Hey everyone,

I hope you had a great week, let’s get into it.

Portfolio & Market Updates

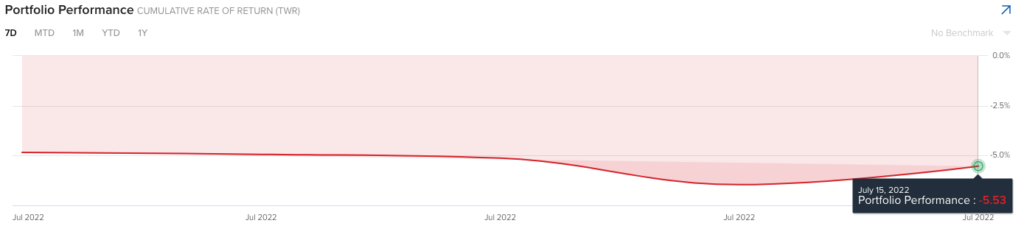

My portfolio was down -5.5% this week, which was not great compared to the S&P 500 (-0.9%), and Nasdaq 100 (-1.2%). Ark was down (-5.9%), while small cap growth $IWO was down (-2.1%).

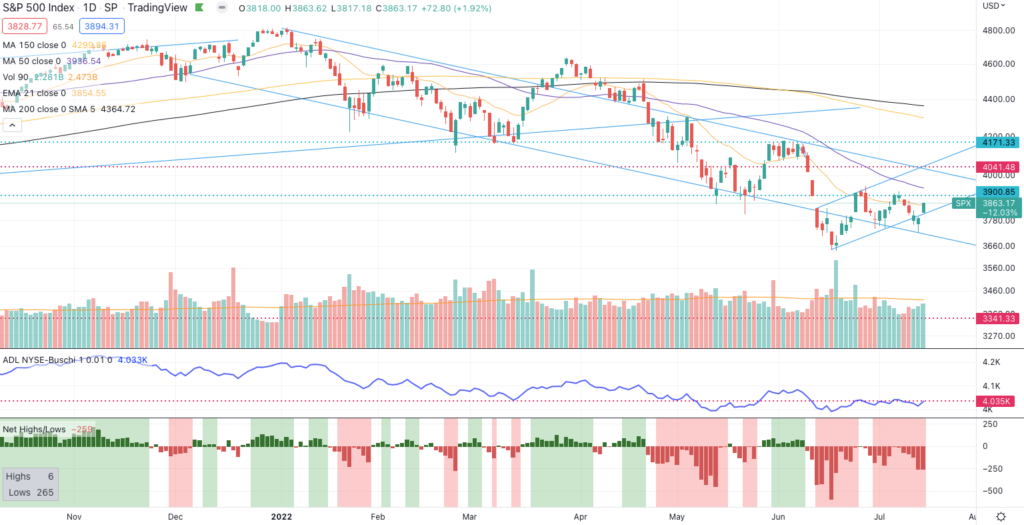

As you can see from the S&P 500, this was a choppy week.

The week opened up below the 21-day EMA, fell below the little channel it has been trading in since June 16th, and if you shorted then, you would have lost 2%, as the market rallied back above the 21-day on Friday.

Such choppiness isn’t a big deal during bull markets, as it often means the market is catching a breather before the next leg up.

Bear markets are another story, though, as it could mean that the market is catching a breather before the next leg down.

While I keep taking swings at encouraging opportunities, this is still a bear market. More stocks have made new lows in the NYSE for 24 trading days in a row, as you can see in the bar chart above. Given that, I plan on keeping my stops tight, until I see the general market improving.

Money Is Rotating Back to Small Cap Tech

We have seen a divergence over the past month between the S&P 500 and Nasdaq. While the S&P 500 has logged 4 distribution days, the Nasdaq only has had 1.

I believe this means money is rotating back from cyclicals to tech, and even more is rotating to small cap tech, and will share why below. Consider first the Nasdaq 100 compared to the S&P 500, $QQQ/$SPY.

Notice how the Nasdaq 100 has been solidly outperforming the S&P 500 since mid-May. We have several higher highs and higher lows validating this.

But not just tech is in the Nasdaq 100. Some non-tech companies include Dollar Tree, Starbucks, Marriott, & Kraft Heinz. One way to strip out tech is by comparing the technology ETF $XLK to the Nasdaq 100, $XLK/$QQQ.

Doing so shows that tech has not only been outperforming in May, they have outperformed the Nasdaq 100 since November.

Remember though, I’m focusing on small caps, how are they doing compared to general tech?

Well, we can strip this out as well, by comparing IPOs to technology, $IPO/$XLK

Sure enough, despite tech’s outperformance, small cap tech and IPOs are performing even better since May.

I’ll share prior small cap tech names like The Trade Desk after the market trends section. Aside from this rotation happening, I’m taking swings on tech because the sentiment is still miserable.

Retail Is Heavily Short While Insiders Keep Buying

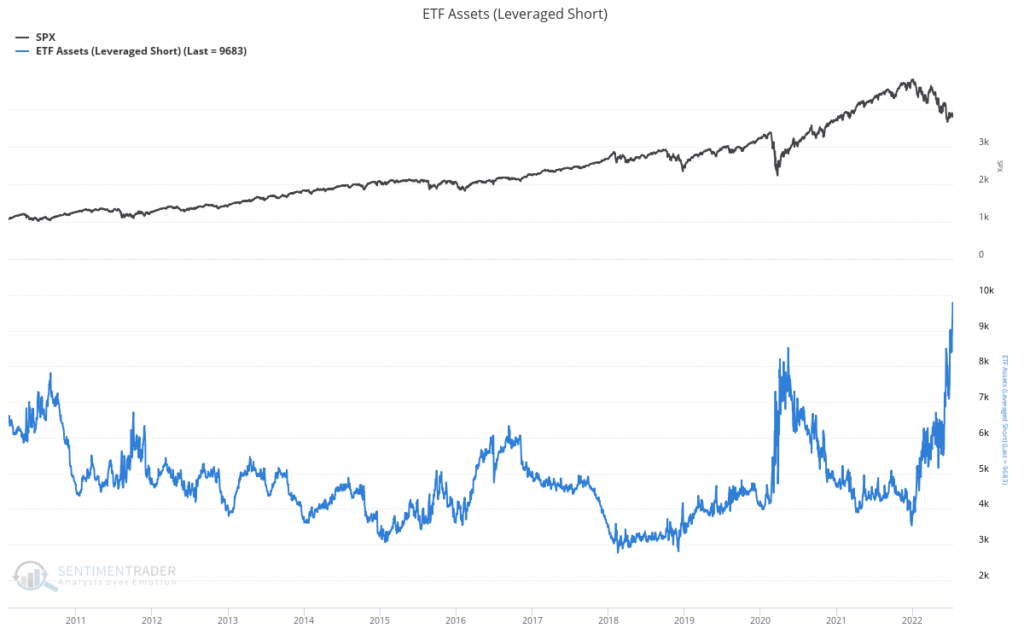

Retail has never been this short before, as we see leveraged short ETFs hit all-time highs, blowing past the COVID crash high.

Remember, hedge funds can easily short using their leverage, meaning it is not worth owning a levered short ETF, due to the higher costs and slippage fees. This is how we know leveraged short ETFs are specific for retail sentiment.

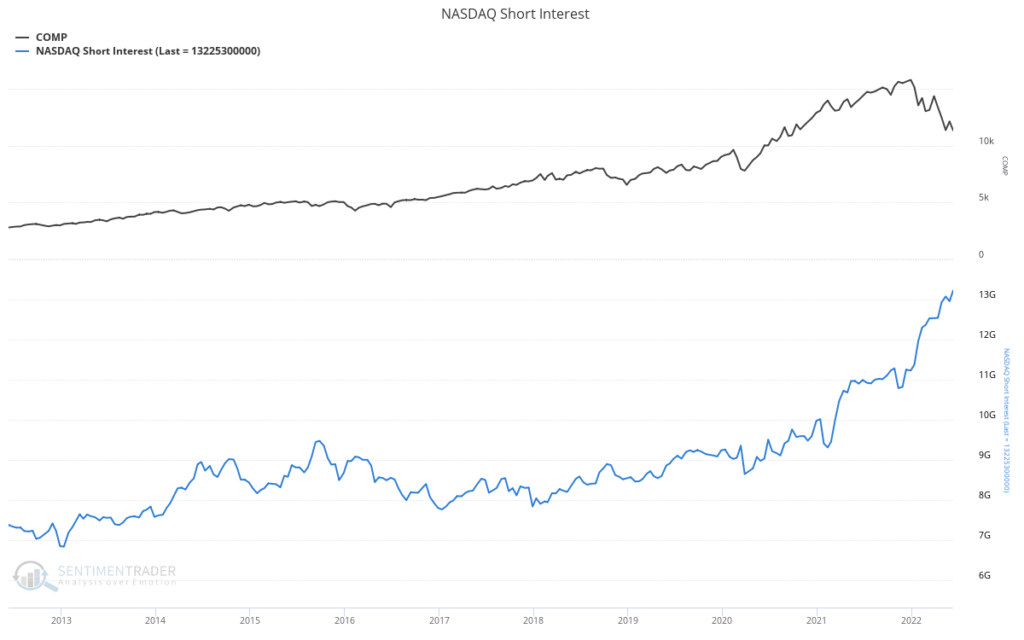

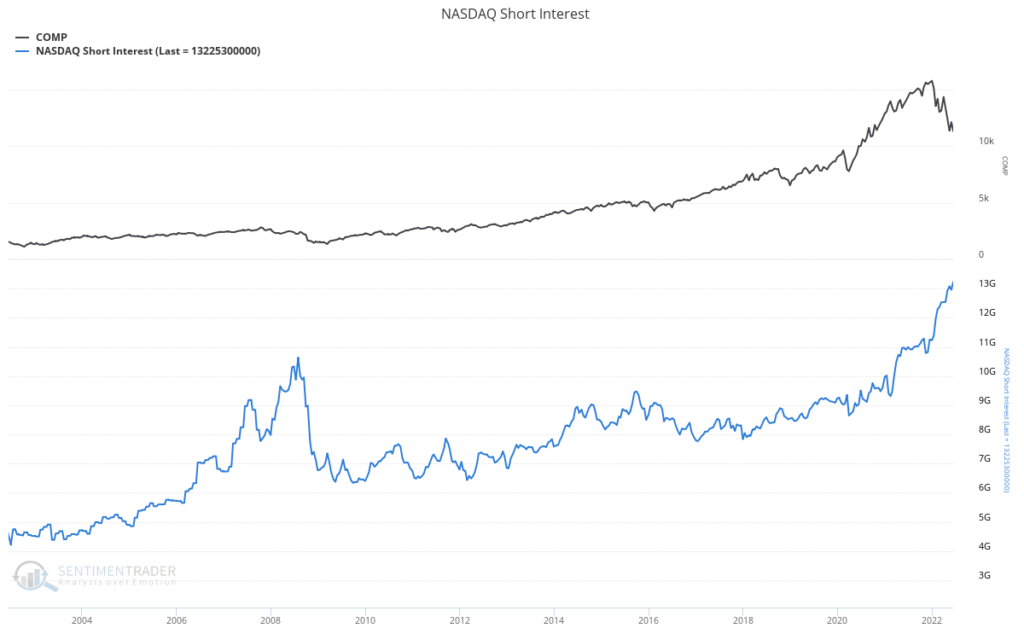

But more than retail is short. Look at how overall Nasdaq short interest is at all-time highs.

As you can see, this chart is not helpful for finding tops or bottoms. Also, the Nasdaq should have higher short interest as prices appreciate, in order to keep short ratios in line.

What doesn’t happen often, though, is happening now. Notice how short interest is skyrocketing while price has been plummeting. I can’t find a time this has happened, even during the financial crisis, which tells me that bears might be getting greedy.

Here is the same chart including the financial crisis, in case you’re curious. Notice show short interest plummeted along with price in 2009.

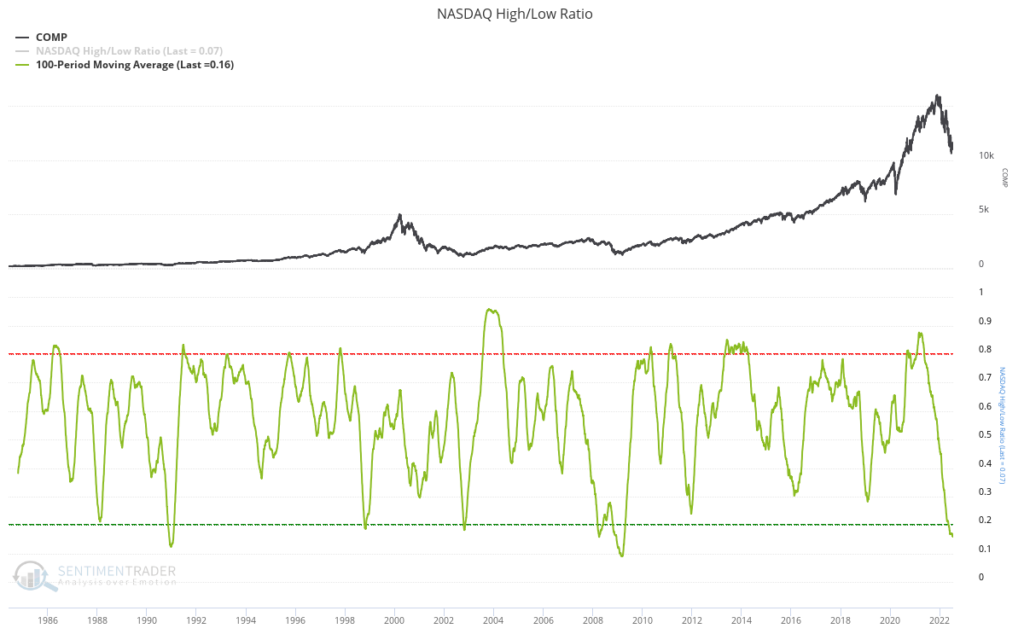

The Nasdaq Hi-Lo ratio shows how this short interest is flying in the face of overall lows. The Nasdaq’s 100-day average has only been lower 4x since inception in 1984.

In other words, short interest is very high while prices are very low. With all of this negativity surrounding the general market, as well as the Nasdaq, what have people in the industry been doing?

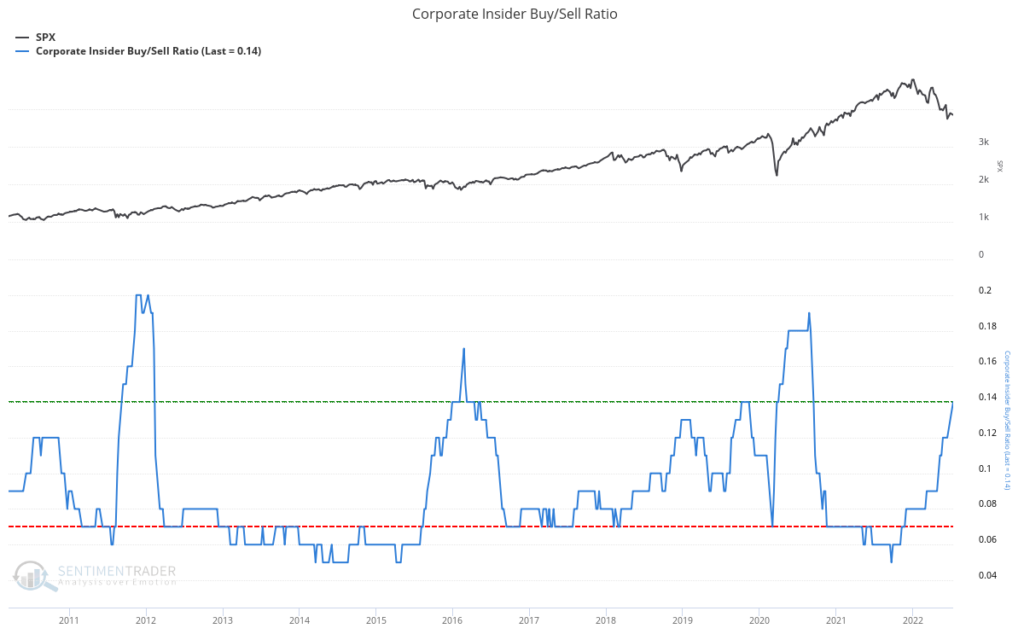

As I have called out throughout the year, insiders keep buying up their stock. Overall, insiders are buying at levels that have only been seen 4 other times over the past 10 years.

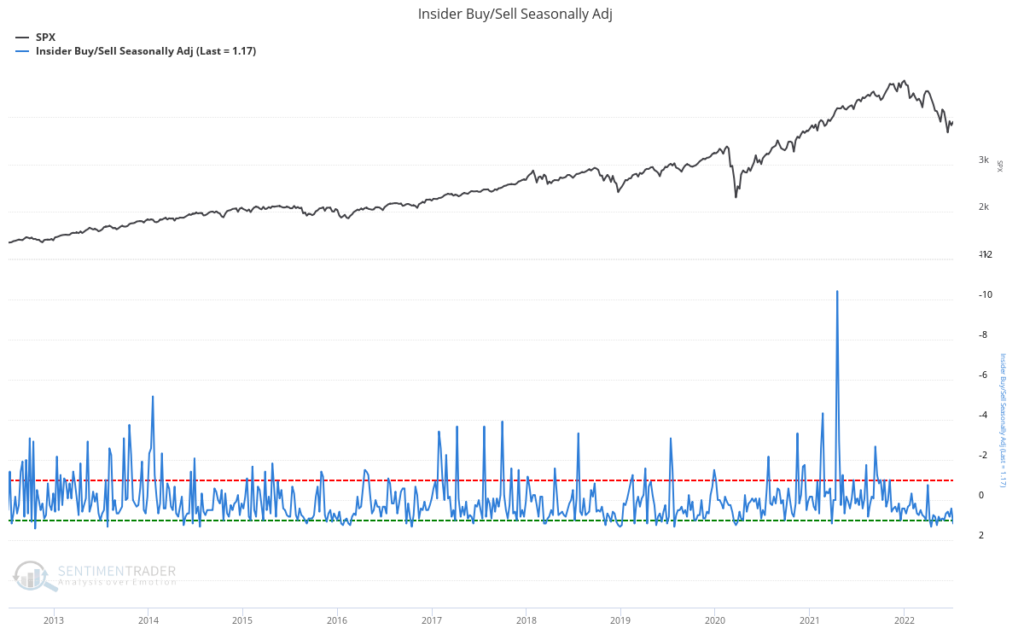

That chart does not factor seasonality though, as insiders typically buy and sell during certain times of the year. Once seasonality is factored in the chart below, you see that insiders haven’t been buying this consistently since 2016.

Of course, tech is even more pronounced, as I have been writing all year. Notice how the corporate buy/sell ratio for technology ETF $XLK is still near all-time highs.

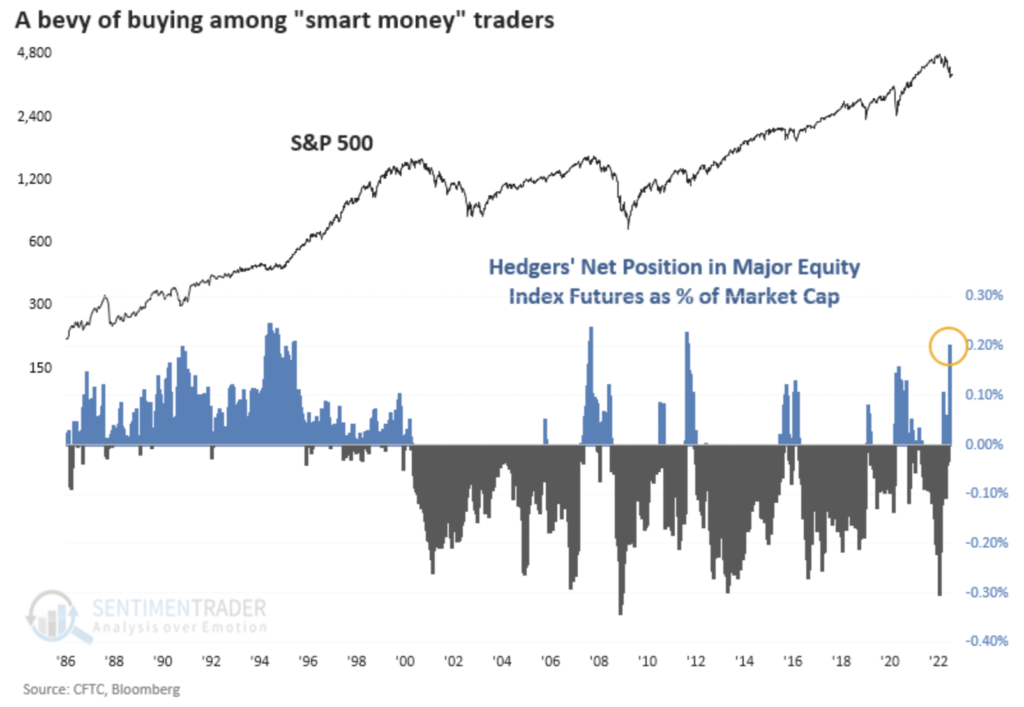

Interestingly, hedgers have recently been matching their bets with the insiders. These hedgers are only supposed to hedge their day-to-day business risks in the futures market, and specifically not speculate on rising nor falling prices. When they do set a position, that’s a strong signal about their business outlook. Clearly, we see they are heavily long right now.

We see this is not gospel, as hedgers were heavily long before the financial crisis in 2007 as well, but they generally nail it when they’re heavily long or short.

China’s New Issues Will Signal How Real This Rally Is

China was hit with a flurry of bad news this week, and I stopped out of all my positions.

- COVID cases are rising at their fastest pace since May,

- Their GDP only grew 0.4%

- Possible property crisis, with bond delinquencies exceeding $26 billion this year, roughly 2x the year prior

All of this news is pretty concerning. So far, though, the price reaction hasn’t matched how terrible this news could be. Notice how China large cap $FXI has fallen to the trend level set from their mid-March lows.

Certainly prices could keep going down, and doing so would be very concerning.

If they don’t, though, we could find ourselves in a similar situation as crypto, where the general market shrugs off bad news. Whenever we see this, we’re likely at a bottom with far more upside to go.

I’ll be keeping an eye on this market, and will reopen my positions if I see the trend improve.

Market Trends

Which takes us to the market trends. We see that China large cap $FXI and Chinese internet $KWEB have both turned down, which explains why my positions stopped out.

Aside from that, it’s more of the same. Biotech and small cap tech are still outperforming, while solar is hanging on a thread. I’m guessing the market didn’t respond well to Biden meeting with the Saudis. My Enphase position may not survive due to this, but I’m giving it the benefit of the doubt for now.

Focusing on Recent IPOs & Prior Success

Back to small cap tech. As mentioned earlier, the $IPO ETF has been outperforming the Nasdaq 100 since mid-May.

This is very encouraging, and explains why I keep taking swings on recent IPOs that I have been bullish on. Many of these names had been opened in the past, and were thankfully sold before their major drawdowns.

The Trade Desk, which IPOd in 2016, and I sold for a 21x return before this bear market in December 2021, exemplifies the potential of these IPOs perfectly.

Notice how The Trade Desk broke down in November 2018, roughly 3 months before the S&P 500. While the general market made a lower low in April 2018, The Trade Desk made a higher low (blue arrows).

TTD also had a high volume selloff when price broke down in November, and then saw significant accumulation in March and May.

That May accumulation day, which came after earnings, resulted in a major gap up for TTD, in which it never turned back. Please keep in mind, though, had I waited for the S&P 500 for validation, I would have waited until September before opening this position. By then, $TTD was already up roughly 2x.

Which is why I’m taking early swings on recent IPOs now. We see that $TTD had a few breakdowns below the 50-day & 200-day moving averages, similar to some of the positions I have been shaken out of recently. However, investors who took these swings were eventually rewarded handsomely.

Let’s zoom out the chart, with the same moving averages, over the 5 year life cycle of The Trade Desk. Remember, had you not opened a position sooner, you ideally bought after the big breakout shown in the blue arrow.

Not a bad couple of years. Now, it is quite rare that companies will yield such incredible returns, but I have a few names that could, and explained the potential for each when putting them on my radar. The goal is selling companies who don’t realize that thesis, and doubling down on the companies who are executing.

So far, Gitlab is the only name that I have not been shaken out of, but several other targets look constructive.

Hashicorp, which I put on your radar April 14th, has once again reclaimed the 50-day moving average. There was substantial selling despite their beat and raise in June, and then a big accumulation day happened at the bottom in mid-June.

SentinelOne, my favorite cybersecurity stock, has also been basing after breaking down from a bear flag in May. Investors have been accumulating this QoQ, and we see high accumulation volume in mid-June.

Price has been respecting this longer term downtrend line, which goes back to when it rolled over in November. It is basing currently, and I plan on reopening this once that downtrend is broken.

Braze, my favorite marketing software company, has been killing it recently. While they’re finding resistance at the 150-day moving average (yellow line), it seems like price is forming a cup and handle. I was unfortunately shaken out last week, and plan on getting back in.

Nextdoor, which SPACd right before the market rolled over, is also retesting that 50-day moving average.

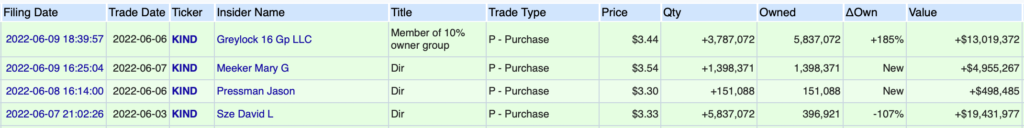

There has been an incredible amount of insider buying by Greylock, as well as three of their board members, throughout June.

All of these names share a common theme of The Trade Desk, where they broke down months before the general market, and have been outperforming recently.

I’m keeping my eye on all of these, among others, and will let you know when I find the next entry point. As you can see from The Trade Desk, you can realize substantial gains even if you’re late.

Sell China: Pinduoduo (PDD), Kingsoft Cloud (KC), Li Auto (LI), Futu (FUTU)

Speaking of outperforming, China had been doing quite well recently, but investors grew skittish as more bad news came out of the country.

This stopped me out of my China holdings. Li Auto, which was opened Wednesday, didn’t even last a week.

As mentioned before, monitoring price action is key in China. I believe this region is incredibly undervalued, and plan on reentering these names so long as China does not make lower lows.

Sell: Marathon Digital (MARA) DLocal (DLO), Zoom (ZM)

Marathon Digital was a 13% winner, and I sold once price fell below the 21-day EMA (orange).

That was a false breakdown in hindsight, and on Thursday price broke above a flag. Given that the 50-day moving average (purple) is just above price, I’m waiting for a reaction before reopening this position.

I wrote last week that it’s possible that crypto has bottomed, and I’m still waiting for validation.

DLocal may have been another shakeout. Price broke below the 50-day Thursday, and reclaimed it on Friday. I’m being conservative given that we’re in a bear market, but this stays high on my radar.

I didn’t even wait for Zoom’s close below the 50-day, as price broke below this trend line. Zoom was a momentum play, which unfortunately did not work out.

Interestingly, many new institutional investors opened positions with Zoom QoQ. This is a cash printing machine, and the product is incredibly sticky, which is why I see them doing well in a slow growth environment.