Hey Everyone,

I hope you had a great week, let’s get into it.

Portfolio & Market Updates

My portfolio rose 1.3% this week, which was well below the S&P 500 (+3.7%), and Nasdaq 100 (+4.1%). Ark was up (+9.9%), and small cap growth $IWO was in line with the Nasdaq 100 (+4.8%).

Similar to why I have been outperforming over the past few weeks, my high cash position was unfortunately a drag this week. Which I saw coming, having called a bounce, but was premature when buying S&P 500 futures.

The bulls are back in control after Friday, thanks to a 91% upside day, and price closing above the 50-day moving average (purple line).

While I believe the bulls are back in control, the question is whether or not this momentum holds. Ark’s weekly chart shows how this market hasn’t done much, as there have only been 2 weeks of positive consecutive returns in 2022 (early August).

While this basing is constructive longer term (notice how much that 40 week moving average is coming down), I’m not missing on any uptrends by staying in cash.

Another Sign Inflation is Rolling Over

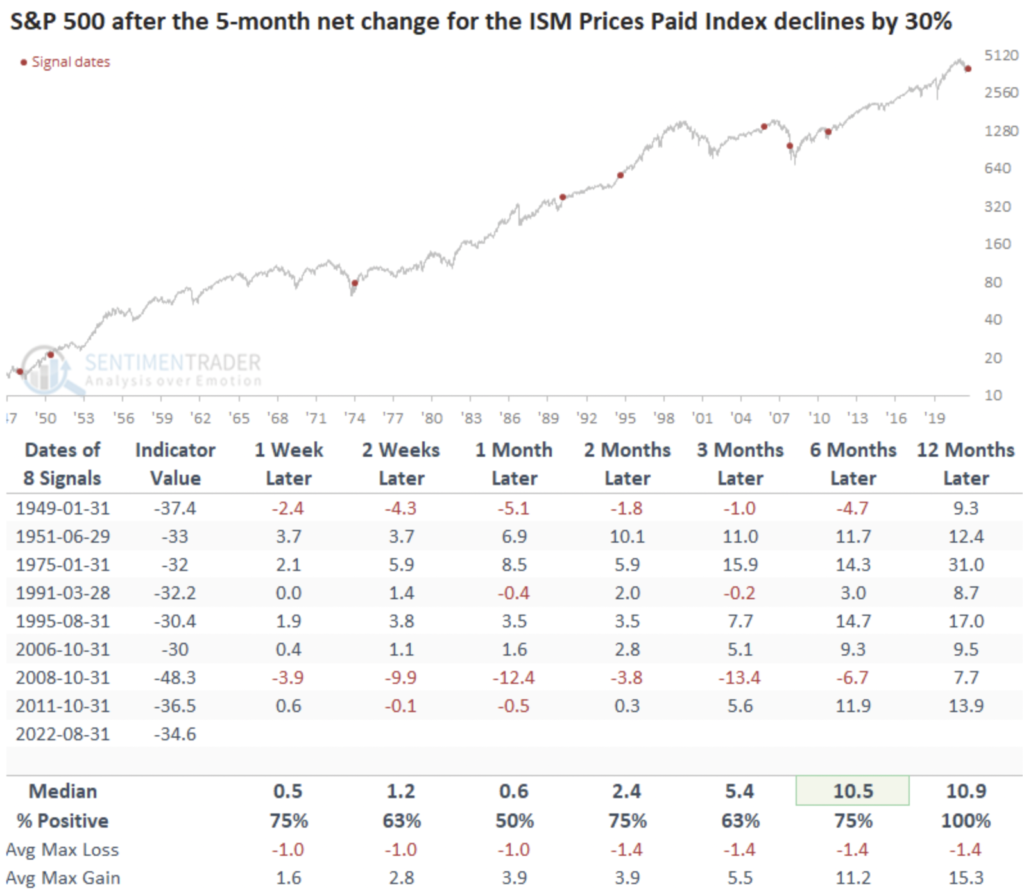

We’re nearly a month into my peak inflation claim from August 19th, and SentimenTrader found yet another data point supporting that thesis this week.

The Institute for Supply Management showed that manufacturing prices paid have declined by 34% over the past 5 months, the 5th largest decline in history. This makes sense, as I wrote that commodities have rolled over. Zooming out a year, and the S&P 500 had positive gains every time ISM prices declined by 30% or more.

Updated CPI numbers come out September 13th, and we’ll know then just how significantly inflation has fallen. Regardless of the print, I believe inflation rolling over is a matter of when, not if.

Bulls Retreating Again

This week’s AAII print was surprising, as the percent of bulls fell back down to 18%.

All of the positive sentiment from this summer’s run up has effectively disappeared. Looking at a 20 week moving average, which is roughly half of the year, you can see we haven’t been this bearish since the 90s.

Although September is seasonally the worst month of the year, I would be surprised if the market cratered with this much pessimism, which is why I opened positions in Enphase & Celsius near the end of the week.

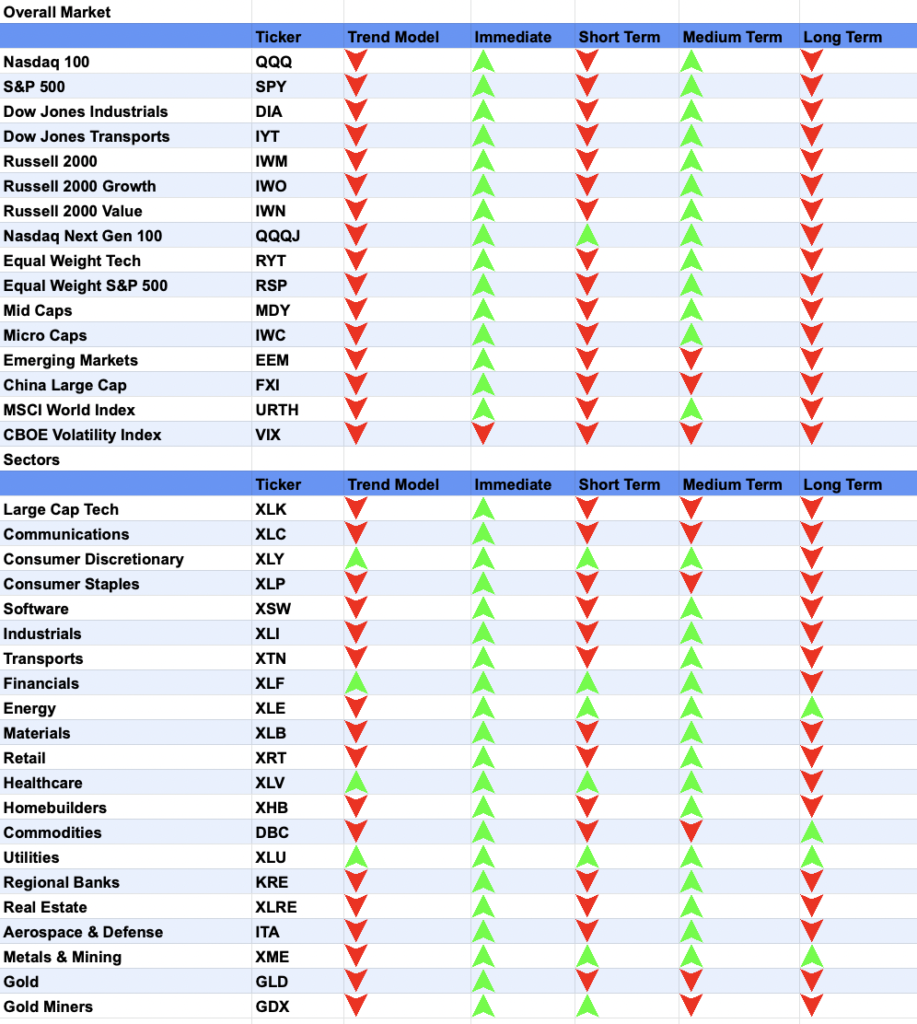

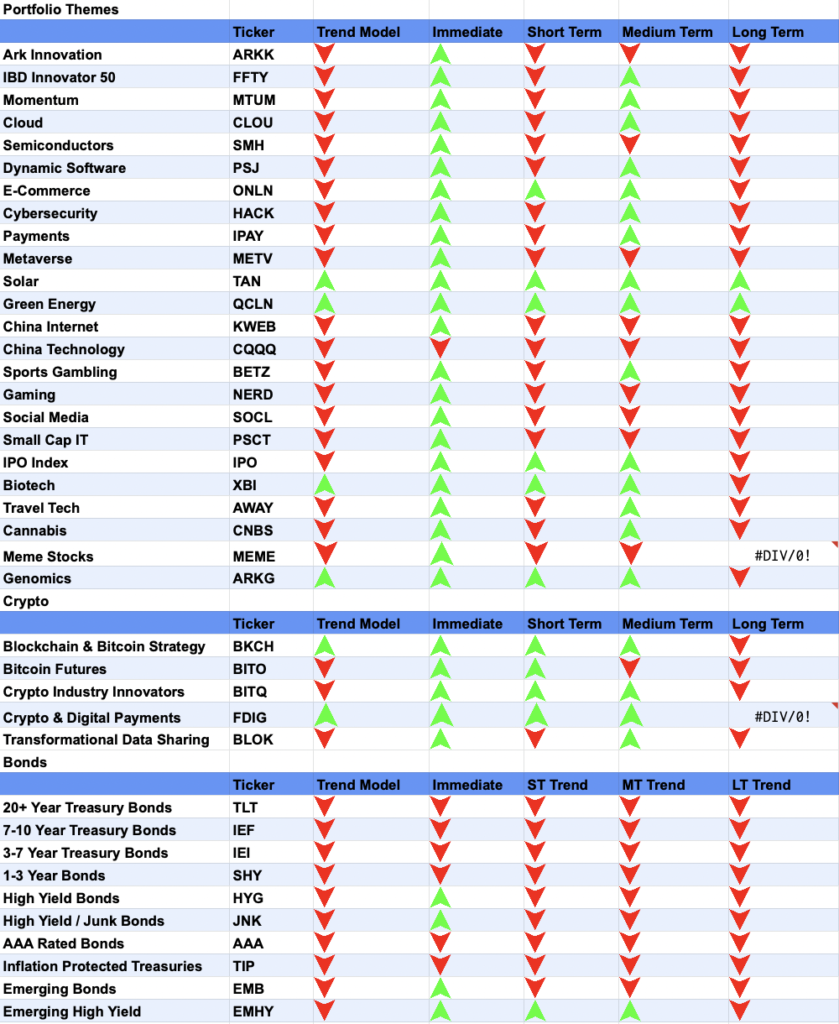

Market Trends

Which takes us to market trends, and while the general markets look better this week, solar and green energy are still the best in class.

Aside from green energy, bond yields may have started rolling over, which would be bullish for bonds. I stated last week that “I don’t believe we’ll eclipse this 3.45% number, given the disinflationary news we’re seeing”.

Yields increased to 3.3% this week, but we still aren’t at those June highs.

If those highs aren’t eclipsed, bonds may be a compelling opportunity. 20 Year Treasury Bond ETF $TLT shows this, with the RSI making a higher low, while price made a lower low. We often see these bullish divergences during a bottoming process.

I may capitalize on this, either through $TLT or through Ultra 10-Year Futures $TN. If my thesis about inflation rolling over is right, yields should roll over as well, meaning bonds would have significant upside.

New Position: Enphase (ENPH), 7%

I last showed Enphase’s chart in the August 26th update, and I opened this position once price held above the former highs at $308. My June 24th summary explains Enphase in detail

The solar leader sold off on Friday, but buyers stepped in throughout the day. Zooming out, we see that while the S&P 500 is back at late July prices, Enphase is up significantly higher.

Since Enphase has held steady while the market fell, I’m betting that Enphase will hold stronger if the market declines again.

New Position: Celsius Holdings (CELH)

Same logic with Celsius, a fitness energy drink.They shot up 11% after announcing a distribution partnership with Pepsi on August 1st, and has consolidated ever since.

Celsius has been outperforming since May, and I opened my position once price broke out of their last correction.

Aside from their relative strength, I can’t help but think of Monster Energy Drink when I imagine Celsius’ potential. Monster is one of the best stocks ever, having appreciated 37,000% over the past 18 years.

Clearly there is a market for Celsius, and I’ll park my money in this momentum name while I wait for direction in my focus companies, namely SentinelOne & Datadog.