Hey everyone,

I hope you had a great week, here’s a quick recap of last week’s plan:

- Leaning bullish, positioned bullish

Same as last week – equities were negative, but buyers stepped in Friday. The S&P 500 finished (-2.3%) and Nasdaq 100 (-2.5%).

Friday was a 91% upside day, which can often signal short term bottoms, as it signals institutions are buying equities hand over fist. The only item missing is a follow-through day, which I believe was just missed due to lower volume Friday. I’ll update you if that is wrong.

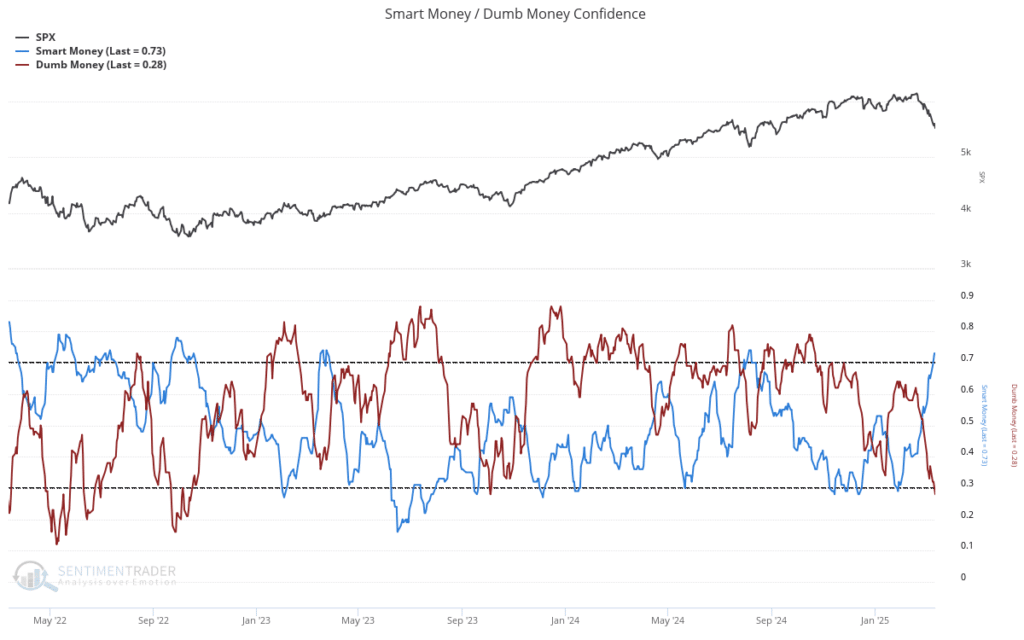

Sentiment is still near 10 year lows while Friday’s buying happened.

We also see that smart money is euphoric (blue) while dumb money is miserable (red). This signaled intermittent bottoms over the past 3 years.

This amount of selling is making me reconsider my longer term bullishness. I’m still bullish over the short term, and will need to see aggressive buying out of this dip to be bullish longer term.

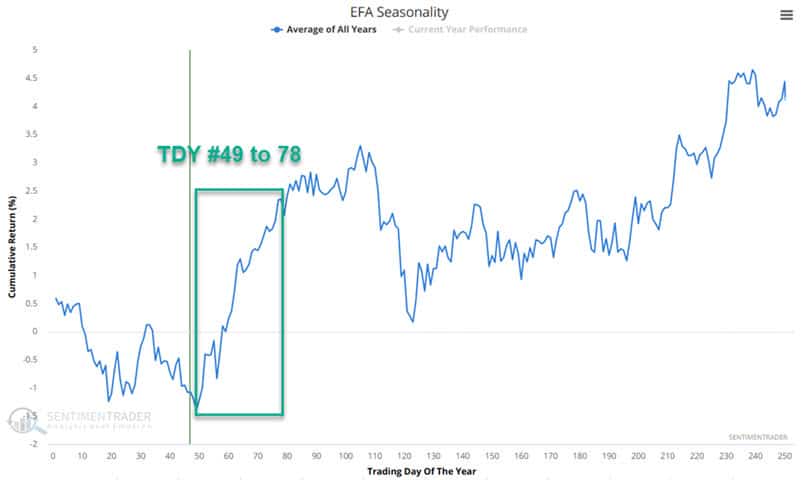

Market Trends – Emerging Markets Enter Favorable Seasonality

One area that keeps outperforming is emerging markets, and they are about to enter great seasonality.

This has been a recurring theme for the past month, and they are about to enter a great seasonal period. Given the money rotating into this group, I am optimistic about this seasonality playing out.

This keeps emerging markets at the top of my list. I’ll let you know once I open a position. For now, I’m happy I did not buy in to this correction prematurely.