It has been 12 months since my first post about Slack and the virtues of patience. That post feels like yesterday, and the past 5 months have felt like decades. I’m sure for all of us, these 12 months have been weird.

Thankfully, my 12 months of investment returns have done a lot better. After I take a quick (okay, it’s kind of long, give me a break) victory lap, we’ll dive into my plans for Year 2 of this website.

My Year 1 Returns

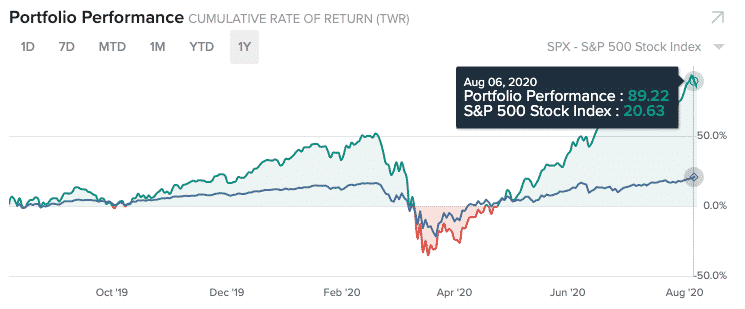

As you can see, my 12 month returns have been nothing less than phenomenal. Hence the victory lap.

My time weighted returns were nearly 90%, which was more than 4x the S&P 500.

You also noticed that my portfolio took a hit during the COVID crisis. This was mainly due to making some big bets on two companies I wrote about – Abiomed and Pinterest. Although the timing couldn’t have been worse, these companies have skyrocketed since I bought them. As I wrote about Abiomed, great value beats great timing.

The volatility looks worse than the reality. My Sharpe ratio was 1.3 over the past 12 months, which is considered “good” by investors. The Sharpe ratio is the average return earned above the risk-free rate per unit of volatility, or total risk.

I’m improving this through hedges and short term trades, and my Sharpe ratio over the past month has been over 3. This is considered “excellent”, but the timeframe is too short. Time will tell if I can keep this up.

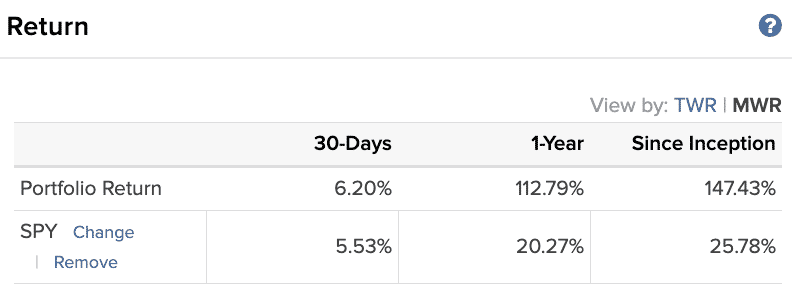

My money weighted returns have been far better at nearly 113%, or 5x the S&P 500. Money-weighted returns reflect my investment timing. I advocate for patience, and that patience has consistently been rewarded.

Before we go any further, I must state the obvious: I will likely not repeat these returns over the next 12 months. My primary strategy is finding long term compounders, and the key phrase is long term. While I do not know when these investments will materialize, my “Since Inception” returns prove that my investments generally pay off over the long term (nearly 5x the S&P 500).

Thankfully, my recent calls have been quite lucrative relative to the S&P 500 (more on that in the ROI section). Either way, I hope last year’s success has earned at least some patience. Rest assured, I will not be complacent.

My Writing Performance

Another great question for all of the Free Subscribers, have my writings been worth your time?

Hopefully they have at least been entertaining! But entertainment is not my job. While I do not make recommendations, I do share my sentiment. Knowing these sentiments, have my writings made you money?

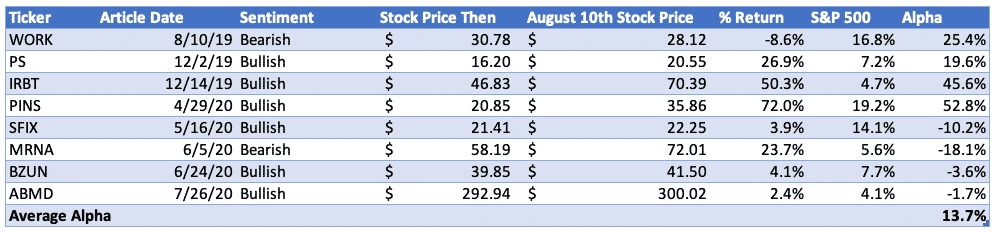

Each of my articles have, on average, exceeded the S&P 500 by 13.7%. My recent writings have not had much room to run (Premium members have made a killing off of Abiomed & Baozun, though), and my worst pick was my bearishness on Moderna. I still stand by that sentiment, as must their executives, since they continue unloading their shares. Premium members have seen me make a decent living off that bearishness through put options.

I left off Tesla because I took a neutral position (which somehow still upset the $TSLA crowd on Twitter). I also left off nCino because I advocate against investing in IPOs pre-lockup. WeWork is also missing, as they imploded before their IPO went out the door. Perhaps Softbank wishes they talked to me before their $4.7 billion write-down, though.

Finding Investments vs Selling Subscriptions

My Premium Membership terms could not be clearer about my focus for this website.

More people are searching for get rich quick schemes, and there are several websites selling to this need. Many of them actually derive more income from what they sell than what they claim to teach. Discount The Obvious will not be one of these websites.

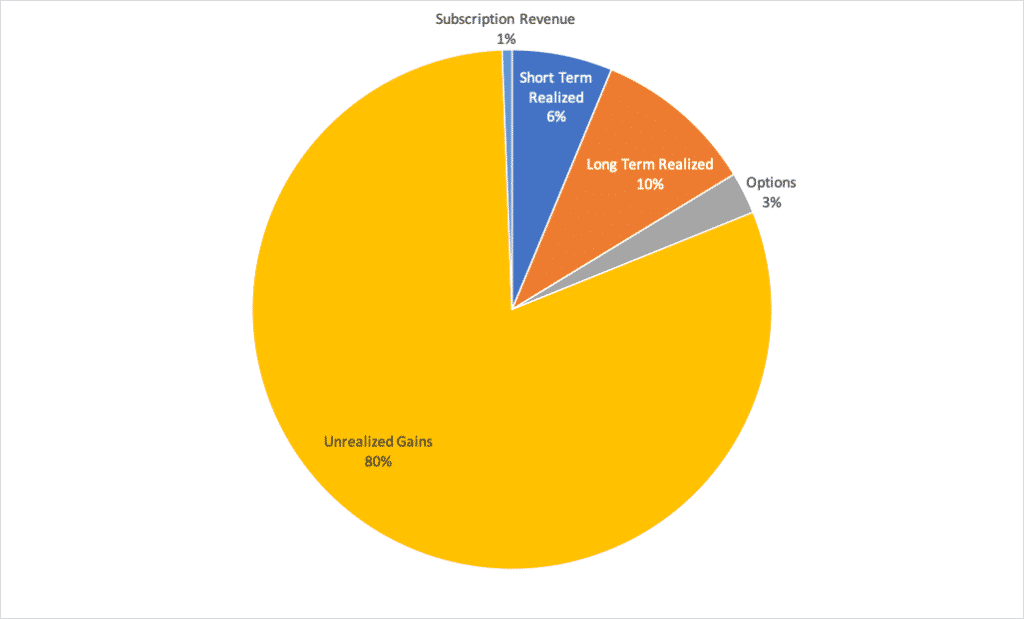

In other words, my income will come from maximizing investing returns, not by selling premium subscribers. To put my money where my mouth is, here are my 113% annualized returns broken out relative to my subscription revenue.

The real number is less than 0.70%, and that’s a best case scenario with incredibly generous future assumptions. In short, my subscription revenue is a rounding error.

My subscription revenue is a feature, not a bug. I will make far more money by making a good investment instead of adding a subscriber. Not only does this focus help me, it also helps my subscribers. This is what I mean when I say that our incentives are 100% aligned. Technically, 99.3% aligned.

Finally, any premium subscribers are welcome to audit me. I appreciate your partnership, and will by no means take it the wrong way. You have every right to verify that our incentives are aligned. Feel free to DM me on our Slack.

Goals for the Next 12 Months

While I can’t make any promises about my performance, my commitment to finding market-beating companies will remain. After all of my research, I can confidently say that there are still compelling businesses trading at reasonable prices. I will keep digging for more.

Aside from the obvious, here are my top 3 goals over the next 12 months.

Goal 1: Increase Options Activity

Options represented 3% of my gains last year.

My options activity has been (knocks on wood) phenomenally profitable. Over the course of 64 options trades, I have made $3 for every $1 lost. Assuming these profits sustain as trading activity increases, it’s hard to call this blind luck.

These options not only increase my overall profitability, they also act as shock absorbers when my long term investments take a hit, thus improving my Sharpe ratio. Premium members have seen me take incrementally bigger bets, and I will search for more opportunities over the next 12 months.

Goal 2: Increase Short-Term Trading Activity

Same goes for short term trades. While long term compounders are the top of my priority stack, these short term trades can help just like options. This is becoming more important because of the economic uncertainty we’re in. I believe there are short term opportunities available, and am flipping those investments so my capital isn’t exposed to a justifiable downturn.

My short term trading performance has also been (knocks on wood) phenomenal. I somehow realized $0 in short term losses over the last year, so let’s use throw in my unrealized losses for good measure. Please keep in mind that 80% of my total income came from unrealized gains, which is not at all being factored.

For every $1 in unrealized losses over the past year, I made $2 in realized gains. No matter how you slice it, these investments have been quite lucrative.

I’m also getting better at finding these short term opportunities, as I confessed to Premium members in my July 31st weekly update about flipping a call option on The Progressive Corporation.

Alright, time to get something off my chest. I’ve spent the past 4 months learning about charts and technical analysis. This transaction was the first time I invested solely off of a chart.

I’ll never be a full-time chart reader, and my results should explain why. With that being said, if this can make money over the short term, that is a win for all of us, especially with the market’s current valuations.

Anyways, this one worked out. I flipped it for a 34% gain over 4 days.

Expect me to make bigger and more frequent bets, which will ideally improve overall profitability.

Goal 3: Finalizing the Premium Membership

The Premium Membership has been in beta for roughly 6 months. As I said before, I’m in no rush to roll out the finalized product. With that being said, I appreciate your feedback (please send more!), and hope there is a finalized product available by summer 2021.

For all beta subscribers, you will be locked in at this monthly price regardless of what I add in the future. I appreciate you giving this a chance, as well as all of your contributions so far. Your feedback has truly added more paid subscribers, and I hope the service has given you some value as well.

Premium’s ROI

Speaking of value, what was a Premium subscriber’s return on investment last year?

Charles Schwab reported that the average self-directed brokerage account held $268k in 2019. After five minutes of Googling, I found similar stats from reliable firms like Deloitte.

Since we have only known each for a year, I wouldn’t expect the average investor to dedicate 100% of their holdings to my investments. Instead, let’s assume that you’re comfortable with 10%. We’ll round down to $25k to make the math simpler.

With my 112.8% returns, that $25k would be worth over $53k today, which means the average investor would have made $28k over the year. Had they simply invested in an S&P 500 ETF, that $25k would have been worth $30k.

- DTO Returns: $28k

- S&P 500 Returns: $5k

- DTO Alpha (Return over S&P 500): $23k

- DTO Premium Annual Cost: $600

- DTO Premium ROI: 3,755%

Granted, every extra dollar invested makes the ROI stronger. Even if you only invested $5k, though, your ROI still would have been 671%.

But what if you didn’t replicate my portfolio, and just followed my investments for the past 12 months? Also, let’s assume you did not invest in any of my short term trades and options.

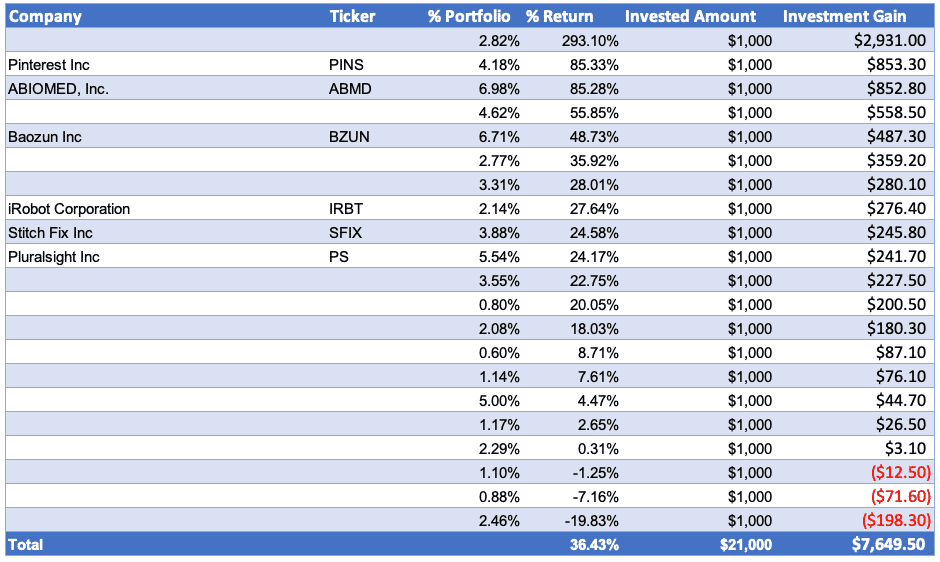

Even in this convoluted scenario where over 70% of my returns are wiped away, Premium subscribers still fared pretty well. Here’s a hypothetical example assuming that investors blindly invested $1k in each of my long-term investments over the past 12 months.

To protect Premium members, all companies that have not been written about are blank.

Even in this example where we back out over 70% of my returns, and assume my prior investments and short term trades didn’t even exist, investors still returned over 36% through the year. That beats the S&P 500 by 80% over 12 months, and I would argue the number should be higher.

Abiomed, for instance, has returned 85% over the course of 6 months. The S&P 500 is flat over that same timeframe. Regardless of how you slice the numbers, I’m proud of the value that you received. Hopefully, you were satisfied as well.

How Else Can I Help?

Thank you all again for your contributions over the past year. This would have been a lot less fun if not for your time, feedback, and trust. Thank you especially to those who have joined in the beta membership. The experience has a ways to go, admittedly, but hopefully the returns have made up for any hiccups.

As I echoed in my goals, overall returns are my north star, but I believe there are more ways that I can help. Please DM me on Twitter if you have any ideas that will make this service more valuable for you.

Same goes for the Slack channel for Premium members. We have had some good interactions, and I hope we have more of them.

After what we experienced over the past 12 months, I can confidently tell you that nobody knows what will happen over the next 12 months. As long as we own great companies, though, we should be ready for whatever the world brings next.

I’ll keep looking for those companies. Thank you all for your support.