American tech stocks are getting relatively expensive. While I do not believe they are anywhere close to a bubble, I also believe that there are better places to direct your capital.

I wrote about these concerns to our Premium subscribers last week.

Many of the companies I own are probably overvalued. When your portfolio is killing it, it’s hard to divorce that success from your intelligence.

Which is why I’m not adding to most of these companies. I said before that we should look at relative prices. Right now, those prices are relatively high to sales.

I do believe there are opportunities in some places, such as China. However, I’m concerned about the relative prices for American tech stocks overall.

Castles in the Air

The term “castles in the air” was coined by Burton Malkiel in A Random Walk Down Wall Street.

It helps to buy stocks with the kinds of stories of anticipated growth on which investors can build castles in the air.

Individual and institutional investors are not computers that calculate warranted price-earnings multiples and then print out buy and sell decisions. They are emotional human beings—driven by greed, gambling instinct, hope, and fear in their stock-market decisions. This is why successful investing demands both intellectual and psychological acuteness.

The key to success is being where other investors will be, several months before they get there. So ask yourself whether the story about your stock is one that is likely to catch the fancy of the crowd. Can the story generate contagious dreams? Is it a story on which investors can build castles in the air—but castles in the air that really rest on a firm foundation?

In other words, skate where the puck might be going, not where it was. If your narrative proves right, investors will bid up the relative valuations of those companies. This is known as “multiple expansion”, where valuations increase simply because investors are willing to pay more for the same revenues, profit, or cash flow.

Now, let’s see how the puck has moved during COVID.

COVID Is Accelerating Tech

This shouldn’t be a surprise by now. COVID is a neutralizer and accelerator. Brick and mortar everything has been neutralized by COVID, which accelerated demand for cloud services and technology. Increased demand leads to growth, and investors are paying up for that growth.

In other words, any investor who guessed that COVID might build “castles in the sky” for tech companies back in March 2020 have made a killing.

The problem? This is a narrative, and narratives change. As I wrote about iRobot in December 2019.

Robot’s decline is based on a change in narrative, not results. They have dominant market share, their revenue is increasing despite crushing tariffs, and they are innovating with new products.

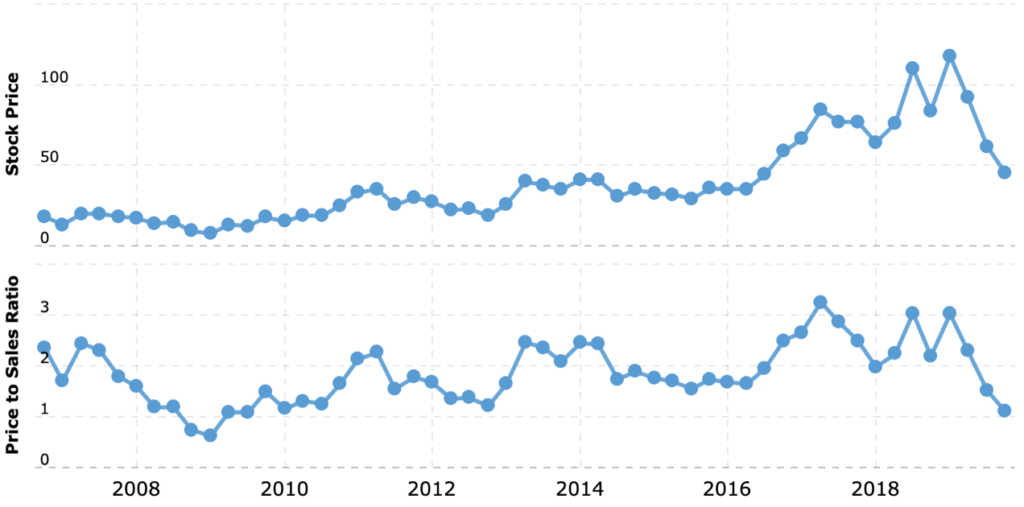

As you can see, iRobot’s valuation is almost perfectly correlated with their price to sales ratio. This is the amount investors are willing to pay for $1 of revenue.

Investors were willing to pay 3x revenue before the 25% tariffs were announced in May 2019. Now, investors are only willing to pay 1x iRobot’s revenue.

Thankfully for those who invested with me, that narrative changed. iRobot’s price relative to sales has corrected, and Premium members who invested with me enjoyed an 80% gain on their investment. Not bad for 6 months.

Narratives are a powerful force for moving stock prices. While I believed iRobot’s narrative was unfairly negative in December, I believe technology’s narrative is becoming too positive.

American Tech Stocks Are Getting Expensive

I previously wrote that whenever we evaluate companies, we should not be looking strictly at the stock price. Instead, we should ask, “relative to what”?

I prefer gauging the price relative to sales. Why sales? It can’t be manipulated like profits (unless you’re Luckin Coffee). Revenue stays constant regardless of how companies change accounting practices, or how governments change their tax policy.

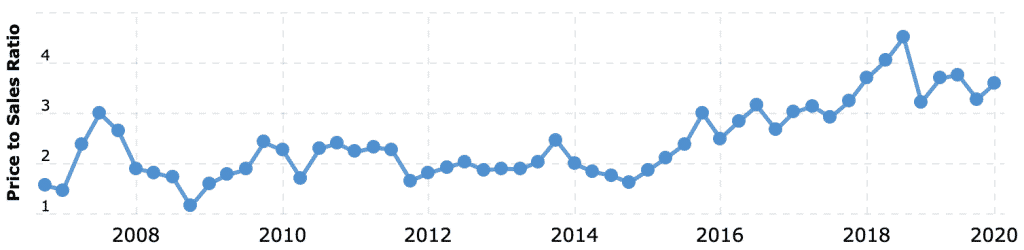

Well, let’s check the valuations of some American tech stocks relative to sales. I’m focusing on established companies. This way, we can look at their valuations over the past 12 years. Don’t worry though, the results are no different with new entrants like Zoom or The Trade Desk.

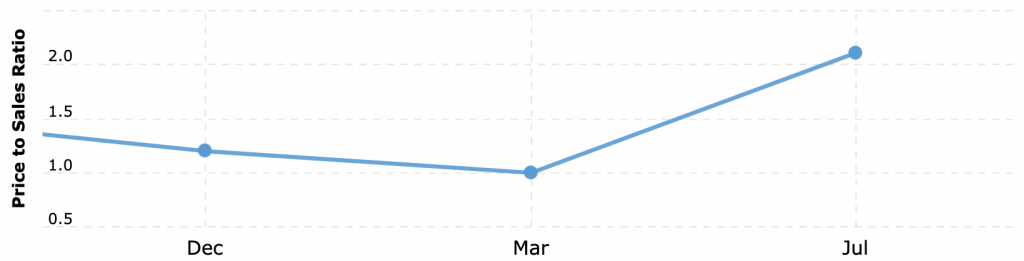

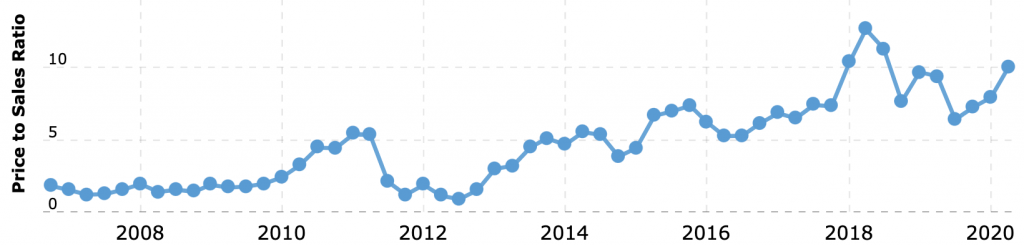

Amazon Price To Sales

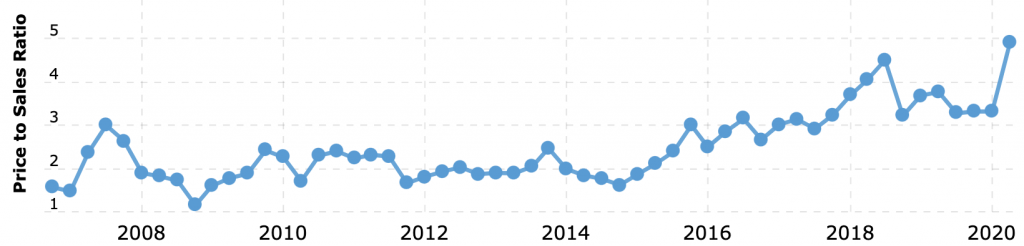

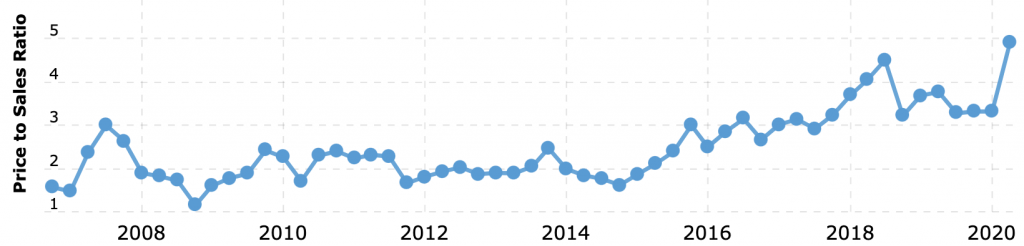

Microsoft Price to Sales

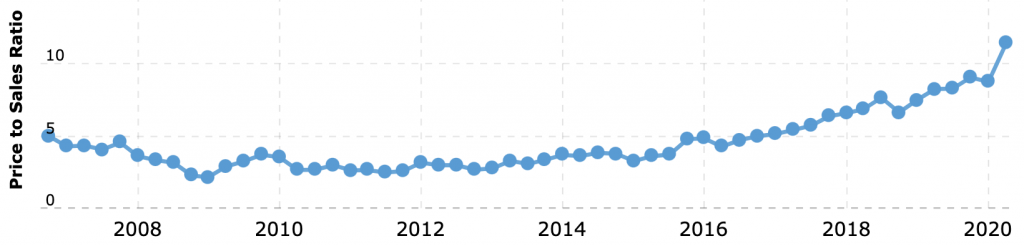

Netflix Price to Sales

Notice anything in common? They’re all trading at or above their highest value relative to sales over the past 12 years.

For Amazon specifically, $1 of revenue was worth $3.32 in valuation in March 2020. Four months later, that same $1 of revenue is now worth $5.42 in valuation. There’s no way a trillion dollar company like Amazon can change their business that quickly in 4 months. Narratives, however, can turn on a dime.

Tech Is Not In a Bubble

With so many tech companies trading at their highest relative multiples ever, we can agree that the castle has been built. Only question is, what happens next?

Going back to A Random Walk Down Wall Street, Burton Malkiel explains that these castles in the air can quickly turn to greed, which quickly turns to madness.

GREED RUN AMOK has been an essential feature of every spectacular boom in history. In their frenzy, market participants ignore firm foundations of value for the dubious but thrilling assumption that they can make a killing by building castles in the air.

The psychology of speculation is a veritable theater of the absurd. Several of its plays are presented in this chapter. The castles that were built during the performances were based on Dutch tulip bulbs, English “bubbles,” and good old American blue-chip stocks. In each case, some of the people made money some of the time, but only a few emerged unscathed.

In other words, these “castles” can become “bubbles”. When they do, it’s impossible to know when you should sell.

Now, a few things. One, bubbles don’t happen often. “Bubble” gets overused roughly as often as the term “Nazi” for politicians we disagree with. Show me a politician who has been called a “Nazi” over the past few decades, and I’ll show you someone who didn’t murder 11 million people.

Similarly, contrary to mainstream media, in no way do I believe these tech companies are in a bubble. Premium companies deserve premium multiples. The real question is, “what premium makes sense?”

What We Know About Multiples

However, we do know that multiples for many tech companies are higher today than they ever have been before. With that knowledge, we can surmise that relative valuations could drop again in the future.

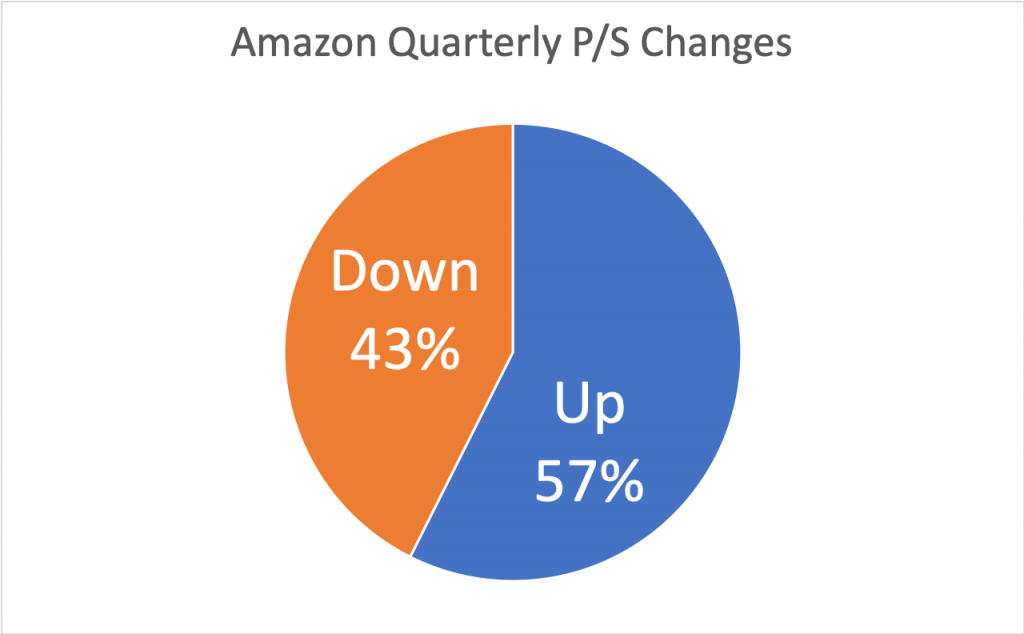

What are the odds that their relative valuations will keep going up? Let’s consider the powerhouse Amazon one more time.

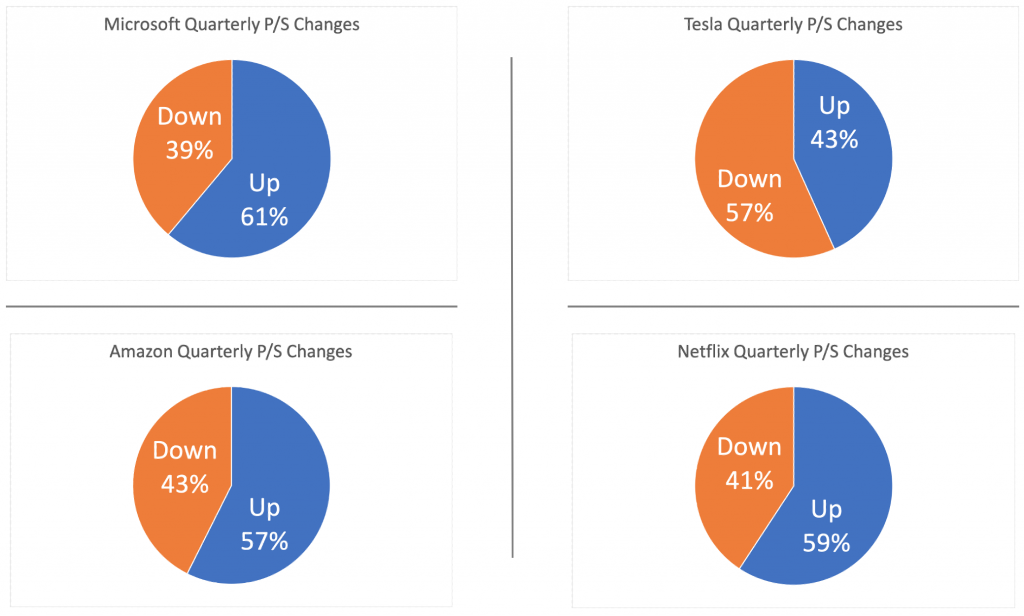

Amazon’s relative price to sales multiple didn’t go straight up over those 55 quarters. How frequently did it go down?

43% over 55 quarters is pretty frequent, and Amazon isn’t an outlier. Coincidentally, most of the incredible companies we hear about haven’t gone straight up.

Microsoft, Netflix, and the currently unstoppable Tesla have frequently seen down quarters as well.

Why? Have all of these companies changed that often, or did their narratives change?

High Prices Torpedo Your Returns

There is a compelling argument for paying these premiums. Simply put, if you’re a long term investor, even though there may be some declines, these fantastic companies will beat the general market in the long run.

There’s only one problem with this logic: it doesn’t make sense. As I sharply criticized in The Virtues of Patience Updated.

Anybody who says that they wish they would have invested in Amazon at any price is either: a liar, or does not understand numbers.

If you invested $10k in Amazon at the height of the dot com bubble in 1999 at $116 per share, you would have roughly $164k today.

16x returns are not bad, but do you know what’s better? A 318x return. Had you patiently waited a few years and invested when the company was under $6 per share, you would have over $3 million today.

Since we don’t have crystal balls, there was no way to know that $116 was the top, or that $6 was the floor. However, we do know that Amazon’s price to sales multiple is generally between 1.5x – 4x.

In 1999, Amazon’s price to sales multiple was over 35x on 19% gross margins (their margins are 2x higher today thanks to AWS). A couple years later, that multiple cratered to 0.9x at the trough of their valuation.

We should always be long term investors. As you purchase great companies, ask yourself: are you investing because their valuation is relatively compelling, or because they keep going up?

The latter strategy works, until it doesn’t. Once the music stops, investors who joined late are left holding the bag.

FOMO, Revisited

I wrote about the power of FOMO when I discussed IPOs in the beginning of 2020.

In a word, FOMO (fear of missing out), which Warren Buffett perfectly articulated in September 2018:

People start being interested in something because it’s going up, not because they understand it or anything else. But the guy next door, who they know is dumber than they are, is getting rich and they aren’t. And their spouse is saying can’t you figure it out, too? It is so contagious. So that’s a permanent part of the system.

While this applied to IPOs at the time, the message sounds eerily similar to tech valuations today.

When you own the best companies in the world, it’s incredibly difficult to know when to sell. Buying is a different story, though. If companies are priced at their highest relative valuations, you can safely assume that future returns will be lower.

I am not saying to dump these American tech stocks, as I certainly haven’t. However, I do believe there are greener pastures than American tech stocks at the moment. China is one example, and so far that has been proven correct.

It will likely take years to determine whether or not this was the right call. As you consider investments in the meantime, ask yourself: are you investing because the valuation is relatively compelling (thanks to your patience), or because they keep going up?

If you’re investing because they keep going up, make sure you’re emotionally prepared for a possible fall.