Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Neutral equities, long equities and gold

In hindsight, I should have went long equities, as the S&P 500 appreciated 1.3% this week. The Nasdaq 100 was up 2.9%.

But Powell showed just how cautious this market is on Thursday. During his famous “close the f*cking door” speech, the S&P 500 fell by 1% in just over an hour.

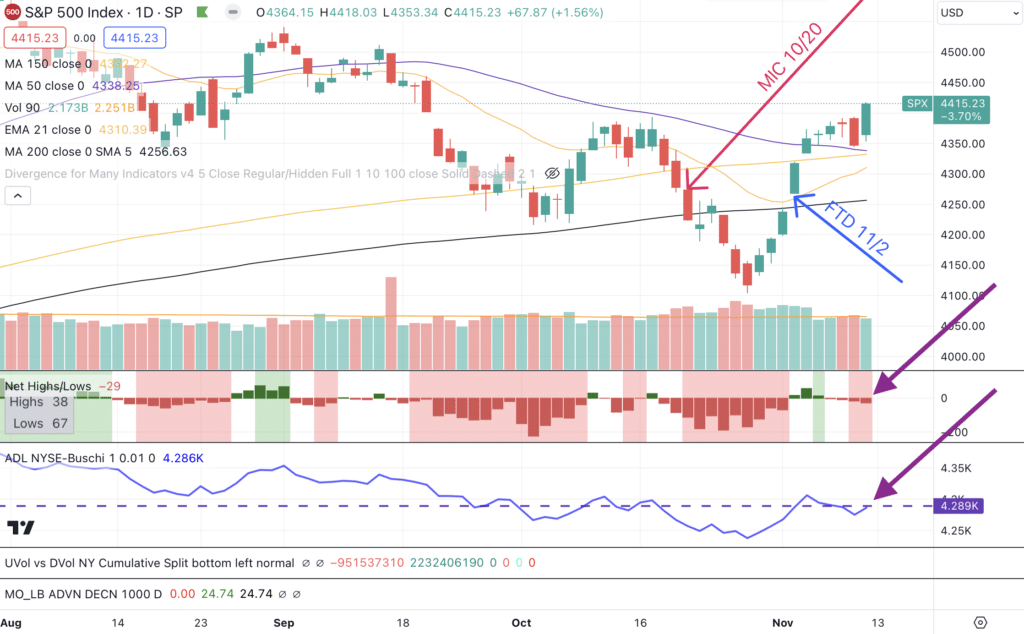

And I believe breadth is one of the reasons why the market can fall so quickly. As you can see below, the S&P 500 had 4 straight days of net lows this week, despite the index advancing overall (upper purple arrow).

This is mirrored with the advance decline line (lower purple arrow), which is significantly lower than mid-October, the S&P 500’s last intermittent high. Once again, it seems like far fewer stocks are participating in this rally.

While that’s why I’m holding on to hedges over the short term, I believe more evidence is mounting for a bullish rally over the intermittent term. We saw institutional buying return last week, and this week had the 1st Zweig Breadth Thrust since 2019. So while I’m still neutral equities, I’m bullish longer term, and am looking for a lower level to close out my hedges.

1st Zweig Breadth Thrust Since 2019

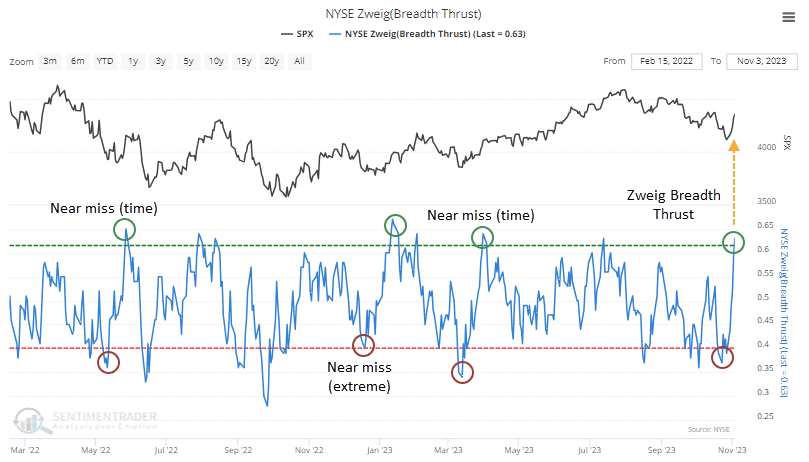

Made famous from Martin Zweig, the first Zweig Breadth Thrust happened since 2019. It is computed by calculating the number of advancing issues on an exchange, divided by the total number of issues (advancing + declining) on it, and generating a 10-day exponential moving average of this percentage.

The indicator signals the start of a potential new bull market when it moves from below 40% (indicating an oversold market) to above 61.5% (indicating an overbought market) within any 10-day period.

And as SentimenTrader shows, this breadth thrust finally triggered after several close calls.

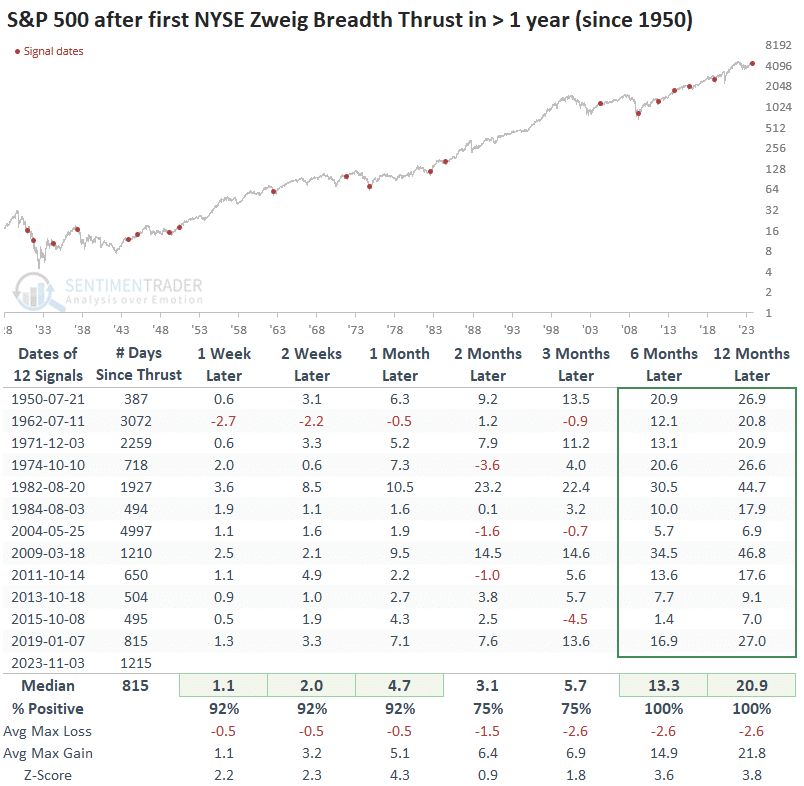

There have been 12 breadth thrusts since 1950, and the average returns 1 year later was 20.9%. On top of that, the market has never declined 6-12 months after.

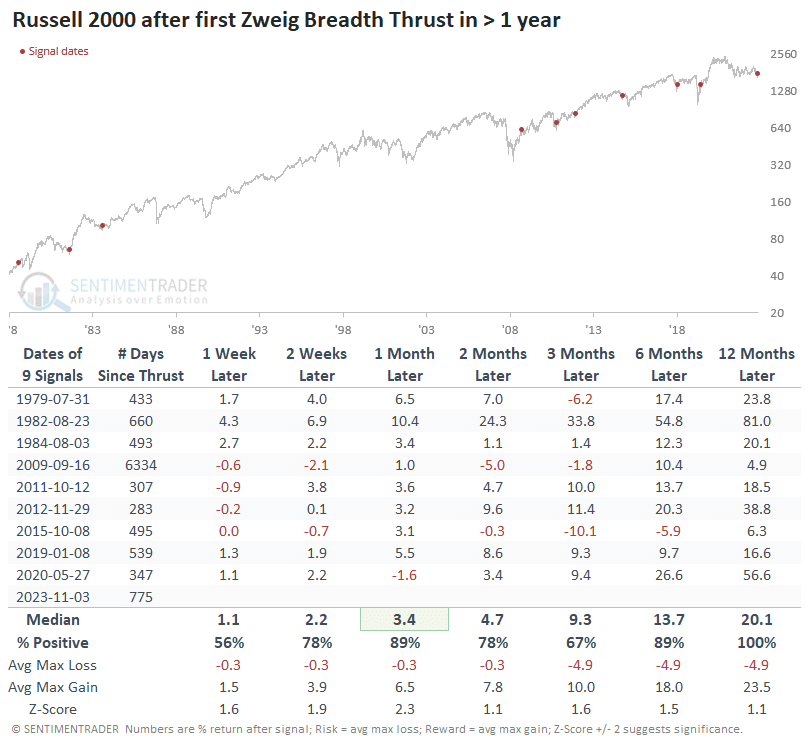

Even small caps, which have been struggling, flashed their own Zweig Breadth Thrust, suggesting that they could finally rebound as well.

So lots of bullish stuff is happening, I’m just waiting a little longer before releasing my short hedge.

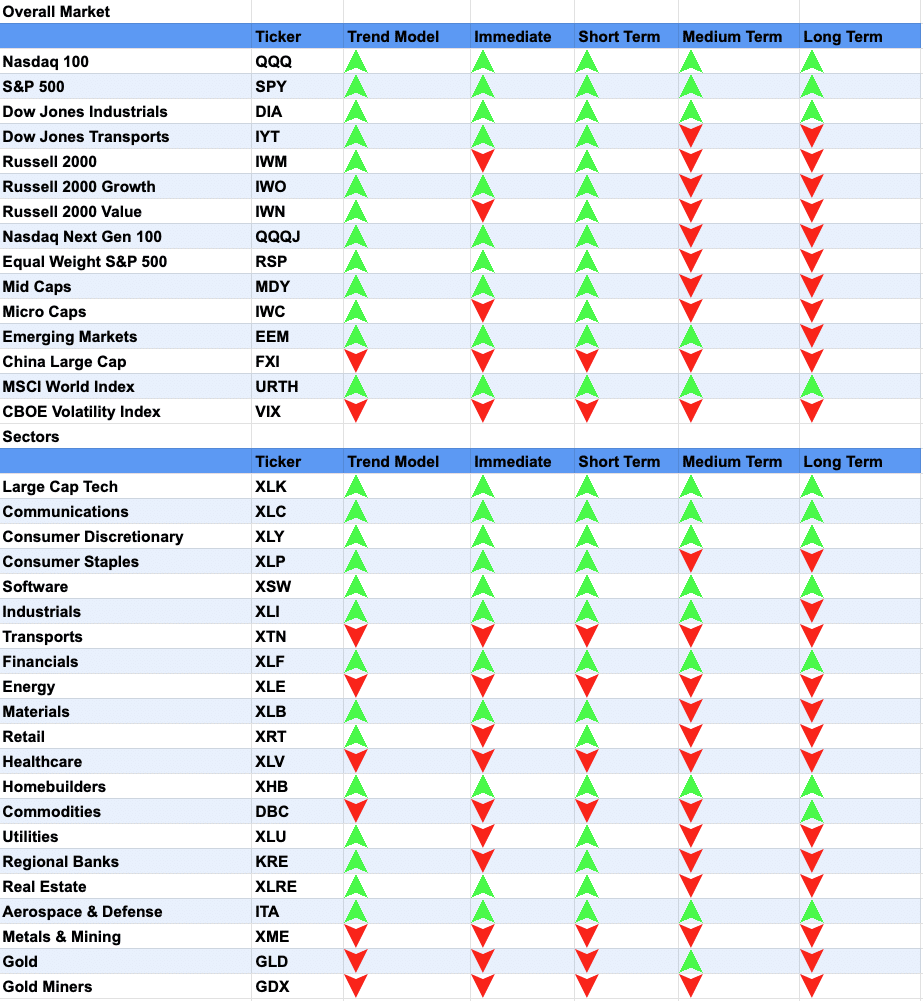

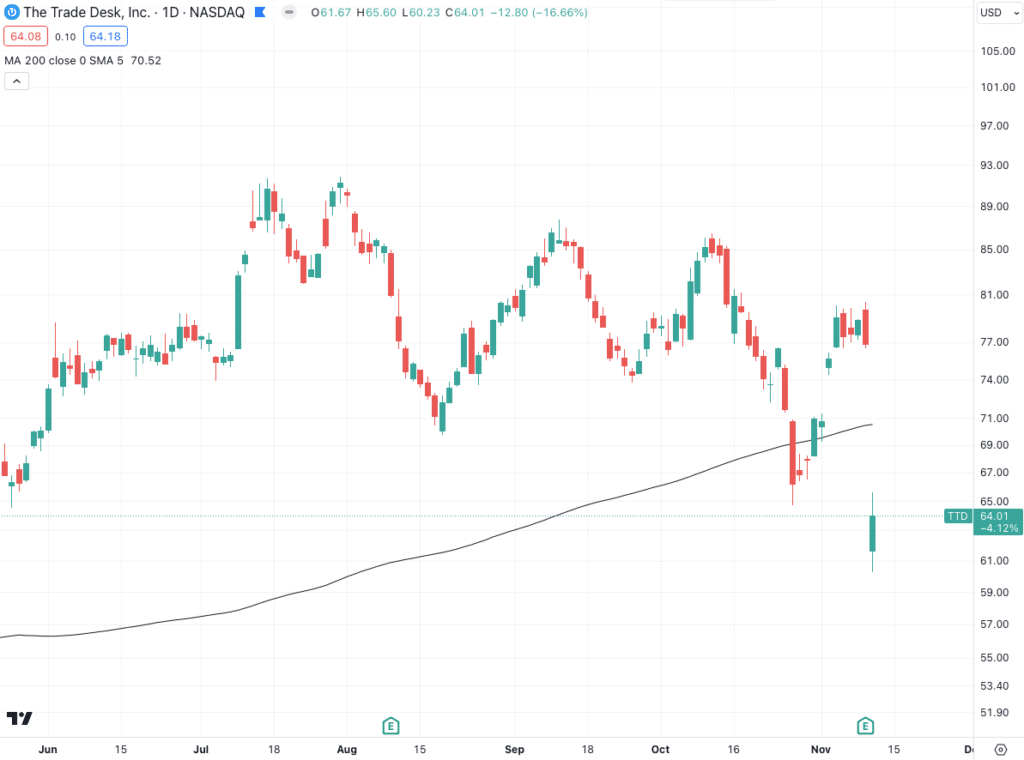

Market Trends – Small Caps Still Behind

As for market trends, the Russell 2000 fell -3.1% this week, while the major indexes rose. The Russell’s decline is similar to what I’m looking for in the S&P 500.

As for right now, the top themes still look like cybersecurity, cloud, semiconductors, and software.

Payments and FinTech companies are on my radar after big beats from Block aka Square and PayPal. Both of these names are significantly below their 200-day moving average, and have only outperformed the S&P 500 last week, so I don’t plan on opening new positions soon.

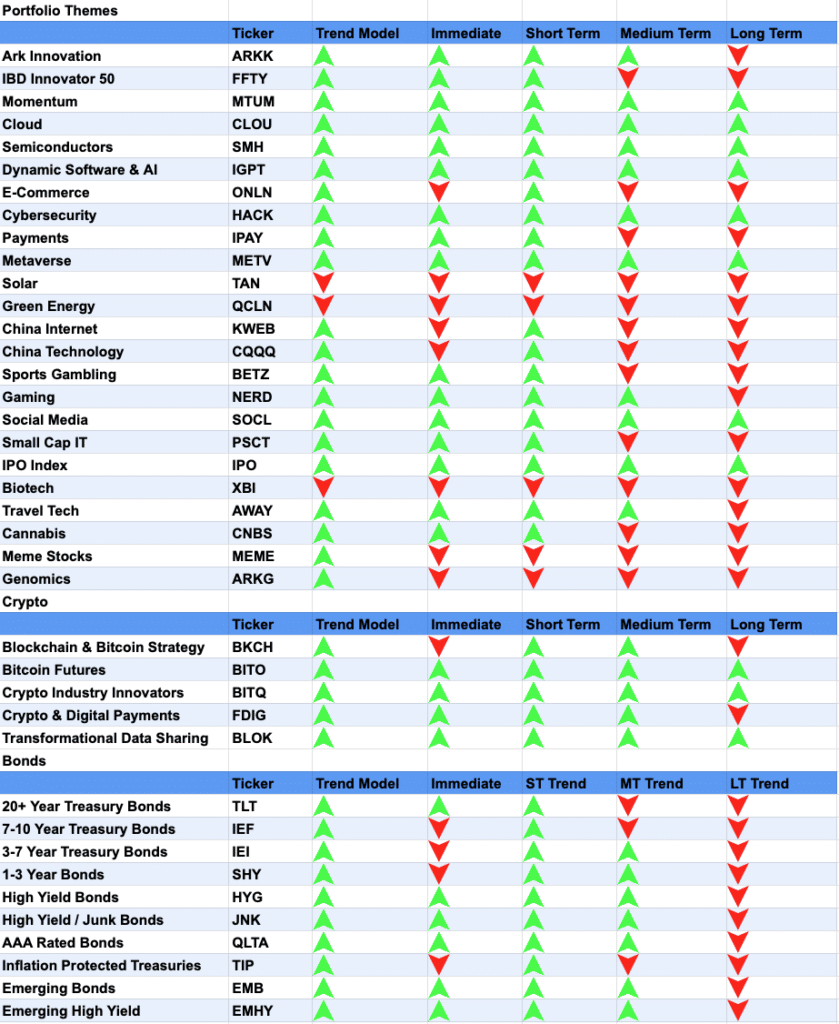

But there’s another name that has been outperforming for months, and that is former holding Affirm.

This company has been steadily increasing sales while improving their profit margins. They’re still not profitable, but that could change if rates fall.

You’ll see how beaten down this company is once you zoom out (black line is that same 200-day moving average above).

Who knows if they can ever reclaim those November 2021 highs, which was roughly where I sold this position. I do find it interesting that they’re well ahead of established FinTech names like PayPal & Square, and buy now pay later is a great win-win for businesses.

More research is needed, and I’ll let you know when I make a decision on them.

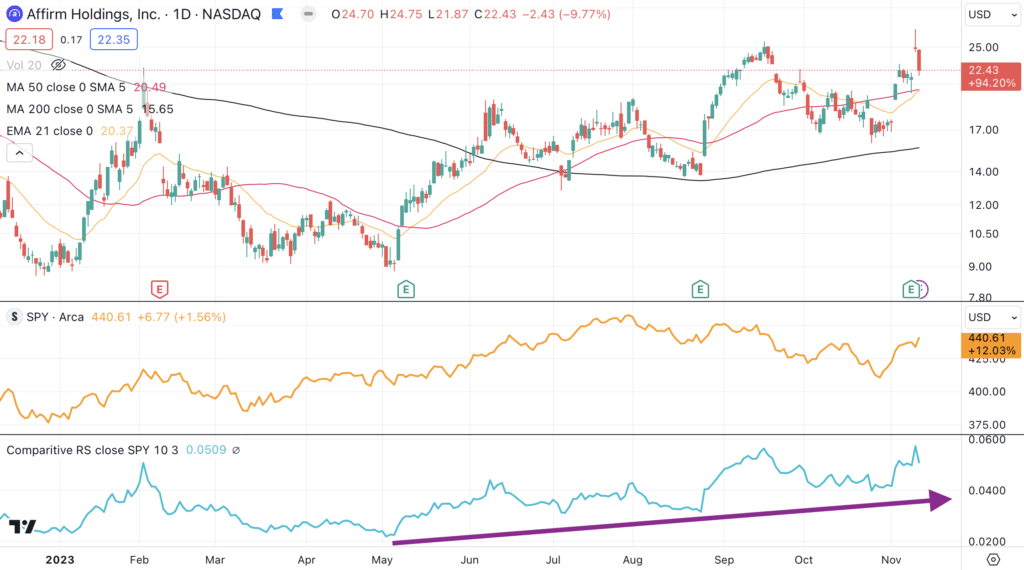

I’m taking The Trade Desk off my radar after last week’s post, as they fell 17% despite beating earnings. As I mentioned at the beginning, there’s still a lot of fear in this market.

Futures – Neutral Equities, Long Bonds & Gold

No change on this. I wrote out my plan after Powell pulled the rug on equity investors on Thursday.

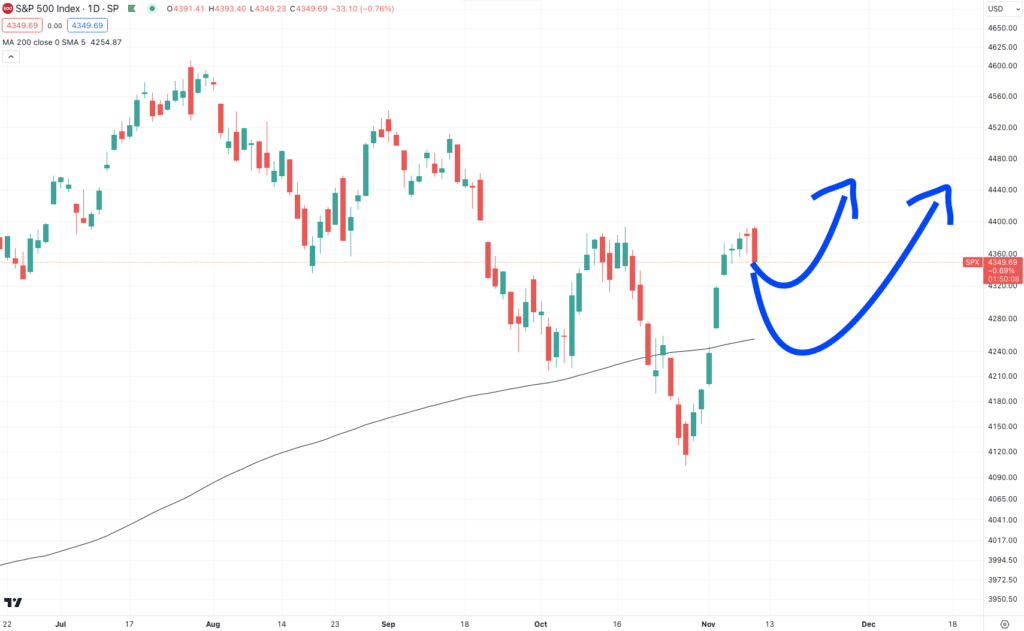

I’m expecting the S&P 500 will fill one of these two gaps, and will decide in real time when to close my short hedges. Regardless of this, please know that I’m quite bullish over the intermittent term, and will let you know once I start opening more positions.