Abiomed had a rough 2019, and their stock declined substantially because of it. The FDA warned that Abiomed’s flagship product had an “increased rate of mortality”, which stunted their revenue growth and collapsed their stock price.

Instead of fighting the FDA, Abiomed worked with them to determine how these increased mortality rates occurred. Later in 2019, they confirmed with the FDA that the higher death rate was due to physicians operating on patients who were out of options. Essentially, they used Impella as a last resort, and it did not always work out.

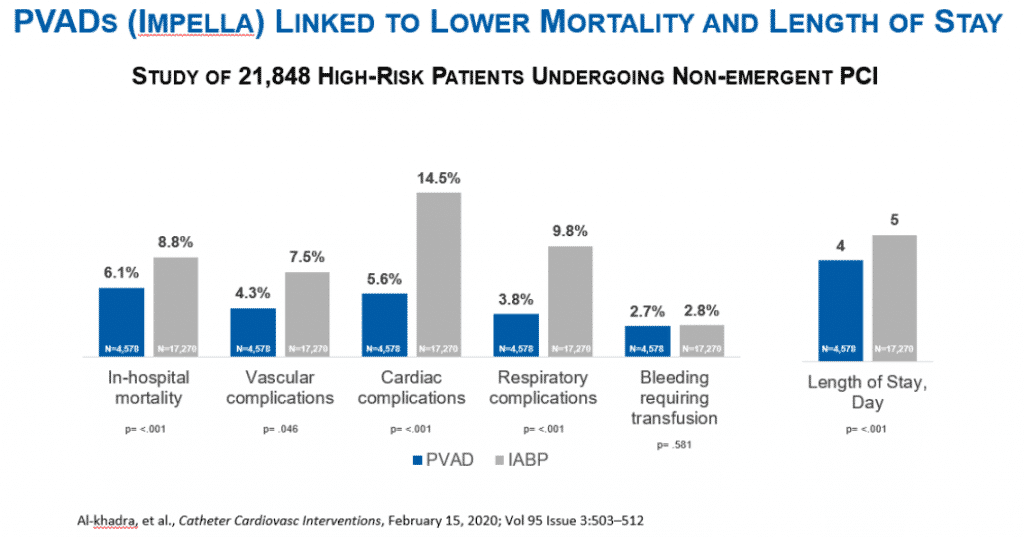

On top of these findings, insiders did not sell much equity during 2019. In fact, only one director sold shares after the FDA’s letter, and it was only 25% of their holdings.

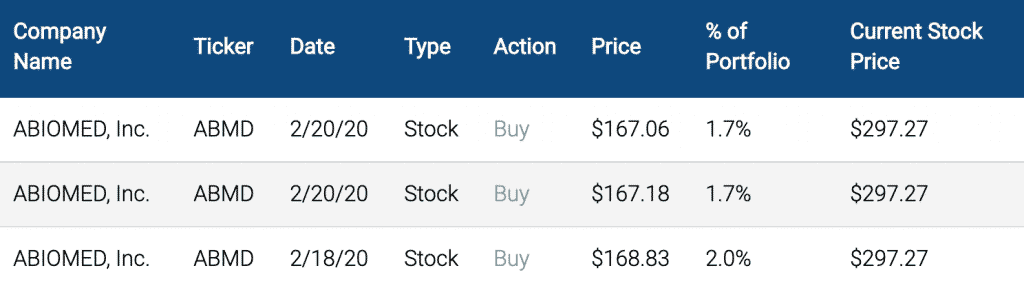

With the depressed stock price, I felt this was an educated bet worth making. Premium members saw me invest 5.4% of my portfolio in Abiomed in February 2020.

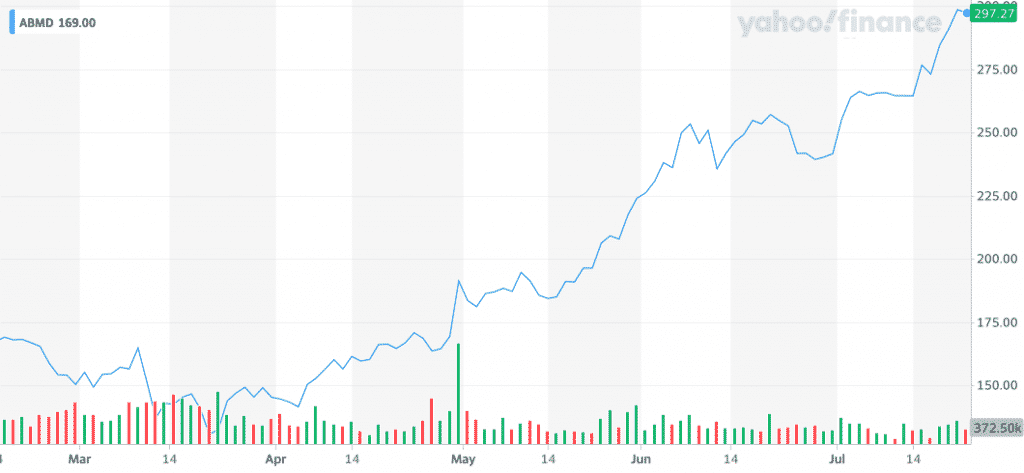

The investment has worked well so far, with the company up 76% over those five months. Over the same time, the S&P 500 has declined 4.6%.

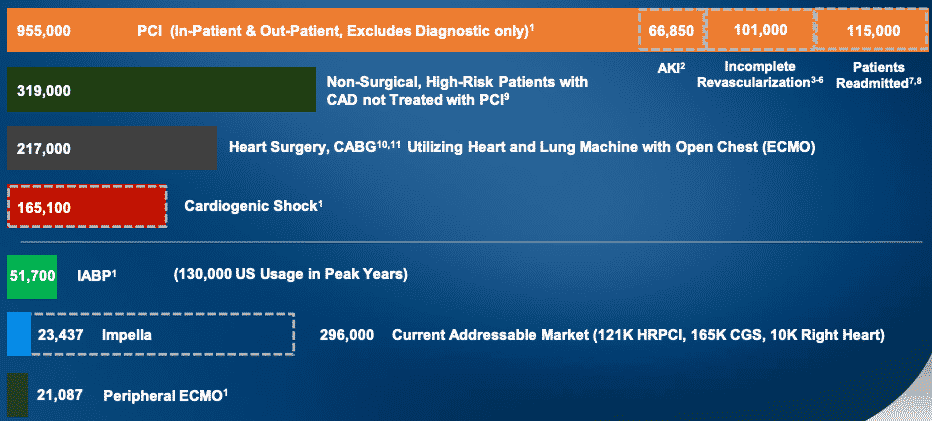

Abiomed only has 9% of their current addressable market, and are still not at their previous highs. If they can corner this market, Abiomed can grow far larger than their current $13 billion valuation.

What is Abiomed

Coronary artery disease, better known as “heart failure”, is the number one cause of death in the United States. Over 15 million people in the USA have heart disease, and 875k people die per year from it.

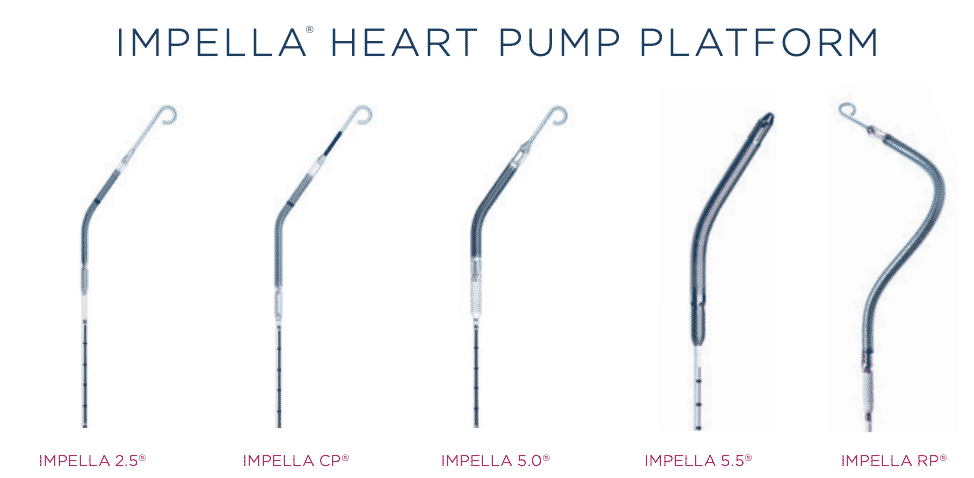

Abiomed is the leading provider of heart pumps for heart failure patients. Their Impella products enable the heart to rest, heal, and recover by improving blood flow to the coronary arteries and end-organs while temporarily assisting the pumping function of the heart. This is called a percutaneous coronary intervention, or PCI.

Their product helps heart failure patients go home with their own heart. This is not only far cheaper than a heart transplant, the odds of survival are far more likely, as there are not enough hearts for all patients to receive a transplant.

U.S. hospitals performed 955k PCI procedures in 2018, and they didn’t always work out. Among those procedures, 134k patients needed multiple procedures, 101k received incomplete revascularization, and 67k patients suffered from acute kidney injury (AKI). These PCI metrics highlight the clinical need for a complete revascularization in a single setting, which is exactly what Impella supports.

Of the 955k PCI procedures, Abiomed estimates that nearly 296k U.S. patients demonstrate a clinical need for Impella. Impella performed 23k procedures, which means they have only 9% of the market so far.

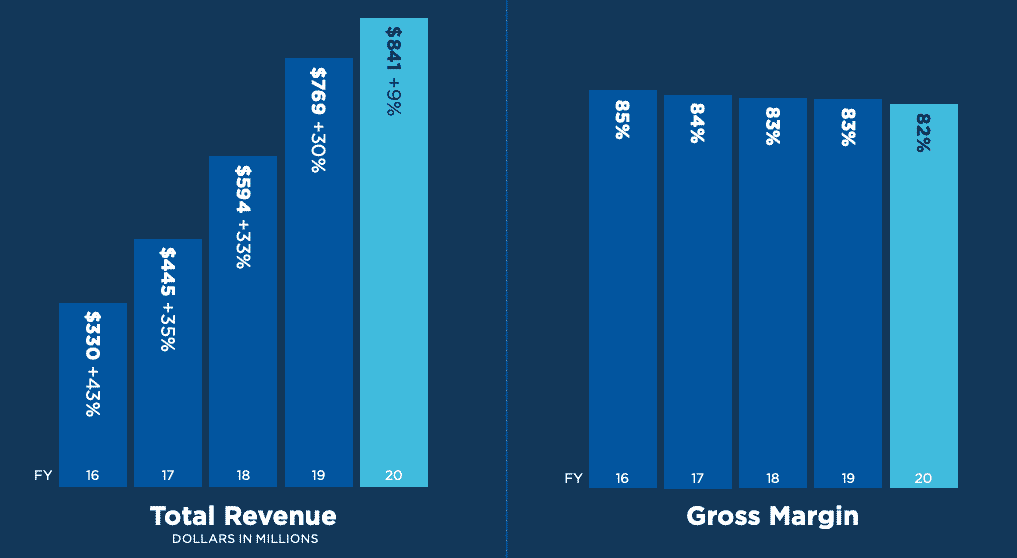

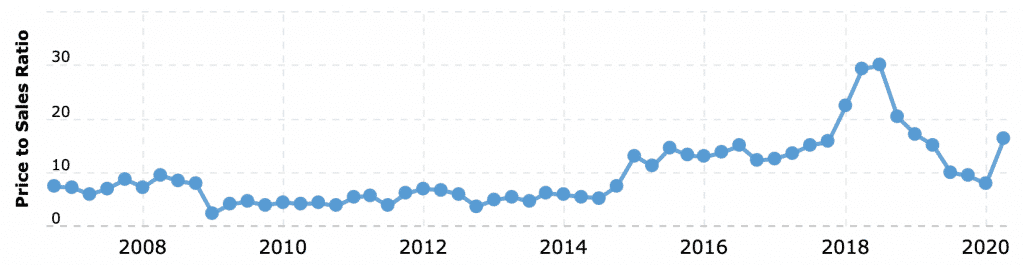

As you can imagine for life saving products, Abiomed’s revenue had been growing over 30% over the past several years. I say “had”, because there was a big slowdown in 2020. We’ll get to that in a moment.

The gross margins have been high as well. Heart replacements are incredibly expensive, and patients can save money (and their lives) going with this cheaper alternative. Not a bad win for everyone.

With a market this big, many competitors are getting in on the action. Abbott Laboratories, Medtronic, Edwards Lifesciences, Boston Scientific, LivaNova, Terumo Heart, Teleflex, Getinge (Maquet Cardiovascular) as well as several early-stage companies are developing heart assist products. Products include implantable left ventricular assist devices and miniaturized rotary ventricular assist devices that directly and indirectly compete with Abiomed’s products.

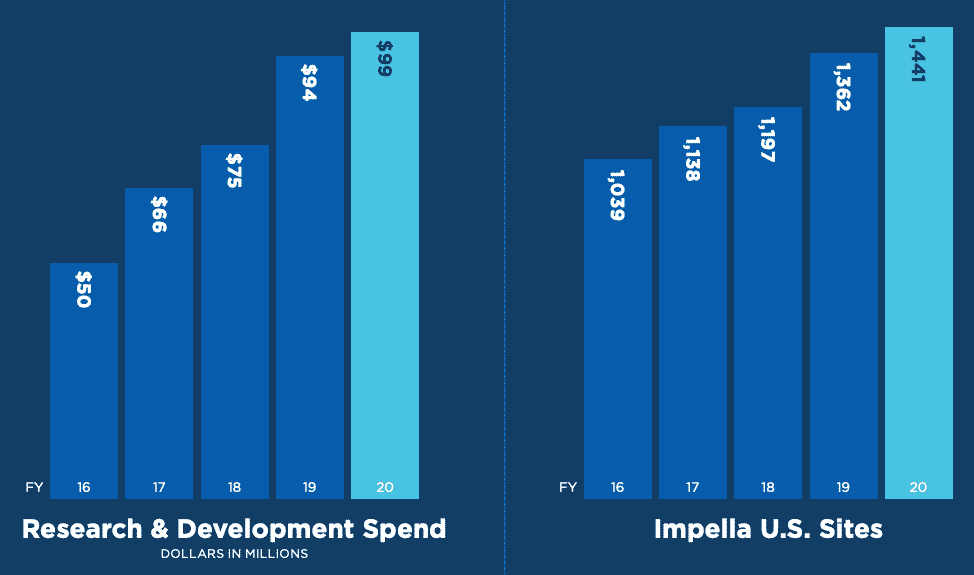

While competitors are getting into this market, Abiomed is doing the right thing by spending more in R&D and increasing their footprint.

Many of these competitors are large and well capitalized, but they lack a big motivator: focus. Similar to Microsoft fighting Pluralsight, the juice just isn’t worth the squeeze for these large medical device players. Abiomed, on the other hand, has no choice but to make this device successful.

Why Abiomed’s Stock Fell

Abiomed’s revenue growth hit a brick wall last year, declining from 30% in 2019 to 9% in 2020. What happened?

The FDA happened. They sent a letter to health care providers in February 2019. The headline starts with “Increased Rate of Mortality“, and gets worse.

The FDA is evaluating recent interim post-approval study (PAS) results which suggest a higher mortality rate for patients treated with the Abiomed Impella RP System than the rate previously observed in the premarket clinical studies. The Impella RP System is a temporary right heart pump system intended to help patients maintain stable heart function without open chest surgery. The FDA wants to ensure you are aware of the mortality rate that has been observed in the ongoing PAS.

This is clearly not good. Aside from cigarettes and guns, products should generally not kill their users. Not surprisingly, Abiomed’s stock was cut in half in 2019.

Abiomed conducted studies to determine how this happened. Aside from working with the FDA, they also ran an independent study with nearly 22k high-risk patients.

Their study confirmed that Impella led to lower mortality and length of stay at hospitals. In October 2019, Abiomed released an updated study with the FDA confirming that Impella led to higher survival rates. Key highlights are below.

When physicians followed the FDA’s approved protocol for Impella RP use they achieved 72% patient survival and 88% native heart recovery.

The FDA has confirmed the classification of Impella RP post-approval study patients into two categories: Recover Right protocol and salvage support. The Recover Right category includes patients who met the inclusion and exclusion criteria of the Recover Right FDA PMA clinical trial for Impella RP.

The FDA and Abiomed believe that physicians should have the ability to attempt lifesaving recovery measures on these salvage patients based on their best judgement but emphasize that earlier recognition and treatment is associated with markedly better survival.

In a letter to health care providers on May 21, the FDA noted the importance of proper patient selection and timing of Impella RP insertion.

The FDA also wrote, “Additionally, be aware that there are currently no other device interventions that have been approved by the FDA under the premarket application (PMA) process for the patient population demonstrating a higher mortality rate in the PAS.

Alright, now we have the story. Impella patients were dying at higher rates, but that is because physicians were performing the procedure on patients who were out of options. Imagine you have heart failure, and there are no hearts available for donation. If you have a 1% chance of this procedure working, compared to a 100% chance of dying, which would you choose?

The FDA not only admitted that there are “no other device interventions” that can help, but also said that physicians indeed “should have the ability to attempt lifesaving measures on these salvage patients”. In other words, this Hail Mary worked often enough, and the FDA gave physicians the green light to keep doing it.

Abiomed’s Insiders Have a Bias, But Held On

Now, Abiomed’s executives clearly have a bias to make their product work. Insiders own 1.4% of this $13 billion company, which means they have 182 million reasons why they want this to succeed.

Imagine for a second, that you were an insider at Abiomed. There are two paths after the FDA’s initial letter, and you likely know which is more likely as an executive. How would you address each?

- Abiomed’s product does not work, and the FDA caught them

- Abiomed’s product does work, and the FDA was wrong

In either scenario, you will dispute the FDA’s findings. That’s your job security. However, there could be another way to find which of these options is more likely, as I previously wrote about insider buying and selling.

General purchases and sales aren’t terribly concerning. Executives may be exercising stock options when they buy, and might have bills to pay when they sell.

Huge aberrations, on the other hand, could be a strong signal. When executives bet the ranch on their company, they likely believe that the company’s undervalued.

As you can see, Abiomed’s insiders did not dump much of their equity in 2019. Only one insider sold anything, which was 25% of his stake. That is literally it throughout 2019.

This is the exact opposite reaction that we see with Moderna as they develop their COVID vaccine, as I previously wrote.

We already saw his announcement that Moderna’s vaccine “has the potential to prevent COVID-19 disease.” Should we start buying?

Well, before we do, let’s check one thing. What is [Chief Medical Officer] Tal Zaks doing with his lottery tickets?

He’s dumping them as quickly as possible.

One director selling 25% of their equity is far less extreme than Moderna’s CMO dumping everything he owns on a weekly basis. If Abiomed’s insiders were willing to bet their life savings on the company after the FDA’s report, I felt comfortable betting 5.4% of my net worth as well.

Great Value Beats Bad Timing

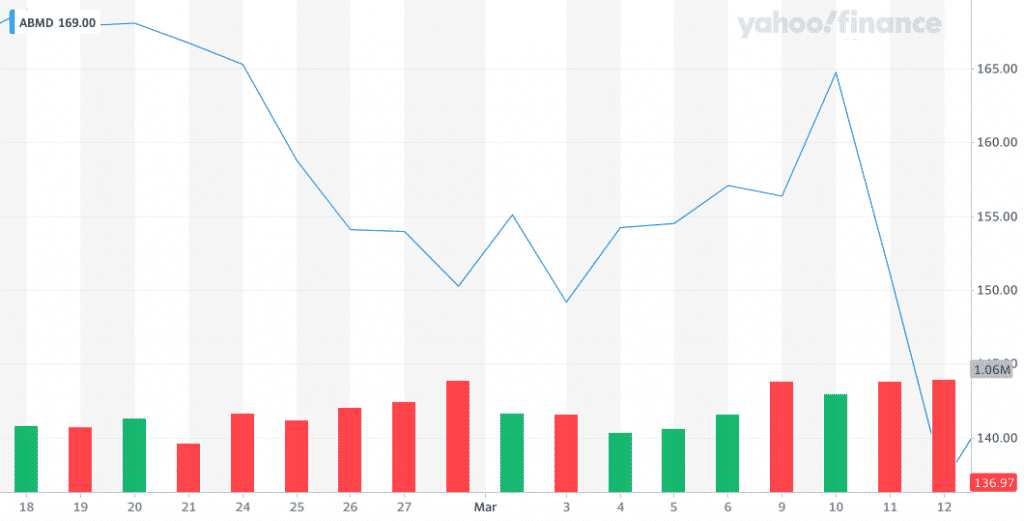

If you notice my purchase dates, I could not have timed this investment worse. We did not know the extent of the Coronavirus at the time, and a panic started soon after my investment.

I last wrote how powerful narratives are for valuing stocks, and a powerful narrative moved Abiomed. That narrative came from the FDA in February 2019, and I seized the opportunity.

Sure enough, a new narrative called “COVID” drove Abiomed’s stock down another 20%. When I say I don’t have a crystal ball, I mean it.

Obviously COVID-19 changed the game, but our investing playbook remains the same. As I wrote in Investing During a Crisis.

Since we don’t know when to invest during a crisis, do we at least know which companies to invest in?

Ideally, you’ll invest in the same companies that you planned on before a crisis. These are great businesses that are probably cheaper than they were before.

“Great businesses” typically are best in class in a growing industry. They also have high gross margins, little to no debt, and recurring revenue.

Thankfully, Abiomed is best in class in a growing industry. In fact, as the FDA confirmed, Abiomed is often the only game in town.

Once you fast forward five months, you’ll see that strategy paid off. Abiomed is now up 76% since my Febraury 2020 investment.

While we may not be able to time the market, we can gauge relative valuations. Great value will consistently beat bad timing, we just need to be patient.

Healthcare Is Tough – Abiomed Stock is No Different

Healthcare is such a difficult business for investors. The industry is surrounded by capitalists, yet the consequences of failure are far graver than any other industry. Add on top of that our general bias – society wants these companies to succeed. Who wouldn’t want cancer cured tomorrow?

Aside from the consequences of failure, the general incentives in healthcare are completely backwards. I remember sitting in a healthcare conference in Washington DC around 2015, as a Chief Nursing Officer of an Ivy League health system explained how they guide patients to surgeries for comorbidities instead of preventive treatments like diet and exercise.

Such surgeries maximize revenue for the health system, while minimizing ongoing costs. This is great for the health system, but what about that person you put under the knife? How much cheaper would it have been for everyone had that person just ate better and exercised more?

If that is what the best health systems are thinking, imagine what is on the mind of upstarts. Should we be surprised at the lives that Elizabeth Holmes ruined at Theranos?

Which is all to say, that we should be skeptical of any healthcare company. Not only because they have every incentive to lie, but our bias wants them to succeed. When these companies do lie, human lives are at risk. We may be frustrated that Wells Fargo opened millions of fake bank accounts, but nobody died from it.

I believe we should be skeptical of companies like Abiomed. After reading all of the research, and following their insider transactions, I believe this company is a bet worth making. I hope I am right, not only for the upside, but for the lives that will be saved.