nCino filed for their IPO last week, and their S-1 has received little attention. The Wall Street Journal still has not written about their IPO.

Perhaps this is because nCino only makes $138 million in revenue, or because bank software isn’t as attractive as subletting long term leases like WeWork. Perhaps, it is simply due to their S-1 only having 3 pictures, more on that later.

Regardless of why, it’s a shame for investors, because nCino is a fantastic business with an incredible market opportunity. Additionally, their legacy competitors have been caught flat-footed by this entrant.

No investment is a sure thing. nCino has one major red flag, and their valuation could be driven too high at IPO. Premium Members will see if I invest, and I believe every investor should put nCino on their radar.

nCino – “Built by Bankers, For Bankers”

How many successful tech companies have come from a bank? nCino might be the one. Live Oak Bank is based in Wilmington, North Carolina, and needed a new commercial loan origination system a decade ago. After talking to all the vendors, they weren’t happy with any of the options.

We heard this story before. Slack started as a video game company, and built their own communication platform because they couldn’t find a suitable vendor. Similarly, Live Oak Bank built their own loan origination system. The product was a hit, so Live Oak spun the product off so they could sell it to other banks. They named the company nCino in 2011.

What Does nCino Do?

According to their S-1, nCino “provides cloud-based software for financial institutions.” That undersells the types of products nCino sells. Their software is the heart of these financial institutions.

There are two jobs that every bank and credit union fundamentally provides:

- Take in deposits

- Loan out deposits

That is basically it. If a bank cannot open bank accounts, or underwrite loans, they can’t be a bank. This explains why banks often call software that enables these functions their “Core Banking System”.

Once you have a bank’s account and loan information, there’s a lot more value you can add. You could add workflows to improve compliance, or track banker activities to improve cross-sell and customer service. The possibilities are endless.

That is essentially nCino’s Bank Operating System. They revolve around these core banking services, and are building additional products to drive more value for their banks.

nCino’s Execution

nCino’s S-1 is, without a doubt, the worst marketed S-1 I have ever read. The entire S-1 has 3 pictures, total. WeWork, for contrast, had 87 pictures in their S-1.

This IPO is not being underwritten by a mom and pop shop, it’s being underwritten by Bank of America Securities. Why did a bulge bracket bank turn around an S-1 like this?

Maybe it’s because they’re lazy. Or, perhaps, nCino doesn’t need to market themselves. The business speaks for itself.

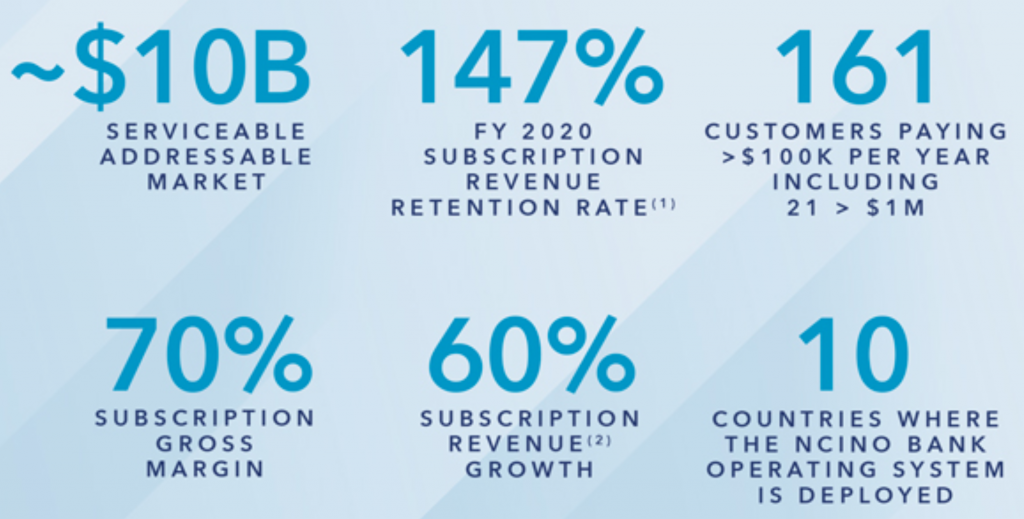

This company is killing it. While all of these numbers are fantastic, the big one is their net retention rate. I wrote about this in my PluralSight write up.

Net retention rates gauge how much companies renew services from their vendors, thus being one of the best litmus tests for whether customers find value in a product. If a customer spends $1 million on Pluralsight in 2017, and renews for the same $1 million in 2018, that client has a 100% net retention rate.

Pluralsight has a 126% net retention rate, meaning that their clients are spending 26% more than they spent the year before. More importantly, their net retention rate has consistently increased every year.

nCino’s net retention rate is 147%. This number reflects how well bankers respond to their product, as well as how much bankers trust nCino’s salespeople.

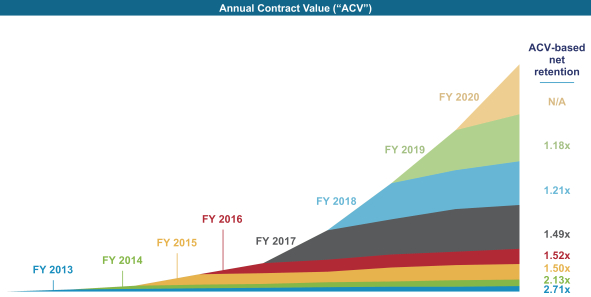

nCino’s S-1 also shows how incredible subscription businesses are. Look at how their annual contract value (ACV) has grown each incremental year.

Competitors Are The Comcast of Bank Software

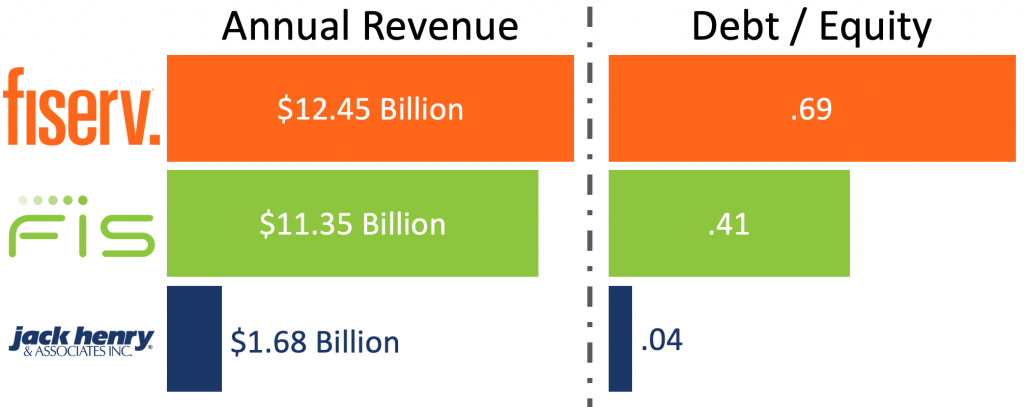

Fiserv, FIS, and Jack Henry are the big names in core banking software. They have 90% market share of banks with $1 billion or less in assets. If nCino wants to thank anybody for their opportunity, these three firms are a great place to start.

These companies are the Comcast of bank software, minus the monopoly. They consolidated the market by buying out competitors, then axed product development, and jacked up pricing. In all fairness to them, this strategy printed a lot of cash for a long time.

And, similar to Comcast, their customers despise them. The WSJ wrote a scathing article in 2019 (bold emphasized by me).

But discontent is starting to simmer at the small banks that most depend on them. Smaller lenders and some industry groups say the service providers’ onerous contracts and sometimes mediocre digital offerings have made it harder to keep up with big competitors.

Executives at some small banks say they feel like they are becoming franchises of the core providers because they are so reliant on their technology. Firms are filing lawsuits, turning to financial-technology startups and trying to negotiate as a group for better contracts.

“I’ve met with over 3,000 bank CEOs, and this came up time and again: the challenges and constraints they face with their core provider.”

-Rob Nichols, chief executive of the American Bankers Association

nCino’s Competitors Aren’t Ready for the Cloud

This poor brand equity didn’t matter much in the age of on-premises software, as the switching costs to move were simply too high. How many enterprises loved Oracle, IBM, or Microsoft in the 1990s? Unfortunately for these legacy core providers, we are no longer in the 1990s.

We all know about the cloud’s disruptive force by now. It eroded the switching costs from leaving on-premises software, and forced legacy tech companies to rely on consumption. Instead of simply selling software, companies must now build great software, and ensure their customers are successful with it. The book Consumption Economics: The New Rules of Tech explains this tectonic shift perfectly.

The cloud computing era has turned companies who deliver great products with successful customers into winners. These winners came at the expense of legacy tech companies like Oracle and IBM. Similar to Oracle and IBM, Fiserv, FIS, and Jack Henry stuck their chin out with their poor brand equity and high leverage. nCino caught them flat-footed.

It shouldn’t surprise you, then, how these legacy companies have responded so far. Instead of building better products, they’re charging banks simply for leaving.

Another community lender, Iowa Falls State Bank, sued Jack Henry in 2017, alleging the provider charged roughly $137,000—nearly 10% of the bank’s annual profit—for access to the bank’s own data as part of the bank’s discussions with a new vendor, according to court filings.

In the suit, the bank described Jack Henry as “essentially holding [our] information for ransom.” Jack Henry in a court filing denied the allegations, citing the bank’s agreements with the firm. The lawsuit is ongoing.

This reaction may be easier than building better products, but it’s not sustainable. Just as Salesforce seized market share from stubborn legacy companies, nCino has a chance to do the same. Unfortunately, Salesforce is also nCino’s biggest risk.

nCino is Dependent on Salesforce

nCino has one big risk, and it revolves around Salesforce. From nCino’s S-1 (bold emphasized by me).

Fundamental elements of the nCino Bank Operating System, including our client onboarding, loan origination and deposit account opening applications, are built on the Salesforce Platform and we rely on our agreement with Salesforce to use the Salesforce Platform in conjunction with our solution, including for hosting infrastructure and data center operations. Any termination of our relationship with Salesforce would result in a materially adverse impact on our business model.

Furthermore, there are no exclusivity arrangements in place with Salesforce that would prevent them from developing their own offerings that compete directly with ours, acquiring a company with offerings similar to ours, or investing greater resources in our competitors. While we believe our relationship with Salesforce is strong, Salesforce competing with us could materially and adversely affect our business and results of operations.

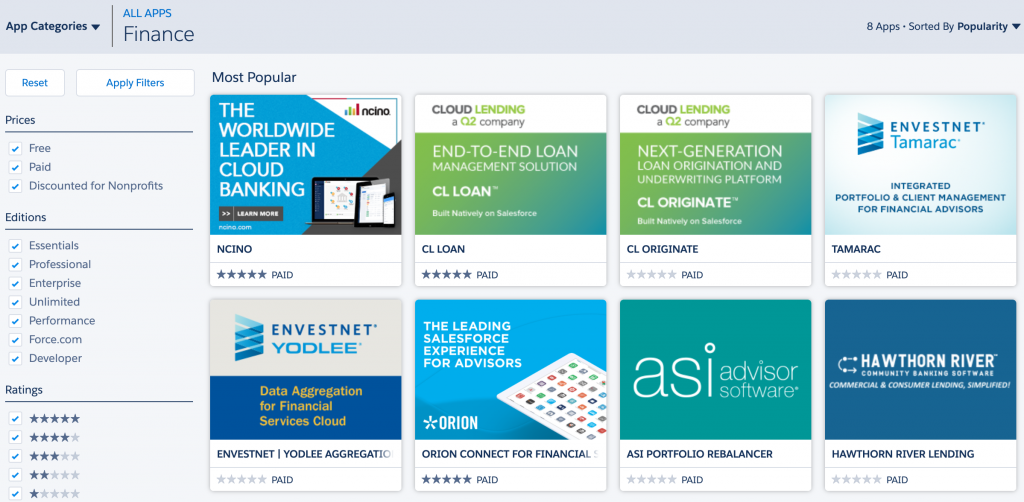

Instead of building out their own platform, nCino built their product on Salesforce. This was a great deal for nCino, as plugging into Salesforce is cheaper than building Salesforce. nCino invested less up front, while still having the benefit of immediate scale. Every nCino customer is connected to one of the largest and most secure SaaS platforms in the world.

Unfortunately, there’s nothing stopping Salesforce from competing with nCino. Furthermore, nCino’s Salesforce agreement expires in June 2027. If nCino is completely reliant on Salesforce, what’s stopping Salesforce from squeezing them at renewal?

Salesforce Ownership Isn’t Enough

Although Salesforce is nCino’s second largest shareholder, we shouldn’t put too much weight in that. Even if nCino traded at 80x sales like Zoom, which is unlikely, they’re only an $8 billion company. With a $167 billion market cap, Salesforce won’t lose much if nCino goes to zero. In fact, they would likely make more off nCino’s demise.

Make no mistake, this dependance is nCino’s achilles heel, and both sides know it. Salesforce has every incentive to bring more competitors on the platform. While Salesforce searches for competitors, every incremental client makes nCino more reliant on Salesforce.

But what if that threat forces nCino to keep building a best in class product? If they stay laser focused on developing bank software, and somehow build better relationships than their Salesforce peers, nCino could use this weakness to their benefit.

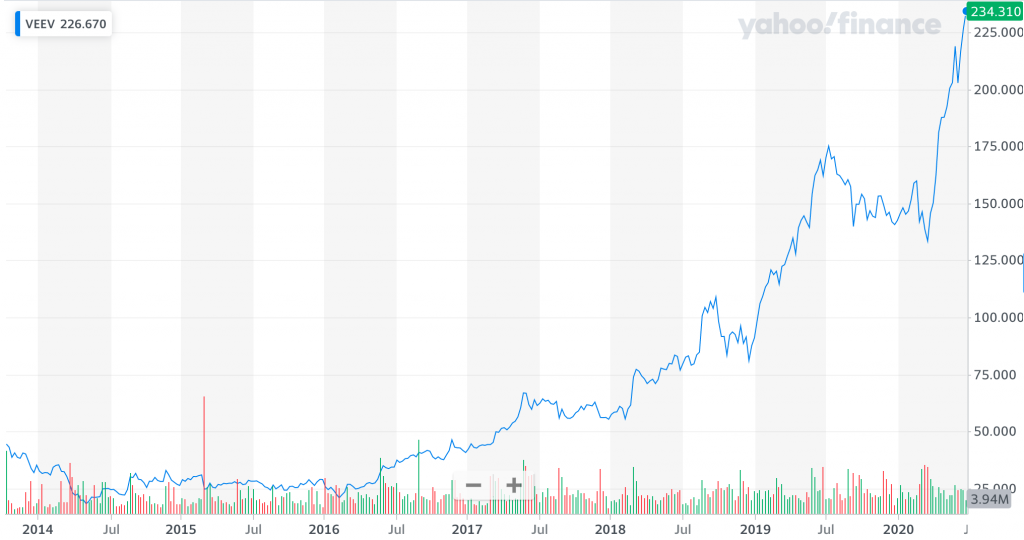

They wouldn’t be the first company to pull this off. Veeva Systems built their product on Salesforce for life sciences, and they’re up nearly 5x since their 2014 IPO.

The nCino IPO is Compelling

nCino is a fantastic business with a huge market opportunity. Their 147% net retention rate shows that customers love their product, and that their salespeople are building solid relationships.

They also have the benefit of complacent competitors. nCino continues innovating and finding new ways to drive value for their customers while Fiserv, FIS, and Jack Henry are all sleeping at the wheel.

This won’t be a layup for them, though. Salesforce knows exactly how well nCino is doing, and has every incentive to capture that market. If they can’t, Salesforce can still charge higher rents when nCino renews in 2027. Thankfully, nCino has 7 years until that happens.

Veeva Systems has shown that pure play industry vendors can succeed on the Salesforce platform. If anything, I believe that Salesforce will acquire nCino rather than compete directly. They did the same with Vlocity earlier this year.

So when will I invest? Easy, when the price is right. I always advocate for patience in IPO investing, and will keep an earnest eye on nCino.

Premium members will see when I decide the price is right. Very few companies have the potential that nCino has, and these IPOs deserve extra attention.