Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Neutral equities, long equities and gold

And what a difference a week makes. Price gapped up above the 200-day moving average on Thursday (black line), and has not looked back.

While this is great news for bulls over the intermittent term, I’m not ready to go all-in on longs just yet. Historical gap ups with the S&P 500 show why (blue circles).

Notice how these gap ups have previously caused retracements. I’m not expecting lower lows like the prior two instances, but I also wouldn’t be surprised if price took a slight breather early next week.

Given that, I’m slightly bearish early next week, and bullish over the next several weeks. Ideally, I’ll close my short hedges at lower prices, and will open up some new positions afterwards.

Institutional Buying Has Returned

Both bullish signals that I waited for happened this week.

- Follow-through day on November 1st

- Back to back >80% upside days (blue box)

Only thing bulls missed was a selling flush, but we have been missing those all year. With the positive seasonality I have been writing about, I don’t believe now is the time to be bearish.

The beauty of follow-through days is that if they fail, you normally aren’t losing much. My follow-through day page has charts for reference.

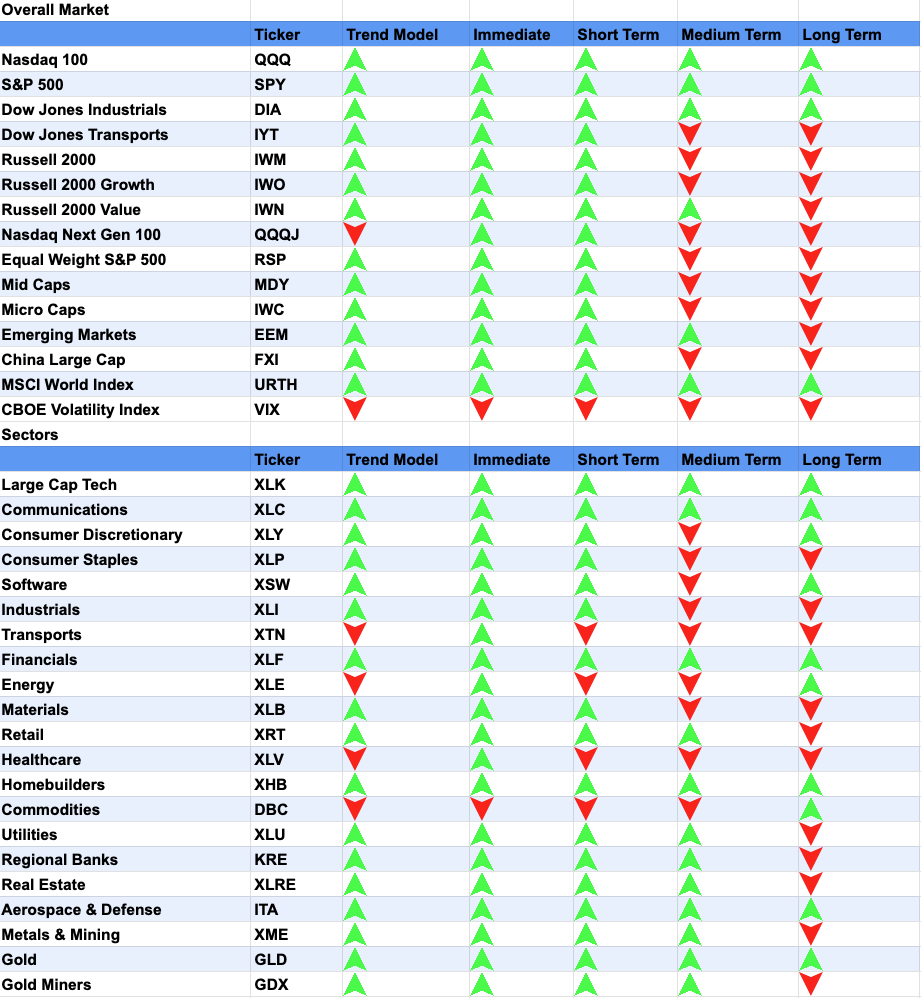

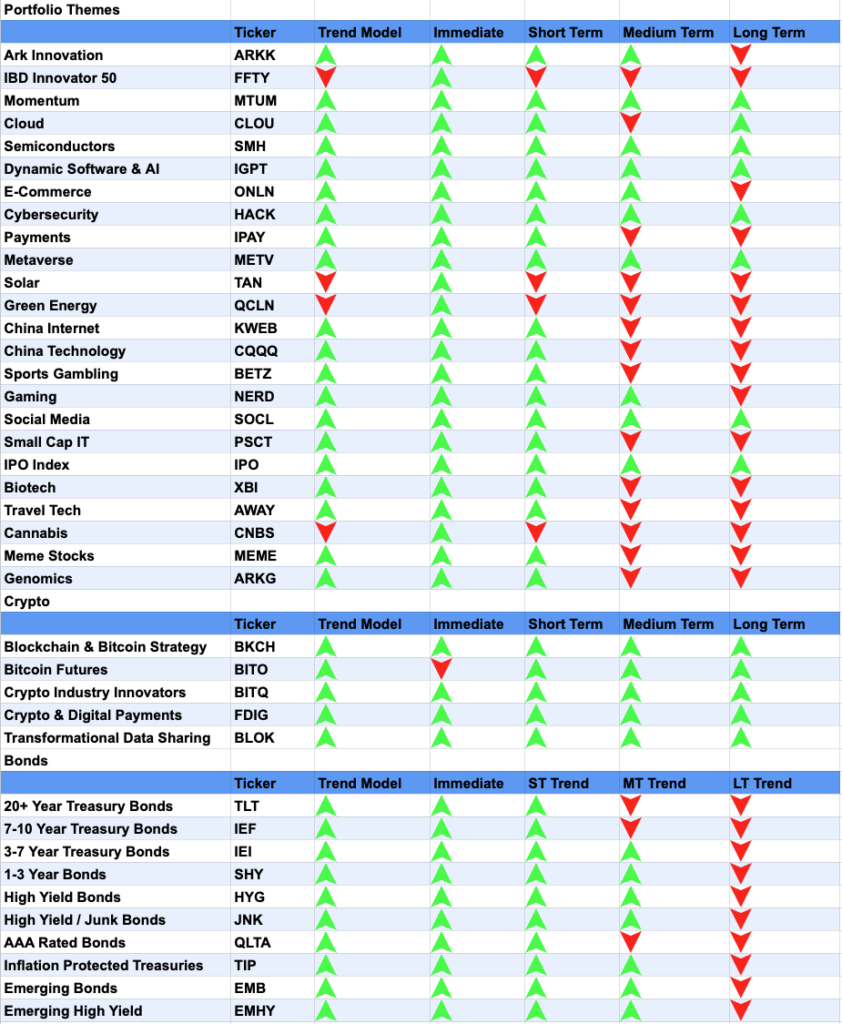

Market Trends – Small Caps Underperforming

As for market trends, the same winners are leading. Namely semiconductors, cloud, and cybersecurity.

For some reason, though, small caps have not recovered as much as large caps. The IPO index being the exception. Just look the Russell 2000 chart since 2019.

Given that investors are not rolling money into small caps, I plan on focusing on larger names.

One of them is an old favorite of mine, The Trade Desk.

This name closed under the 200-day moving average for a couple days, and violently bounced back after Powell’s pivot.

Another name I may double down on is Samsara.

After flirting a couple days with the 200-day moving average, Samara rose 10% today with heavy buying. It seems like institutions are once again accumulating this name.

Futures – Neutral Equities, Long Bonds & Gold

My bond position rose dramatically this week after Powell’s pivot. My equities hedge was a safety precaution, given that we closed below the 200-day moving average, and I hope this will be covered at an early price early next week. Assuming that happens, I plan on opening some more positions next.

We’ll see what happens next week, take care in the meantime.