If you follow my writings, you may notice that articles are released months after my investment was made.

If you’re interested in joining my beta Premium membership to access my trades and portfolio in real time, please register below. The cost for beta members is $50 per month, or $500 per year.

Subscribe for $50/month Subscribe for $500/year

All beta members will be locked in to this discounted price when the Premium service is generally available.

What You Get

While the product is in beta, all subscribers are guaranteed:

- Instant access to my trades

- End of week portfolio by %

- Weekly summaries of my new positions and exits

- Real-time updates on Slack

- 1:1 conversations by request

My Performance

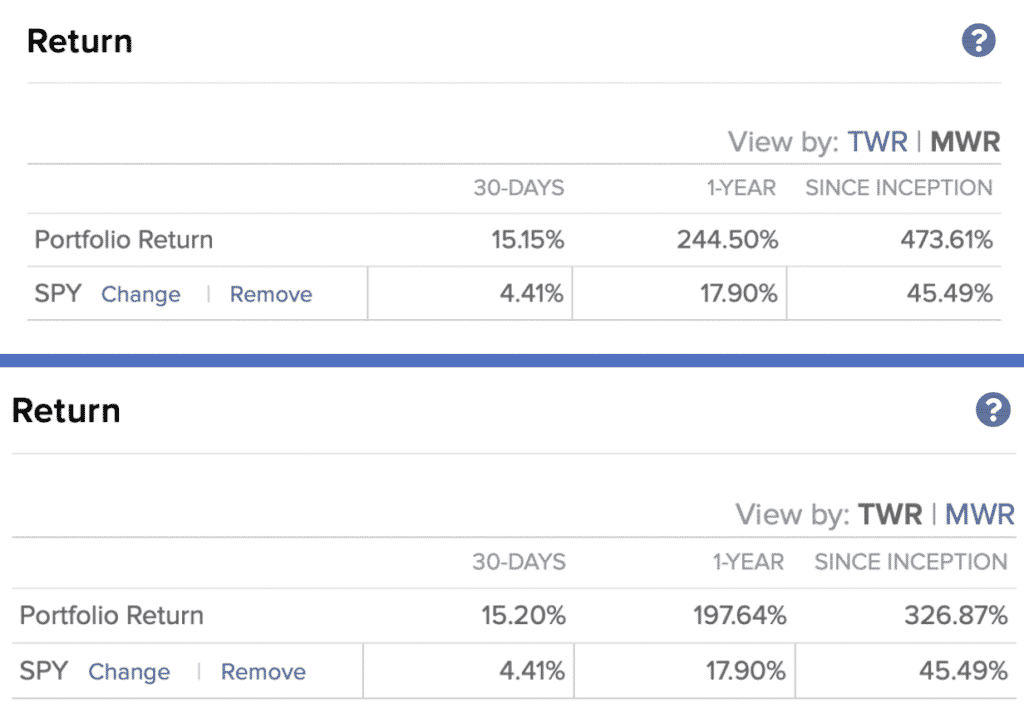

I have soundly outperformed the S&P 500 since I started investing in 2008. In January 2018, I moved my investments to Interactive Brokers, and that outperformance has accelerated.

My money-weighted returns have outperformed the S&P 500 by over 10x, and my time-weighted returns have outperformed it by over 7x.

Money-weighted returns reflect my investment timing. I advocate for patience, and have thankfully been rewarded with my cash flow timing so far. I have also been mostly lucky with my exits, such as Under Armour.

By subscribing to my Premium membership, you will see the investments I make in real time. Many have led to multibagger returns:

- The Trade Desk: 17x

- Under Armour: 11x

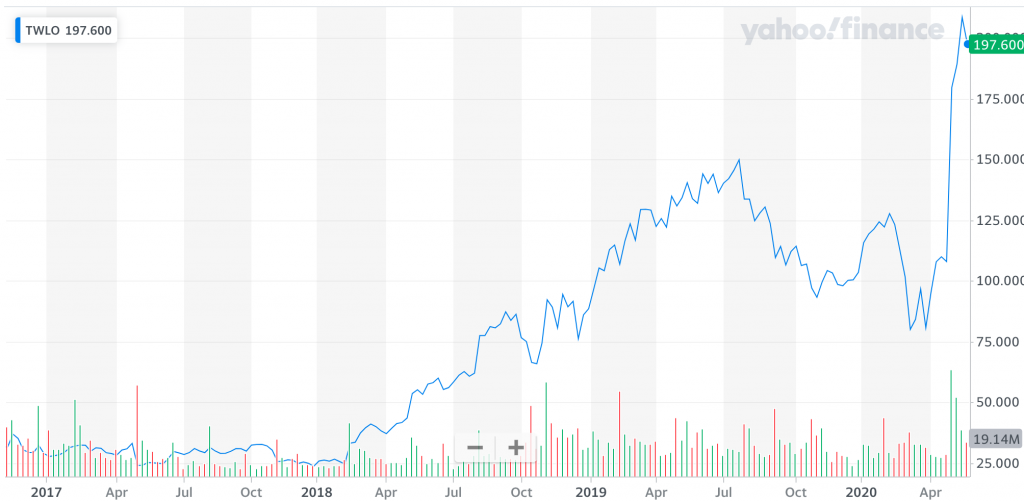

- Twilio: 9x

- DocuSign: 5x

- Fortinet: 4x

- Fastly: 4x

- MercadoLibre: 3x

- Visa: 3x

Additionally, you will have access to my end of month portfolio, broken down by percentage.

Finally, any beta subscribers can schedule 1:1 conversations with me to answer general investing or financial management questions. I appreciate you joining my beta, and would love to help any way I can.

Why You Should Not Join

Look, my goal is to not be like every YouTube and website you generally see. If you have read anything from me, you might have noticed that I do a little more work than draw sh*t on a stock chart.

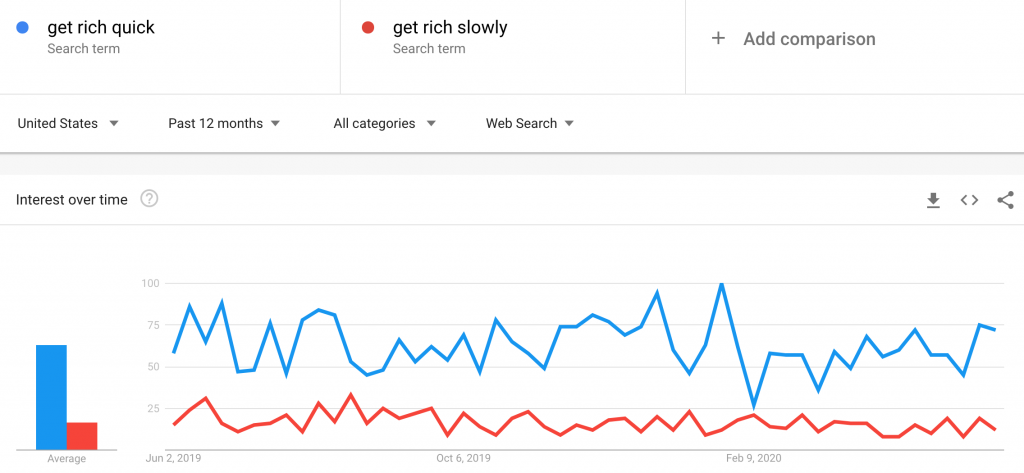

I haven’t seen anybody accomplish a difficult task quickly and easily. Similar to losing weight, investing is hard, and getting rich takes time.

More people are searching for get rich quick schemes, and there are several websites selling to this need. Many of them actually derive more income from what they sell than what they claim to teach. Discount The Obvious will not be one of these websites.

I Don’t Know When My Investments Will Appreciate

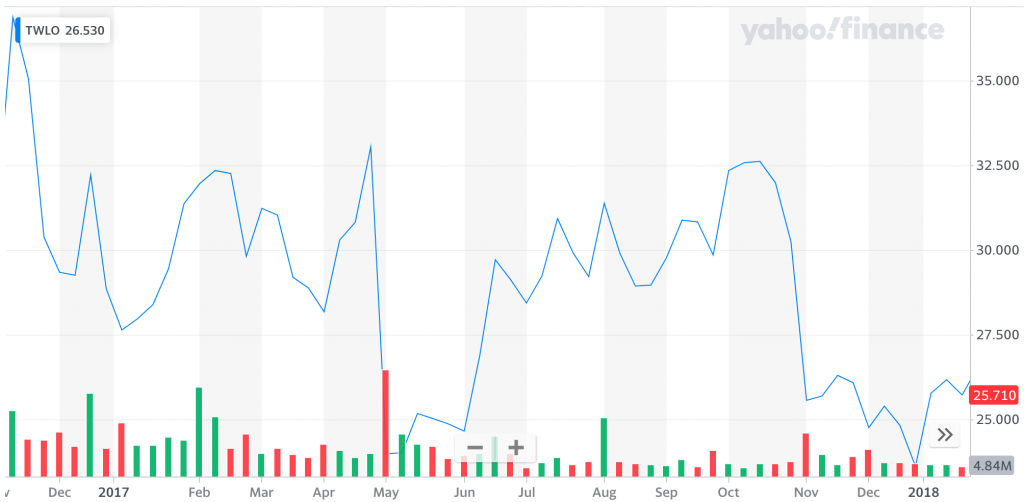

I sat on Twilio for over a year as the company went up and down roughly 50%. Understandably, subscribers might have asked what in God’s name I was doing.

At the time, I believed Twilio was worth well more than their $2 billion market cap. Thankfully, I was correct, they are worth $28 billion today. It’s easy to be patient when you start an investment, and a lot harder to be patient once you’re a shareholder.

Twilio was not the first, and will not be the last, investment that doesn’t 2x tomorrow. I generally buy companies that I believe are undervalued, and time will tell when the market realizes the discount as well.

These Investments Are Volatile

As you can see from Twilio’s chart, companies can make big fluctuations over the short term. You probably won’t care when you fast forward 3 years from now and the company is worth exponentially more. In the meantime, these fluctuations could be difficult for investors.

Please know yourself and consider how you have handled previous price jolts. If you sold at the bottom of the global financial crisis, or if Twilio’s price chart makes you anxious, my membership may not be worth the possible stress.

My Exits Are Not Perfect

My money-weighted returns prove that my timing is generally good. Unfortunately, I have never called the perfect bottom when I bought, nor the perfect top when I sold.

Under Armour, for example, went up another 30% after I sold it.

I sold out around July 2015, and the company continued appreciating throughout the summer.

Investors would have been disappointed if they sold at the same time, and rightfully so. The company is now down over 80% since I made that move, which would hopefully earn your forgiveness. I would have understood your frustration at the time, though.

Final Disclosure

None of my writings and investments are recommendations. I am simply sharing my activity in the most transparent way possible. While my record speaks for itself, no investor is perfect.

Past results don’t guarantee future returns. With that being said, 100% of my net worth is in the portfolio I’m sharing. My incentives are 100% aligned with my readers and subscribers.

Hopefully you appreciate this transparency. If you have any questions, please email me directly. Thank you for your consideration, and thank you for reading Discount The Obvious.