Hey Everyone,

I hope you had a great week, here’s a quick summary of my plan:

- I believe this advance is a bear market rally

- It’s possible that we rally after the expected mid-December decline

- 90% upside day will be needed for this

Quick reminder that I’m hosting a webinar on Tuesday, December 13th, at 3pm PST. Hopefully you can join.

Portfolio & Market Updates

My portfolio was down 13.2% this week, which is far below all comps:

- S&P 500 (-3.4%)

- Nasdaq 100 (-3.6%)

- Ark (-9.2%)

- Small Cap Growth $IWO (-5.4%)

This loss was hopefully due to a lag between the bond market (yields) and equities, instead of totally miss the market’s direction. If it is timing, this loss should quickly be made up next week. My additional error was in not buying bonds. I almost always buy and short bonds when I expect a change in the 10 year yield, and that omission proved costly this week.

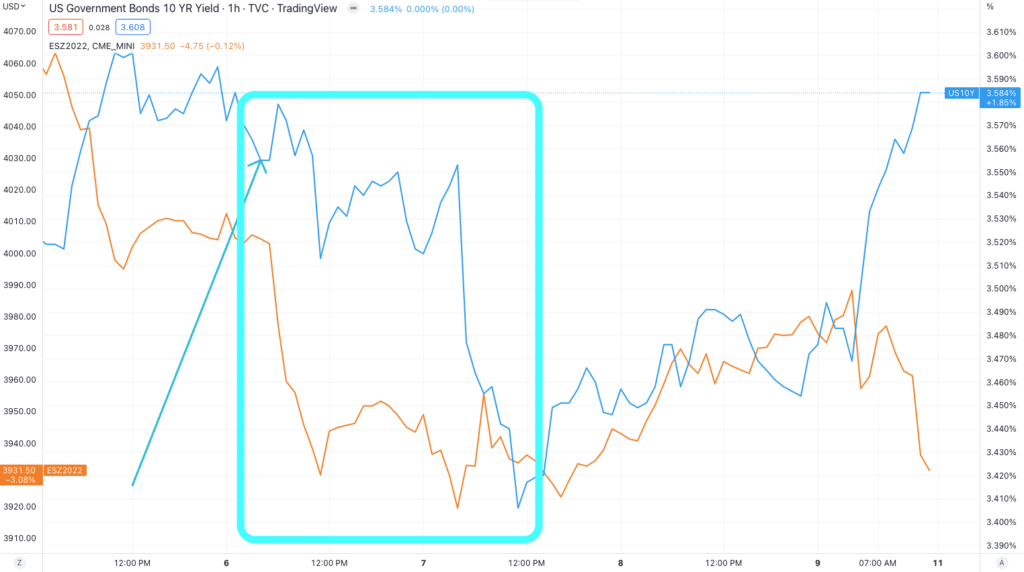

Yield & Equities Inverse Correlation, Lag or Miss?

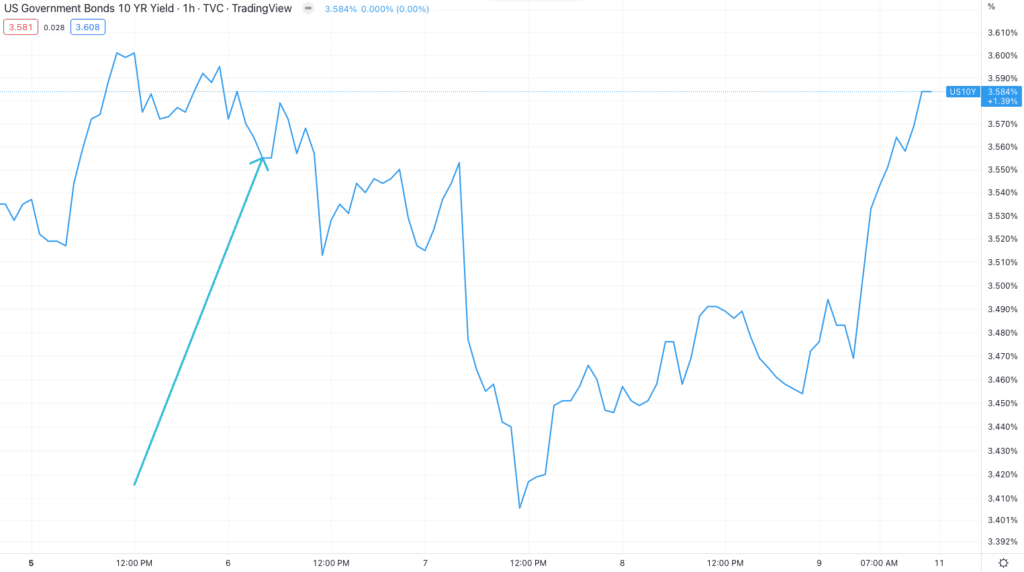

I bought my current holdings at Tuesday before 5am PST expecting yields would roll over, and pretty much nailed the timing (light blue arrow).

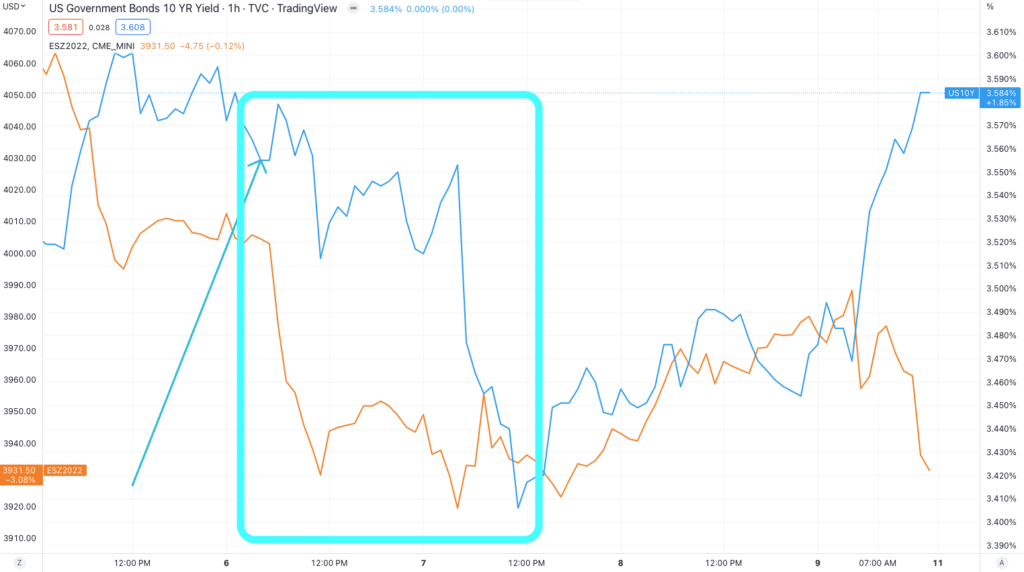

Unfortunately, though, equities did not follow along with the change. Overlaying the S&P 500 futures (orange) with where I bought (blue arrow), you’ll see equities fell with yields.

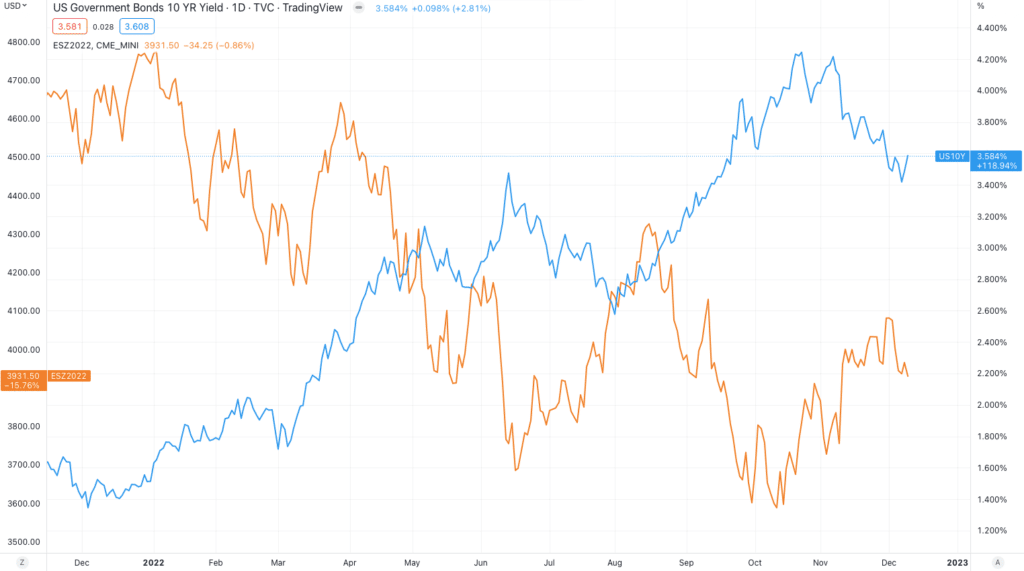

Which is very uncommon in this bear market. Zooming out throughout the year, you’ll see how consistent this inverse correlation has been.

Which is why I’m still leaning towards a move up over the short run, and why I haven’t closed these longs or hedged them. I’m disappointed in this week, but my bias still leans towards making up for this towards the middle of December.

More importantly, I don’t see any reason to hedge (short) my equities when yields are clearly declining. If I did that consistently, I would have already run out of money.

And even though the 10-year shot up towards the end of day Friday, we’re still seeing a consistent trend of lower highs and lower lows throughout the month. Meaning, I expect yields will keep declining next week.

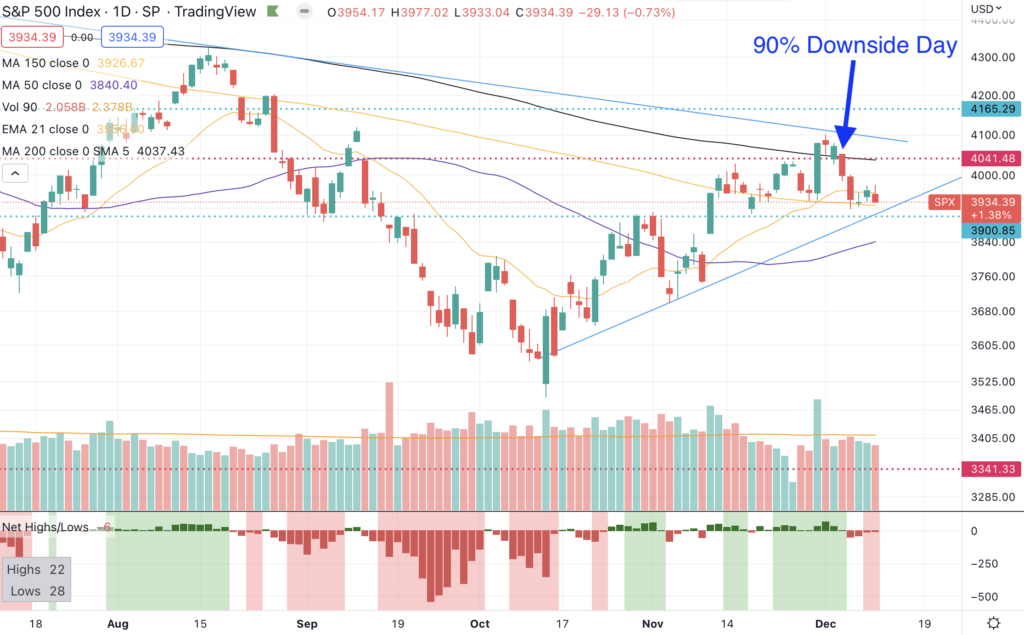

The S&P 500 had a 90% downside day on Monday, which I wrote on Slack puts the ball back in the bear’s court.

I was already writing that I was bearish towards the middle of this month, so we’ll need heavy demand (>90% upside day) for a possible end of year rally.

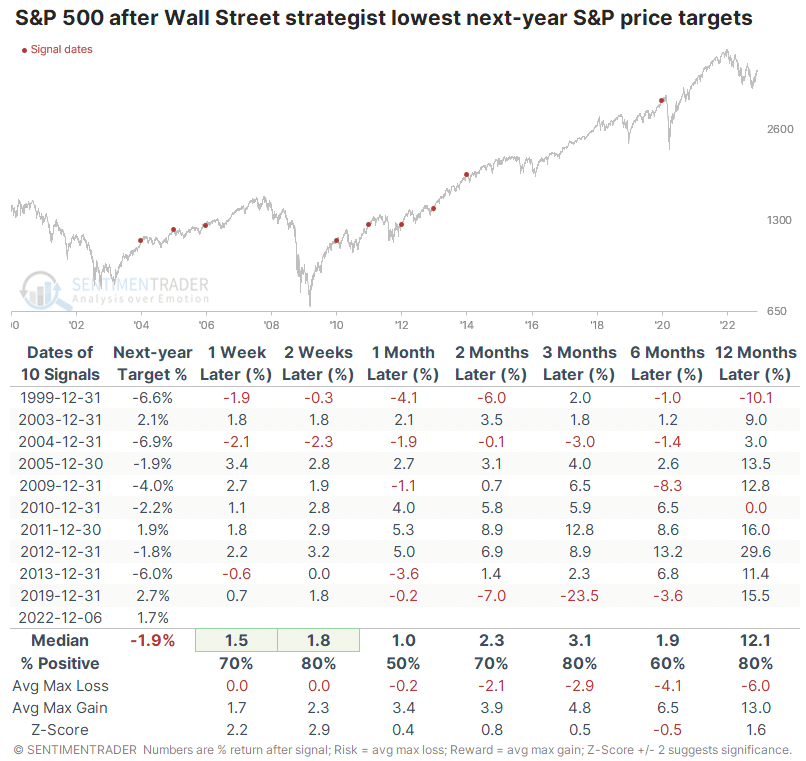

Wall Street’s 2023 Pessimism Good News for Bulls

Wall Street strategists haven’t been this bearish over the past 22 years, and SentimenTrader shows that the market generally does well when everyone is this negative.

You’ll notice that the market could keep dropping after this negative sentiment, but the market averaged 12% returns 12 months out, with only the Depression in 1931 being negative.

Clearly a lot of bad news is already priced in, and we’ll need much more bad news if we want a repeat of the Great Depression.

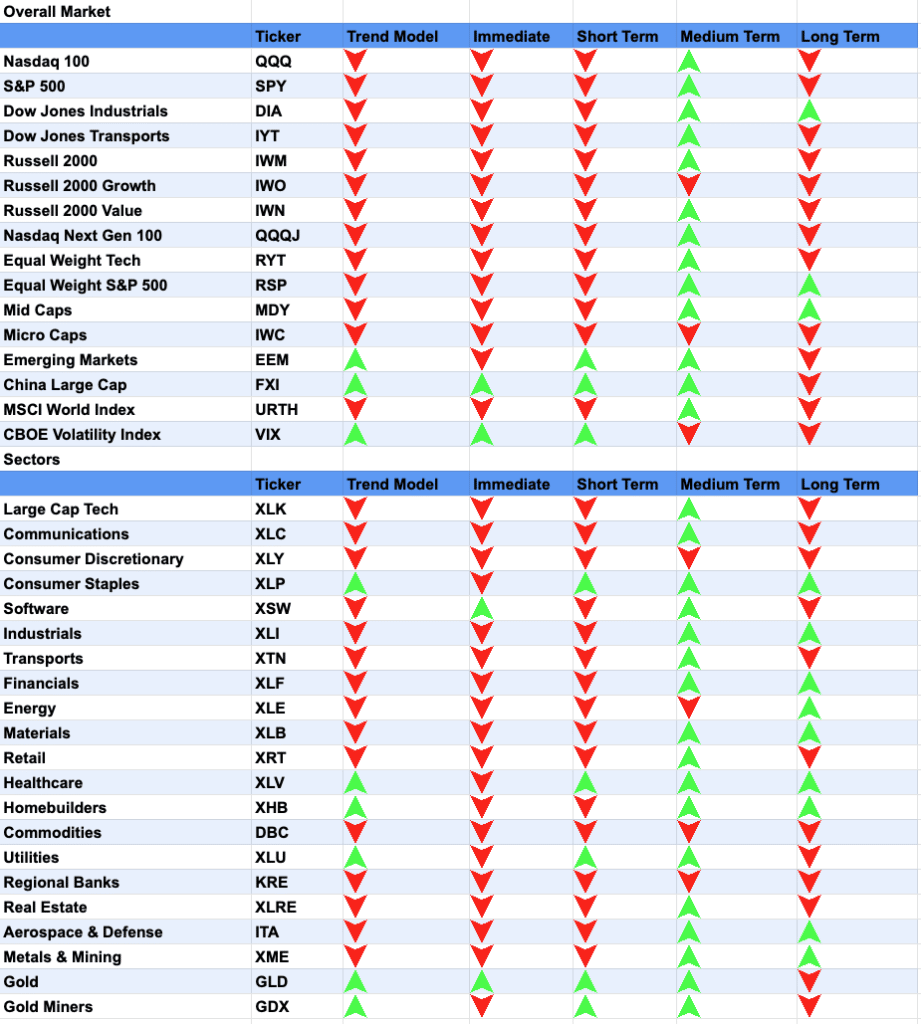

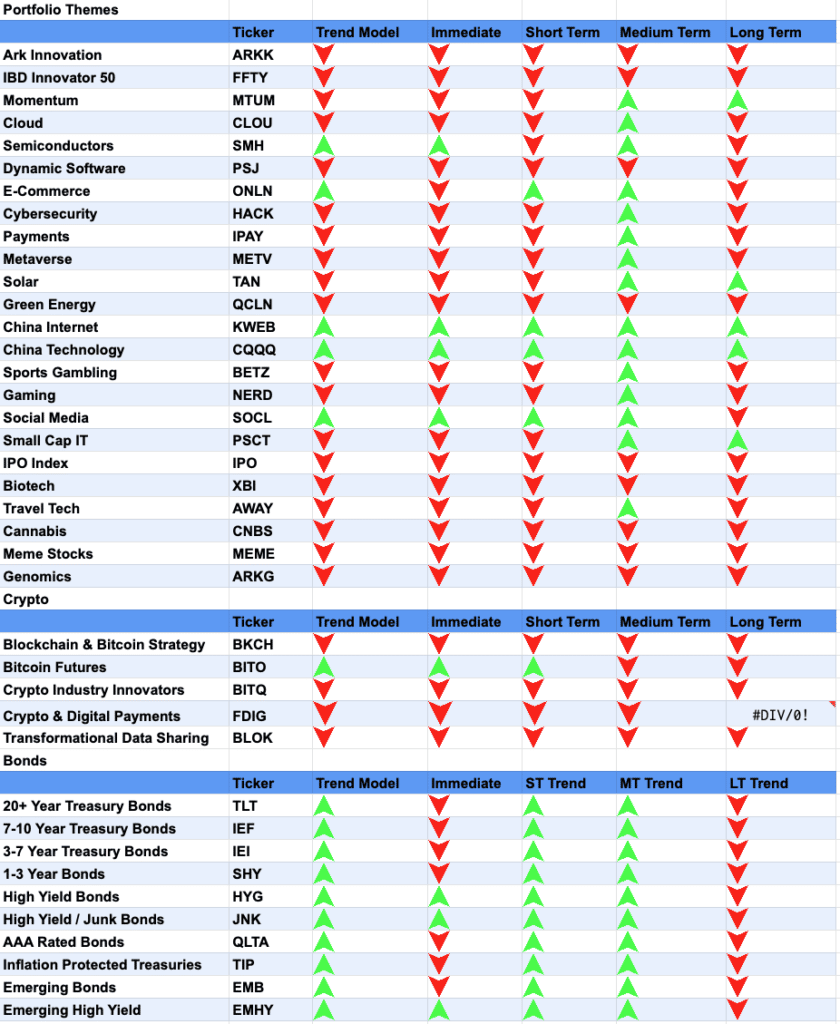

Market Trends – Turned Down, As Expected

Remember when I wrote two weeks ago why I felt my market trends are misleading, and doubled down on that last week? Unfortunately, all it took was 5 business days for nearly everything to turn red.

Some sectors are still holding up, and China stands out after writing about them last week. The rejection has been quick for the rest, unfortunately, which is another reminder about how painful bear markets are. I’ll quantify this pain in next week’s webinar.

Futures: Long S&P 500 (ES), Nasdaq 100 (NQ), & Dow Industrials (YM)

I thankfully missed Monday’s bad drawdown (technically I made money going long for a few hours), but my Tuesday entry is driving this week’s underperformance.

After the market closed on Monday, I wrote that “I am expecting one more leg down before a 2ish week bull run”, and changed my mind once I thought the 10 year yield would roll over. Here’s that chart one more time showing the yield rolling over, and equities not following through.

Even if I was just wrong about the timing, I should have bought bonds as well, as they are literally what drive yields. Doing so would have blunted the loss in equities, and I apologize for not doing so.

We should know early next week whether this was a miss, or if my timing was off. Either way, I’ll let you know when my short-term bullish sentiment changes, and will keep you updated on whether I’m expecting a drawdown or rally towards the end of month.