagine how much society would be willing to pay for a vaccine. If the United States spent just 1% of that economic impact on a vaccine, Moderna would net $79 billion. Not a bad deal for $7.9 trillion.

Unsurprisingly, retail investors have been devouring Moderna’s shares. The number of Robinhood users who own Moderna has increased 5x from 600 before the announcement to 3.4k today.

In all fairness to retail investors, these odds are probably better than winning Powerball, or Charles Barkley dunking a basketball.Your odds of winning Powerball are 1 in 292 million. After hearing from Moderna’s CMO, their odds of winning the COVID-19 lottery look light years better.

Now the price is up 3x thanks to this enthusiasm, but how much better are the odds? It’s tough to say, but this thought experiment could help us figure it out.

Stacking The Lottery Deck

Imagine, for a moment, that you worked for Powerball. Your only job is to fill the gravity pick machine, and you can choose any lottery balls you want.

Now that you know the winning numbers, what would you do with this knowledge? For those of you with a conscience, assume you can donate all of the winnings to any charity of your choice.

If this question was asked in trivia, the only acceptable answer would be: buy a sh*tload of lottery tickets.

Insiders are in a similar position. These executives and board members know more about their businesses than anybody else. Now, which of these insiders would know Moderna’s lottery odds the best?

Probably that Chief Medical Officer, Tal Zaks. His job description, after all, is: “oversees clinical development and regulatory affairs across Moderna”.

We already saw his announcement that Moderna’s vaccine “has the potential to prevent COVID-19 disease.” Should we start buying?

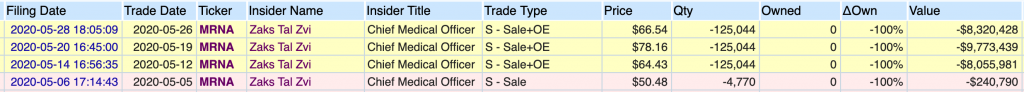

Well, before we do, let’s check one thing. What is Tal Zaks doing with his lottery tickets?

He’s dumping them as quickly as possible.

Mathematically, this is not an exaggeration. This guy is getting equity grants on a weekly basis, and then flipping them as soon as they show up in his brokerage account. That’s the only possible way he can dump 100% of his holdings 4 weeks in a row.

I previously wrote about insider buying and selling.

General purchases and sales aren’t terribly concerning. Executives may be exercising stock options when they buy, and might have bills to pay when they sell.

Huge aberrations, on the other hand, could be a strong signal. When executives bet the ranch on their company, they likely believe that the company’s undervalued.

This guy is selling the ranch, on a weekly basis.

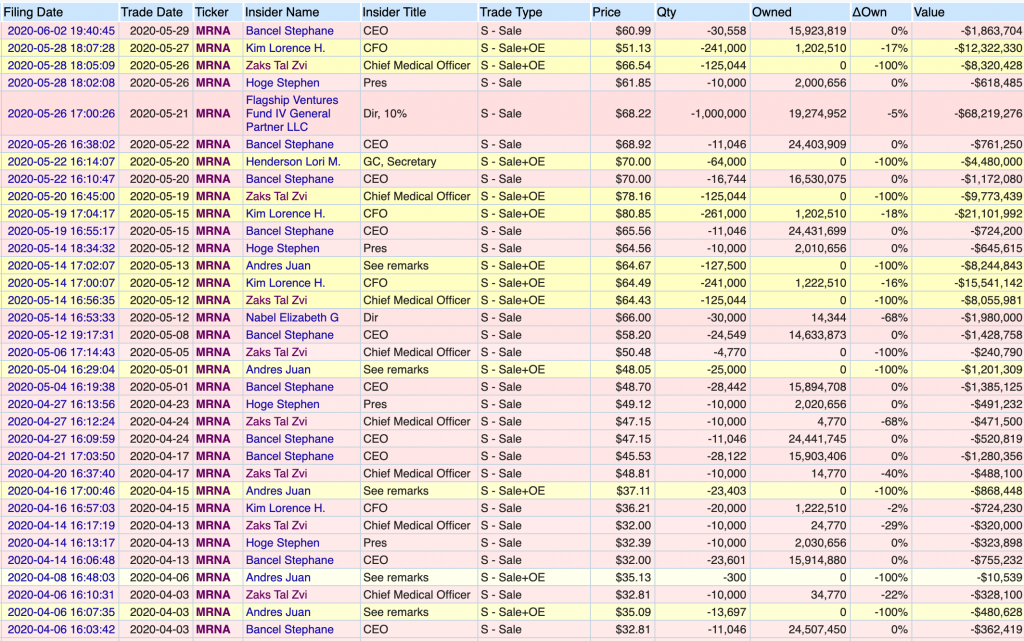

In all fairness to him, his colleagues are selling out as well. These colleagues definitely make him look better in the board room, but how would you feel as an investor?

Moderna Is Selling More Lottery Tickets

The same day Moderna announced their Phase 1 success, they also announced a secondary offering for $1.3 billion. This would double the $1.1 billion they already have on the books.

Granted, drug trials are not cheap. Moderna is rolling out Phase 2 trials shortly, and Phase 3 would start in July. If this vaccine gets approved, Moderna will need to ramp up production quickly.

All of that is true. However, having never worked in biotech, I have a pretty good guess at how much it costs to distribute nothing.

Moderna’s stock will rocket up further if they pass their Phase 2 trial. Same for Phase 3. On the other hand, if their Phase 2 trial fails, Moderna is likely done. At best, there will be a pause to restart trials. While Moderna is restarting these trials, their competitors will be pressing forward.

Moderna already has $1.1 billion cash on the books, and only burned through $121 million in Q1. Why do they need another $1.3 billion before knowing whether or not they have a drug to distribute?

Perhaps they want to share the wealth with us. Maybe the $26 million that Tal Zaks sold in May was all that he and his family need. Or maybe, just maybe, Moderna’s odds aren’t that good. If sharing the wealth sounds like bullsh*t, trust your instincts.

Moderna Is Not The Only One

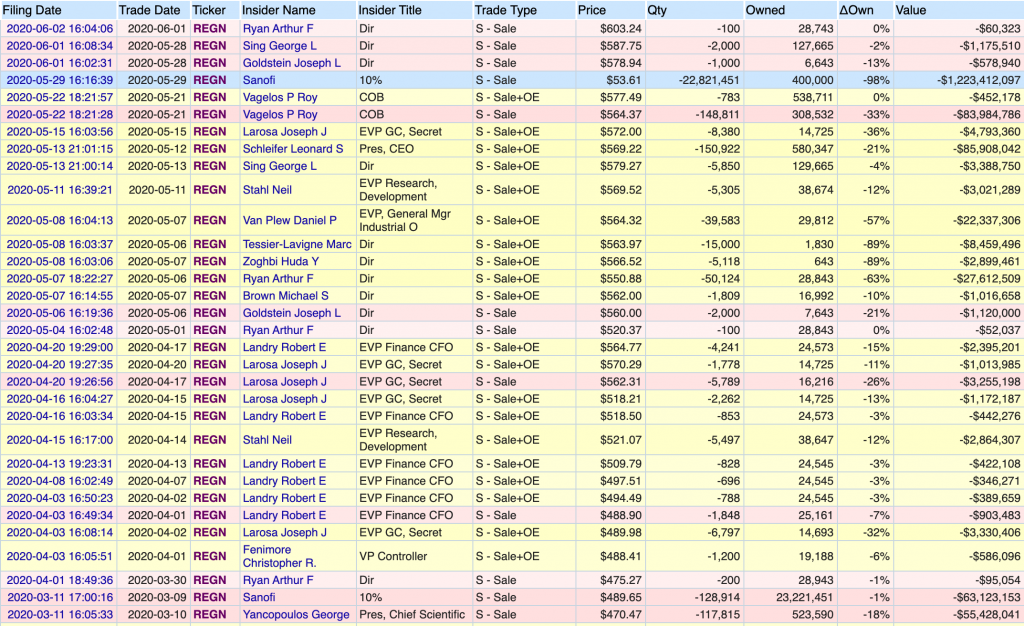

Regeneron has Kevzara in Phase 2 trials to treat hospitalized patients with COVID, and is investing in new antibody medicines as well.

Their stock has nearly doubled since they announced Kevzara. Like Moderna, they also announced a secondary offering in May. They raised $5 billion, which is nearly double the $3 billion they already had on the balance sheet.

Also, like Moderna, retail investors have been gobbling up Regeneron’s shares.

Now, we know better than to read Regeneron’s announcements or quotes this time. What are their investors doing?

You probably already guessed it.

As bad as this selling looks, it’s not as severe as Moderna. With the exception of Sanofi, there are no insiders dumping 100% of their equity.

This could be because Regeneron actually makes money. Regeneron made $2.3 billion in annual income last year, while Moderna lost $505 million.

Actions Speak Louder Than Words

The Congressional Budget Office projects that COVID-19 will contract the United States GDP by $7.9 trillion over the next 10 years. With such a large impact, investing in COVID treatments could net incredible returns.

Several biotech companies have joined this nuclear arm’s race, and are investing tons of money towards treating the disease.

After reading their splashy announcements, take a deep breath before buying the shares these insiders are selling. Remember, nobody sells a winning lottery ticket. If executives are selling everything behind the veneers of encouraging announcements, they might be hiding a worn down, broken company.

I have not shorted these companies yet. All premium members will know if I short them in real time.

There is only thing one thing that is more fun than playing the lottery. And that is winning it. Unlike Powerball, you can stack the odds in your favor by investing. Insider actions are one of many tools at your disposal.