Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Leaning bullish, positioned bullish

Equities finished the week negative, but recovered some of the DeepSeek selloff. The S&P 500 finished (-1.0%) and Nasdaq 100 (-1.3%).

Notice the green bars in the middle of this chart. More stocks kept making net highs during this week, which is bullish longer term. This suggests a positive rotation happening under the hood.

Deepseek really hurt Nvidia, which fell 16% this week alone.

This is exactly why I bought the semiconductor basket instead of Nvidia. While I’m still bullish on Nvidia, I would rather wait for an opportunity like this to open my positions.

DeepSeek Compromises Nvidia, but How Much?

This question is ultimately on the minds of all investors right now. First, let’s explain what DeepSeek pulled off.

DeepSeek’s inference costs are remarkably cheap, roughly 95% cheaper than OpenAI. This is great for big tech in general, but a massive concern for Nvidia, because more efficient inference means less GPUs may be required over the long run.

On top of that, DeepSeek attacked two of Nvidia’s main moats, courtesy of Ben Thompson at Stratechery:

- CUDA is the language of choice for anyone programming these models, and CUDA only works on Nvidia chips.

- Nvidia has a massive lead in terms of its ability to combine multiple chips together into one large virtual GPU.

Out of desperation, DeepSeek showed tech that there is another way. Heavy optimization can produce incredible results on weaker harder with lower memory bandwidth. By bypassing CUDA, tech could use competitor GPUs like AMD for inference instead of Nvidia.

But the ultimate question I’m asking is: would DeepSeek’s model be better if they had access to Nvidia’s best GPUs? I believe the answer is yes, which is why I’m still bullish on Nvidia.

There’s another important point, Nvidia’s demand is far outpacing what they can supply. Hyperscalers like Amazon and Microsoft want more GPUs, so imagine if they cut off their Nvidia procurement. This could put them in the back of Nvidia’s line, which would severely compromise them if they can’t substitute Nvidia.

DeepSeek has made Nvidia more vulnerable longer term, which makes this selloff rational. I, for one, am excited about their prices returning to October 2024 levels, and am looking at buying.

Price closed below the 200-day aka 40 week moving average Friday (black line), and I plan on opening a position once price closes back above.

Manufacturing’s Recovering Could be Bullish

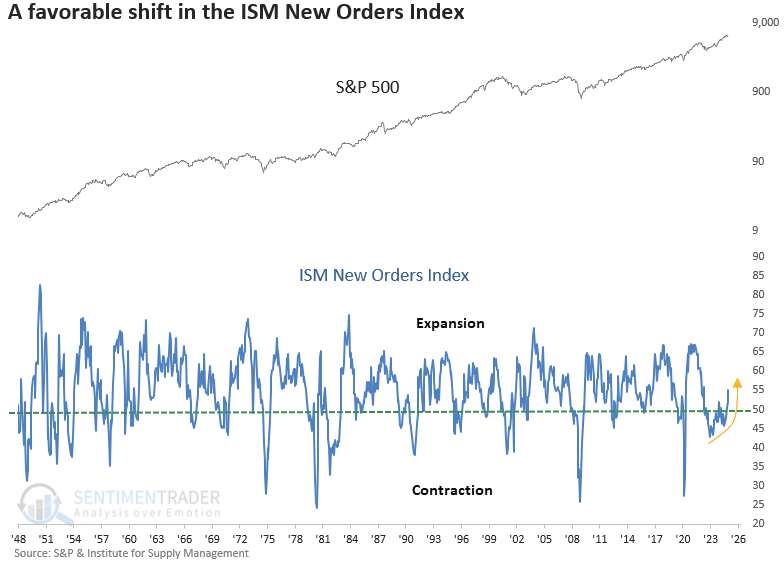

Another positive indicator is the manufacturing recovery, as highlighted by the Institute for Supply Management (ISM). While the headline index edged above 50—signaling expansion—the critical new orders component surged past 55, reaching a 32-month high.

Why does this matter? New orders ignite the production cycle, making them a leading indicator of manufacturing output, GDP growth, and corporate earnings.

Although not a primary stock market signal, survey-based data like new orders can validate a supportive economic backdrop, often reinforcing favorable conditions for equities.

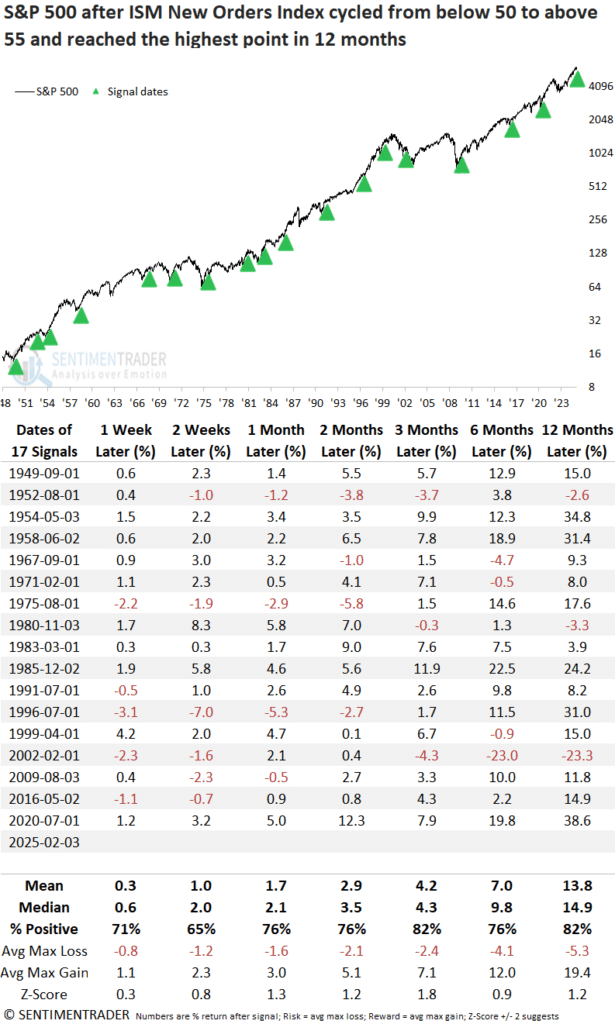

Historically, when the ISM New Orders Index climbed from below 50 to above 55 and hit a 12-month high, the S&P 500 delivered strong and consistent returns over the following year, signaling a favorable economic tailwind.

The only significant adverse signal emerged during the 2000–02 bear market—a period vastly different from today. To refine historical comparisons, let’s apply a filter: the S&P 500 must be within 5% of an all-time high.

Market Trends – Software Still Outperforming

Software keeps outperforming this year, and closed this week positive +0.3% while the major indices fell.

This outperformance makes me believe that institutional investors are positioning for more risk, which means they’re still bullish.

I don’t plan on opening software positions, preferring sectors like semiconductors and China, but this is another risk-on data point that explains why I’m bullish.

Future – Neutral Equities

Yields broke below the purple line I have been tracking, which is making me more bullish. I planned on opening an Nvidia position, but changed my mind after price closed below the 200-day moving average.

We’ll see how it goes next week, take care in the meantime.