Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Leaning bullish, positioned bullish

Equities were negative again, but buyers stepped in Friday. The S&P 500 finished (-3.1%) and Nasdaq 100 (-3.3%).

But as you can see, not as many stocks are declining (lower blue arrow) despite the big drop in indexes (upper blue arrow). Similar to last week, more stocks participating generally means a rally is more durable, and you can imagine the same for fewer stocks falling during a drawdown.

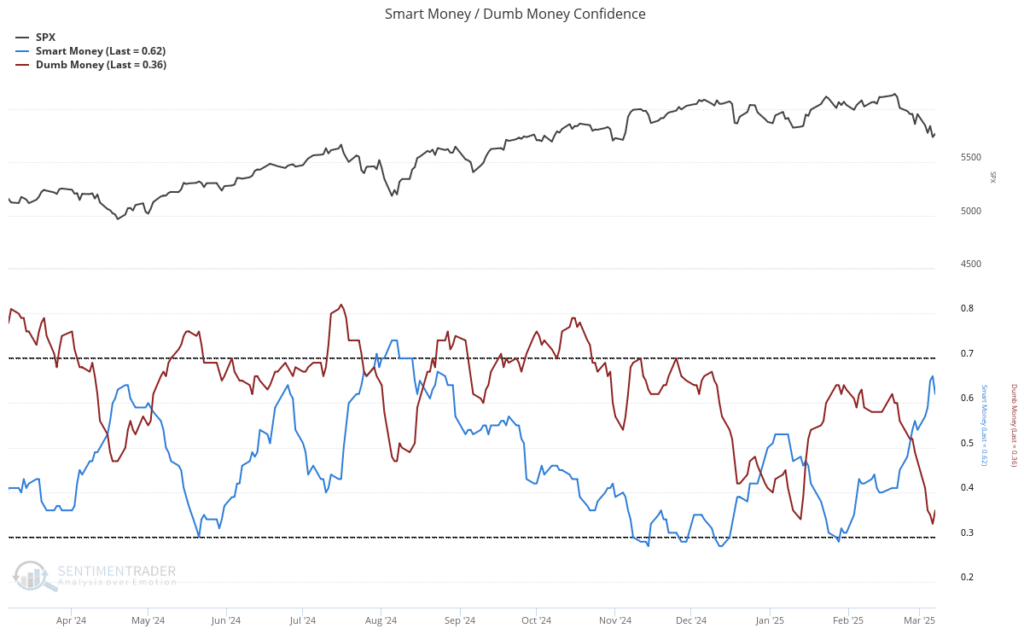

Smart money and dumb money had a massive shift this week as well.These inversions have typically signaled intermittent lows in the market.

And overall sentiment is still at 3 year lows.

Given all of this, I’m looking at buying, and will let you know when I open more positions.

One of those positions might be Uber, which finished the week positive, and has outperformed since December.

Their cash flow has improved from -$9.1 billion in 2023 to +$9.9 billion today.

Market Trends – Emerging Markets Keep Outperforming

While US equities had another rough week, emerging markets finished the week positive +2.8%.

I wrote last week that the outperformance was compelling, and it seems like more money is rotating in that sector.

Emerging markets have basically gone no where for the past 20 years, as this monthly chart shows.

That $51 level has been a decent lid since 2008, if prices get there this time, will it finally break out?

That’s a larger macroeconomic question, but this accumulation looks interesting over the short term. With sentiment this bearish, I’m looking at positions, and emerging markets are on the top of the list.