Hey Everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- I was short equities, and stated that I may hedge these positions long, fearing a bounce.

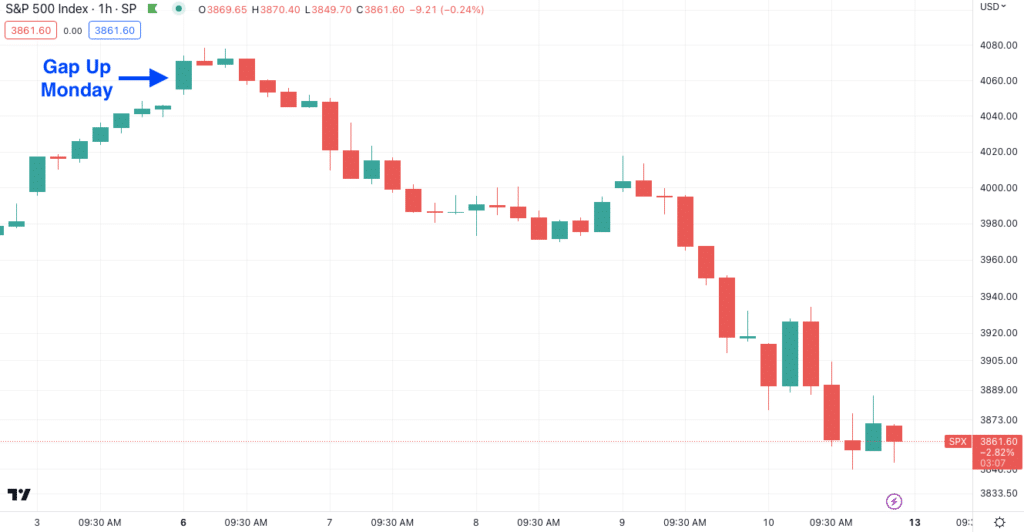

That “bounce” happened faster than anticipated, as Monday morning opened with the S&P 500 gapping up over half a percent. The following day, my bearish thesis was realized.The S&P 500 fell 4.8% from Monday’s open.

Currently I’m neutral equities and short bonds and gold. I believe equities will bounce from this selloff, and that the recent bond and gold rally will mean revert. I’m still bearish over the intermittent term (4-6 weeks).

Portfolio & Market Updates

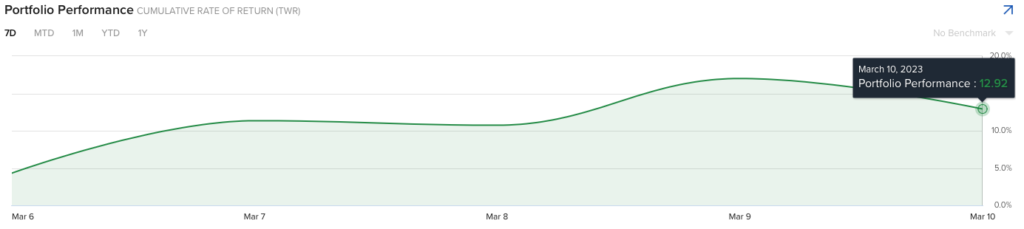

My portfolio rose 12.9% this week, as my short thesis was realized. Seeing that the market fell substantially, I blew out all my comps.

- S&P 500 (-4.6%)

- Nasdaq 100 (-3.8%)

- Ark (-11.0%)

- Small Cap Growth $IWO (-7.8%)

Unfortunately my bond and gold shorts are not doing as well for now, which explains most of Friday’s drop. I believe the bond rally is thanks to Silicon Valley Bank shutting down, and will expand on that below.

SVB’s Closure Fueling a Bond Rally, Signaling Countrywide Bank Run

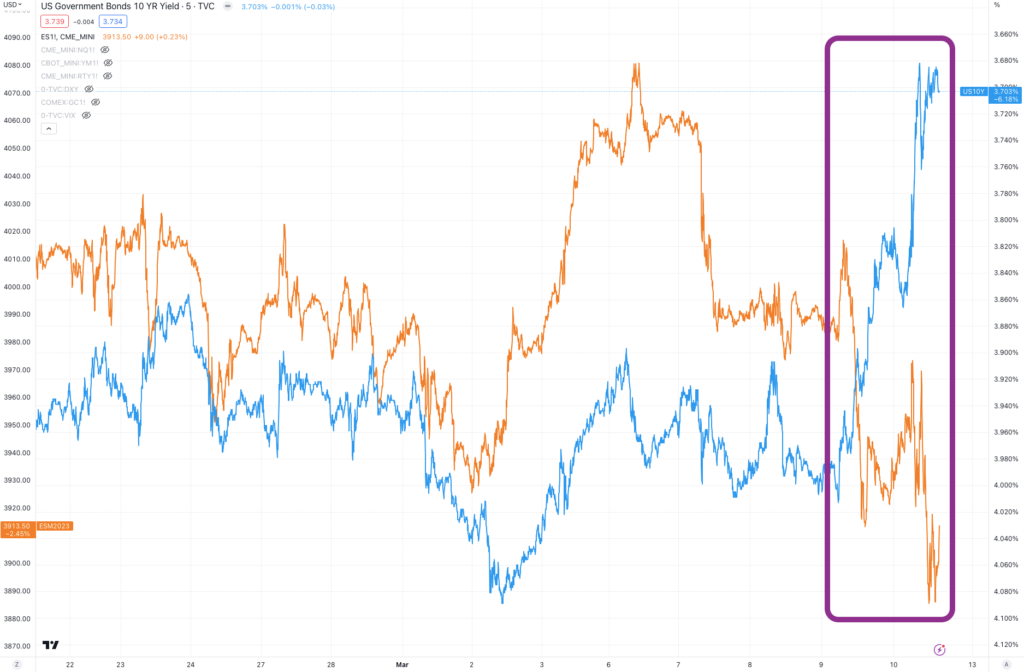

The correlation between inverse yields (blue line) and equities (orange line) broke at the same time concerns about Silicon Valley Bank were raised.

When this correlation breaks, my bias typically leans towards the bond market, as they manage exponentially more money than equities.

This time, I’m not so sure. I believe falling yields are signaling the start of a country-wide bank run, where companies are moving cash out of deposits and into bonds. In other words, bonds will keep outperforming even as the overall market falls, as reflected by equities.

If the Federal Government fully backstops SVB’s deposits, as well as deposits at all other banks, I believe Friday’s bond rally will subside. If not, I believe that Friday’s bond rally will be the start of a countrywide bank run.

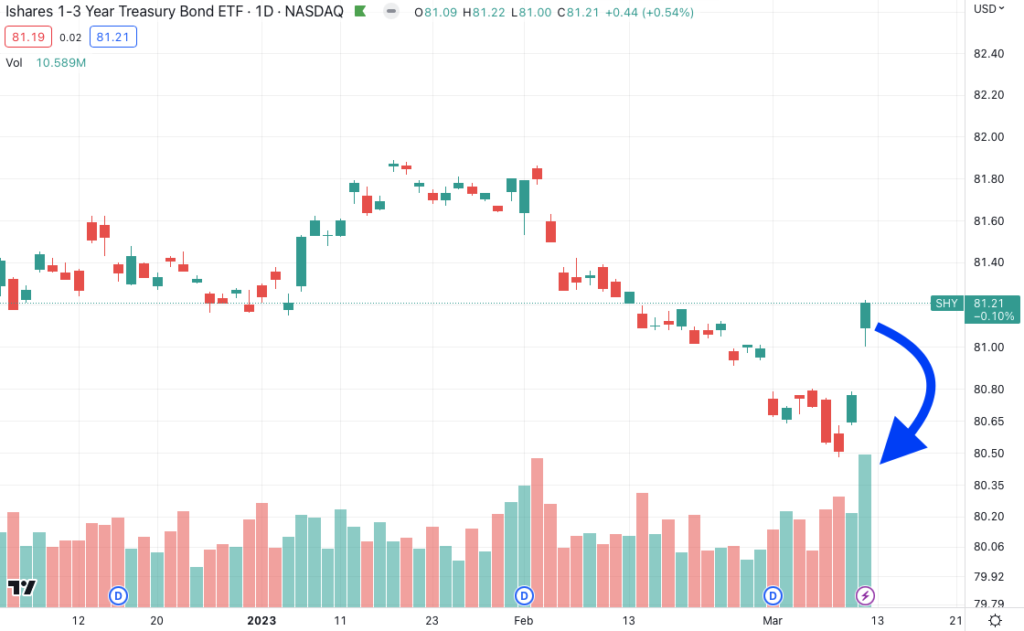

1-3 Year Bond ETF $SHY shows the rotation out of deposits and into bonds, gapping up half a percent on Friday with huge volume.

Only 2.7% of SVB’s deposits were FDIC insured, as business deposits >$250k make up the lion’s share of overall deposits at banks. No idiot would keep their money at a bank if there’s a remote possibility that it disappears. Cash will rotate out, and that cash will likely be parked in US treasury bonds.

All regional banks will then implode, and the USA will be left with the Big Four: JP Morgan, Bank of America, Wells Fargo & Citigroup.

Given this severity, I believe that the government steps in, which could end this bond rally. In the meantime, I must say how surprised I am that Yellen’s only comment has been that she’s monitoring the situation. The longer this uncertainty persists, the more deposits will be pulled, and more regional banks will be gone.

Retail Finally Rolled Over

I have been warning about this since January 6th (“retail optimism could fuel the next drawdown”), and was clear on February 3rd that no rally could happen while retail was that exuberant.

Why would market makers bid up stocks when retail is making them so expensive? Why not remove them from the equation first and buy the same shares cheaper?

Retail started cracking last week, and we got our first sense of capitulation over the past couple of days. Similar to Ernest Hemingway going bankrupt, as well as SVB’s collapse, these drawdowns happen gradually, and then suddenly.

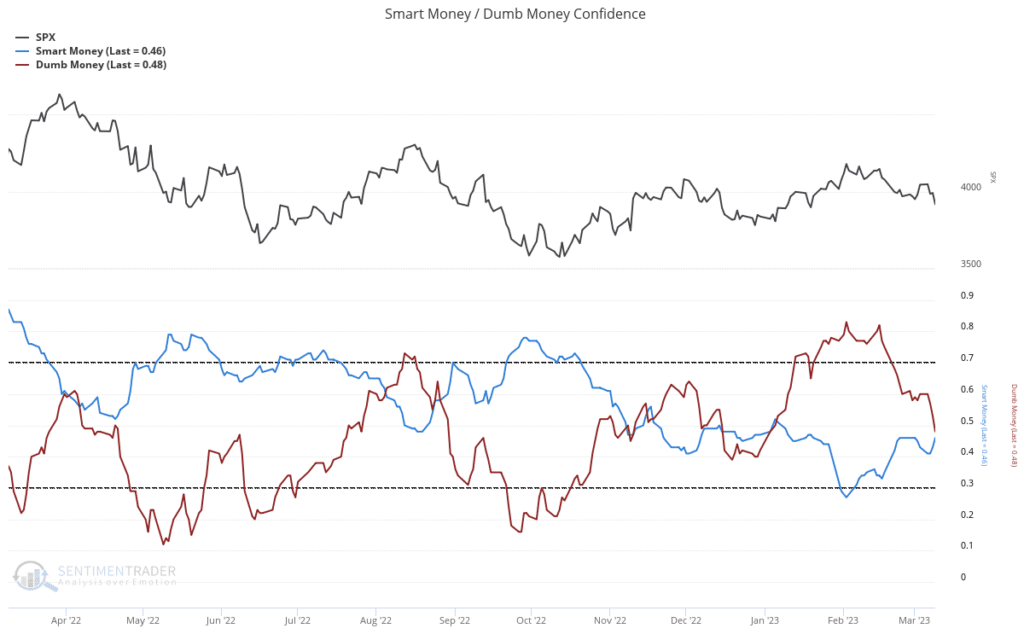

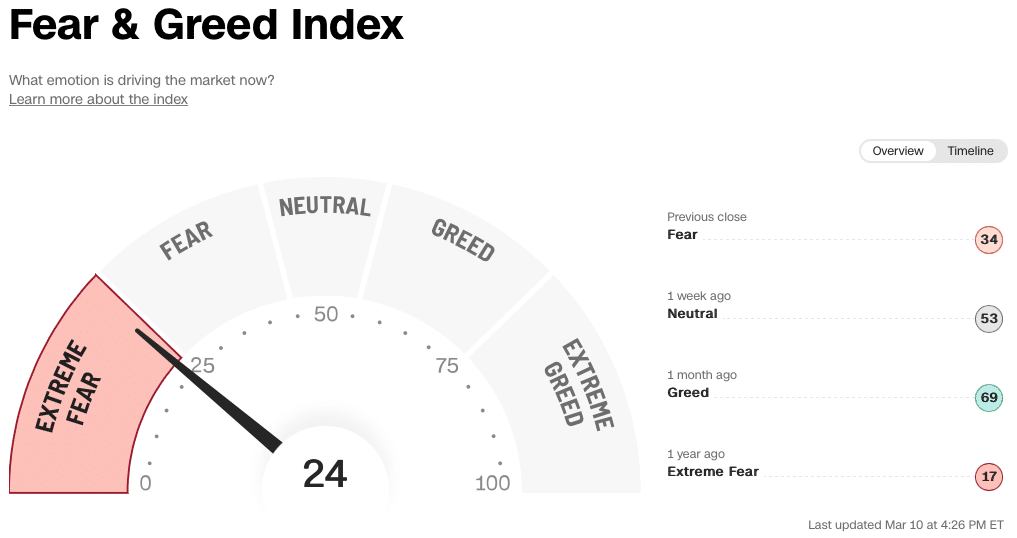

Which is another reason why I’m looking for a bounce early next week. Retail sentiment is getting pretty bearish, while smart money (blue line) is getting more optimistic, and the CNN Fear & Greed Index is now flashing “Extreme Fear”.

While I’m bearish longer term, I believe the market needs a little more optimism before another sustained drawdown. If we get a run on regional banks, though, all bets are off.

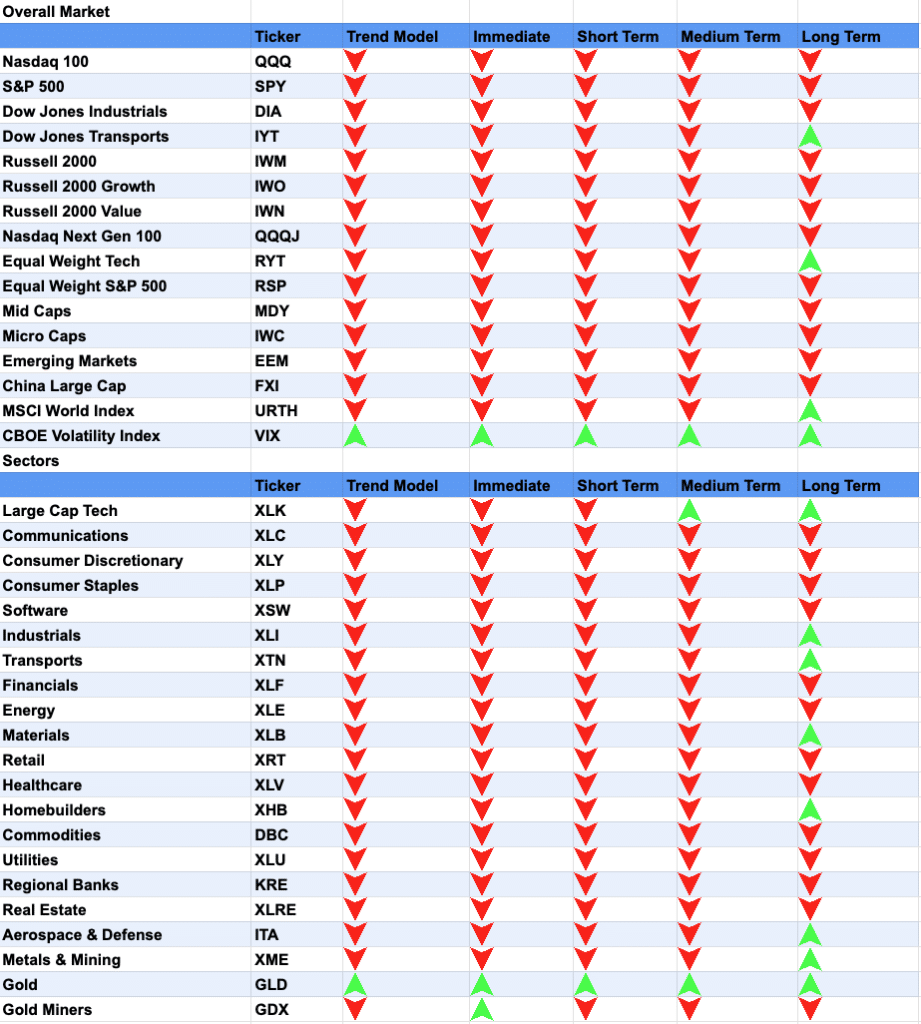

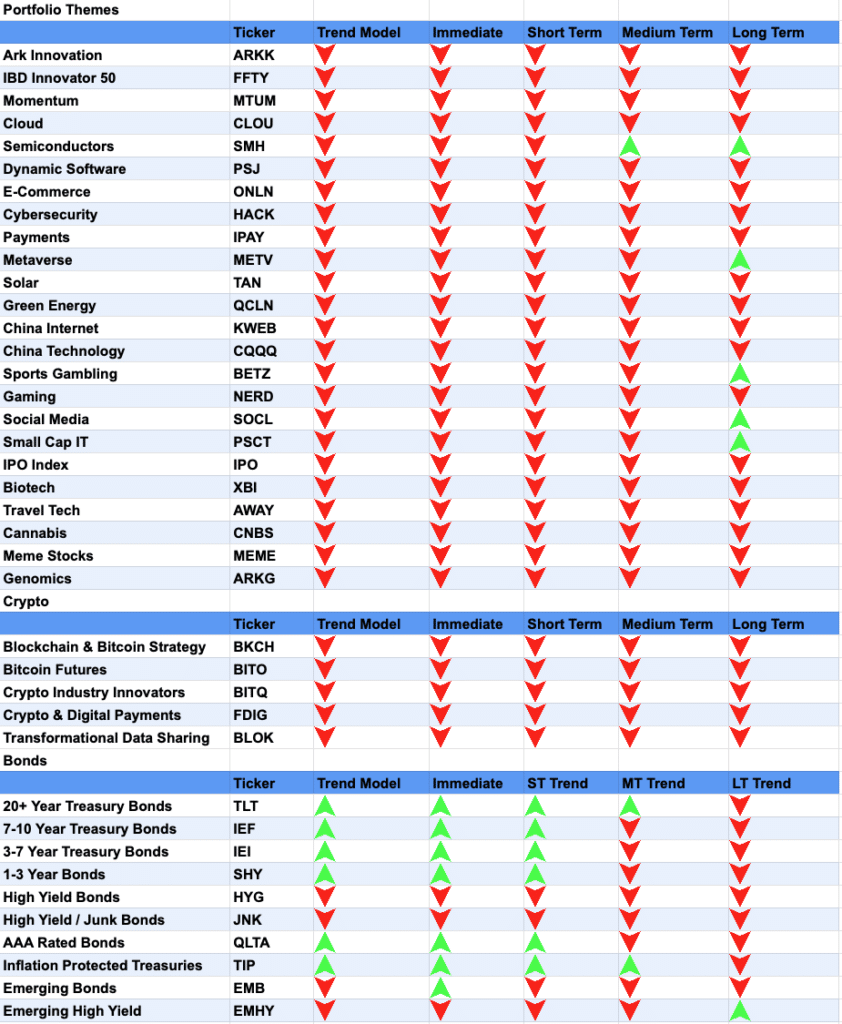

Market Trends – Semiconductors & Sports Gambling Holding Up

Market trends quickly turned south this week, which I hope wasn’t a surprise. Since February 17th I explicitly called out how deceptive equity was looking, as bonds were not confirming the bullishness

Far more money is in the bond market, making it much more difficult to manipulate. Given that, my bias typically leans towards the bond market.

Semiconductors and sports gambling are holding up the strongest as of now. The names who hold up the strongest during this drawdown will likely be winners in the next rally, let’s see how long this drawdown lasts.

Futures: Short Bonds & Gold, Neutral Equities

I hedged up my equity shorts Friday morning, and even went long expecting a bounce. That was poorly timed, but the risk was also minimal, so I hedged back neutral for a slight loss. I’ll likely go long early next week as well.

I also doubled down on my bond short, as bonds could be topping.

Similar to equities, this is also fairly low risk. If $TN breaks above recent highs at around 119’16, I’ll cover my short for a slight loss. If this bond demand subsides, and yields increase, we could have a decent drop ahead of us. Let’s zoom out on $TN.

That’s quite a rally, and even some slight mean reversion would be profitable. If bonds fall, that means yields will rise, which should cause the dollar to rise as well. Here’s the correlation between yield (blue) and the US Dollar (orange).

If the dollar does appreciate by following yields up, commodities like gold should fall, which will help my gold short.

There are clearly a lot of hypotheticals, which is why I’m hedged equities and have a tight stop on bonds. This bond and gold rally could squeeze higher, which I can thankfully absorb with my equity gains. Once that rally subsides, though, my bet is that there will be a decent drop in bonds and gold.

CPI comes out Tuesday, and a cold number could totally blow up this thesis. If the facts change, I’ll change my mind as well.