Hey everyone,

I hope you had a great week, let’s get into it.

Portfolio & Market Updates

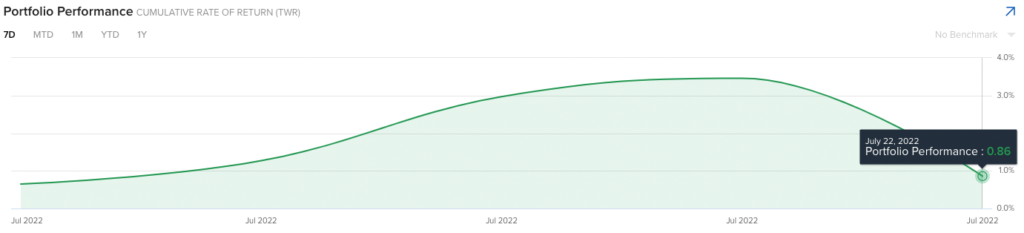

My portfolio was up 0.9% this week, once again below the S&P 500 (+2.6%), and Nasdaq 100 (+3.5%). Ark was up (+4.9%), while small cap growth $IWO was up (+3.9%).

I was trending with the general market despite my 60% cash position, and then Snap’s disappointing earnings torched my Roku & Twilio positions. All new positions are still positive in aggregate.

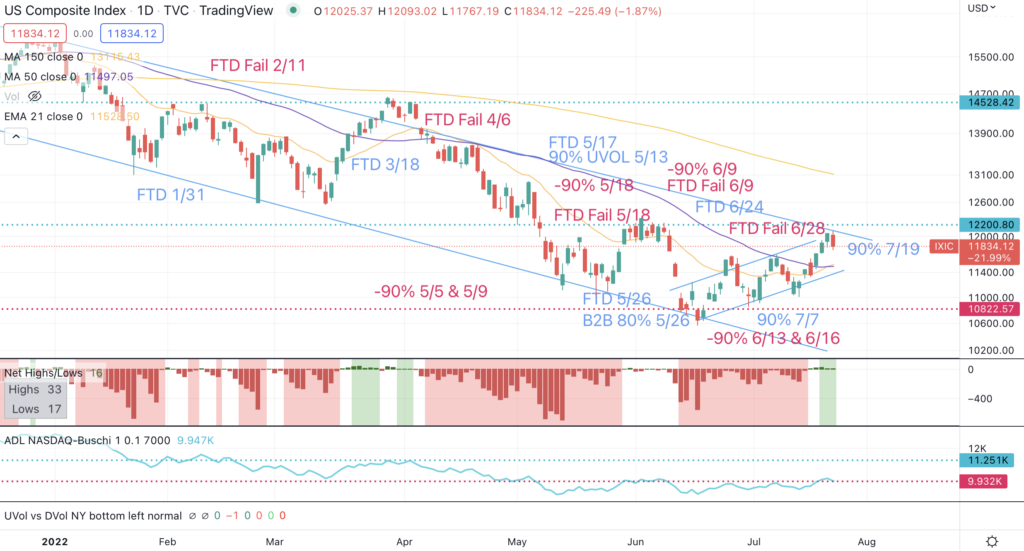

The Nasdaq hit the upper end of their channel Thursday, and I forecasted why a drawdown could happen afterwards on Slack.

As of right now, though, it’s hard being too bearish on the price action. The Nasdaq had more net highs than lows for the 5th day in a row, suggesting that this could be more of a pause than a trend change. As you can see above, the big drawdowns didn’t start until we had more net new lows than net highs.

Small caps are another positive note, as the Russell 2000 cleared the 50-day moving average for the first time since March. Small cap tech had been outperforming since May, and $IWM suggests that the rest of small caps are following suit.

Seeing that these smaller companies led us in to this drawdown, seeing them recover first would be constructive. Clearly March was not the time, we’ll see what happens this round.

Optimism Improving, Positioning Is Still Defensive

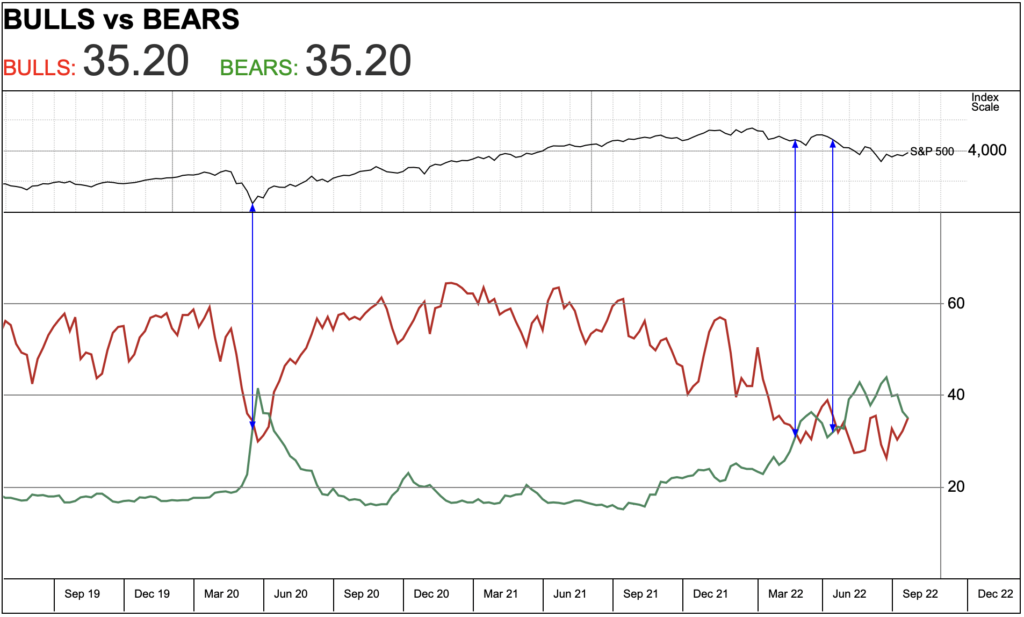

We have been covering how bears are outnumbering bulls through much of 2022, and Investors Intelligence shows that the percent of bulls match bears for the first time since April 29th.

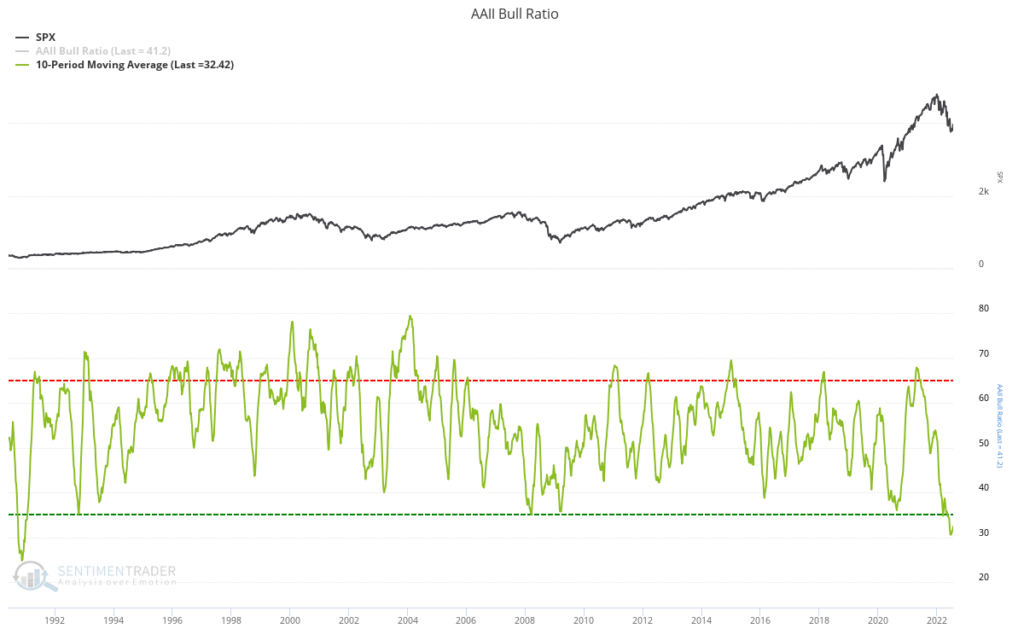

We see the AAII bull ratio confirming this sentiment improvement, as the 10 week moving average just started trending up. Despite this improvement, sentiment hasn’t been this poor since Iraq invaded Kuwait in the early 1990s.

A sustained uptrend is impossible without a meaningful improvement of bulls, but more bullish investors also open the opportunity for more drawdowns.

Which is why tracking actual dollar movement is a helpful sanity check. Looking at this, we see that investors are still positioned defensively.

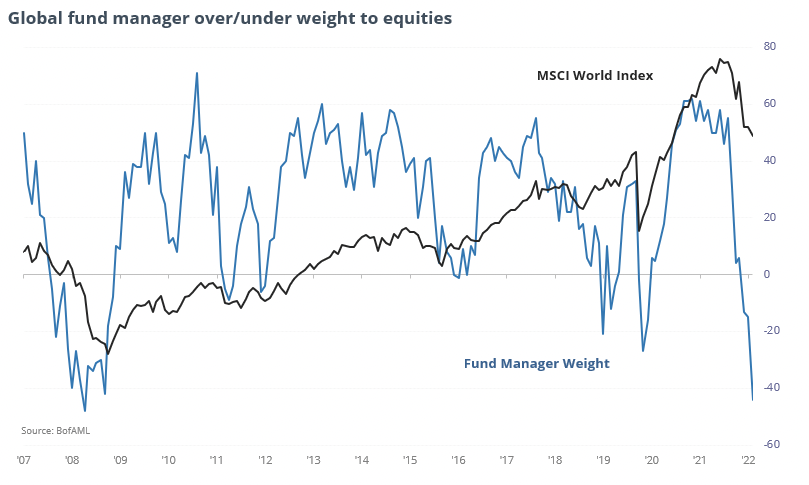

Bank of America shared this week that fund managers haven’t been positioned this defensively since the financial crisis. Market collapses are easy to call, but rarely happen. So far, I don’t see how this market environment is as concerning as 2008.

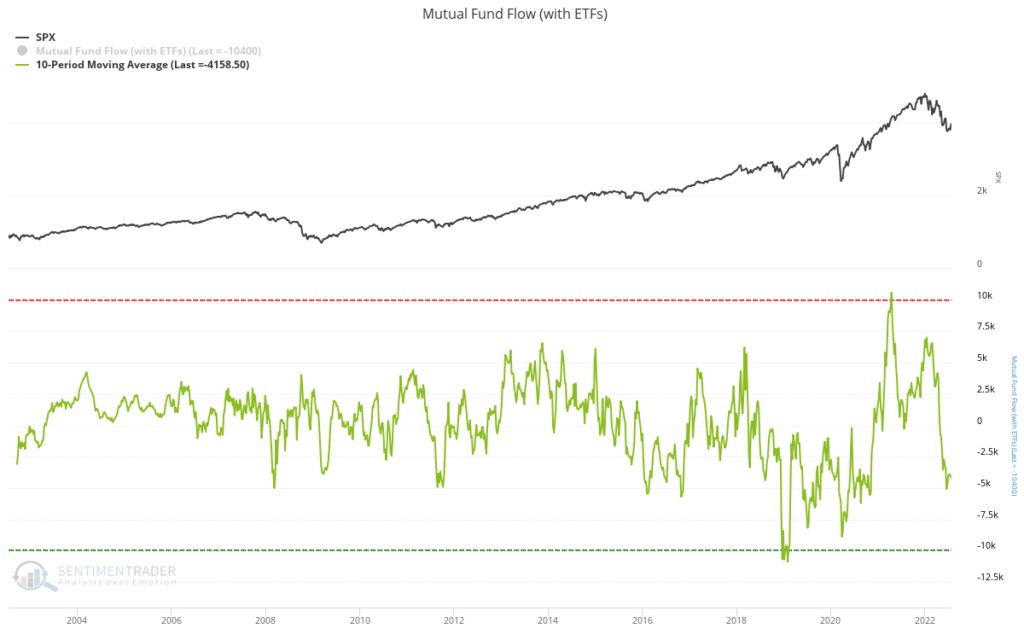

We see overall fund flows are defensive as well, with the 10 week moving average near levels that have seen intermittent bottoms, including the financial crisis.

2019 & and 2020 (COVID crash) saw greater withdrawals. While I’m not calling a bottom with this chart, I believe this reinforces how defensive investors generally are.

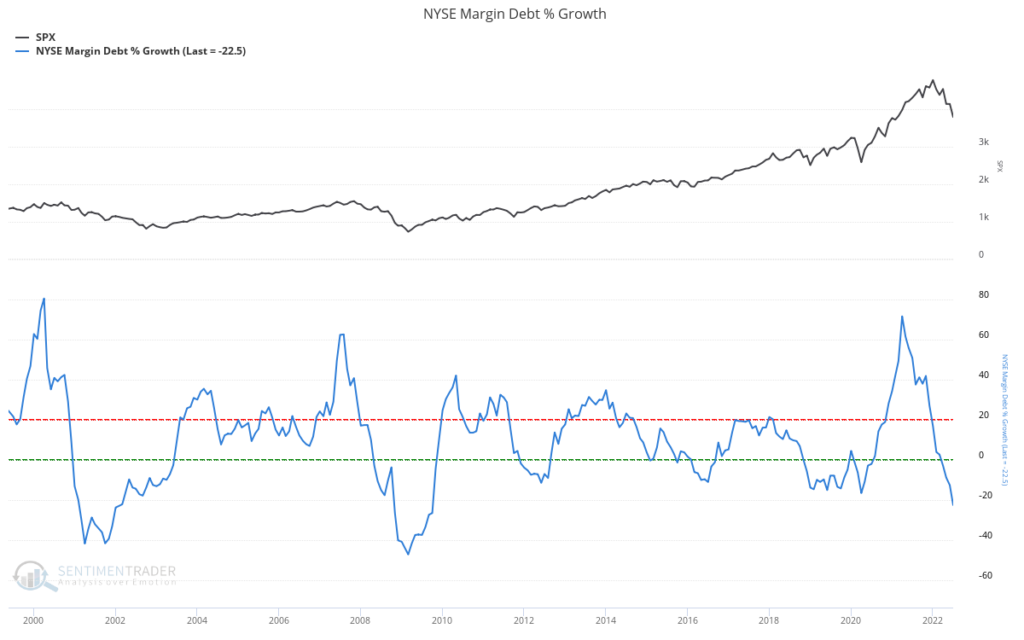

Overall margin use has declined below 10 years lows as well, and is approaching levels that haven’t been seen since the financial crisis.

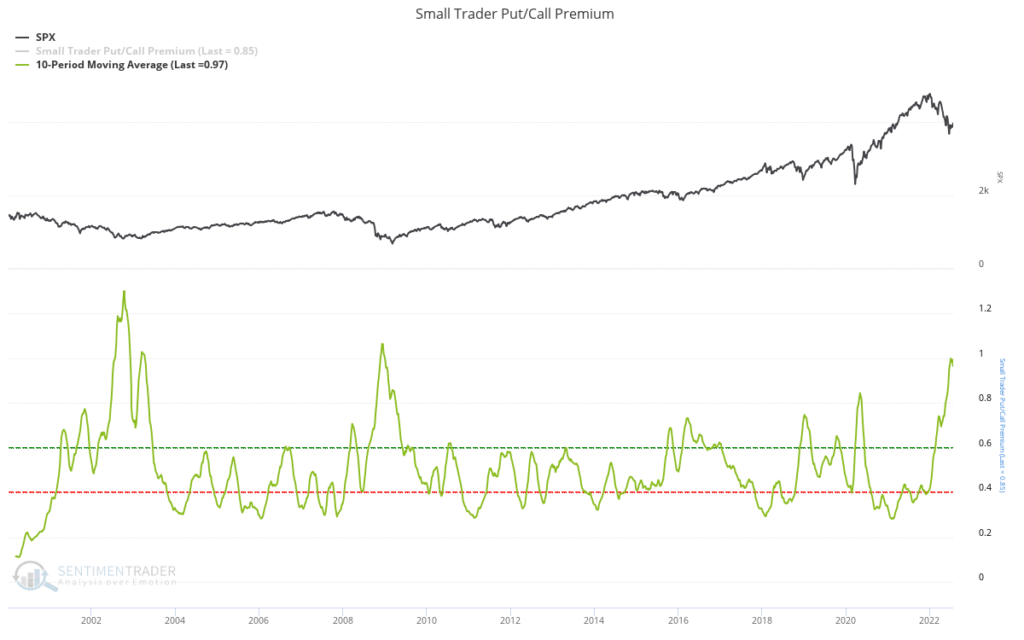

While that’s happening, small traders are spending an overwhelming amount of money on puts. Given that calls have demonstrably more upside than puts, we rarely see investors willing to pay more for puts than calls (above 1x premium).

In fact, looking at the 10 week moving average, we see that the put/call premium has only exceeded 1 during the financial crisis in 2009, and after the dot com meltdown in 2002.

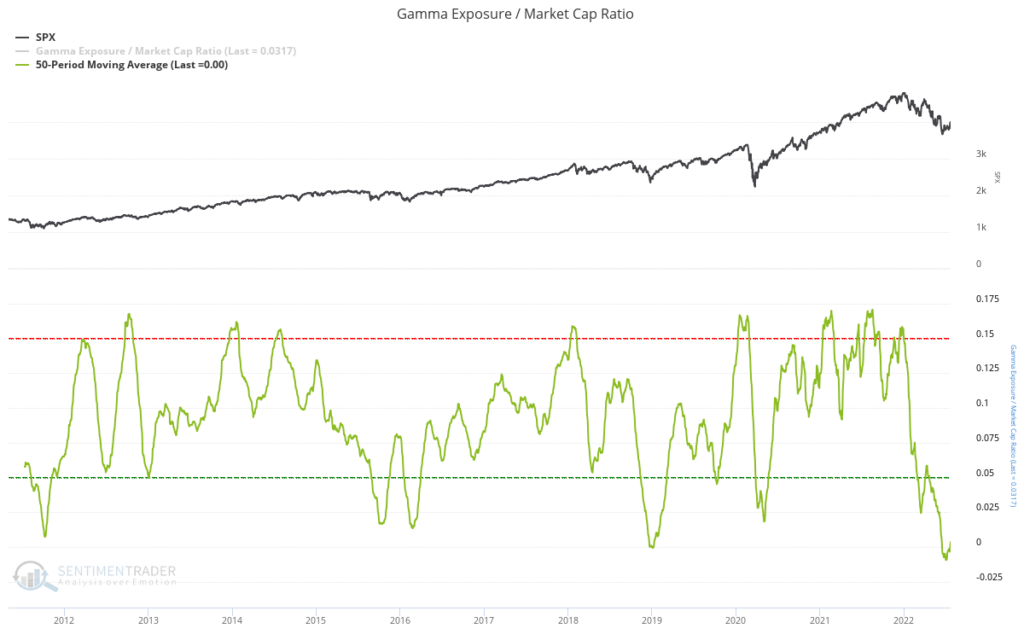

Gamma exposure reflects a similar sentiment, which has been negative for quite some time. This suggests that dealers must buy stocks to hedge their options if there are further declines, effectively providing a shock absorber to the market.

Looking at the 50 week moving average, we see gamma exposure hasn’t been this negative over the past 10 years.

Overall, some bulls coming out of the woodwork, while the general market is still overwhelmingly defensive. Given this, I am opening some positions that have shown relative strength and are breaking above their intermittent downtrends.

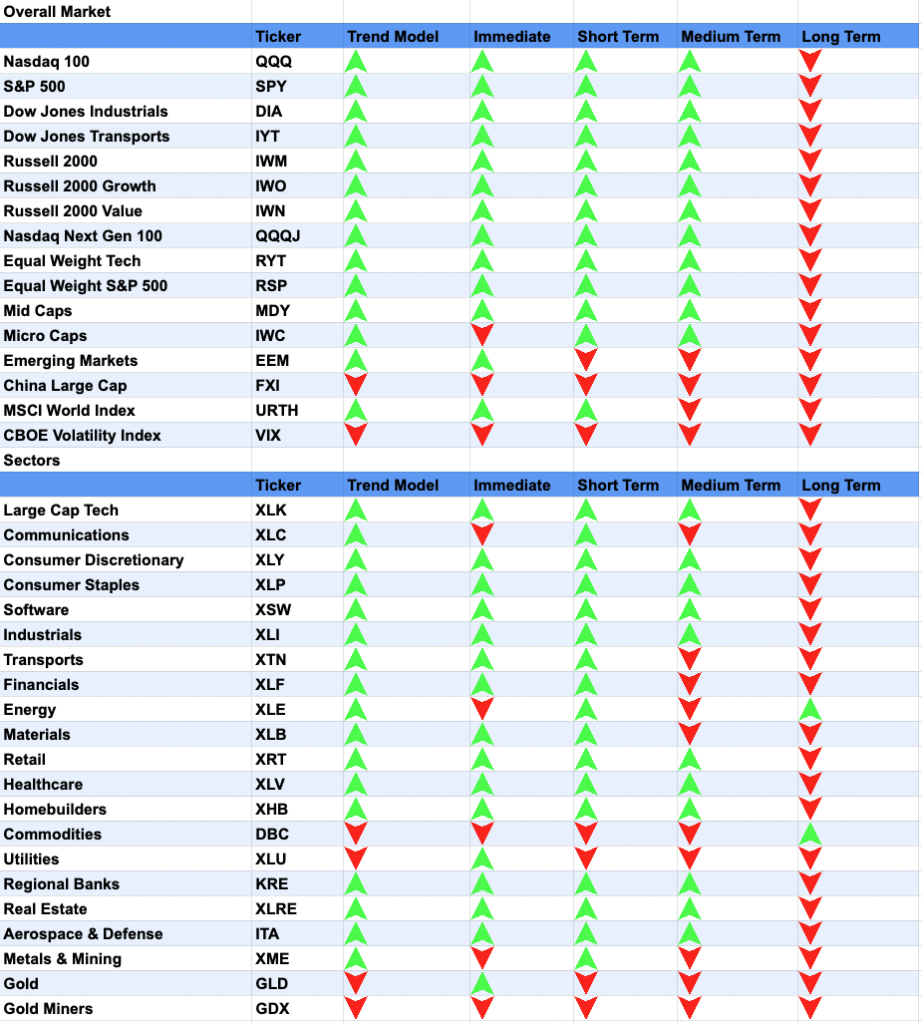

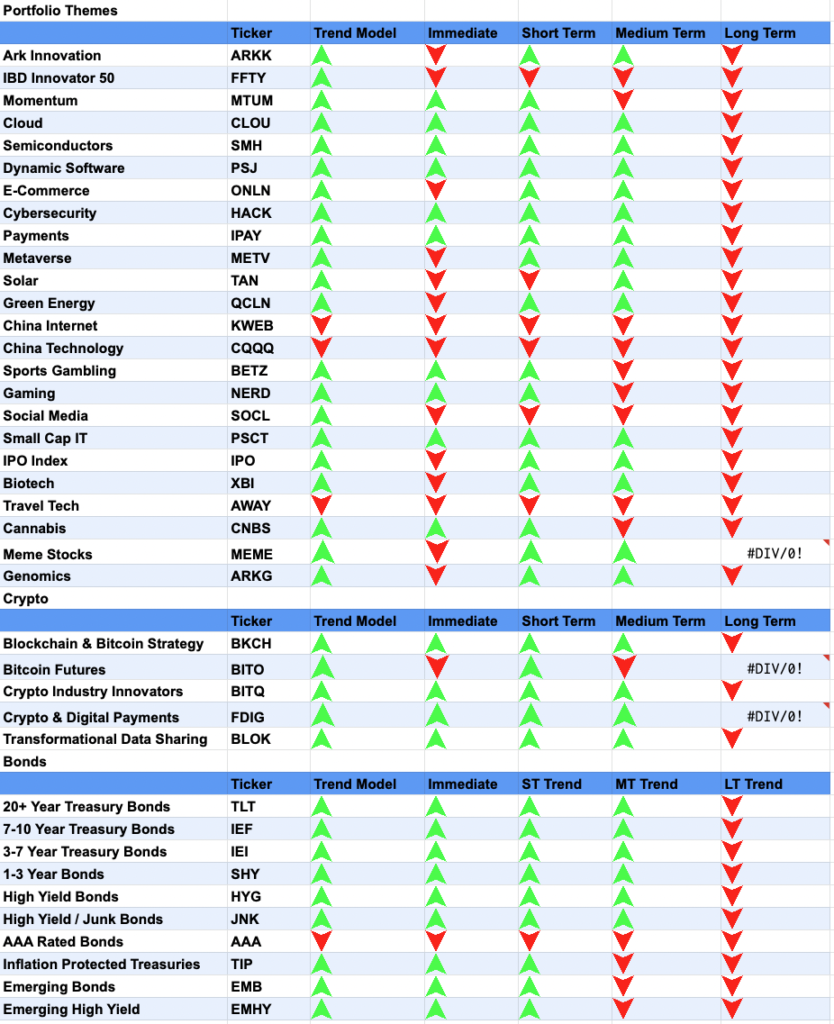

Market Trends

Which takes us to the market trends. We see that China large cap $FXI and Chinese internet $KWEB have not improved, suggesting the issues I wrote last week are being recognized by the market.

Aside from that, we see many more portfolio themes have turned up, such as semiconductors, cybersecurity, payments, and cloud.

High yield bonds have also turned up, suggesting that risk appetite is improving overall. Given how well bonds have been doing, I could open a position in them as a substitute for cash. The FOMC is this week, along with big tech earnings, which will ultimately determine where the market moves next.

Significant Tech Earnings Next Week

As mentioned above, any trends could quickly change after earnings next week. Here’s a quick list of some important themes.

- Semiconductors: Qualcomm, NXP Semiconductors

- Advertising: Google, Facebook, Roku

- Software: Microsoft, ServiceNow

- Consumer Electronics: Apple

- E-Commerce: Shopify

Earnings have been positive overall, but Snap showed the consequences of not executing, falling 39% on Friday.

As you can see, earnings next week will be important determining whether Snap’s issues are acute to them, or a reflection of the general economy collapsing.

New Position: Instructure (INST), 2%

Instructure sells cloud-based education services to universities. My grad school at Berkeley was a customer, and I know one of their first sales guys. Unfortunately he left on bad terms (lawsuits were involved), but he won them a shit ton of deals at the top universities before that went down.

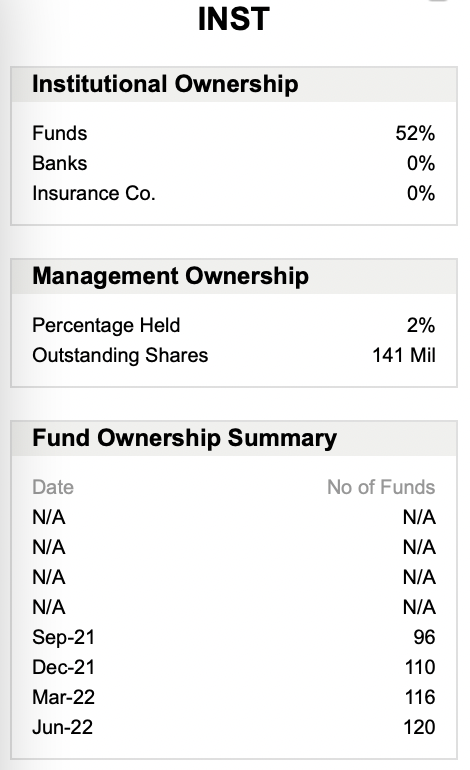

Ed-tech in general has held up very well. Duolingo $DUOL is another example, as well as Stride $LRN, and we see institutional investors have been building their $INST positions since IPO.

My guess on the thesis is that their revenue will be quite durable, and could even grow during a downturn. If people can’t find jobs, perhaps they go off for grad school.

Price has been consolidating above the 200-day (black line) since June 23rd, and I bought once price broke out above $23.53.

This level is near the IPO highs, and while we have seen a decent amount of selling whenever price approached this level, institutional investors have consistently accumulated this position.

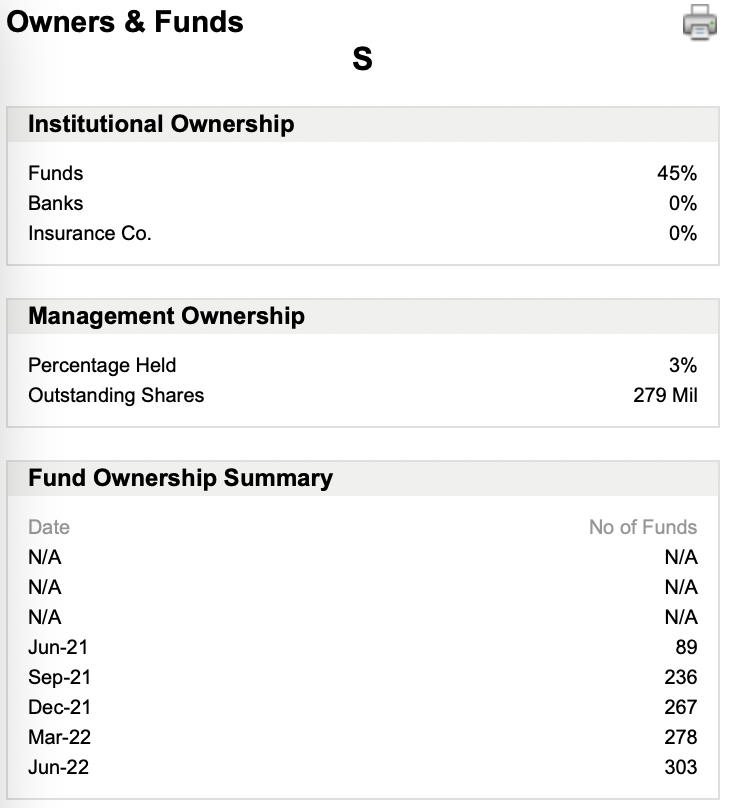

New Position: SentinelOne (S), 1.5%

My favorite cybersecurity name, price broke out of the downtrend that started in December, so I’m taking a shot on this.

This is another name that has seen persistent accumulation throughout this drawdown.

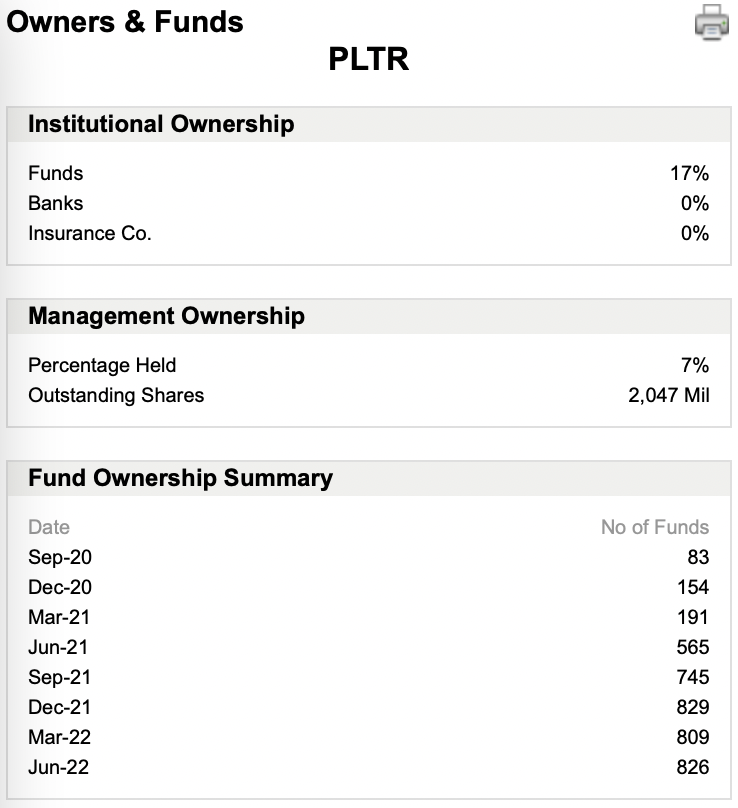

New Position: Palantir (PLTR), 2%

Same for Palantir, which is my favorite data name, also broke out of a long term downtrend.

Friday’s price action is suggesting a retest as of now. Aside from seeing decent accumulation volume, we also see that more institutional investors accumulated Palantir QoQ.

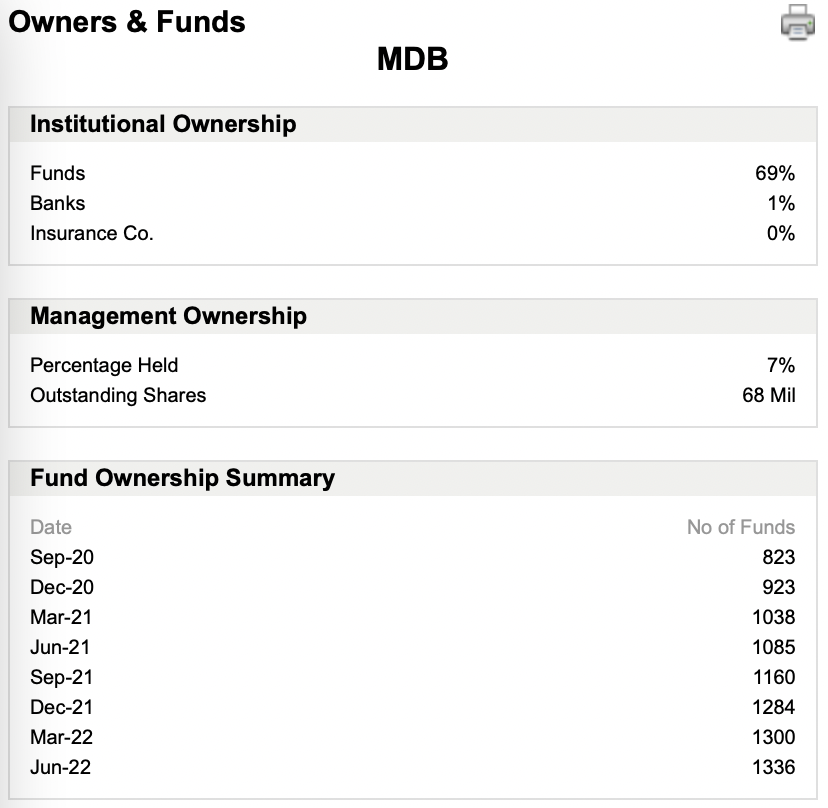

New Position: MongoDB (MDB), 1.9%

MongoDB has also seen significant accumulation. Unlike many tech names, this never let up.

And rightfully so, as MDB is executing on Atlas, their multi-cloud database offering. In fact, Atlas is growing at a faster clip than their overall revenue.

As you can see, MongoDB actually broke out of their downtrend a month ago on June 23rd, but I have been waiting for the 50-day moving average to smooth out (purple line).

Algorithms often sell into the declining 50-day moving average, and we saw that happen after the June 23rd breakout. Fast forward to today, and we see that MDB had a successful retest of the 50-day, and is maintaining a shorter term trend line.

I will likely sell this name, and others, if price breaks back below their respective 50 day moving averages. They all have significant upside once their uptrends resume, and I’ll happily take a small loss if now isn’t the right time.